This Insurance Giant Looks Ready For A Breakout

MetLife's stock (NYSE: MET) has endured a rather forgettable year. Up to this point in the year, the stock has experienced a decline of nearly 14%, significantly lagging behind the broader market. Nevertheless, over the past few months, MET's shares have managed to mount a recovery, surging by almost 24% from their low point in June.

The current resurgence in MET's performance, combined with its bullish consolidation pattern and a higher low as several important moving averages converge, warrants attention as a potential signal for further upward movement.

MetLife is a global financial services company offering insurance, annuities, employee benefits, and asset management. It operates through five segments: U.S., Asia, Latin America, Europe, Middle East and Africa, and MetLife Holdings. MetLife has a long history since its founding in 1863 and is headquartered in New York.

The Opportunity In MET

With the stock trading confidently above its rising 5-day Simple Moving Average (SMA) and 50-day SMA, while consolidating in a tight range near the pivot-high, it is now showing a strong bullish trend. The recent uptrend and consolidation above two key moving averages is an evident change of character for the stock and signals a significant shift in momentum and direction.

Notably, an attractive setup has now formed, with a break of the consolidation resistance acting as confirmation of a breakout. If the stock can break over the consolidation resistance of $62 and hold above it with increasing volume, it might be gearing up for a move back above the 200-day SMA and potentially $66.

Recent Earnings and Dividends

On August 2nd, 2023, MetLife released its quarterly earnings. The company exceeded expectations with earnings per share (EPS) of $1.94, surpassing the estimated $1.85 by $0.09. The quarter's revenue was $16.62 billion, slightly below the anticipated $16.91 billion. This still marked a 7.4% increase compared to last year's period.

Over the past year, MetLife has achieved $2.57 in earnings per share over the past year and currently holds a price-to-earnings ratio of 24.2. The company anticipates an 18.89% earnings growth in the upcoming year, expecting earnings to rise from $7.78 to $9.25 per share.

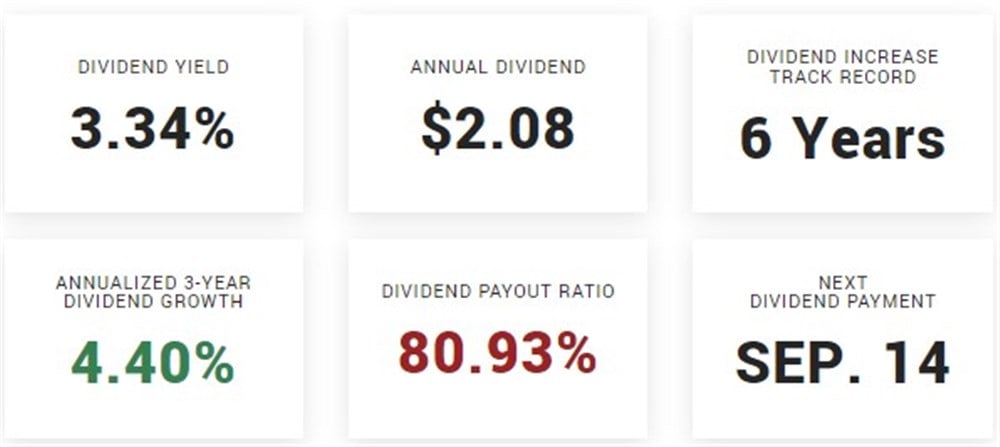

MetLife offers an attractive dividend yield of 3.34%. Over the last several years, MET’s dividend payments have modestly increased, from $0.46 in Q3 2020 to an expected $0.52 in Q3 2023. However, the company's annual dividend of $2.08 is less than the average annual dividend of relevant listed financial companies, $6.21, but greater than its competitors listed on the NYSE, $1.53.

Analysts See Upside For MET

Analysts are predicting a significant upside for shares of MET. Based on eleven analyst ratings, the consensus price target is $77.40, expecting an impressive 24.30% upside for the stock. MET has a consensus rating of Moderate Buy, with eight analysts placing the stock as a Buy and three as a Hold. The rating is above the consensus rating of finance companies, which currently stands at Hold.

Source MarketBeat

Metlife Inc. Aktie

Starke Bevorzugung von Metlife Inc. in der Community mit ausschließlich Buy-Einschätzungen.

Das von der Community festgelegte Kursziel von 73 € für Metlife Inc. deutet auf ein leichtes Wachstumspotenzial im Vergleich zu 69.41 € hin.