News und Analysen

Hess stock to see 96% growth in EPS

The markets may have just ended their super cycle for the past four years (2020-2024), sponsored by low-interest rate environments pushed by the FED to counteract the effects of the COVID-19

Snowflake breaks resistance hinting at momentum shift

Shares of Snowflake Inc. (NYSE: SNOW), a cloud-based data storage, computing, and analytics company, have been impressive lately, with its stock rising almost 50% over the previous three months.

3 high-yielding Dividend Kings: Buy, sell or hold?

Dividend Kings are attractive for income investors because of the reliable payments and insulation from market downturns.

These buy-and-hold names are also tightly held, significantly affecting

Is it a logical time to buy Logitech?

Shares of Logitech International S.A. (NASDAQ: LOGI) fell sharply despite a solid earnings report and improved guidance. The move took share prices to a two-month low, setting up an attractive

Proctor & Gamble: a trend-following signal for income investors

Proctor & Gamble’s (NYSE: PG) stock price entered consolidation following the COVID-19 bubble, but its uptrend is intact, and a trend-following signal is in play. Because the stock has sustained

2 gene editing stocks to keep on your 2024 watchlist

Gene therapy will get its share of the spotlight in the medical sector in 2024. The FDA approval for Casgevy, Vertex Pharmaceuticals Inc. (NASDAQ: VRTX) and CRISPR Therapeutics AG (NASDAQ: CRSP)

Johnson & Johnson's stock price is at a critical turning point

Johnson & Johnson (NYSE: JNJ) had a solid quarter in Q4 despite the impacts of the Kenvue spin-off and the deleveraging of COVID-19 sales. However, little has emerged to catalyze the bulls

3 uranium stocks to buy as the metal hits 16-year high

The rally in the spot price of uranium that began in 2023 is heating up in the first month of 2024. On January 15, the spot price of uranium broke the $103 level, a 16-year high. For uranium

3 personal care stocks that smell like good earnings plays

2023 was a year to forget for the personal care industry. With traders clamoring for growth-oriented technology and media shares, the defensive group became an afterthought and woefully

Higher prices at the pump? Make up for it in Baker Hughes stock

You are about to witness a pivoting moment in the stock market, driven by similar changes in the underlying economy today. People tend to fall into a sort of continuation fallacy, where what has

Is Applied Digital’s 35% stock plunge an AI buying opportunity?

Applied Digital Co. (NASDAQ: APLD) shares experienced a 4X surge in 2023, riding the artificial intelligence (AI) trend as a provider of next-generation AI data centers. Its data centers were

Should you follow the analysts’ lead on Birkenstock stock?

Shares of Birkenstock Holdings plc (NYSE: BIRK) made a decent recovery after falling more than 10% from its closing price of $50 on January 17, 2024. The reason for the stock's decline was the

Eilt: Sensationelle Übernahme nahe Barrick Gold ($GOLD) und Endeavour Mining ($EDV). Diesen 586% Gold Hot Stock 2024 jetzt kaufen nach 58.420% mit Great Bear Resources

Eilt: Sensationelle Übernahme nahe Barrick Gold und Endeavour Mining. Diesen 586% Gold Hot Stock 2024 jetzt kaufen

22.01.24 08:34

Vancouver (www.aktiencheck.de, Anzeige)

SLB drills down to a trend-following signal for income investors

The price action in SLB (NYSE: SLB) entered a correction last fall, but it has ended. Within a sustained uptrend, the correction has drilled to critical levels and rebounded after the Q4 earnings

Energy sector's risk-off stance, underperformance so far in 2024

In the early days of 2024, the SPDR S&P 500 ETF Trust (NYSE: SPY) is soaring near its all-time high, primarily driven by the impressive rally in the technology sector. Over the past month, it has

Gaming-App Q GamesMela von QYOU Media demnächst auf der Mobile-App-Plattform mSeva verfügbar

Indische Regierung entwickelt eigenen App-Store für mobile Geräte als Alternative zum Google Play- und Apple App-Store

Vertrieb der revolutionären Gaming-App Q GamesMela wird über mSeva

QYOU Media’s Q GamesMela To Launch on mSeva Mobile App Platform

India’s Government Owned and Developed Mobile App Store Created as an Alternative to Google Play and Apple App Store

Breakthrough Gaming App Q GamesMela Expands Distribution Into Tier 2 &

3 fast food stocks report Q4 earnings, heres what to expect

Hiring struggles. Supply chain issues. Food cost inflation.

These are just some of the challenges faced by U.S. quick service restaurants (QSRs) in 2023. To the group’s credit though, restaurants

Yes, Morgan Stanley can hit a record-high this year

Morgan Stanley’s (NYSE: MS) Q4 results were mixed relative to the analysts' estimates but give no reason to fear a stock price correction. The stock price may move lower before it moves higher

MarketBeat's Dividend Screener uncovers bullish news on 3 stocks

Identifying the right dividend stock for your investment strategy can be like finding a needle in a haystack. You know you want an equity that makes regular cash payouts — but where do you go from

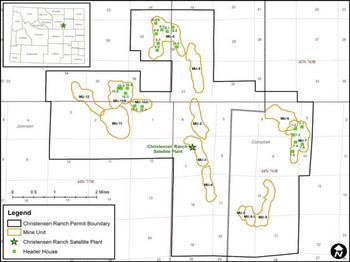

Uranium Energy Corp Restarting 100% Unhedged Uranium Production in Wyoming

Corpus Christi, TX, January 16, 2024 - Uranium Energy Corp (NYSE American: UEC, the “Company” or “UEC” - https://www.commodity-tv.com/ondemand/companies/profil/uranium-energy-corp/) is

Uranium Energy Corp nimmt zu 100 % ungesicherte Uranproduktion in Wyoming wieder auf

Corpus Christi, Texas. 16. Januar 2024 - Uranium Energy Corp (NYSE American: UEC, das „Unternehmen“ oder „UEC“ - https://www.commodity-tv.com/ondemand/companies/profil/uranium-energy-corp/)

Surgery Partners feeling no pinch from macroeconomic weakness

Surgery Partners Inc. (NASDAQ: SGRY) is a leading healthcare services provider that owns and operates over 180 outpatient surgical centers in 31 states. Its integrated delivery model includes

3 Russell 2000 stocks for your January watchlist

As investors face another uncertain year in the market, it could be time to look at small- and mid-cap stocks. That means looking at stocks that are listed on the Russell 2000 index. The Russell

Hagerty is the insurance play attracting J.P. Morgan analysts

Some industries refuse to change and invest in innovative technologies; it is sometimes valuable and helpful to adopt the 'If it's not broke, don't fix it' mentality; however, sometimes, it can