2.4, 33, 30, 41, 25, 24: These Are Not Lottery Numbers, but They Will Affect America’s Future…

2.4, 33, 30, 41, 25, 24: These Are Not Lottery Numbers, but They Will Affect America’s Future Prosperity

2.4

When it comes to demographics, America, unlike most other Western countries, will maintain a healthy ‘prime-age’ bulge in its population over the next 35-years because of the higher birth-rate among immigrants. “Among Hispanics, the total fertility rate is 2.4. For non-Hispanic whites and for non-Hispanic Asians, it is 1.8. Non-Hispanic blacks (2.1) have higher fertility than whites but lower fertility than Hispanics”. (Pew research)

33, 30

Historically, immigrants have played a leading role in the building of the American economy, and America needs them to build its future economy as well. 33% of venture-backed companies that went public between 2006 and 2012 had at least one immigrant founder at the helm. Refugees and immigrants are 30% more likely to start a business than non-immigrants, and those businesses employed an estimated 4.7 million people in 2007 (Whitehouse Blog, 2012). Refugees and immigrants produce an increase in spending on local goods and housing, open-up new markets in diverse areas of the Globe, bring new skills and fresh perspectives, create employment and fill empty employment niches, and pay taxes; in other words, all the activities that result in GDP growth.

41, 25, 24

Along with demographics, education is a crucial elemental driver of America’s future economy. Unfortunately, America’s students are failures when compared to students from the other OECD countries. On the international PISA test in science, math, and reading, American 15-year-olds placed 41st, 25th, and 24th, respectively. Compare this with Canada next door, who’s students placed 10th, 7th, and 3rd in the same test.

The currency of the future (and present) economy is innovation, which requires critical thinking, and which, in general, the American education system has done a ‘less than optimal job’ of teaching said basic skill — evidenced by the PISA results, and by the fact that Americans voted against their own best interests in the recent election. Hi-tech firms hire a significant proportion of their talent from off-shore because they have no choice — there simply is not enough high-caliber domestic talent to do the job. Readers need to be cognizant that the future is not in digging coal out of the ground, but rather, in new energy sources, new types of transportation vehicles, new medical technologies, and new ways of organizing society, all of which require the ability to hire the best minds in the world. What effect will the ossification of immigration have on America’s future prosperity? Has America forgotten who it is — a land of immigrants and refugees?

Equities

{This section is for paid subscribers only}

The Rydex fund asset allocation indicator, gives a more objective measure of investor sentiment since it shows where investors are actually putting their money, as opposed to a self-reporting of investor opinion. The chart below shows extremely low Rydex bear:bull ratios have correlated to market tops in the past. The ratio is at an extremely low level (red question mark on the graph).

{This section is for paid subscribers only}

The put:call option ratio, also informs us of investor risk sentiment, and the chart below shows that the ratio may have formed a down-spike which correlates to market tops in the past (red ovals on the chart below).

{This section is for paid subscribers only}

That last statement, arises from the technical picture that the market has been painting. The chart below shows the growth in GAAP earnings which has supported rallies in the S&P 500 in the past (green vertical lines).

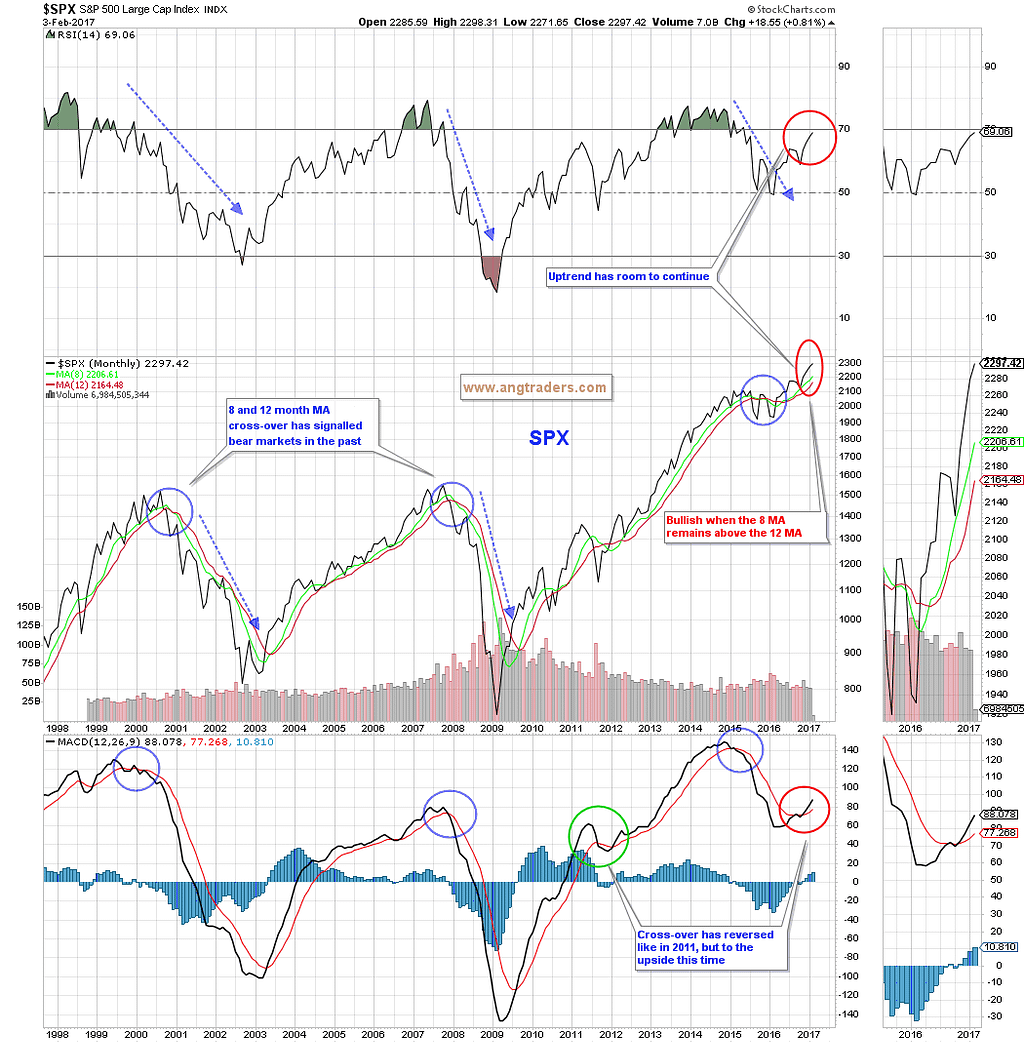

The long-term moving averages, continue to predict higher equity prices (red ovals in the chart below).

{This section is for paid subscribers only}

Gold

We continue to maintain that gold does not drive the markets, it is the markets that drive gold; Treasury rates, the dollar, the USD/JPY FOREX ratio, and inflation.

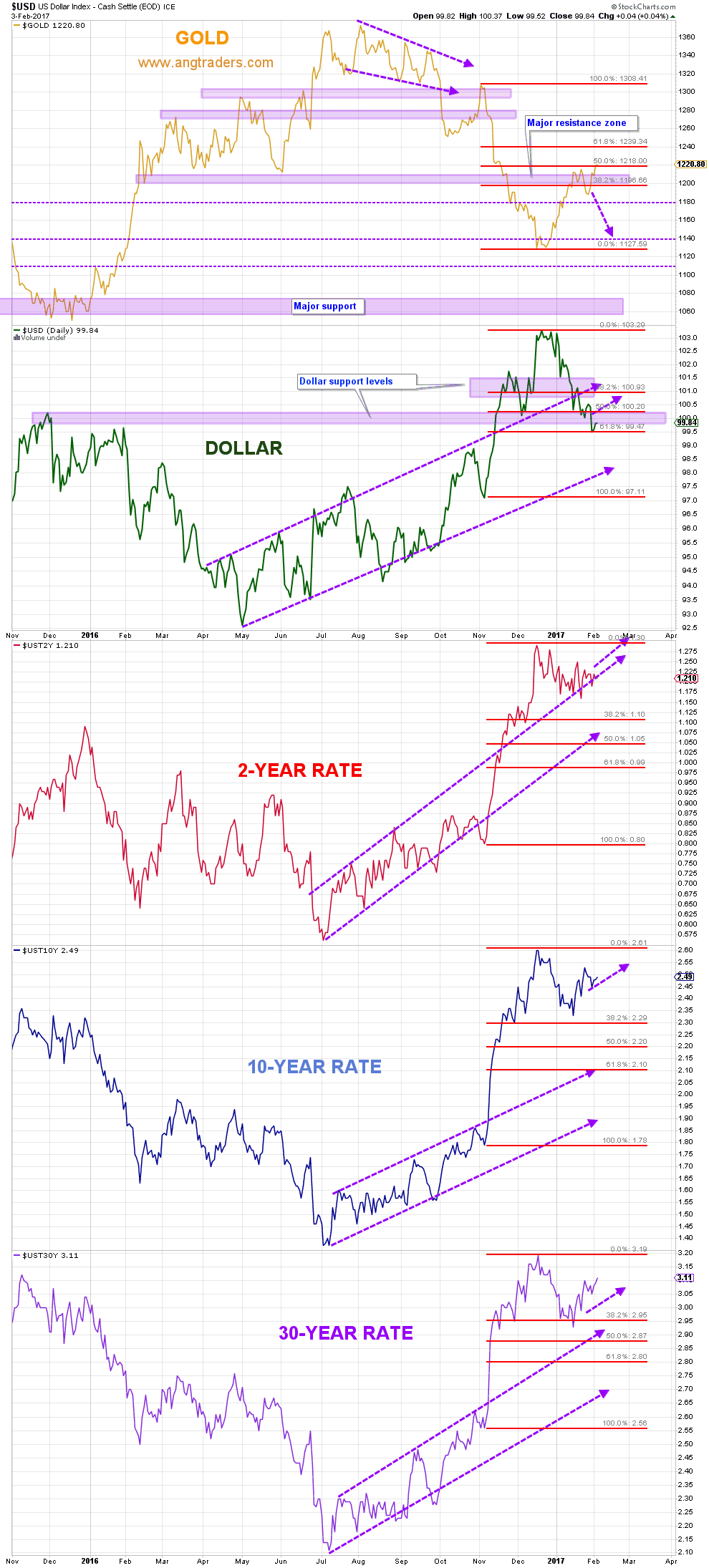

The chart below shows that rates have continued to maintain their bias to the upside, and that the dollar, even though it moved below a resistance zone, it did bounce-off of the 61.8% Fibonacci retrace line. Gold, in the meantime, has reached the 50% Fibonacci retrace line. If gold closes above $1225 and the dollar breaks below 99, we will reassess our thinking on gold. Until then, we see rates and the dollar as well supported, and gold as vulnerable. In fact, the weakness in the dollar is due to the “Trump Twitter”, not to fundamental interest rate effects.

{This section is for paid subscribers only}

We wish our subscribers a profitable week ahead and ask that emails be monitored for Trade Alerts.

ANG Traders

Join us at www.angtraders.com and replicate our trades and profits.

Source: Nicholas Gomez