Article updated August 3rd, 2019 by Ben Reynolds

Spreadsheet data updated weekly on Wednesdays

The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A Stock with 50 or more consecutive years of dividend increases.

The downloadable Dividend Kings Spreadsheet List below contains the following for each stock in the index, among other important investing metrics:

- Payout ratio

- Dividend yield

- Price-to-earnings ratio

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

There are currently 26 Dividend Kings. Each Dividend King satisfies the primary requirement to be a Dividend Aristocrat (25 years of consecutive dividend increases) twice over.

Note that not all Dividend Kings are Dividend Aristocrats. This unexpected result is because the ‘only’ requirement to be a Dividend Kings is 50+ years of rising dividends, whereas Dividend Aristocrats must have 25+ years of rising dividends, be a member of The S&P 500, and meet certain minimum size and liquidity requirements.

Table of Contents

- How To Use The Dividend Kings List To Find Dividend Stock Ideas

- Analysis Reports On All 26 Dividend Kings

- Performance Of The Dividend Kings

- Sector & Market Capitalization Overview

- Final Thoughts

How To Use The Dividend Kings List to Find Dividend Stock Ideas

The Dividend Kings list is a great place to find dividend stock ideas.

However, not all the stocks in the Dividend Kings list make a great investment at any given time.

Some stocks might be overvalued. Conversely, some might be undervalued – making great long-term holdings for dividend growth investors.

For those unfamiliar with Microsoft Excel, the following walk-through shows how to filter the Dividend Kings list for the stocks with the most attractive valuation based on the price-to-earnings ratio.

Step 1: Download the Dividend Kings Excel Spreadsheet.

Step 2: Follow the steps in the instructional video below. Note that we screen for price-to-earnings ratios of 15 or below in the video. You can choose any threshold that best defines ‘value’ for you.

Alternatively, following the instructions above and filtering for higher dividend yield Dividend Kings (yields of 2% or 3% or higher) will show stocks with 50+ years of rising dividends and above-average dividend yields.

Looking for businesses that have a long history of dividend increases isn’t a perfect way to identify stocks that will increase their dividends every year in the future, but there is considerable consistency in the Dividend Kings.

You can view a preview of our Dividend Kings spreadsheet in the table below:

| ABM | ABM Industries, Inc. | 42.32 | 1.7 | 2,803.6 | 32.6 | 54.8 |

| AWR | American States Water Co. | 77.95 | 1.4 | 2,841.7 | 43.7 | 61.2 |

| CBSH | Commerce Bancshares, Inc. (Missouri) | 60.99 | 1.6 | 6,681.4 | 16.2 | 25.8 |

| CINF | Cincinnati Financial Corp. | 107.80 | 2.1 | 17,270.4 | 14.4 | 29.6 |

| CL | Colgate-Palmolive Co. | 72.97 | 2.3 | 64,127.4 | 27.7 | 62.7 |

| CWT | California Water Service Group | 53.57 | 1.4 | 2,559.8 | 46.7 | 66.8 |

| DOV | Dover Corp. | 97.10 | 2.0 | 14,236.9 | 23.5 | 46.1 |

| EMR | Emerson Electric Co. | 65.99 | 2.9 | 41,357.8 | 17.8 | 51.6 |

| FMCB | Farmers & Merchants Bancorp (California) | 781.10 | 1.8 | 614.7 | 11.7 | 21.0 |

| FRT | Federal Realty Investment Trust | 132.33 | 3.1 | 9,936.7 | 43.6 | 134.7 |

| GPC | Genuine Parts Co. | 98.04 | 3.0 | 14,305.4 | 18.1 | 54.9 |

| HRL | Hormel Foods Corp. | 41.51 | 1.9 | 22,224.0 | 22.2 | 42.4 |

| JNJ | Johnson & Johnson | 131.13 | 2.8 | 348,581.6 | 21.5 | 59.3 |

| KO | The Coca-Cola Co. | 53.05 | 2.9 | 229,708.3 | 32.3 | 94.9 |

| LANC | Lancaster Colony Corp. | 156.17 | 1.6 | 4,255.0 | 28.6 | 46.3 |

| LOW | Lowe's Cos., Inc. | 103.07 | 1.9 | 81,243.2 | 35.2 | 65.2 |

| MMM | 3M Co. | 176.70 | 3.2 | 102,186.8 | 20.9 | 66.0 |

| NDSN | Nordson Corp. | 141.88 | 0.9 | 8,187.8 | 25.5 | 24.1 |

| NWN | Northwest Natural Holding Co. | 71.89 | 2.7 | 2,173.3 | 31.3 | 83.0 |

| PG | Procter & Gamble Co. | 119.77 | 2.4 | 302,028.0 | 82.0 | 197.4 |

| PH | Parker-Hannifin Corp. | 177.41 | 1.7 | 22,680.8 | 16.0 | 27.5 |

| SCL | Stepan Co. | 99.76 | 1.0 | 2,223.9 | 22.0 | 21.8 |

| SJW | SJW Group | 65.49 | 1.8 | 1,844.7 | 35.7 | 63.8 |

| SWK | Stanley Black & Decker, Inc. | 149.58 | 0.0 | 22,975.4 | 31.3 | 0.0 |

| TGT | Target Corp. | 87.25 | 2.9 | 44,511.6 | 15.1 | 44.6 |

| TR | Tootsie Roll Industries, Inc. | 37.77 | 0.9 | 2,474.5 | 42.4 | 39.6 |

| Ticker | Name | Price | Dividend Yield | Market Cap ($M) | P/E Ratio | Payout Ratio |

Analysis Reports On All 26 Dividend Kings

All 26 Dividend Kings are listed below by sector. You can access detailed coverage of each by clicking on the name of each Dividend King. Additionally, you can download our newest Sure Analysis Research Database report for each Dividend King as well.

Basic Materials

Consumer Cyclical

- Genuine Parts Company (GPC) – [5/14/19 Sure Analysis report]

- Lowe’s Companies (LOW) – [5/27/19 Sure Analysis report]

Consumer Defensive

- The Colgate-Palmolive Company (CL) – [4/27/19 Sure Analysis report]

- Hormel Foods Corporation (HRL) – [5/31/19 Sure Analysis report]

- The Coca-Cola Company (KO) – [5/14/19 Sure Analysis report]

- Lancaster Colony (LANC) – [5/2/19 Sure Analysis report]

- Procter & Gamble (PG) – [4/25/19 Sure Analysis report]

- Target Corporation (TGT) – [5/23/19 Sure Analysis report]

- Tootsie Roll Industries (TR) – [5/31/19 Sure Analysis report]

Financial Services

- Cincinnati Financial (CINF) – [5/17/19 Sure Analysis report]

- Farmers & Merchants Bancorp (FMCB) – [5/8/19 Sure Analysis report]

- Commerce Bancshares (CBSH) – [7/25/19 Sure Analysis report]

Healthcare

Industrial

- ABM Industries (ABM) – [6/30/19 Sure Analysis report]

- Dover Corporation (DOV) – [7/19/19 Sure Analysis report]

- Emerson Electric (EMR) – [5/11/19 Sure Analysis report]

- 3M Company (MMM) – [7/25/19 Sure Analysis report]

- Nordson (NDSN) – [5/21/19 Sure Analysis report]

- Parker Hannifin (PH) – [5/13/19 Sure Analysis report]

- Stanley Black & Decker (SWK) – [7/23/19 Sure Analysis report]

Real Estate

Utilities

- American States Water (AWR) – [5/28/19 Sure Analysis report]

- California Water Service (CWT) – [6/4/19 Sure Analysis report]

- Northwest Natural Gas (NWN) – [5/30/19 Sure Analysis report]

- SJW Group (SJW) – [7/26/19 Sure Analysis report]

Additionally, you can see the Dividend Kings analyzed in the video below.

Performance Of The Dividend Kings

The Dividend Kings outperformed The S&P 500 ETF (SPY) in July of 2019 on a relative basis. Return data for June 2019 is shown below:

- Dividend Kings June 2019 total return: 1.4%

- SPY July 2019 total return: 0.6%

Total return performance year-to-date through July 2019 is below:

- Dividend Kings: 17.9%

- SPY: 20.1%

Through the first 6 months of this year, the Dividend Kings as a basket have underperformed The S&P 500 ETF SPY by 2.2 percentage points. Stable dividend growers like the Dividend Kings tend to slightly underperform in bull markets, and outperform on a relative basis during bear markets.

The Dividend Kings are not officially regulated and monitored by any one company. There’s no Dividend King ETF.

This means that tracking the historical performance of the Dividend Kings can be difficult. More specifically, performance tracking of the Dividend Kings often introduces significant survivorship bias. Survivorship bias occurs when one looks at only the companies that ‘survived’ the time period in question. In the case of Dividend Kings, this means that the performance study does not include ex-Kings that reduced their dividend, were acquired, etc.

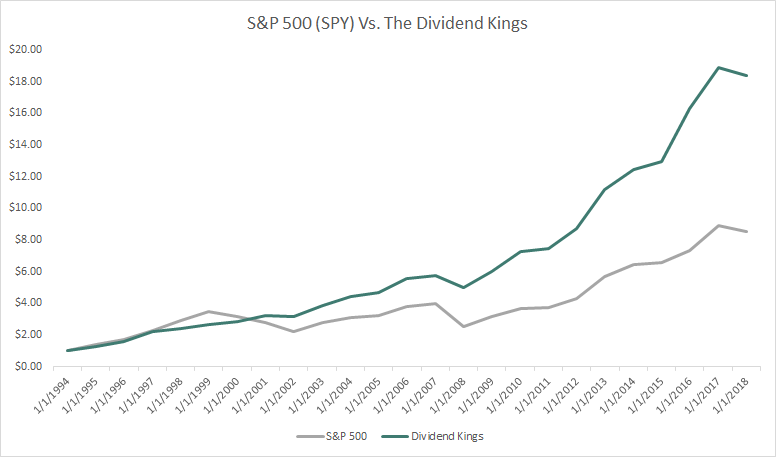

But with that said, there is something to be gained from investigating the historical performance of The Dividend Kings. Specifically, the performance of The Dividend Kings shows that ‘boring’ established blue-chip stocks that increase their dividend year-after-year can significantly outperform over long periods of time.

The image below shows the long-term performance of $1 invested in an equal-weight portfolio of today’s Dividend Kings is versus The S&P 500 through 2018.

Notes: S&P 500 performance is measured using the S&P 500 ETF (SPY). The Dividend Kings performance is calculated using an equal weighted portfolio of today’s Dividend Kings, rebalanced annually. Due to insufficient data, Farmers & Merchants Bancorp (FMCB) returns are from 2000 onwards. Performance excludes previous Dividend Kings that ended their streak of dividend increases which creates notable lookback/survivorship bias. The data for this study is from Ycharts.

The table below shows the performance of The Dividend Kings by year versus The S&P 500 by year through 2018.

Notes: S&P 500 performance is measured using the S&P 500 ETF (SPY). The Dividend Kings performance is calculated using an equal weighted portfolio of today’s Dividend Kings, rebalanced annually. Due to insufficient data, Farmers & Merchants Bancorp (FMCB) returns are from 2000 onwards. Performance excludes previous Dividend Kings that ended their streak of dividend increases which creates notable lookback/survivorship bias. The data for this study is from Ycharts.

In the next section of this article, we will provide an overview of the sector and market capitalization characteristics of the Dividend Kings.

Sector & Market Capitalization Overview

The sector and market capitalization characteristics of the Dividend Kings are very different from the characteristics of the broader stock market. The following bullet points show the number of Dividend Kings in each sector of the stock market.

- Industrial: 7

- Consumer Defensive: 7

- Utilities: 4

- Consumer Cyclical: 2

- Financial Services: 3

- Basic Materials: 1

- Real Estate: 1

- Healthcare: 1

The Dividend Kings are overweight in the Industrials, Consumer Defensive, and Utilities sectors. Interestingly, The Dividend Kings have no exposure to the Technology sector, which is the largest component of the S&P 500 index.

The Dividend Kings also have some interesting characteristics with respect to market capitalization. These trends are illustrated below.

- 3 Mega caps ($200 billion+ market cap; JNJ, PG, & KO are the 3)

- 11 Large caps ($10 billion to $200 billion market cap)

- 10 Medium caps ($2 billion to $10 billion)

- 2 Small caps ($300 million to $2 billion; SJW & FMCB are the 2)

Interestingly, 15 out of 26 Dividend Kings have market capitalizations below $20 billion. This shows that corporate longevity doesn’t have to be accompanied by massive corporate size.

Final Thoughts

Screening to find the best Dividend Kings is not the only way to find high quality dividend growth stock ideas.

Sure Dividend maintains similar databases on the following useful universes of stocks:

- The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- The Complete List of High Dividend Stocks: Stocks with 5%+ dividend yields.

- The Complete List of Monthly Dividend Stocks: our database currently contains more than 30 stocks that pay dividends every month.

- The Sure Dividend Blue Chip Stocks List: our list of “blue chip stocks” is a combination of our Dividend Kings, Dividend Aristocrats, and Dividend Achievers lists.

There is nothing magical about investing in the Dividend Kings. They are simply a group of high-quality businesses with shareholder-friendly management teams that have strong competitive advantages.

Purchasing businesses with these characteristics at fair or better prices and holding them for long periods of time will likely result in strong long-term investment performance.

The most appealing part of investing is that you have unlimited choice. You can buy into mediocre businesses, or just the excellent companies. As Warren Buffett says:

“When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever.”

– Warren Buffett