News und Analysen

Micron Is the NVIDIA of Memory Chips: Here’s Why

Micron Technology (NASDAQ: MU) is perfectly positioned to follow in the footsteps of AI leader NVIDIA (NASDAQ: NVDA). Where NVIDIA commands the bulk of data center market share and, by extension

Micron Is the NVIDIA of Memory Chips: Here’s Why

Micron Technology (NASDAQ: MU) is perfectly positioned to follow in the footsteps of AI leader NVIDIA (NASDAQ: NVDA). Where NVIDIA commands the bulk of data center market share and, by extension

Energy Sector Nears Multi-Year Resistance: Breakout Ahead?

As the U.S. market hovers near all-time highs, one sector has quietly surged higher and now stands at a critical juncture - the energy sector. While the broader market has experienced a

Energy Sector Nears Multi-Year Resistance: Breakout Ahead?

As the U.S. market hovers near all-time highs, one sector has quietly surged higher and now stands at a critical juncture - the energy sector. While the broader market has experienced a

3 Stocks About to Join the Rate Cut Party

You can think of the S&P 500 and the NASDAQ 100 indexes as the sun that gets the rest of the stock market booming or busting. As these have been making all-time highs lately, you’ll notice that

Is Ollies Bargain Outlet a Smart Buy-On Post-Release Weakness?

Strength in Ollie’s Bargain Outlet (NASDAQ: OLLI) results, including market-leading growth and broader margins, suggests this stock is a buy on post-release weakness. Nothing in the report was

Chipotle Stock Shoots Higher, Announcing 50 for 1 Stock Split

Shares of Chipotle Mexican Grill Inc. (NYSE: CMG) shot up nearly 6% in after-hours and pre-market trading after the company announced that its Board of Directors had approved a 50-for-1 stock

General Mills Stock Price Reversal Gains Momentum on Good News

General Mills (NYSE: GIS) stock made a hasty retreat in 2023 as peak inflation, growth and margin fears undercut the market, but now a complete reversal is in play. The company’s FQ3 results are

Is it Time to Take Profits in Financial Stocks?

The financial sector and the popular sector ETF Financial Select Sector Fund (NYSE: XLF) continue to demonstrate impressive momentum as we progress into 2024. Much like its stellar performance in

Is it Time to Take Profits in Financial Stocks?

The financial sector and the popular sector ETF Financial Select Sector Fund (NYSE: XLF) continue to demonstrate impressive momentum as we progress into 2024. Much like its stellar performance in

Growing Twice as Fast as Tesla, XPeng is a Buy

You can't deny the two most significant trends today in technology stocks like Nvidia Corp. (NASDAQ: NVDA) and electric vehicle stocks like Tesla Inc. (NASDAQ: TSLA). However, the trend hasn't

Growing Twice as Fast as Tesla, XPeng is a Buy

You can't deny the two most significant trends today in technology stocks like Nvidia Corp. (NASDAQ: NVDA) and electric vehicle stocks like Tesla Inc. (NASDAQ: TSLA). However, the trend hasn't

4 Stocks Building Long-Term Value for Shareholders

Investing in business growth, acquisitions, improving margins, cash flow, dividends and share repurchases are among the leading drivers of shareholder value today. Oddly, too few companies rely on

4 Stocks Building Long-Term Value for Shareholders

Investing in business growth, acquisitions, improving margins, cash flow, dividends and share repurchases are among the leading drivers of shareholder value today. Oddly, too few companies rely on

4 Stocks Building Long-Term Value for Shareholders

Investing in business growth, acquisitions, improving margins, cash flow, dividends and share repurchases are among the leading drivers of shareholder value today. Oddly, too few companies rely on

FedEx Stock Has Analysts Upgrading in Bulk, a Sudden Discount

Wall Street analysts tend not to take unnecessary risks when rating and valuing stocks. If they become overly bearish or bullish, and their predictions turn out wrong, that’s a bonus they won’t be

SoFi Presents Another Entry Opportunity for Investors

Fintech provider SoFi Technologies Inc. (NASDAQ: SOFI) is a one-stop shop for financial services conveniently accessible around the clock through its mobile-first platform and online. The

This Sector Ready to Outshine Key Rival, Says New Report

A new report from Bank of America analysts found that consumer discretionary stocks have the edge over consumer staples stocks.

That's despite a one-month outperformance of the Consumer Staples

MAG Silver Reports 2023 Annual Financial Results

Vancouver, B.C. MAG Silver Corp. (TSX / NYSE American: MAG) (“MAG”, or the “Company”) - https://www.commodity-tv.com/ondemand/companies/profil/mag-silver-corp/ - announces the Company’s

LifeMD Shares Come Back to Life on GLP-1 Business Growth

LifeMD Inc. (NASDAQ: LFMD) provides telehealth services to consumers in the United States. The medical sector company operates many telehealth brands, including men's telehealth brands RexMD and

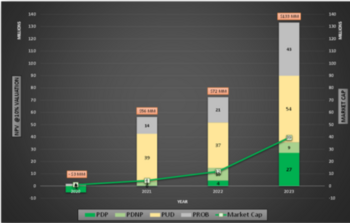

Prospera Energy Inc. meldet eine 508%ige Erhöhung der Bewertung der nachgewiesenen, erschlossenen und produktiven (PDP) Reserven für das Jahr 2023

Calgary, Alberta, 14. März 2024 / IRW-Press / Prospera Energy Inc. („Prospera“, „PEI“ oder das „Unternehmen“) (TSX.V: PEI, OTC: GXRFF, FWB: OF6B, OF6B.SG, OF6B.F, OF6B.BE) freut sich, eine

Insider Selling of Amazon Spikes in Q1, but it's Not Time to Sell

It’s not unusual for insiders to sell Amazon.com (NASDAQ: AMZN) stock. Insiders own a large 12% of the company, and share-based compensation is a factor, but there has been unusual activity this

2 Deep Value, High Yield Stocks With a Double-Digit Upside

Value and yield are where you find them, and you will find them with Verizon Communications(NYSE: VZ) and Whirlpool (NYSE: WHR). These stocks trade at discounted valuations relative to the broad

2 Dollar Stores Taking Different Paths to Profitability

In uncertain macroeconomic climates, conscious consumers try to stretch their dollars at dollar stores. These microenvironments should be strong drivers for these discount retail sector stocks