Published by Josh Arnold on November 7th, 2022

One area of the market that investors tend to overlook is that of spin-offs. The idea is that a business separates, or “spins off” a portion of the aggregated business to shareholders, generally to provide more focus to both of the businesses once they are separate. We often see this with conglomerates, where one or two parts of the business no longer fit with the goal of the parent company, so the parent company separates out one or multiple pieces.

Investors can buy high-quality dividend growth stocks such as the Dividend Aristocrats individually, or through exchange-traded funds. ETFs have become much more popular in the past five years, especially when compared to more expensive mutual funds.

With this in mind, we created a downloadable Excel list of dividend ETFs that we believe are the most attractive for income investors. We have also included the dividend yield, expense ratio, and average price-to-earnings ratio of the ETF (if available).

You can download your full list of 20+ dividend-focused ETFs by clicking on the link below:

A spin-off is often done to shed a low-growth (or contracting) business segment, or if a segment is no longer a strategic fit. The result, however, can be terrific, as companies that spin off parts of their business tend to outperform the market, as do the spin-offs themselves.

To that end, in this article, we’ll take a look at 10 spin-offs from recent years that now pay dividends after being separated from their parent companies. We’ll rank them in order of total expected annual returns, from least to greatest.

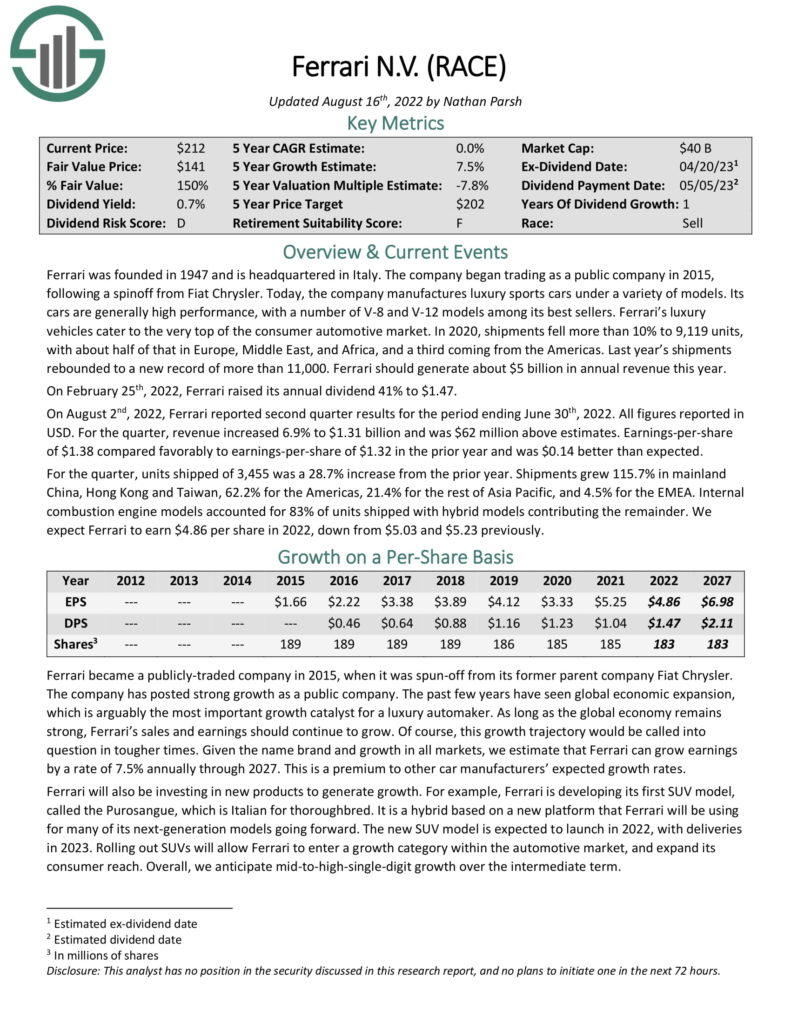

Ferrari N.V. (RACE)

Our first stock is Ferrari, the venerable Italian maker of luxury sports cars and hyper cars. The company makes about 10,000 cars annually, meaning it is ultra-exclusive. In addition, it operates racing teams, theme parks, and has a larger merchandising business with Ferrari-branded goods worldwide.

The company was founded in 1947, generates about $4.9 billion in annual revenue, and trades with a market cap of $35.1 billion.

Ferrari was formerly owned by Stellantis (STLA), the global automaker conglomerate that owns Fiat, among other brands. The spin-off was completed in early 2016. Since Ferrari was spun off, the stock has returned about 300% to shareholders.

The company now pays a dividend to shareholders, that is good for a yield of about 0.8%. That’s only about half of the S&P 500’s average yield, so Ferrari is far from an income stock.

Part of the reason is because we see it trading in excess of fair value, given it is priced at 41 times earnings. That is likely to drive a headwind to total returns of nearly 7% in the years to come, and reduces the dividend yield.

In total, we see expected returns at just 1.2% going forward, consisting of the small yield, headwind from the valuation, and a partial offset of those factors in the form of robust 7.5% annual earnings growth. Still, that lands Ferrari at the bottom of the pile in terms of total returns.

Click here to download our most recent Sure Analysis report on Ferrari (preview of page 1 of 3 shown below):

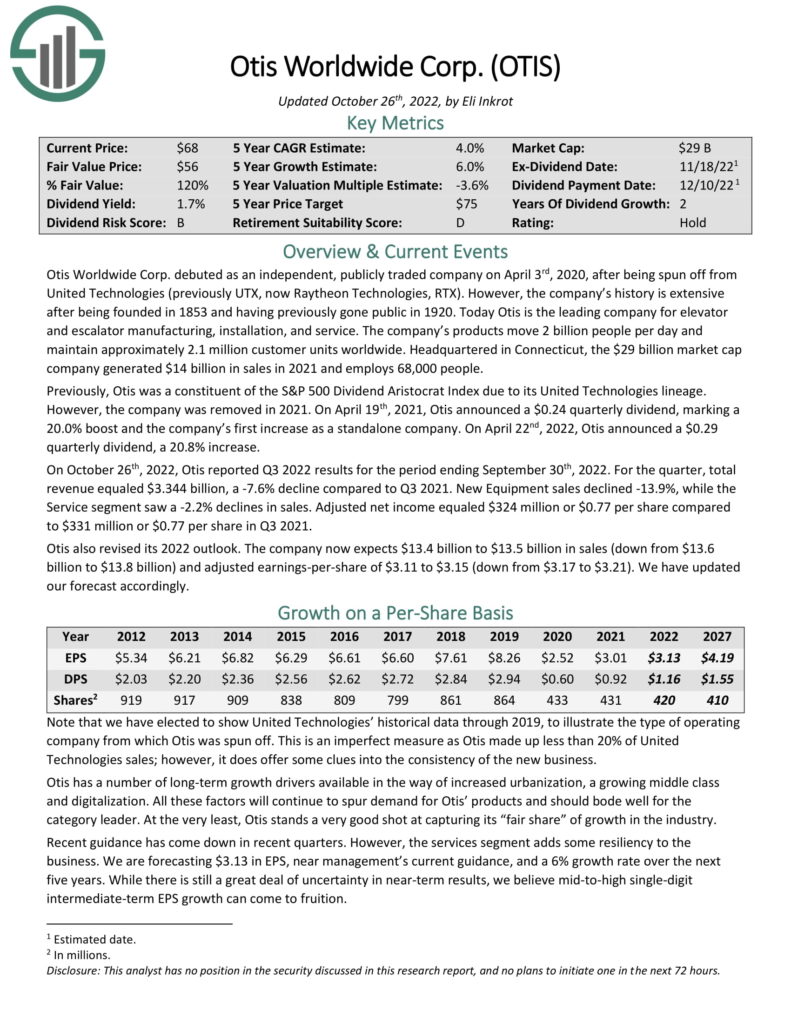

Otis Worldwide Corporation (OTIS)

Our next stock is Otis Worldwide, a company that manufactures, installs, and services elevators and escalators internationally. The company is fully integrated from manufacturing to servicing to replacing when it comes to elevators and escalators, and has predictable revenue and earnings due to its strong brand reputation.

The company was founded in 1853, produces just under $14 billion in annual revenue, and trades with a market cap of $29 billion.

Otis was spun off from United Technologies, a company that was subsequently merged into Raytheon (RTX). Otis was separated from United Technologies in the spring of 2020, and since that time, has returned about 60% to shareholders.

The stock pays a market-matching yield of 1.6% today, so it’s a reasonable income stock. However, we think there’s room for growth in the payout in the years to come.

We expect just 2.3% total annual returns as the 1.6% yield and 6% projected growth are mostly offset by a 5.2% headwind from a contracting valuation. Shares trade at more than 23 times earnings, and we see that as about 30% overvalued today.

Click here to download our most recent Sure Analysis report on Otis Worldwide (preview of page 1 of 3 shown below):

Edgewell Personal Care Company (EPC)

Next up is Edgewell Personal Care, a consumer personal care conglomerate that operates globally. Edgewell operates three segments, including Wet Shave, Sun and Skin Care, and Feminine Care. Through these segments, the company produces a huge variety of disposable products such as razors, shaving gel and cream, sunscreen, sanitizing wipes, pads and liners, and much more.

Edgewell traces its history all the way back to 1772, and today it generates $2.2 billion in annual revenue, while trading with a $1.9 billion market cap.

Edgewell was spun out from Energizer Holdings (ENR) in the summer of 2015. Since then, the stock has struggled to find footing, and returns have been subpar.

However, today the stock has a yield of 1.5%, roughly equal to that of the S&P 500. We think the company can grow its dividend in the range of 5% annually in the years to come, so there’s a dividend growth component in play.

Still, we expect only 2.7% total returns as the stock looks meaningfully overvalued today. Shares go for nearly 16 times earnings, well ahead of the 13 times earnings where we assess fair value. The resulting 3.6% headwind from the valuation nearly offsets 5% projected growth and the 1.5% yield.

Brookfield Business Partners L.P. (BBU)

Brookfield Business Partners is a private equity firm that specializes in acquisitions. The partnership invests in construction, energy, and industrial companies, generally, and takes majority stakes in target companies.

Brookfield is set to generate just over $13 billion in revenue this year and trades with a market cap of $4.5 billion.

The partnership was spun out of the Brookfield Asset Management (BAM) family of companies, along with several other partnerships that are publicly traded. Brookfield Business Partners was spun out in 2016 and has produced total price returns of just 26% in the six-plus years it has traded separately.

The yield is quite low at 1.2% as well, given Brookfield’s earnings tend to go through boom and bust cycles depending upon when the partnership enters and exits stakes in portfolio companies.

With these factors in mind, we see 5.1% total annual returns in the years ahead. Shares trade for just 3.5 times earnings, and we assess fair value at 5.5 times. That could drive a 9.5% tailwind from the valuation, but that will be somewhat offset by 5% annual declines in earnings. Adding in the 1.2% yield gets us to 5.1% estimates returns.

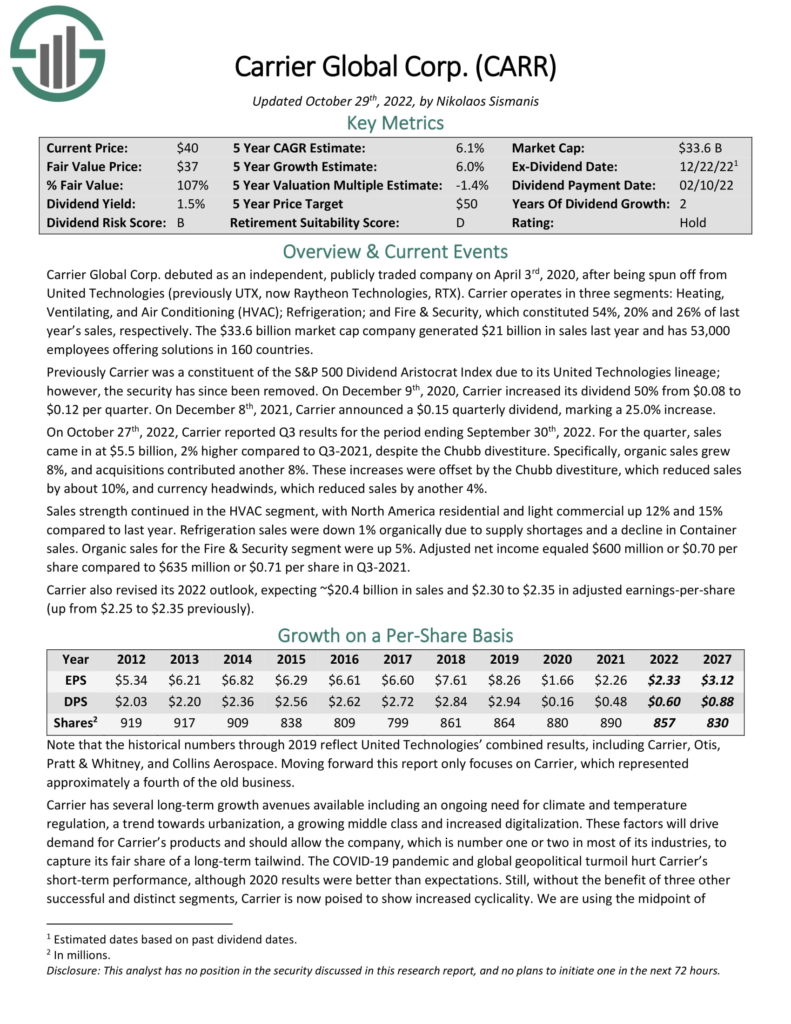

Carrier Global Corporation (CARR)

Our next stock is Carrier Global, a company that provides heating, ventilation, refrigeration, fire security, and building automation products and services worldwide. The company has popular brands in the space, including Kidde, Carrier, and Sensitech.

Carrier produces just over $20 billion in annual revenue, and trades with a market cap of $33 billion.

Carrier was also spun out of United Technologies, the same as Otis Worldwide, and at the same time. Since early 2020, Carrier has seen stock returns of about 175%, so it has been a very strong performer.

Like many of the others we’ve looked at, Carrier has a 1.5% dividend yield, putting it about even with the market average today.

We see this helping to produce 5.8% total annual returns in the coming years with the balance of returns netting from a 1.7% headwind from the valuation, and 6% projected earnings growth. Shares trade for just over 17 times earnings today, and we see that as about 9% overvalued.

Click here to download our most recent Sure Analysis report on Carrier Global Corporation (preview of page 1 of 3 shown below):

Hewlett Packard Enterprise Company (HPE)

Next up is Hewlett Packard Enterprise, which is a data-driven company that helps customers capture, analyze, and act upon its internal data. HPE operates globally, and has a wide variety of hardware, software, and services it provides to customers.

HPE traces its roots to 1939, produces about $28 billion in annual revenue, and trades today with a market cap of $18 billion.

HPE was spun out of the former version of HP Inc. (HPQ) in 2015. The stock has seen just 12% price returns since the spin-off, as it has struggled for earnings direction.

It has a 3.4% dividend yield today, however, so while price returns are lacking, it is a proper income stock. We think this yield that is double the market average will help drive respectable 7.1% total annual returns in the years to come.

The yield will be aided by a 1% valuation tailwind, as shares are slightly below fair value, and 3% projected earnings growth. We note HPE has not raised its dividend since 2020.

Click here to download our most recent Sure Analysis report on Hewlett Packard Enterprise Company (preview of page 1 of 3 shown below):

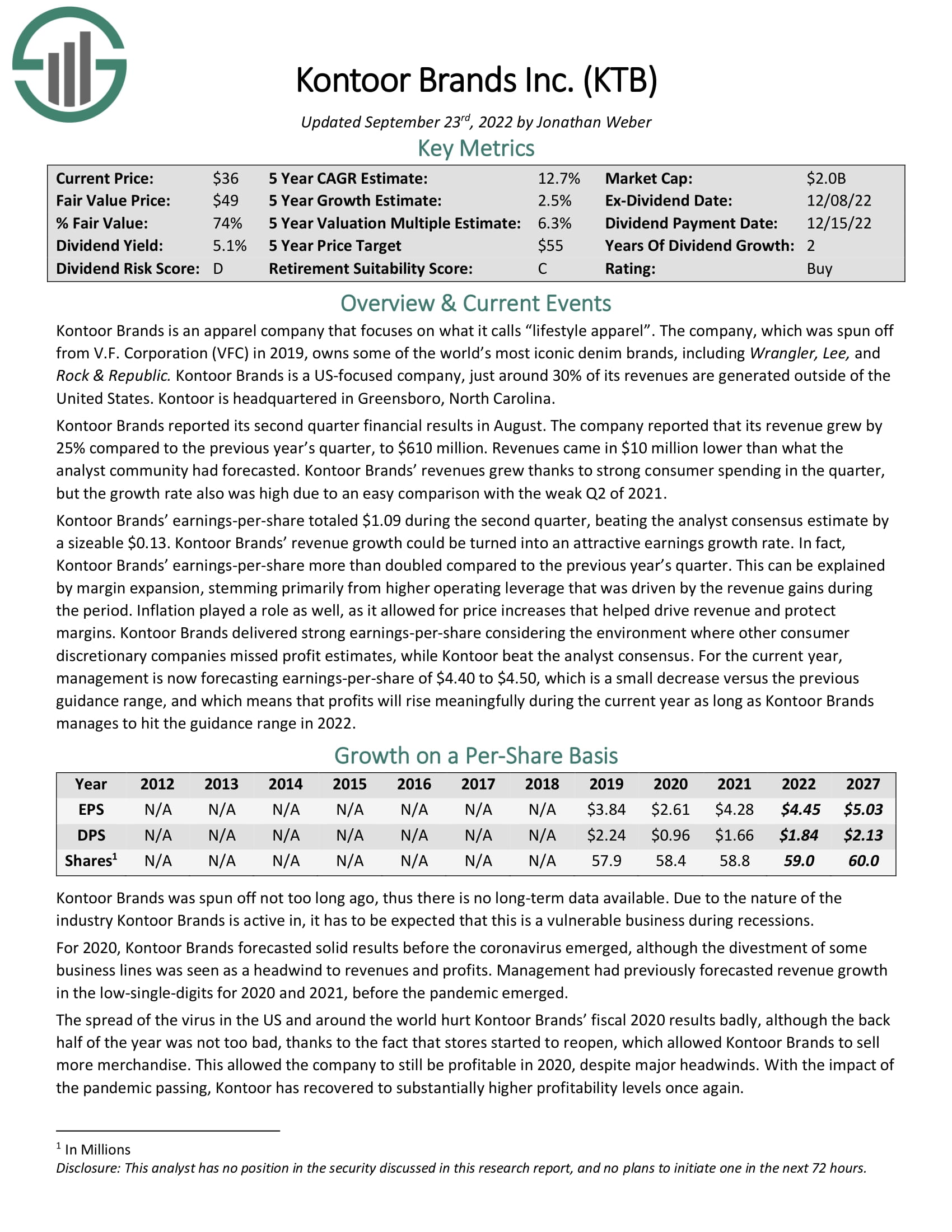

Kontoor Brands Inc. (KTB)

Our next stock is Kontoor Brands, a lifestyle apparel company that designs, manufactures, markets, and distributes apparel and accessories worldwide. Kontoor owns lucrative brands such as Wrangler, Lee, and Rock & Republic.

Kontoor produces about $2.5 billion in annual revenue, and it trades today for a market cap of $2.1 billion.

Kontoor was spun out of V.F. Corp (VFC) in May 2019. The stock is roughly flat since the spin-off, but today, it offers a massive 5.1% dividend yield, putting it in rare company on that measure.

The company paid initial dividends of 56 cents per share quarterly after the spin-off. However, it then went nearly a year without any dividends at all during the worst of COVID. The dividend has been raised twice since being reinstated, but remains below that of the initial dividend in 2019.

We think the company’s growth is likely to be muted at 2.5% annually, but we also think it’s undervalued at 8.5 times earnings. That could drive a 5.2% tailwind from the valuation, so combined with the other factors, we think Kontoor could see impressive 11.6% total annual returns in the coming years.

Click here to download our most recent Sure Analysis report on Kontoor Brands Inc. (preview of page 1 of 3 shown below):

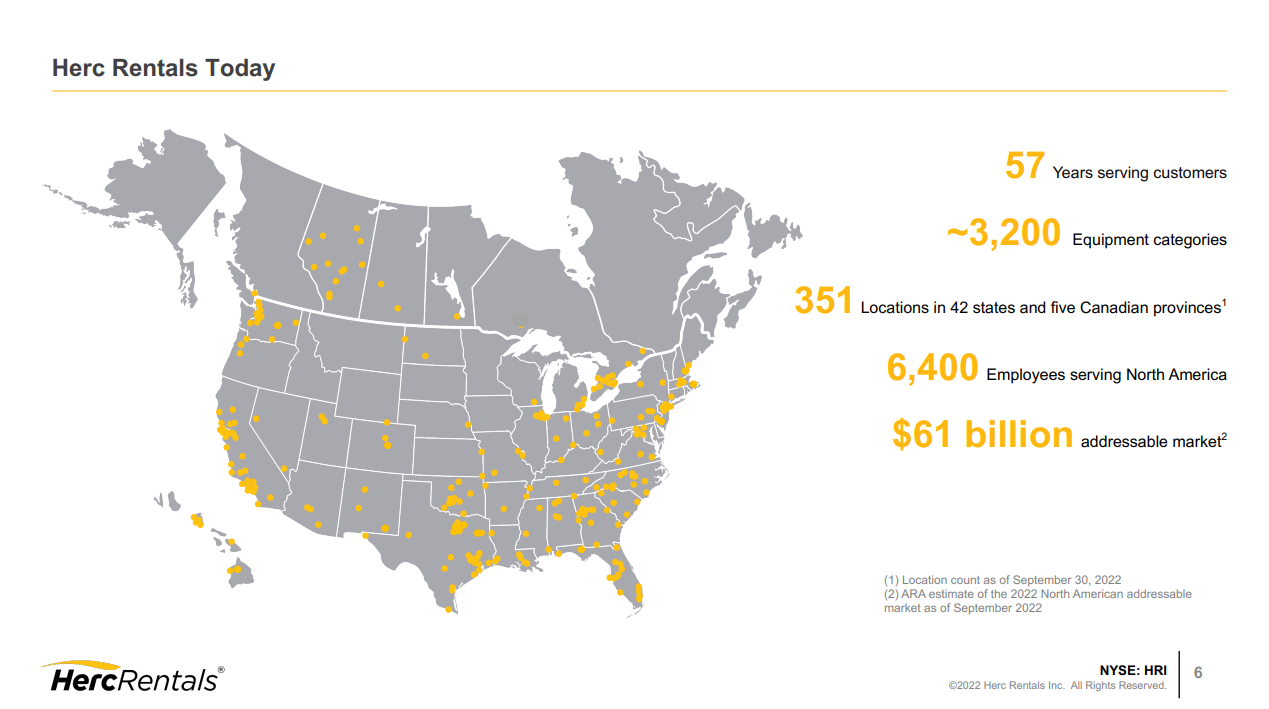

Herc Holdings Inc. (HRI)

Our third-from-last stock is Herc Holdings, a company that operates an equipment rental network, primarily in the U.S. Herc leases a wide variety of industrial equipment to construction companies, maintenance providers, metals and mining companies, aerospace customers, and more.

Herc traces its roots to 1965, generates about $2.7 billion in annual revenue, and trades today with a market cap of $3.5 billion.

Source: Investor presentation

Herc was spun out of Hertz Global Holdings (HTZ) in the summer of 2016. Herc has returned about 300% to shareholders since then, despite being well off its recent price highs today.

Shares yield just under 2% as the company pays about one-fifth of its earnings to shareholders. That helps drive expected returns of 13% annually. We think returns will be helped by 8% expected annual earnings growth, as well as a tailwind from the valuation. We peg fair value at 13 times earnings and Herc trades at just 11 times today. Overall, we think Herc offers a significant value proposition to prospective shareholders.

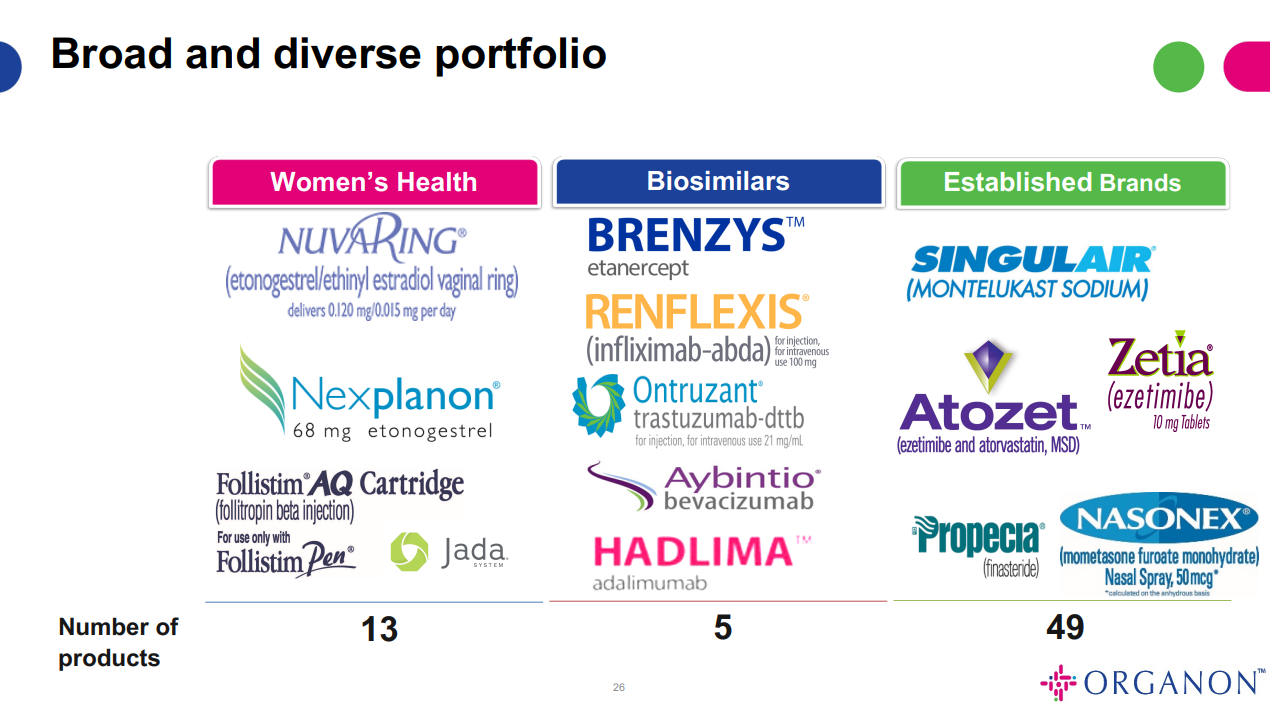

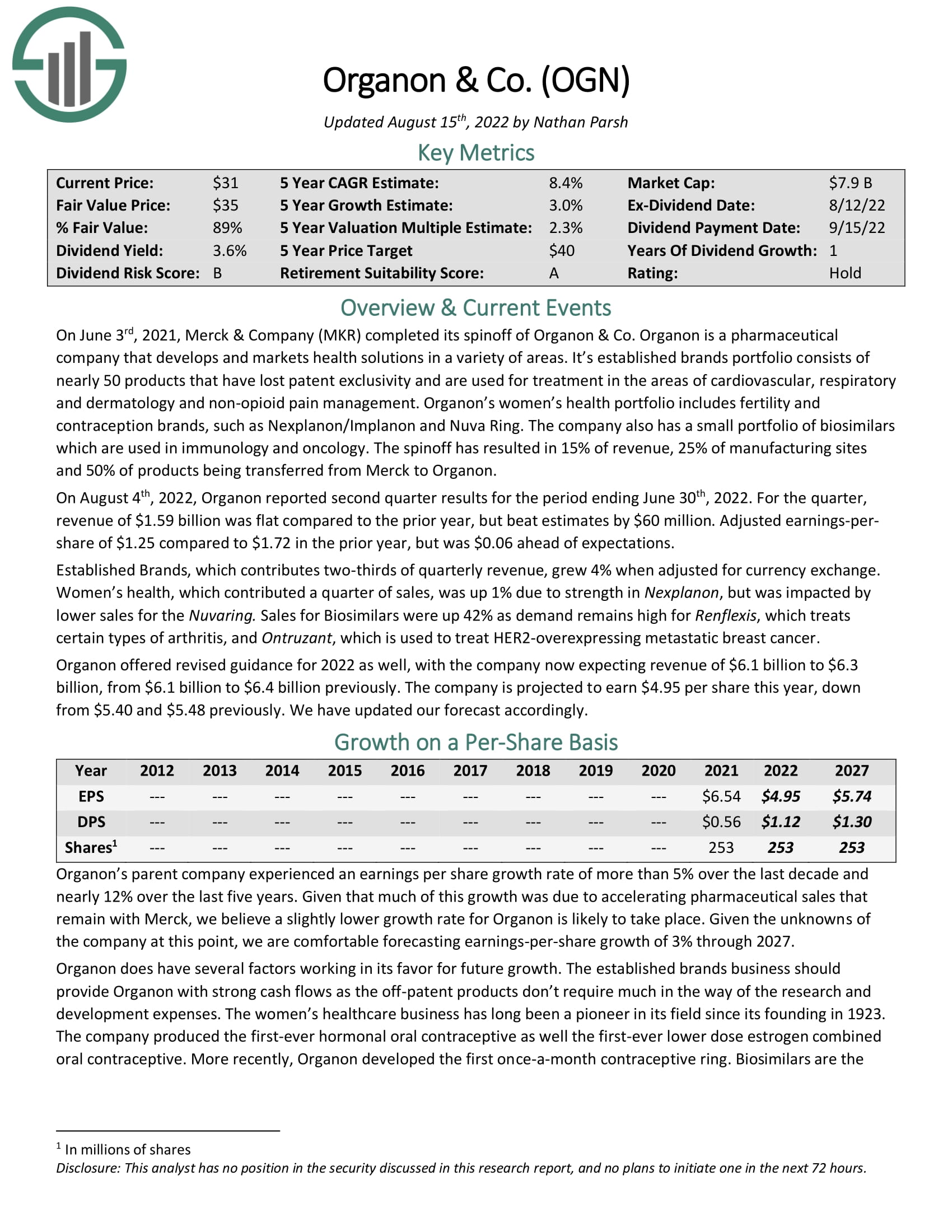

Organon & Co. (OGN)

Our penultimate stock is Organon, a healthcare company that develops and delivers health solutions through a portfolio of prescription therapies globally. The company focuses on women’s health through a long list of products that treat various indications.

Source: Investor presentation

Organon was spun out of pharmaceutical giant Merck (MRK) in the summer of 2021, and Organon has performed quite poorly since then. Shares have returned -35% in the past year, admittedly during a very tough bear market.

However, that has created what we believe is an undervalued stock, and we think it offers nearly-14% total annual returns in the years to come.

We expect the valuation to drive a 7.5% tailwind as shares trade for under 5 times earnings today. We forecast modest 3% earnings growth, but the stock also yields 4.6%. This combination of value and yield look quite attractive for income investors, in particular. Growth is likely to be muted given the company’s products are largely mature, so revenue growth isn’t forecast to be more than a low-single digit gain each year.

Click here to download our most recent Sure Analysis report on Organon (preview of page 1 of 3 shown below):

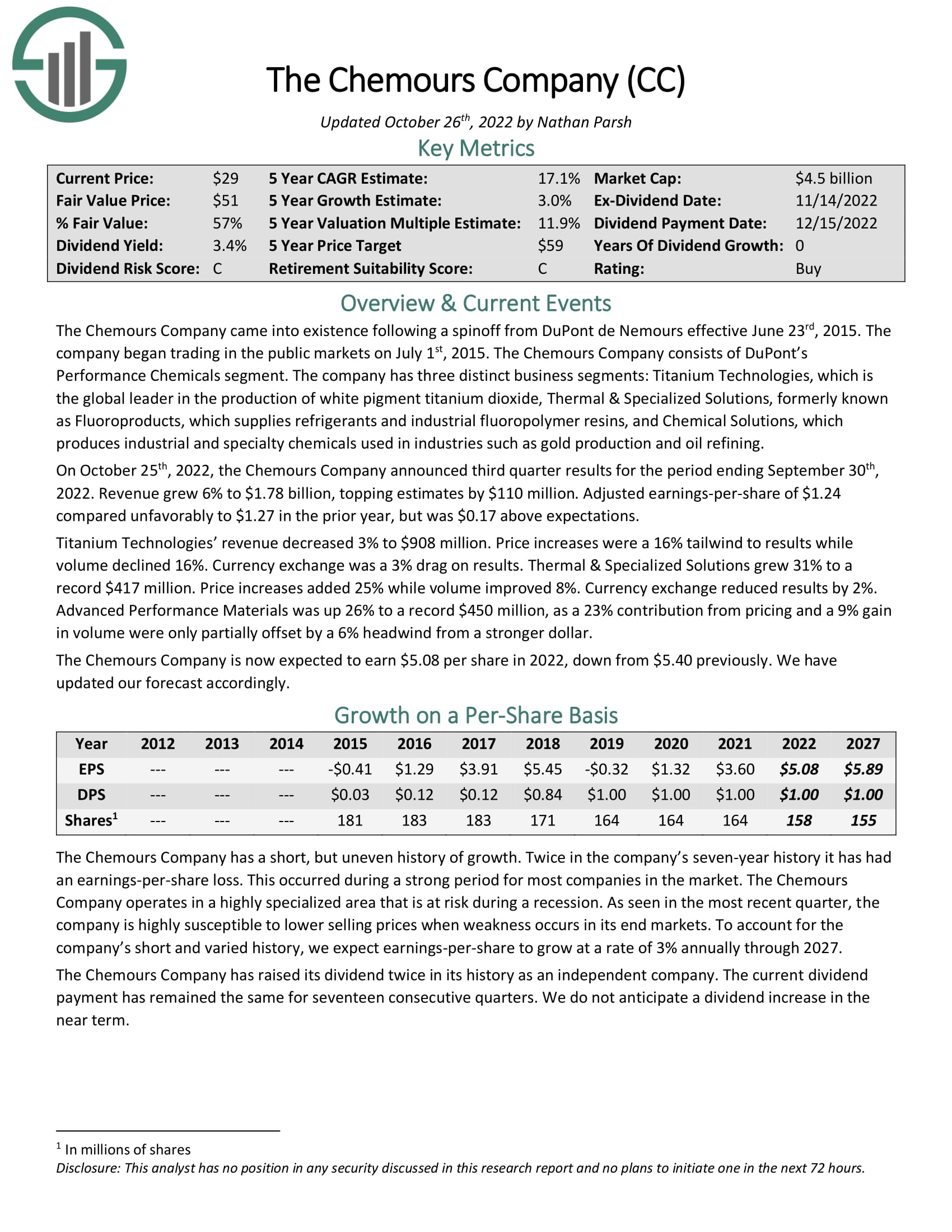

The Chemours Company (CC)

Our final stock is The Chemours Company, a performance chemicals manufacturer that operates globally. The company makes and sells a long list of specialty chemicals used by customers in numerous end products and applications.

Chemours was spun out of the former DuPont (DD) in 2015, and has produced price returns of 100% since that time.

Source: Investor presentation

One thing that hampered Chemours after being spun off was its debt load, which has been reduced over time to $2.4 billion on a net basis, or 1.5X leverage on a trailing-12-months basis. The company continues to reduce its leverage while maintaining enough cash flow to return to shareholders.

The stock yields 3.3%, which is about double that of the S&P 500. In addition, we see 3% total annual earnings growth, and a massive tailwind from the valuation.

Shares trade for just 6 times earnings, which is about 40% below where we assess fair value. That could drive an 11% tailwind to total returns, bringing the stock to expected returns of more than 16%.

Click here to download our most recent Sure Analysis report on The Chemours Company (preview of page 1 of 3 shown below):

Final Thoughts

While not all spin-offs result in market-beating returns, many of them do given it allows more focused management. In addition, many of them pay strong dividends, and have double-digit expected total returns in the coming years.

We like Chemours, Organon, and Herc the best from this list, but each has their own unique combination of yield, growth, and value.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.

- The Complete List of Russell 2000 Stocks

- The Complete List of NASDAQ-100 Stocks