Updated on March 20th, 2020 by Josh Arnold

Investors looking for companies that generate strong profits and pay dividends to shareholders should take a closer look at the major alcohol stocks. These are companies that manufacture and distribute a variety of alcoholic beverages, including beer, wine, and liquor.

The top companies in this industry have many attractive qualities in common. They have strong brands, which give them pricing power.

And, thanks to their global distribution, they generate high cash flow, which allows them to pay dividends to shareholders. They also tend to perform quite well during periods of economic distress, meaning they can provide diversification and recession-resistance to a portfolio.

All six stocks in this article can be found on our list of ~350 consumer staples stocks that pay dividends to shareholders.

You can download an Excel spreadsheet of all ~350 dividend-paying consumer staples stocks (along with relevant financial metrics like dividend yields and payout ratios) by clicking the link below:

More information can be found in the Sure Analysis Research Database, which ranks stocks based upon the combination of their dividend yield, earnings-per-share growth potential and valuation changes to compute total returns.

This article will rank the top alcohol stocks by forecast total returns for the next five years.

Table of Contents

The top alcohol stocks are listed here, according to annual expected returns over the next five years. Stocks are ranked in order of expected returns, from lowest to highest.

- Brown-Forman (BF-B)

- Diageo PLC (DEO)

- Constellation Brands (STZ)

- Molson Coors (TAP)

- Ambev SA (ABEV)

- Anheuser-Busch InBev (BUD)

Alcohol Stock #6: Brown-Forman (BF-B)

- Expected Annual Returns: 1.6%

Brown-Forman has an impressive history of dividend growth. It has increased its dividend for over 30 years in a row. It is a Dividend Aristocrat, an exclusive group of 64 high-quality stocks with at least 25 consecutive years of dividend growth.

Brown-Forman’s long dividend growth history is due to its strong brands and recession resiliency. It has a large product portfolio, which is focused on whiskey, vodka, and tequila. Its most famous brand is its flagship Jack Daniel’s. Other popular brands include Herradura, Woodford Reserve, El Jimador, and Finlandia.

Brown-Forman reported Q3 earnings on March 4th, 2020, with both top and bottom line results missing expectations slightly. For the first nine months of the year, net sales were up 3% to $2.7 billion, which was also +3% on an organic basis. Reported operating income fell 1% to $904 million, also down 1% on an organic basis. Diluted earnings-per-share, however, rose 4% to $1.45 thanks to a lower share count.

Management provided updated earnings-per-share guidance of $1.75 to $1.80 for the year, which is slightly below consensus estimates. The company felt lowering guidance was the prudent thing to do in light of the coronavirus outbreak globally, and now expects low-single-digit net sales growth, along with flat or modestly declining operating income.

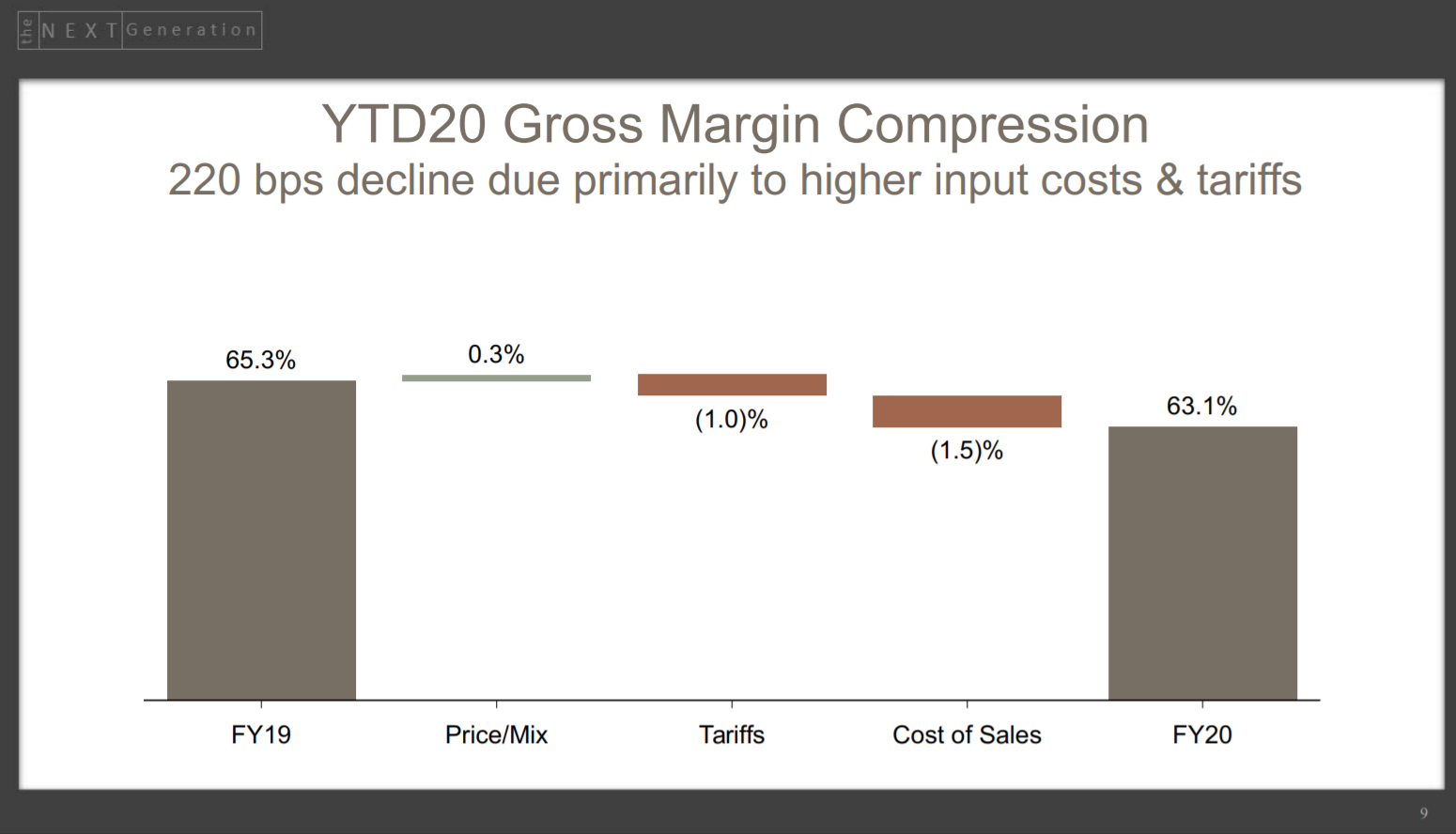

Source: Investor presentation, page 9

The decline in operating profit is from lower gross margins, which, as you can see above, is due primarily to higher cost of goods as well as tariffs. These are largely out of the company’s control, but have dampened earnings growth for 2020 nonetheless.

We expect approximately 7% annual earnings growth for Brown-Forman over the next five years. In addition, the stock offers a 1.3% dividend yield. Despite a positive growth outlook and a decent dividend yield, Brown-Forman’s expected returns are quite low due to significant overvaluation.

Brown-Forman stock trades for a price-to-earnings ratio of 30.7 which is well above our fair value estimate of 22. As a result, we expect the valuation to compress over the next five years, which could reduce total returns by 6.4% per year.

The combination of earnings growth, dividends, and valuation changes is expected to result in annual returns of just over 1% per year. This is a very weak rate of return.

Even though Brown-Forman is a Dividend Aristocrat with a long history of dividend increases, the very high valuation and low dividend yield make the stock an unattractive pick for value or dividend investors. Given the enormous turmoil in the stock market in the early part of 2020, there are numerous bargains to be found, making Brown-Forman seem even less attractive on a relative basis.

Alcohol Stock #5: Diageo PLC (DEO)

- Expected Annual Returns: 10.3%

Diageo traces its roots all the way back to the 17th century and the Haig family, the oldest family of Scotch whiskey distillers. Today, Diageo manufacturers some of the most popular spirits and beer brands in the world, such as Johnnie Walker, Smirnoff, Captain Morgan, Baileys, Tanqueray, Guinness, Crown Royal, Ketel One, and many more.

In all, Diageo has 20 of the world’s top 100 spirits brands. Diageo reported first half results on January 30th, and results showed revenue gaining year-over-year by about 4%.

Source: Investor presentation, page 3

The top line was driven by organic growth of 4%, as organic volume was roughly flat, but pricing and mix contributed strongly. In addition, Diageo saw net sales gain on an organic basis in all of its operating regions.

Operating profit was up 4.6%, driven by higher sales, productivity benefits, and strong pricing and mix. This was partially offset by unfavorable currency exchange, exceptional operating items, as well as acquisitions and divestitures. Earnings-per-share rose 4.2% year-over-year. The company also increased its dividend by 5% in local currency.

We estimate 8% annual earnings growth through 2025, comprised of mid-single-digit organic revenue growth, margin expansion, and share repurchases.

Even after the recent turmoil in the market, Diageo shares are still just fairly valued. Shares currently trade for a price-to-earnings ratio of 18.7, slightly above our estimate of fair value at 18.3 times earnings. This implies very little impact on total returns from the valuation, but with a market that is full of very cheap stocks, Diageo stands out as relatively unattractively valued.

Fortunately, the stock can offset this with earnings growth and dividends. Diageo pays a semi-annual dividend, and increases the dividend regularly. The current dividend yield is approximately 3.4% as a result of the higher payout and lower share price.

We expect 10.3% annual returns for Diageo stock over the next five years, consisting of 8% earnings growth, a 3.4% dividend yield, and negative returns of 0.4% per year from valuation compression.

Even though Diageo’s stock isn’t necessarily cheap, it is more cheaply valued today than it has been for many years. Thus, we still see strong forecast returns moving forward, and rate the stock a buy.

Alcohol Stock #4: Constellation Brands (STZ)

- Expected Annual Returns: 14.7%

Constellation Brands was founded in 1945, and today, it produces and distributes beer, wine, and spirits. It has over 100 brands in its portfolio, including beer brands such as Corona.

In addition, Constellation’s wine brands include Robert Mondavi and Clos du Bois. Its liquor brands include SVEDKA Vodka, Casa Noble Tequila, and High West Whiskey.

In the most recently reported quarter, Constellation Brands reported sales growth of just over 1%, but a negative tax rate helped to drive earnings-per-share up more than 18% during the quarter.

The company guided for earnings-per-share of ~$9.50 prior to the coronavirus impact, and we currently have the adjusted estimate at $8.80 for this year. Constellation, however, is expected to continue generating growth in the years ahead, largely due to its premiumization strategy.

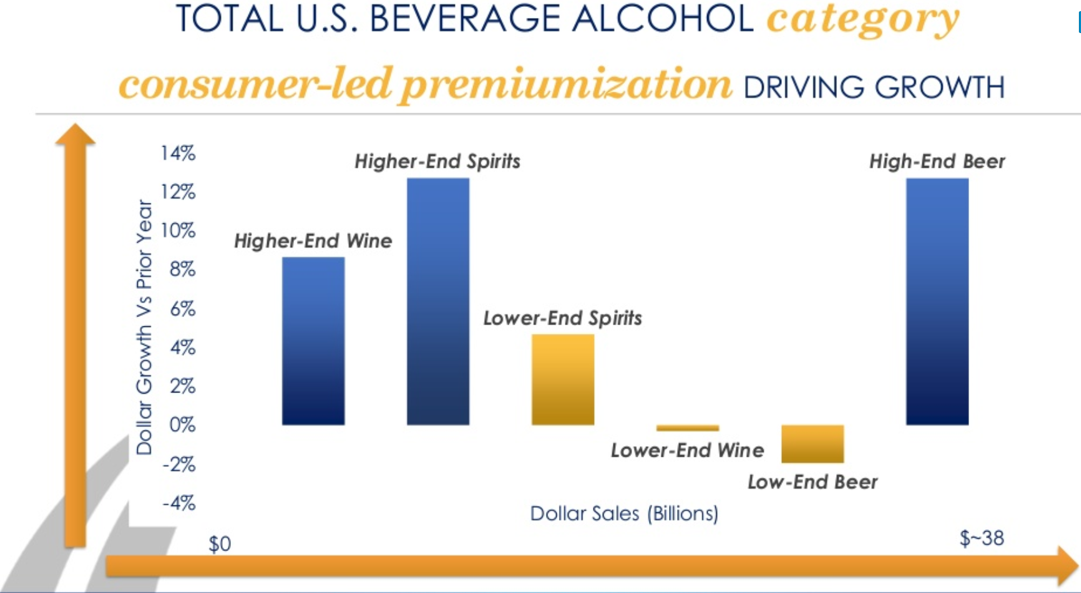

Source: Investor Presentation

One of the biggest reasons for Constellation Brands’ impressive growth in recent years, is its focus on the premium segment, which continues to grow. According to the company, growth rates in the high-end market of spirits, wine, and beer are much higher than lower-priced categories.

Premium alcoholic beverages also carry pricing power, a key driver of revenue and earnings growth. Constellation also competes in all three categories because spending per consumer is much higher for those that drink all three types of alcoholic beverages. Constellation’s strategy is to capture the market share of the most valuable consumers.

Constellation Brands has a number of competitive advantages. Its long list of strong brands gives the company steady demand. It has six of the top 15 imported U.S. beer brands, and 19 of the 100 top-selling wine brands. Its strong distributor network provides an effective route-to-market for the company’s strategy in premium categories.

Another benefit of Constellation Brands’ business is that it can withstand recessions very well. Alcoholic beverages are generally resistant to recessions. Consumers tend to drink as much (or more) beer, wine, and spirits when the economy is in a downturn.

Constellation Brands trades for a price-to-earnings ratio of 13.8, which is well below our fair value estimate of 18.0. A declining valuation could reduce total returns by 5.5% per year, over the next five years. Shares are down ~40% from their recent highs, creating a strong buying opportunity, in our view.

We also expect Constellation Brands stock to grow earnings by 7% per year over the next five years, comprised of volume growth, price increases, and share repurchases. In addition, the stock has a current dividend yield of 2.5%.

Given the very low valuation, reasonable dividend yield, and strong projected growth, we see Constellation Brands producing nearly 15% total annual returns in the coming years.

Alcohol Stock #3: Molson Coors (TAP)

- Expected Annual Returns: 15%

Molson Coors Brewing Company was founded in 1873. Since then, it has grown into one of the largest U.S. brewers. It has a variety of brands including Coors Light, Coors Banquet, Molson Canadian, Carling, Blue Moon, Hop Valley, Crispin Cider, and the Miller beer brands.

In mid-February (2/12/20) Molson Coors reported fourth-quarter and full-year financial results for 2019. Results for both periods were disappointing as the company continues to grapple with shifting consumer preferences, away from mainstream beer brands, and into things like hard seltzer and other spirits and liquors.

Fourth quarter brand volume decreased 1%, although strong pricing power saw revenue up 2.8% on a reported basis, and up 3% in constant currency. Net income came to $1.02 per share on an adjusted basis, up 21.4% from the same period in 2018. Underlying EBITDA was up 15.8% in constant currency as the company reap the benefits of cost saving efforts.

For the year, brand volume was down 3.5%, while revenue declined 1.8% on a reported basis, and 0.6% on a constant currency basis. Net income was $4.54 per share on an adjusted basis, down 9.9% year-over-year. Underlying EBITDA was down 2.6% in constant currency for 2019.

Molson Coors has fallen behind the trends in the U.S. beer industry, specifically the craft beer boom. There is a great deal of growth taking place for smaller breweries that produce craft beers. Molson Coors has a relatively small group of craft beers in its portfolio, which is a big reason for its lack of growth in recent periods.

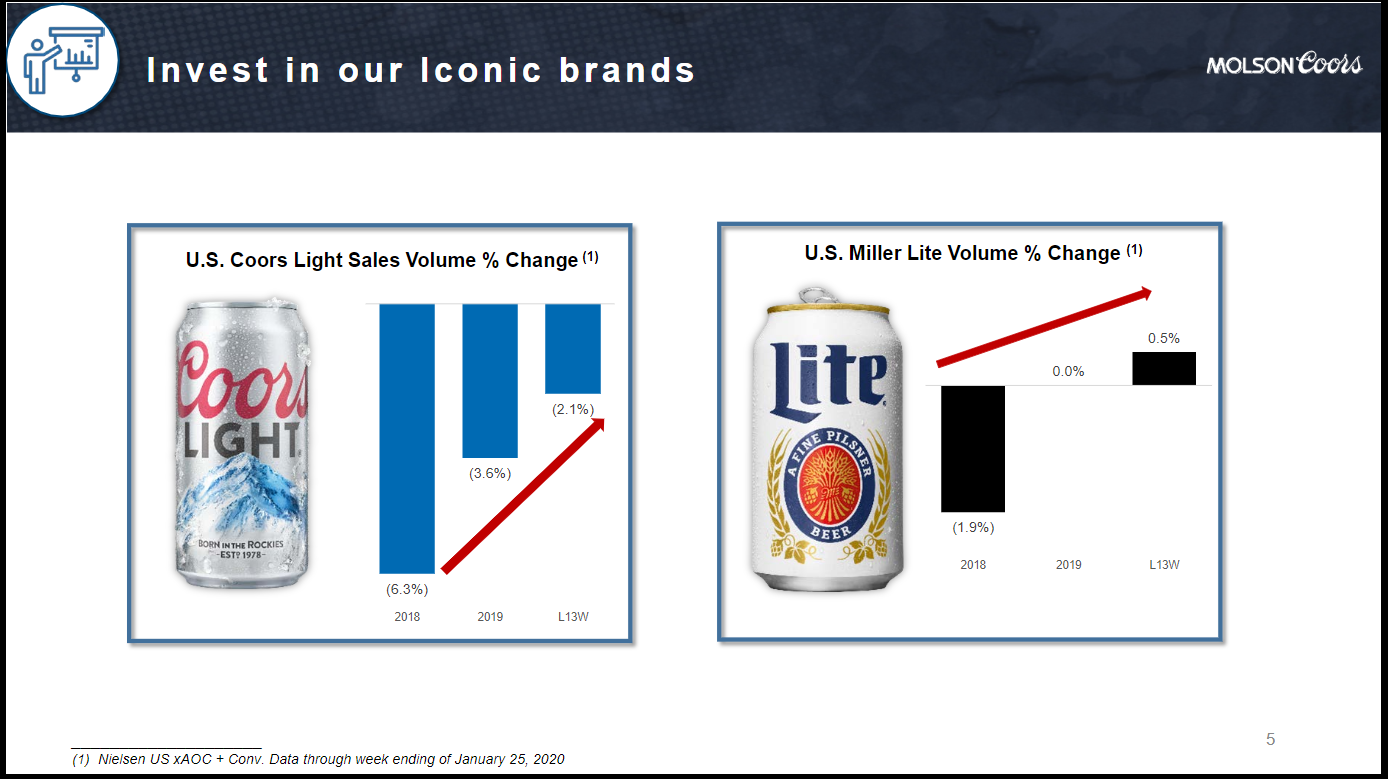

Source: Investor Presentation

As we can see, the company is focused on growing its core brands once more, and although growth is still negative for Coors Light, and only slightly positive for Miller Lite, Molson Coors is committed to investing in those brands and returning them to growth. Early results have been positive, but there is much work to do.

Fortunately, with several top brands, Molson Coors has been able to maintain strong pricing power, and we expect this to continue to help grow margins over time.

Molson Coors has one of the most attractive valuation of the major alcohol stocks. Molson Coors stock trades for a price-to-earnings ratio of 10.5, based on 2020 earnings-per-share estimates that have been reduced due to the projected impact of the coronavirus outbreak. We view fair value as a price-to-earnings ratio of 14.0, which means Molson Coors stock could generate returns of 5.9% per year just from expansion of its valuation multiple.

In addition, we expect Molson Coors to generate annual earnings growth of 5% per year, and the stock has a 5.6% dividend yield. We expect total returns of approximately 15% per year, making Molson Coors a buy.

Alcohol Stock #2: Ambev SA (ABEV)

- Expected Annual Returns: 17.4%

Ambev SA is the successor of two of the oldest brewers in Brazil, Companhia Cervejaria Brahma and Companhia Antarctica Paulista Indústria Brasileira de Bebidas. Antarctica was founded in 1885, while Brahma was founded in 1888.

Today, Ambev operates as a producer and distributor of alcoholic beverages. Its main business is beer, with brands including Skol, Brahma, Antarctica, Quilmes, Labatt, Presidente, and more.

It also has smaller businesses in soft drinks and other non-alcoholic beverages, with brands such as Guarana Antarctica and Fusion. Currently, Ambev has operations in 16 countries, primarily in South America, Central America, and Latin America.

Source: Investor Presentation

On February 27th, 2020 Ambev released fourth-quarter and full year 2019 results. For the quarter, revenue was up 5.7%, while full-year sales grew 7.9% over 2018. Volume was up 3.4% for the quarter, while pricing added 2.2% to the top line. For the full-year, volume was up 2.7%, while pricing added 5.0% to revenue.

Normalized profit and earnings-per-share rose by more than 24% each during the fourth quarter, with normalized profit coming in 24.4% higher than the comparable quarter in 2018, and earnings-per-share gaining 24.6%. For the full-year, normalized profit was up 8.5%, while earnings-per-share rose 8.1%.

Ambev has a positive long-term growth outlook, due largely to its geographic focus on Central America and Latin America. These regions are home to many emerging economies, with rising middle classes and high rates of economic growth.

We are expecting approximately 3% annual earnings growth over the next five years. While earnings growth is expected to be somewhat muted, the stock is down by about 50% from its recent highs, meaning we expect a rising valuation to add nearly 10% to total annual returns in the coming years.

Ambev stock trades for a 2020 price-to-earnings multiple of 12.5, well under our estimate of fair value at 20 times earnings. Ambev is a profitable company with leading brands all over the world, and we see 12.5 times earnings as far too low under normalized conditions.

The stock also has a dividend yield of 6.6%, the product of the precipitous decline in the share price in recent weeks. Ambev pays a current dividend of $0.14 per share (one ADS equals one ordinary share). Investors should note that because the dividend is declared in Brazilian currency, payment in U.S. dollars will fluctuate based on exchange rates.

The dividend appears to be secure, which provides a solid yield above 6% right now. With shares very undervalued, a modest growth outlook, and a 6%+ yield, Ambev looks poised to deliver 17.4% total annual returns in the coming years. The stock receives a buy rating for its high expected returns, albeit with elevated risk due to its international exposure.

Alcohol Stock #1: Anheuser-Busch InBev (BUD)

- Expected Annual Returns: 22.8%

AB-InBev is the largest beer company in the world. In its current form, it is the result of the 2008 merger between InBev and Anheuser-Busch. Today, it sells more than 500 beer brands, in more than 150 countries around the world. Some of its most popular brands include Budweiser, Bud Light, Corona, Stella Artois, Beck’s, Castle, and Skol.

Overall, AB-InBev has 18 individual beers that each generate at least $1 billion in annual sales.

AB-InBev has achieved its growth primarily through huge mergers with other beer companies. AB-InBev was first brought together by the $52 billion merger in 2008, between Interbrew from Belgium, AmBev from Brazil, and Anheuser-Busch from the U.S.

In 2013, AB-InBev acquired the remaining portion of Grupo Modelo that it didn’t already control, for $20 billion. Finally, AB-InBev acquired SABMiller for over $100 billion.

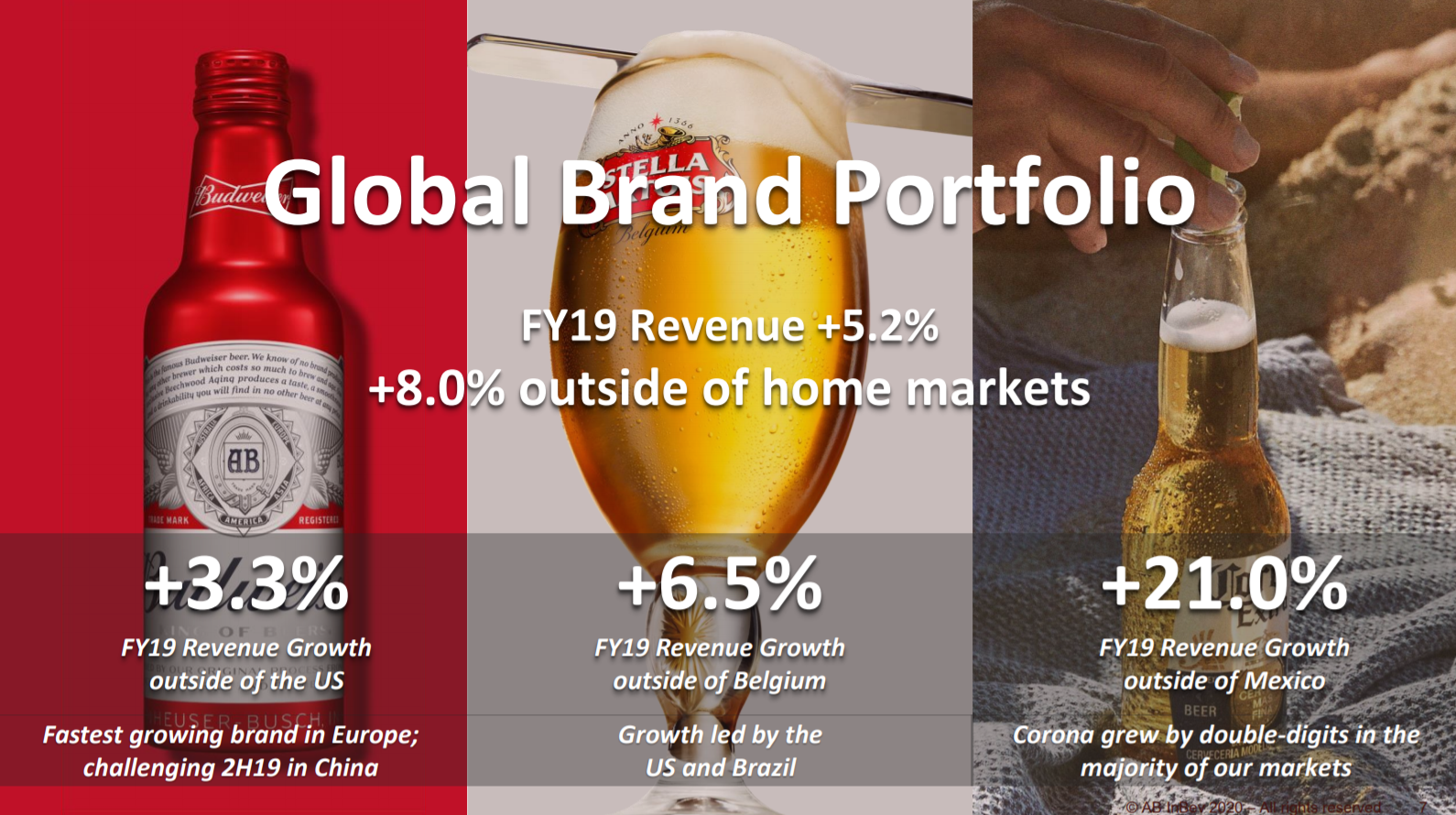

AB-InBev reported Q4 earnings on 2/27/20 and results were somewhat weaker than expected. Revenue was up 4.3% for the year and 2.5% for the fourth quarter. Volumes were up 1.1% for the year and 1.6% for the quarter, with particular strength in the company’s global premium brands. Pricing power helped the top line by adding 3.1% for the year and 0.9% for the fourth quarter.

The company’s three global brands, Budweiser, Stella Artois, and Corona, produced a combined 2.1% top line gain in the fourth quarter and 5.2% for the year, with a 3.9% gain outside of their respective home markets in Q4 and 8.0% for 2019.

Source: Investor Presentation

Normalized profit was $7.2 billion for the year, down from $8.1 billion in 2018. Earnings-per-share on an adjusted basis was $3.63, down from $4.10 in 2018. We see $3.50 in earnings-per-share for 2020, which includes a negative impact from the coronoavirus outbreak.

AB-InBev cut its dividend late in 2018 in an effort to spend extra cash on debt reduction instead of a sizable dividend. We are forecasting a total payout of $2.01 in U.S. dollars.

We expect AB-InBev to grow earnings-per-share by 3% per year over the next five years. Growth will be fueled by sales growth through higher prices and volumes, as well as share repurchases.

Shares are down ~60% year-to-date, which has created a significant value proposition, in our view. Shares trade for just 9.3 times 2020 earnings estimates, which is less than half our estimate of fair value at 20 times earnings. We therefore think shareholders could accrue at 16.4% annual tailwind due to a rising valuation multiple.

Earnings growth and dividends will combine for a high-single-digit tailwind of their own and combined, should create outstanding total returns in the coming years. Anheuser Busch InBev has a 6.1% dividend yield. Combined with earnings growth and valuation changes, we expect total returns at 22.8% per year through 2025. This makes AB-InBev the highest-rate alcohol stock in our coverage universe, and we rate it a buy.

Final Thoughts

The past few weeks have been extremely volatile. Many alcohol stocks have been punished, but for value and income investors, this could present multiple buying opportunities. The world’s best alcohol manufacturers have strong brands, and generate strong cash flow that is used for growth investment as well as cash returns to shareholders.

And, alcohol stocks are likely to be among the best-performers in a recession. People will always consume alcoholic beverages, and in many cases consumption of these products increases in an economic downturn. As a result, many alcohol stocks look attractive for value and income investors.