Updated on September 25th, 2019 by Aristofanis Papadatos

As the saying goes, the house always wins. Casinos operate strong business models, as casinos earn a virtually guaranteed profit from the sum of the bets they receive.

The relatively attractive economics of casinos make the industry worthy of a closer look. Investors may be particularly intrigued by the earnings growth and dividends of the major casino stocks.

The 4 major publicly-traded casino stocks all pay dividends to shareholders. You can find them on our list of list of 674 dividend-paying consumer cyclical stocks.

That said, casinos are not without a fair amount of risk. Casinos are highly vulnerable to recessions, as consumers typically cut back heavily on gaming when the economy enters a downturn. The four major casino stocks saw their earnings collapse during the Great Recession.

And, the large U.S. casinos are heavily reliant on Macau, the largest gaming market in the world and the only market in China where casinos are legal. As a result, these stocks are very sensitive to any developments that affect the gaming activity in Macau.

This was a significant concern several years ago. In 2014, China initiated an anti-corruption regulatory crackdown, which greatly reduced the gaming activity in the area. Fortunately for the casinos, the downturn lasted for approximately two years and gaming activity in Macau has recovered since.

Casinos have enjoyed a rebound, although conditions have become more difficult over the past year due to the trade war between the U.S. and China. The high sensitivity of casino stocks to all the developments related to China and their pronounced cyclicality means that investors should pick casino stocks carefully.

This is why we have analyzed the major casino stocks in the Sure Analysis Research Database, which ranks stocks based upon the combination of their dividend yield, earnings-per-share growth potential and valuation to compute expected total returns.

In this article, we will compare the expected 5-year total annual returns of the four major casino stocks.

Table Of Contents

Top Casino Stock #4: Melco Resorts (MLCO)

Melco Resorts owns and operates casino gaming and entertainment casino resort facilities in Asia. It generates 87% of its revenue in Macau and 13% in Philippines.

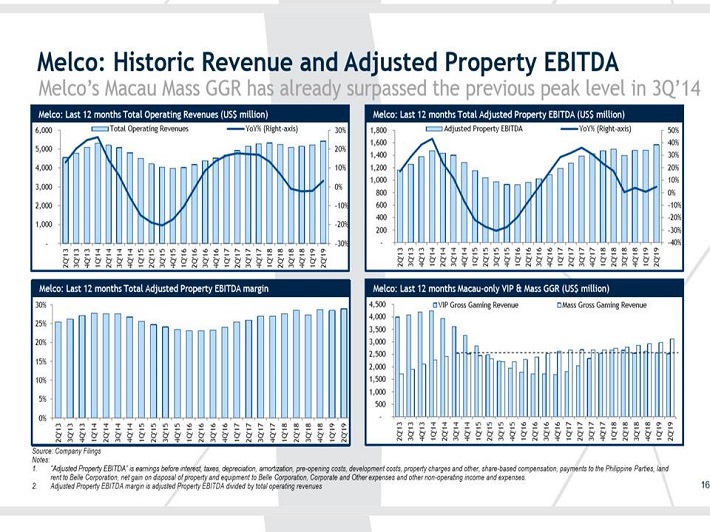

As Melco Resorts is the most leveraged to the gaming activity in Macau in this group of stocks, it was the most affected company during the downturn in the area between 2014 and 2016, when China executed an anti-corruption regulatory crackdown, which greatly reduced the gaming activity in Macau.

Conversely, Melco Resorts is the company that benefits the most from the recovery in the area in the last three years.

Source: Investor Presentation

This is evident in its results, as the company is poised to grow its earnings per share for a fourth consecutive year in 2019.

In the second quarter, the company exhibited strong performance in almost all its segments . It grew earnings per share from $0.12 to $0.22, primarily thanks to the ramp-up of Morpheus, one of the most luxurious hotels in the world, which cost $1.1 billion and opened in June 2018.

Melco Resorts has promising growth prospects. The company expects further growth from its Morpheus hotel. Separately, it is in the process of acquiring a 19.99% stake in Crown Resorts. If the deal materializes, the company will gain exposure in the Australian resort market. Lastly, the company is taking the necessary steps in order to receive a license to open an integrated resort in Japan.

On the other hand, due to its extreme leverage to the gaming activity in Macau, the stock is highly vulnerable to any setback related to the trade war between the U.S. and China. In addition, the gaming activity in Macau has become markedly volatile this year.

For instance, gross gaming revenue in Macau plunged 9% in August over last year’s period. The slump was attributed to a decelerating Chinese economy, Typhoon Lekima and protests in Hong Kong.

Therefore, despite the promising growth prospects, we hold modest expectations for Melco, due to its extreme leverage to the activity in Macau. We expect 2.8% average annual growth of earnings per share over the next five years.

The stock trades for a price-to-earnings ratio of 21.7, which is higher than our assumed fair earnings multiple of 17.5. If the stock reverts to our assumed fair valuation level within the next five years, it will incur a 4.2% annualized contraction of its valuation level. Therefore, given also its 3.0% dividend yield, the stock is likely to offer just a 1.6% average annual return over the next five years.

It is remarkable that Melco Resorts has posted strong free cash flows in 6 out of the last 8 years, with the exception of 2014-2015 due to the downturn in Macau. Given its healthy balance sheet and its low payout ratio, the company is likely to meaningfully grow its dividend in the upcoming years.

On the other hand, income-oriented investors should remain cautious, as the company is highly vulnerable to economic downturns and is very sensitive to any casino-related policy change in China and the ongoing trade war.

Top Casino Stock #3: MGM Resorts (MGM)

MGM Resorts owns and operates casinos, hotels and conference halls in the U.S. and China. It generates 81% of its revenues in the domestic market and 19% in Macau.

The company has by far the least exposure to Macau in this group of stocks. Consequently, while its peers have incurred a steep correction in the last five months due to the poor trends in Macau, MGM Resorts has performed relatively well. MGM Resorts is also less vulnerable than its peers to the trade war between the U.S. and China.

Nevertheless, MGM Resorts reported disappointing results in the second quarter. Adjusted earnings per share fell from $0.26 in last year’s quarter to $0.23, and missed analyst estimates by $0.03. Poor performance was due to Las Vegas Strip Resorts, where the company generates almost half of its revenues.

MGM Resorts has a poor performance record, as it has posted losses for seven consecutive years in the last decade. It also has a weak balance sheet, with net debt around $18 billion, while its interest expense takes up more than half of its operating income.

That said, the company has a positive outlook for conventions and sports betting in the domestic market, as well as the ramp-up of the recently-built MGM Cotai resort, MGM Springfield, and Park MGM. The company expects approximately 9% annual revenue growth and 10% annual EBITDA growth this and next year.

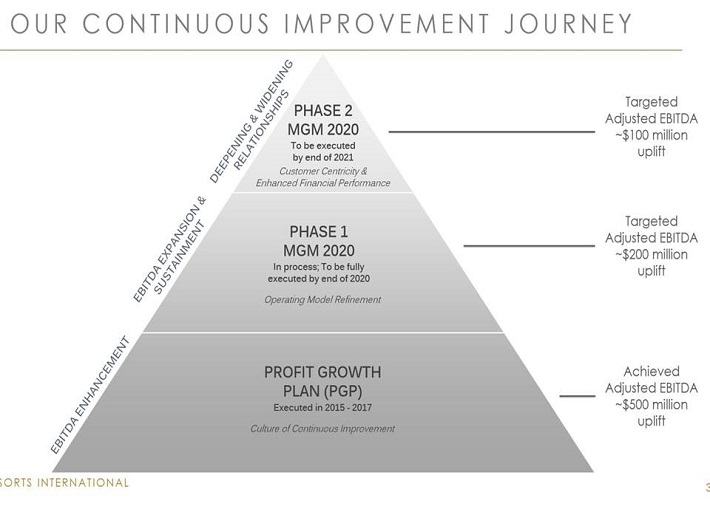

The company will also enhance its earnings growth via its initiative “MGM 2020”, which aims to expand margins by reducing operating costs and enhancing the efficiency of the company.

Source: Investor Presentation

Due to the low comparison base of this year, we expect 13.5% annual earnings-per-share growth over the next five years.

The stock trades at a price-to-earnings ratio of 27.3. As the company has reported losses in seven of the past 10 years, its price-to-earnings history is not reliable. We believe that a fair price-to-earnings ratio for this stock is around 16.0.

If the stock reaches our fair valuation level over the next five years, it will incur a 10.1% annualized drag in its returns. Therefore, given its 1.8% dividend yield and 13.5% annual earnings-per-share growth forecast, the stock is likely to offer a 5.2% average annual return over the next five years.

Top Casino Stock #2: Wynn Resorts (WYNN)

Wynn Resorts owns and operates Wynn Macau and the Wynn Palace in Macau, as well as Wynn Las Vegas and Encore in Las Vegas. It generates 74% of its revenues in Macau.

As Wynn Resorts is highly leveraged to the gaming activity in Macau, it saw its earnings collapse and it cut its dividend by 62% in due to the 2015-2016 Macau downturn. But as Macau has strongly recovered in the last three years, Wynn Resorts is growing again at a fast pace.

The company is expected to earn $6.55 per share this year, just 9% less than its all-time high earnings per share of $7.17. Still, investors should be aware that the stock is very sensitive to any downturn in the Chinese economy and any negative development in the ongoing trade war between the U.S. and China.

In the second quarter, the company saw its earnings per share decrease 6% over last year’s quarter. Management attributed the lackluster performance to the pre-opening expenses for the development of Encore Boston Harbor. While this is true, we also believe that increased competition played a role as well, due to the launch of new properties such as Melco’s Morpheus hotel, and MGM Cotai.

It is also worth noting that Wynn Resorts has continued to experience pressure in its Macau business in the third quarter. Management recently warned that it expects an approximate 7% decrease in revenues and a 30% decrease in adjusted EBITDA in July and August.

On the bright side, Wynn Resorts seems to have ample room to grow in the upcoming years thanks to its promising growth pipeline.

Source: Investor Presentation

The company has made progress in the design of Crystal Pavilion in Macau, which will be a major tourist attraction. In addition, Encore Boston Harbor opened in June so it has ample room to grow in the years ahead.

Nevertheless, due to the heating competition in Macau and the volatile trends witnessed in the gaming revenue in the area this year, we expect Wynn Resorts to grow its earnings per share by a more modest 4% per year over the next five years.

Thanks to the opening of Encore Boston Harbor, Wynn Resorts will have much lower capital expenses going forward. As a result, management recently raised the dividend by 33%, from $3.00 to $4.00 per year. The stock is now offering an attractive 3.7% dividend yield.

Wynn stock is currently trading for a price-to-earnings ratio of 16.5, which is much lower than its historical average of 30.1. However, the stock has traded at abnormally high ratios in certain years over the past decade, due to the temporary collapse of its earnings in those years. Overall, we assume a fair earnings multiple of 18.0 for Wynn Resorts.

If the stock reaches our fair valuation level over the next five years, it will enjoy a 1.8% annualized gain in its returns. Including its 3.7% dividend, the stock is likely to offer a 9.5% average annual return over the next five years. Wynn is an attractive stock for income investors.

Top Casino Stock #1: Las Vegas Sands (LVS)

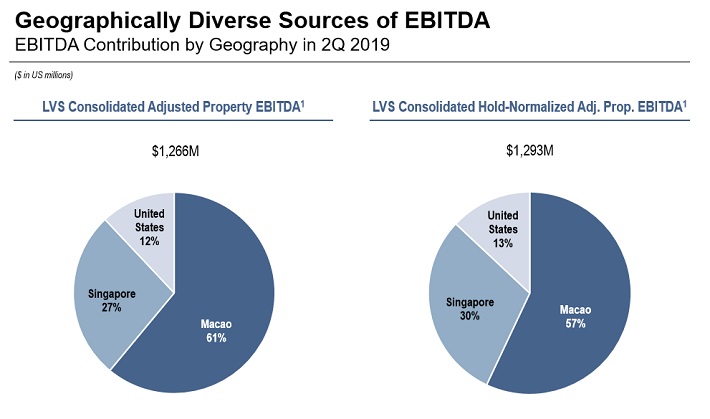

Las Vegas Sands is a leading developer and operator of integrated resorts in the U.S. and Asia. It generates 64% of its revenue and 61% of its adjusted EBITDA in Macau.

Source: Investor Presentation

Due to its high dependence on Macau, Las Vegas Sands saw its revenues and earnings plunge in 2015-2016 due to the downturn in the area. However, the company has recovered since then thanks to Macau’s revival. The recovery proved to be short-lived, as gaming activity in Macau has become volatile again this year.

For example, gross gaming revenue plunged 9% in August over last year’s period due to a slowing Chinese economy, Typhoon Lekima, and protests in Hong Kong. Nevertheless, comparisons are likely to be more favorable in the remainder of the year thanks to a fairly low comparison base formed by last year’s figures.

Moreover, Las Vegas Sands has promising growth prospects ahead. As Japan legalized casino gambling two years ago, Las Vegas Sands has announced that it intends to open integrated resorts in Tokyo and Yokohama. This endeavor will be a significant growth driver, though it will take a few years until the company earns a license and builds its new properties in Japan.

Furthermore, Las Vegan Sands continues to pursue growth by expanding and upgrading its Macau properties. The company is on track to launch Four Seasons Tower Suites Macao later this year, the Londoner Macao within 2020-2021, and expand Marina Bay Sands in Singapore. Thanks to all these growth drivers, we expect the company to grow its earnings per share by about 5% per year over the next five years.

Las Vegas Sands also offers an exceptional 5.5% dividend yield, which is much higher than the yield of its peers. The dividend is covered by the earnings and the free cash flows but the payout ratio is high, as it stands at 97%. Consequently, the dividend is likely to come under pressure in the event of a downturn in Macau or in the U.S.

Las Vegas Sands has adopted a markedly shareholder-friendly policy in recent years. It has returned $3.0 billion per year in each of the last two years and is on track to return the same amount to its shareholders this year. On the other hand, due to the high payout ratio, investors should expect slow dividend growth going forward.

The stock is currently trading at a price-to-earnings ratio of 17.6, which is lower than its historical average of 23.0. However, we believe that a fair earnings multiple for this stock is around 17.0. If the stock reaches our fair valuation level over the next five years, it will incur a modest 0.7% annualized drag in its returns. Overall, given its 5.0% annual earnings-per-share growth and its 5.5% dividend, the stock is likely to offer a 9.8% average annual return over the next five years.

Final Thoughts

After a two-year slowdown, the gaming activity in Macau enjoyed a strong recovery in 2017 and 2018. However, Macau has slowed once again this year. As a result, all the above casino stocks, except for MGM Resorts, which has low exposure in Macau, have incurred a steep stock price correction in the last five months.

Las Vegas Sands currently has the most attractive expected return of nearly 10% per year over the next five years. It also offers by far the highest dividend yield and has the most shareholder-friendly management in its peer group.

On the other hand, investors should not forget that all the casino stocks are highly vulnerable to economic downturns. Because of this, investors anticipating a recession in the near-term are likely to avoid these casino stocks.

Moreover, Las Vegas Sands, Wynn Resorts and Melco Resorts are very sensitive to any negative development in the trade war between the U.S. and China. MGM Resorts is much more resilient in such a scenario, but the stock is fully valued.

Overall, Las Vegas Sands and Wynn Resorts seem to be the most attractive casino stocks right now. Given the risks mentioned, only investors who can stomach volatility should consider investing in casino stocks.