Published January 29th, 2017 by Bob Ciura

A lawsuit by one industry giant against another can have a negative impact on stock prices in the short-term.

This is exactly what happened to Qualcomm (QCOM), on news that Apple (AAPL) has sued the company, both in the U.S. and in China.

Apple stock has not been affected by the news—shares have risen 4% in the past month, and 30% in the past year.

The same cannot be said for Qualcomm…

The lawsuit filed by Apple – one of its biggest customers – dragged down Qualcomm stock by 20% over the past month.

Qualcomm’s elevated level of headline risk has been met by short-term selling pressure, but long-term investors should not panic. Qualcomm remains a strong dividend stock with a history of consistent dividend increases.

If anything, Qualcomm stock may be more attractive after its decline. The valuation has come down, and the dividend yield has risen to nearly 4%.

Qualcomm is a Dividend Achiever, a group of 272 stocks with 10+ years of consecutive dividend increases.

You can see the full Dividend Achievers List here.

That’s why, the best thing to do with Apple and Qualcomm stock, may be nothing at all.

Overview of Apple/Qualcomm Lawsuit

Apple first filed a lawsuit in the U.S. on January 20, alleging that it was being charged exorbitant prices by Qualcomm.

Apple claims that Qualcomm essentially has a monopoly on the precise technology it licenses to Apple. And, that Qualcomm is leveraging that monopolistic position to charge fees that are too high.

Apple then followed up with a lawsuit in China less than a week later, on basically the same terms.

Combined, Apple is seeking roughly $1.145 billion in rebate payments. Apple wants to retrieve these funds, which it states have been withheld. The two parties previously had an agreement which called for rebates paid in exchange for Apple using Qualcomm’s chips in its iPhone device.

Surely, $1.145 billion is a significant sum of money. And it has caused severe damage to Qualcomm’s stock price. Shares fell 12% in a single day, when the lawsuit was initially reported.

But for a company with pockets as deep as Qualcomm’s, it’s a relative drop in the bucket.

Qualcomm ended last quarter with approximately 1.5 billion shares outstanding. Even if Apple were awarded the full amount, it would constitute a penalty of approximately $0.76 per share.

Over the past 30 days, Qualcomm stock has declined by roughly $13 per share.

As a result, the pessimism may have become excessive.

The lawsuit presents a difficult short-term picture, but it will likely conclude with a one-time settlement or financial penalty. It should have little bearing on Qualcomm’s business down the road.

All indications are that the two companies continue to believe their partnership is mutually beneficial. This implies Qualcomm should be fine over the long-term.

Long-Term Growth Potential

Qualcomm’s fundamentals remain healthy. Last quarter, quarter, revenue and adjusted earnings-per-share by 4% and 23%, respectively.

And, total device sales are expected to have their best performance in the December quarter in four years.

Source: Quarterly Earnings presentation, page 7

The smartphone boom is nowhere close to running out of steam. Consumers everywhere still love their devices.

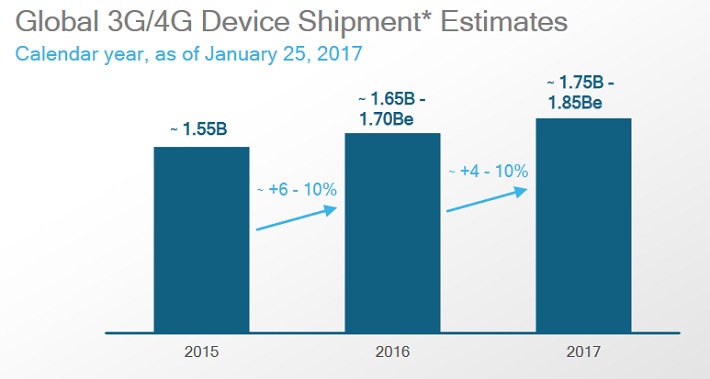

Global 3G and 4G device shipments are expected to grow 4%-10% in fiscal 2017.

Source: Quarterly Earnings presentation, page 8

Longer-term, connectivity is a catalyst because of new technologies like the Internet of Things, which connects devices. Another emerging technology is unmanned aerial devices, such as drones, and autonomous vehicles.

Qualcomm is making a big push into these areas, with its $47 billion pending takeover of NXP Semiconductor (NXPI).

Qualcomm is investing for the future, and in the meantime, its core business is strong. It generated $6.9 billion of free cash flow in fiscal 2016.

It does this by owning a superior intellectual property portfolio, which it has built through significant research and development spending:

- 2016 R&D expense of $5.2 billion

- 2015 R&D expense of $5.5 billion

- 2014 R&D expense of $5.5 billion

And, the company has an excellent balance sheet. It ended last quarter with $30 billion in cash and investments, compared with just $10 billion in long-term debt.

Its balance sheet and cash flow allow the company to invest in future growth, and also return billions to investors each year.

Source: Quarterly Earnings presentation, page 11

Qualcomm returned more than $55 billion to investors in the past 10 years in dividends and share buybacks.

There should be plenty of room for continued dividend growth. Last year, the company raised its dividend by 10%.

It could easily sustain a 10% dividend growth rate going forward, because Qualcomm distributed just 44% of its free cash flow in dividends last year.

Valuation & Expected Total Returns

Qualcomm stock has experienced a sudden and significant decline, which is always unnerving for investors.

Qualcomm stock had been performing well towards the end of 2016, based on its successful turnaround efforts.

But the lawsuit brought its momentum to a screeching halt.

However, the good news is that the decline may have created a buying opportunity. Shares of Qualcomm now trade for a price-to-earnings ratio of 14. By comparison, stocks in the S&P 500 Index have an average price-to-earnings ratio of approximately 26.

This means that Qualcomm essentially trades at a 46% discount to the market multiple. This seems too conservative—Qualcomm is an industry leader, with several competitive advantages in its intellectual property and patent portfolio.

Even if Qualcomm stock were to trade for a price-to-earnings ratio of 20, it would yield a 43% return through multiple expansion.

And, future earnings growth can boost shareholder returns even more. A reasonable breakdown of Qualcomm’s future returns could be as follows:

- 2%-4% organic revenue growth

- 1% revenue growth through acquisitions

- 1% margin expansion

- 1% share repurchases

- 4% dividend yield

Under this scenario, future total returns would reach 9%-11% annualized, not including any returns from multiple expansion.

Final Thoughts

Finding a stock with a 4% dividend yield and 10% annual dividend growth potential is a difficult task. Add to that Qualcomm’s dominant industry position and multiple competitive advantages, and the stock could be a bargain.

Investor sentiment has become highly pessimistic, but the long-term picture remains bright.