This is a guest contribution by Tom Hutchinson, Chief Analyst, Cabot Dividend Investor

For years, Wall Street seemingly treated the alternative energy movement with collective disinterest. Now, the trend has become undeniable. And alternative energy stocks have suddenly become a hot commodity.

The iShares Global Clean Energy ETF (ICLN), which tracks 30 stocks in the Global Clean Energy Index, has recently caught fire after going nowhere for more than a decade. ICLN has soared 175% in the past year, well more than double the 71% return in the S&P 500.

Consider the recent performance of some of the big players in the clean energy space. Electric car company Tesla (TSLA) has soared 1,166% in the last two years. Hydrogen fuel cell company Plug Power (PLUG) has performed even better, up 1,468% in the last two years. At the same time, the energy sector, which is primarily constituted of fossil fuel companies, has been by far the worst performing sector of the market in just about every measurable period over the last 10 years.

What’s going on?

It appears that the technology has developed to a crucial level were clean energy is cheaper and makes more economic sense. Success breeds success. And more and more companies are getting involved.

Alternative energy has been by far the fastest-growing energy source for a while, with usage doubling in the first 18 years of this century. But it’s about to really take off now. The International Energy Agency (IEA) estimates that global renewable power supply will grow 50% in just the next five years.

The outperformance of clean energy stocks may just be getting warmed up. The Biden Administration will surely focus on the climate change agenda. That means more tax breaks and subsidies and other goodies for related companies. But even more importantly, the focus will draw still more investor attention to the booming growth in alternative energy. And investor intrigue will only accelerate.

Of course, it’s still tricky to find the companies with the best technologies. And competition is fierce. Companies will come and go and it can be the Wild West trying to bet on the best ones. Fortunately, there are a couple of ways for conservative investors to play the burgeoning phenomenon without too much risk. Try these two low-risk alternative energy dividend payers on for size.

Alternative Energy Dividend Payer #1: NextEra Energy, Inc. (NEE)

Utility stocks fill a great niche in any investment portfolio, especially when stock prices get a little frothy. The sector is the most defensive on the market as earnings are virtually immune to economic cycles. Stocks also pay high dividends and typically hold up very well in down markets.

It makes sense to look to the biggest and the best. And NextEra is the world’s largest regulated utility and the world’s largest producer of alternative energy. NextEra Energy is on the list of Dividend Aristocrats, a group of 65 stocks in the S&P 500 with 25+ consecutive years of dividend increases. You can see the entire Dividend Aristocrats list here.

It isn’t a regular utility. NEE is really two companies in one. It has one of the best regulated utilities in the country, which accounts for about 55% of earnings and provides steady cash flow, and also a world-renowned alternative energy company, which accounts for about 45% of earnings and provides a higher level of growth.

Investors love it because they get the safety and income of a utility and still get great growth and capital appreciation. It’s the best of both worlds.

2020 was another strong performance for NextEra Energy.

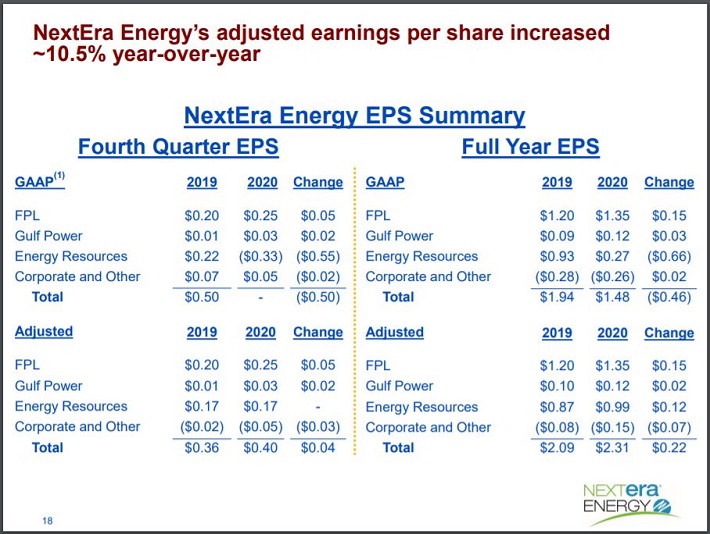

Source: Investor Presentation

For the full year, adjusted earnings-per-share increased 10.5%.

For the last 10-, five-, three- and one-year periods, NEE has not only vastly outperformed the Utility Index, it has also blown away the returns in the overall market. NEE stock has returned more than double that of the S&P 500 over the last 10 years (627% with dividends reinvested). It has also more than tripled the index return over the last five years, three years and one year.

You can see a detailed analysis of NextEra Energy here.

Alternative Energy Dividend Payer #2: Xcel Energy Inc. (XEL)

Xcel is a smaller and less well known alternative energy utility. But the smaller size may also provide more potential upside.

Xcel is a regulated electric and natural gas utility serving 3.7 million electric customers and 2.1 million natural gas customers in eight states, primarily in the northern and southwestern U.S. It is also one of the largest renewable energy providers in the U.S. with 28% of electricity sales generated from alternative energy sources in 2019.

The utility has been heavily investing in clean energy, primarily wind and solar power. Xcel now generates about a third of the electricity it delivers from these clean sources. The company has an ambitious goal of reducing carbon emissions 80% by 2030, from 2005 levels, and being 100% carbon free by 2050. It’s on track as carbon emissions are already down 44% from 2005 levels, as of the end of 2019.

XEL stock has consistently blown away the returns of the utility sector; it’s also beaten the return of the S&P 500 over the past three- and 10-year periods. Investors have gotten returns that have bested the overall market with far less volatility. The stock sports a beta of just 0.27, meaning it is less than one quarter as volatile as the overall market.

That kind of steady reliability is a good quality in an increasingly volatile market. And it’s why XEL and NEE would make strong additions to any conservative investor’s portfolio right now.