This is a guest contribution by Dividend Power

The stock market continues to set new highs and there is no doubt that stock market is overvalued in aggregate. All three major indices: the S&P 500, NASDAQ, and Dow Jones Industrial Average are trading near or at their all-time highs.

For perspective, the S&P 500 is trading at an elevated price-to-earnings ratio of ~34X. This is well above the long-term average of roughly 16X. Fortunately though it is a market of stocks and there are always pockets of value in the stock market.

In this article, we discuss three stocks yielding over 4% with realistically safe and also growing dividends. A 4% yield is decent and almost three times the average yield of the S&P 500. The 3 stocks are International Business Machines (IBM), Gilead Sciences (GILD), and Southern Jersey Industries (SJI).

4% Dividend Stock: International Business Machines

IBM is a company that many investors love to hate. It has disappointed many investors since approximately 2013 due to declining revenue and a declining stock price. Granted, the dividend has been raised and share buybacks were aggressive, but this was at the cost of rising debt.

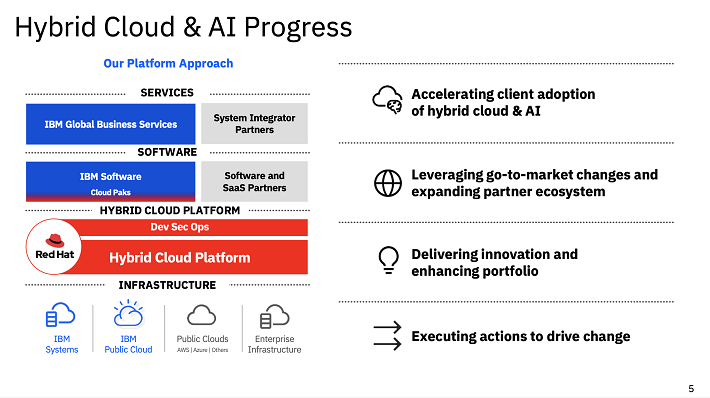

That being said, IBM of yesterday is not the same IBM as today. IBM acquired RedHat for $34 billion in 2019. The price tag was steep and added more debt. But the acquisition made IBM a player in hybrid cloud.

Next, IBM has a new CEO that is focused on making IBM a software company instead of a services company. It did not take him long to announce the divestment of the Managed Infrastructure Services business. The unit will be spun off into a business called Kyndryl.

This move effectively rids IBM of a business that has struggled with growth over the past several quarters. This business also has lower margins than the rest of IBM’s business segments and thus should be a net positive for IBM’s profitability.

Source: IBM Q2 2021 Earnings Presentation

There are two more long-term positives for IBM. First, IBM has quietly become a Dividend Aristocrat having raised the dividend annually for 26 consecutive years. IBM is also one of the few stocks that has paid a dividend for over 100 years. IBM is a blue chip stock.

The second positive is that IBM has been paying down its debt. Core debt peaked at $48.1 billion after the RedHat acquisition but was down to $37.7 billion at end of Q2 2021. Global Financing debt is down from $25 billion to ~$17.7 billion over the same time period.

The dividend yield is about 4.7% now and IBM’s dividend safety has improved. The current yield is greater than the trailing 5-year average of about 4.5%. The forward payout ratio is approximately 61%, which is below my criterion of 65%. The company’s CEO has made statements supporting the dividend.

IBM has also returned to growth for revenue and diluted adjusted earnings in Q2 2021 and seems to have momentum in 2021. The combination of dividend yield, dividend safety, and reasonable P/E ratio of ~13X makes IBM a buy.

4% Dividend Stock: Gilead Sciences

Gilead Sciences is another stock yielding over 4%. The company only started paying a dividend in 2015, but the dividend has grown rapidly since then, making Gilead a Dividend Challenger.

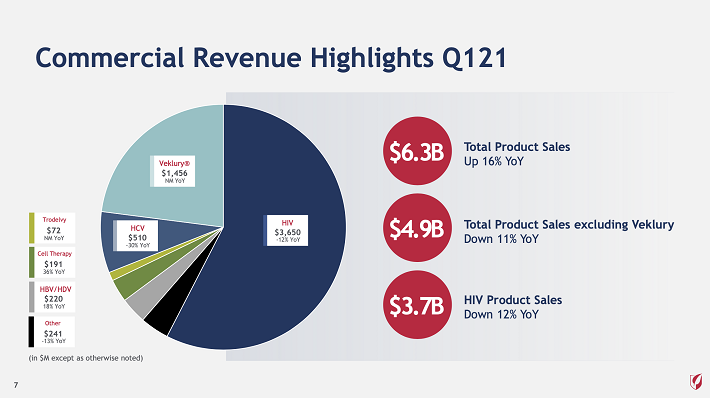

Despite the nice yield and growing dividend, Gilead’s stock price has trended down since 2015. This main challenge for Gilead is declining revenue. Demand for the company’s therapies for hepatitis C have fallen. Gilead’s drugs, SOVALDI and HARVONI, cure HCV, so the patient pool is declining.

Furthermore, competition has increased in the HCV market. Gilead is also facing patent expiration for drugs in its HIV franchise, which is a $17 billion franchise.

Source: Gilead Q1 2021 Earnings Presentation

Gilead is not standing still and is rebuilding its pipeline in areas besides HIV and HCV. Although the HIV business is likely to exhibit slow growth in the foreseeable future. The company acquired Kite for CAR-T, Forty Seven for CD47, and Immunomedics for TRODELVY.

Gilead also has VEKLURY (remdesivir) that is being used as a treatment for COVID-19. Gilead also owns the commercialization rights for filgotinib, although trials have been disappointing to date.

The current dividend yield is 4.2% which is much higher than trailing 5-year average of 3.4%. The dividend safety is solid as well. The forward payout ratio is a conservative 40%. The dividend has grown at a roughly 16% CAGR over the past 5-year.

The dividend growth rate is slowing as the payout ratio has risen. However, assuming that Gilead adds to its product line up from successful R&D or acquisitions, it is likely that revenue, earnings per share, and the dividend will continue to increase over the next few years.

Gilead is trading at very low P/E of about 9.7X compared to the broader market P/E. However, this valuation multiple is within the range that Gilead has traded in since 2015. The combination of dividend yield, dividend safety, and low P/E ratio makes Gilead a buy.

4% Dividend Stock: Southern Jersey Industries

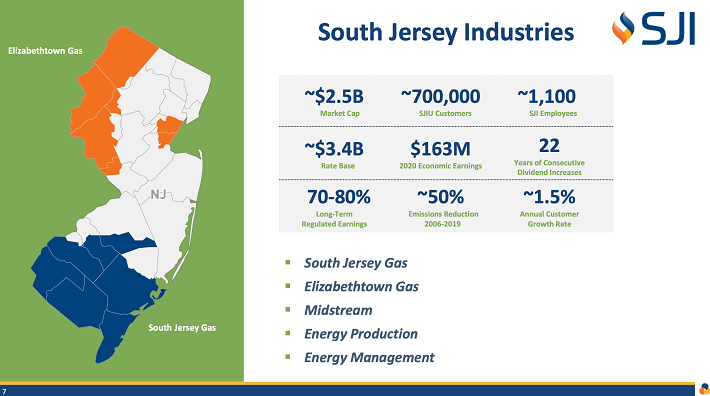

The third stock with a yield over 4% is Southern Jersey Industries. The utility holding company has paid a growing dividend for 22 years making the stock a Dividend Contender.

SJI has three operating segments: SJI Utilities, SJI Midstream, and South Jersey Energy Solutions. About three-quarters of revenue is from the regulated utilities of South Jersey Gas and Elizabethtown Gas. The remainder of revenue is from non-regulated operations.

Source: South Jersey Industries 2021 Investor Presentation

SJI is not a high growth stock, but it grows slowly and steadily over time. The company expects the regulated utility to grow at 1.5% CAGR through new construction and conversions to natural gas. This combined with efficiency improvements, capital spending, investment in clean energy suggests that the rate base should grow at about 10% annually.

Non-regulated, non-utility growth will occur through investment in renewables. SJI is installing rooftop solar generation and fuel cells. The utility also acquired a stake in a company to develop anaerobic digesters at a portfolio of dairy farms to produce renewable natural gas. These efforts should provide SJI with incremental growth.

The forward dividend yield is 4.84%, which is almost a full point higher than the trailing 5-year average of 3.91%. The forward payout ratio is about 75%, which is reasonable for a utility. Most utilities have higher payout ratios due to their regulated nature and predictable cash flows.

SJI is trading at a forward P/E ratio of ~15.4X. This is very reasonable compared to the market average. It is also below the trailing average in the past decade. The combination of dividend yield, dividend safety, and low P/E ratio makes SJI a buy.

Disclosure: Long IBM

Author Bio: Dividend Power is a self-taught investor and blogger on dividend growth stocks and financial independence. Some of his writings can be found on Seeking Alpha, TalkMarkets, ValueWalk, The Money Show, Forbes, Yahoo Finance, and leading financial blogs. He also works as a part-time freelance equity analyst with a leading newsletter on dividend stocks. He was recently in the top 4% out of over 8,091 financial bloggers as tracked by TipRanks (an independent analyst tracking site) for his articles on Seeking Alpha.

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. He is not providing you with individual investment advice. Please consult with a licensed investment professional before you invest your money.