News

Danaos Benefits from Increasing Demand in Container Shipping

Danaos Corp. (NYSE: DAC) is a leader in the global container shipping industry. The company specializes in operating dry bulk and container vessels. Danaos owns and operates its fleet of container

Can Southwest Airlines Stock Truly Rally 77% on Activist Plans?

After a long year and a half of trading within a tight $27 to $35 channel roughly, shares of Southwest Airlines Co. (NYSE: LUV) have finally run into the catalyst investors were looking for to

Despite Bad Headlines, Boeing Still Wins Billion Dollar Contracts

Aerospace giant The Boeing Co. (NYSE: BA) has had a tumultuous year, making negative headlines on a weekly basis regarding safety protocol violations and whistleblower allegations. From mid-air

Foot Locker’s Quarter Sends Doubters Running

After reporting its first quarter 2024 financial results, shares of Foot Locker Inc. (NYSE: FL) jumped by as much as 40% as markets reacted to what could be the retail sector’s latest turnaround

Is It Time to Lock in Profits on These 3 Overbought Stocks?

As summer trading begins and volumes dwindle, the overall market has climbed nearly 11% year to date (YTD), with the SPY ETF just 1% off its all-time high. Leading the charge is NVIDIA Corp.

United Natural Foods Surges on Whole Foods Extended Partnership

United Natural Foods Inc. (NYSE: UNFI) is a leading wholesale distributor of organic, natural, and specialty foods and grocery products in the United States and Canada. The company has an

3 Stocks Insiders are Buying That Should be on Your Radar

Unusual insider activity and changes in insider buying habits can signal opportunities that lead to investor gains. Today, we’re looking at three stocks that popped on Insidertrades.com's radar

Financial Sector: Potential Trend Change Looms with Double Top

Previously an outperformer with a year-to-date gain of over 11%, the financial sector now finds itself at a critical juncture after giving back some of its gains. Just six trading days ago, the

![Survey: The 130 Most Coveted Retirement Destinations in America [2024]: https://www.marketbeat.com/logos/articles/med_20240520152306_survey-the-130-most-coveted-retirement-destination.jpg](https://www.sharewise.com/rails/active_storage/representations/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaHBBM09nYkE9PSIsImV4cCI6bnVsbCwicHVyIjoiYmxvYl9pZCJ9fQ==--deddfcd8e4c63f4cb1bee69e54e3a29715faa874/eyJfcmFpbHMiOnsibWVzc2FnZSI6IkJBaDdCam9MY21WemFYcGxTU0lKTXpVd2VBWTZCa1ZVIiwiZXhwIjpudWxsLCJwdXIiOiJ2YXJpYXRpb24ifX0=--aa36f503a05c343bf077379e5dc8bce118d9db18/med_20240520152306_survey-the-130-most-coveted-retirement-destination.jpg?locale=us)

Survey: The 130 Most Coveted Retirement Destinations in America [2024]

We ran a survey of 3,000 retirees and those nearing retirement, pinpointing specific locations that retirees would choose if money were no object. The results are below.

Implications of the

Incrementum AG: In Gold We Trust-Report 2024 - „Das neue Gold-Playbook“

PRESSEMITTEILUNG: Ruggell / Wien, am 17. Mai 2024

Am 17. Mai 2024 wurde der diesjährige – mittlerweile 18. – In Gold We Trust-Report im Rahmen einer internationalen und live im Internet

Vistra Co. is a Utility that Trades Like Meme Stock

It’s hard to believe that a company in the utilities sector can be trading up 142.5% year-to-date, but it is happening for integrated retail electricity and power generation company Vistra Co.

Raytheon Rides the Defense Boom as a Triple Threat

Shares of the world’s largest aerospace and defense company, Raytheon Technologies Corp. (NYSE: RTX), have launched to new 52-week highs. President Joe Biden signed a $95 billion foreign aid bill

Power Surge: Utilities Sector Breaks out, Outperforms Market

The utilities sector just broke out of its multi-year downtrend, confirming a significant change of character and shift in momentum. The sector, which has certainly taken a back seat to other

Evolv Technologies Had a Bad Week, Is it Time to Buy or Fade?

A bad week continues to get worse for Evolv Technologies Holdings Inc. (NASDAQ: EVLV). The AI-based weapons detection company's stock was subject to a limit up, limit down (LULD) pause after

Plug Power is Building the Future of Hydrogen Despite Headwinds

Plug Power Inc. (NASDAQ: PLUG) is a prominent green energy hydrogen ecosystem player. Plug Power’s earnings report for the first quarter of 2024 was released, offering valuable insights into the

These 7 Stocks Surged Double-Digits and Have Double-Digits to Go

Earnings reports often catalyze big moves in a stock’s price; the bigger the move, the more conviction the market shows. Catalysts for these moves include better-than-expected results, gained

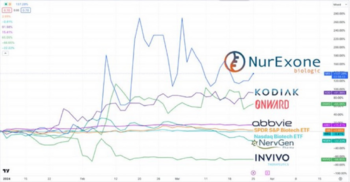

NurExone: Beliebter Biotech-Hot-Stock macht von sich reden

Die Aktie von NurExone Biologic Inc. (ISIN: CA67059R1091) ist in der Finanzpresse und in Investoren-Foren derzeit ein großes Thema. Kein Wunder, denn das kanadische, auf die Exosomenforschung

3 Value Stocks You Can Buy Before They Become Big

What’s Warren Buffett’s secret? The truth is, there is no secret. The only thing the legendary investor can be credited with is an uncanny ability to spot companies that would one day become big

Wall Street Believes in First Solar Stock’s Bull Cycle

Solar energy stocks haven’t been part of the market hype, which rallied to all-time highs in the past quarter after potentially pricing in the Federal Reserve’s (the Fed) interest rate cuts, which

Stagflation Is Real, Mastercard Stock Now a Sudden Must Have

One of the most feared outcomes for the U.S. economy just became a reality. While economists argued over whether the U.S. would see a ‘soft’ landing or a ‘hard’ landing, few focused on the

Is the Financial Sector Poised for a Major Directional Move?

The financial sector, an outperformer year-to-date, up over 8.5% compared to the overall market’s 6.9%, is currently in a fascinating position.

3 Stocks With Unusual Call Option Buying Activity

Buying options is a way to increase the leverage on a trade, as it takes an investor less out-of-pocket money to gain significantly higher exposure to a stock's underlying direction. The caveat lies

Caterpillar’s Market Reset Isn’t Over: Get Ready for Lower Prices

The market’s reaction to Caterpillar’s (NYSE: CAT) Q1 results and guidance proves that the correction in price action is not over. The news isn’t bad, but tepid and weaker than expected, causing a

Power Surge: Utilities Sector's Resilience Shines

One standout player in the exchange-traded funds (ETFs) world has been making waves for its recent relative strength: the Utilities Select Sector SPDR Fund (NYSE: XLU). It's been holding its

Simpson Manufacturing: Buy This Future Dividend King While Down

Simpson Manufacturing Co. (NYSE: SSD) sent its share price reeling as it reported its struggles during Q1 2024, but this is a great time to buy this construction stock. You don’t buy Simpson