Updated on March 15th, 2019 by Jonathan Weber

Income investors have to look at a multitude of factors that determine whether a stock is a good investment, with one of these factors being the safety of the dividend payments – during good times as well as during bad times.

During times of economic expansion most companies benefit from growing profits, but during economic downturns some companies are hit harder than others. Recession resilience therefore is an important data point long term focused investors should look at.

The consumer staples industry is among the most resilient sectors of the economy when it comes to dealing with the impact of recessions, which is not surprising, as their products are bought by customers whether the economy is doing well or not.

You can see the entire list of dividend-paying consumer staples stocks here.

One sub-category of the consumer staples industry is the packaged food industry, which we will look at more closely in this article. Packaged food stocks are not high-growth stocks in most cases, as demand for their products is not growing at an extraordinarily high pace.

Through a combination of relatively high and secure dividends and some growth, which is achieved through rising prices, international expansion, or margin growth, they nevertheless have the potential to deliver attractive total returns. This is especially true in cases where below-average valuations allow for some multiple expansion potential.

In this article we will take a look at the 7 dividend stocks from the packaged food sector in the Sure Analysis Research Database that promise the highest total returns over the coming five years and that have a Dividend Risk score of C or better.

7. Mondelez International (MDLZ)

Mondelez International is one of the largest food processors in the world, valued at $68 billion right now. Mondelez International generates a substantial portion of its revenues in international markets, the company is the leader in several sub-categories of the snack market.

Mondelez International is focused on international markets (Kraft Foods, now a part of Kraft-Heinz, was the U.S.-based part of Mondelez International that was spun off into a separate company), which is why the company records relatively attractive growth rates:

Source: Mondelez International CAGNY presentation

Mondelez International’s strong position in higher-growth, non-US markets allow for solid organic revenue growth rates compared to many other packaged food companies.

In addition to a compelling revenue growth rate (further bolstered by acquisitions), Mondelez International is also executing well on margin expansion initiatives, and last but not least the company keeps repurchasing shares, which further bolsters earnings-per-share growth.

Between 2012 and 2018 Mondelez has lowered its share count from 1.78 billion to 1.47 billion, which equates to a 17% reduction in six years. We forecast a ~7% earnings-per-share growth rate over the coming five years, which is higher than the average of the companies featured in this report.

Mondelez International does not have an overly high dividend yield (2.2%), but due to a low dividend payout ratio (41% for 2019) and a solid earnings-per-share growth rate the dividend has a lot of room to grow further, which is why we forecast a high-single digit dividend growth rate over the coming years.

Through its dividend payments and earnings-per-share growth Mondelez should be able to create a solid total return, although the above-average valuation (~18.5 times this year’s earnings) that leads to valuation compression headwinds, will be a bit of a headwind going forward.

We believe that Mondelez International could deliver total returns of ~7.4% annually going forward from the current level. Mondelez International receives a Dividend Risk Score of C and a Retirement Suitability Score of D.

6. The Hershey Company (HSY)

The Hershey Company is one of the biggest chocolate and sugar confectionary products companies in the world, it controls renowned brands such as Hershey’s and Reese’s.

Despite consumers trending towards being more health-conscious and eating healthier foods Hershey does not have any problems generating top and bottom line growth – when it comes to chocolate and other candy demand by consumers apparently remains strong.

Hershey is not growing sales of its existing brands, but also expanding its portfolio inorganically in markets where it sees strong growth potential, such as with its recent acquisition of Amplify.

Source: Hershey CAGNY presentation

Hershey is the market leader in the U.S., controlling the majority of the top brands in the confectionary market.

Hershey forecasts that sales will grow by 1% to 3% during 2019, earnings-per-share are seen growing by 5% to 7% year over year.

That is still a relatively attractive growth rate when we account for the fact that Hershey has been able to grow during good times as well as during times when the economy was not doing so well.

Hershey trades slightly ahead of its historic valuation, we thus see a small negative impact from changes of Hershey’s multiple throughout the next couple of years.

Hershey has solid fundamentals, a dividend payout ratio of just above 50%, strong interest coverage and manageable debt levels (long term debt totals just $2 billion, versus a market capitalization of $23 billion).

Hershey’s shares have not been volatile at all over the last decade, with a beta of just 0.12 Hershey can thus make a portfolio less prone to up and down movements.

Going forward we forecast total returns of roughly slightly below 8%, made up by earnings-per-share growth (~6.4%), a dividend that currently yields 2.6%, and some multiple compression headwinds (~1.2%). We give Hershey a Dividend Risk score of B and a Retirement Suitability Score of C.

5. Campbell Soup Company (CPB)

The Campbell Soup Company is a manufacturer of branded foods and beverages products. Its product portfolio includes condensed and ready-to-serve soups, broth, pasta sauces, gravies, beans, dinner sauces, cookies and crackers, as well as salad dressings, refrigerated beverages, etc. Campbell Soup Company is valued at $10.6 billion.

Campbell Soup Company has decided that it might sell its Arnott’s biscuits as well as parts of its international portfolio in order to focus on core product categories. This comes as the next step in a line of divestments that Campbell Soup Company has either closed or announced throughout the last year.

Source: Campbell Soup presentation

Proceeds from these divestments are being directed towards debt reduction, which will reduce Campbell Soup’s interest expenses. Reducing the leverage ratio will also mean that the company’s shares will be regarded as a less risky investment once the deleveraging is completed.

Campbell Soup Company has grown its earnings-per-share by roughly 3% a year throughout the last decade. Campbell Soup’s organic sales growth rate was not overly convincing in the recent past (-1% during the most recent quarter), but the company should be able to capture some synergies following its takeover of Snyder’s Lance.

We believe that Campbell Soup will be able to grow its earnings-per-share by 2% annually going forward. This does not sound overly convincing at first, but Campbell Soup offers a relatively high dividend yield of 4.0%, and there is some potential for multiple expansion on top of that.

We see multiple expansion tailwinds of ~2% a year going forward, which is why we believe that Campbell Soup Company can produce annual total returns of roughly 8% from the current level.

Campbell Soup has a Dividend Risk Score as well as a Retirement Suitability Score of C.

4. The J. M. Smucker Co (SJM)

JM Smucker is a packaged foods and beverages company whose history dates back more than 120 years. JM Smucker has, over the years, turned into a powerhouse in several foods categories. The company is well positioned in the spreads business as well as in coffee segment, and JM Smucker also holds a large share in the dog snacks market.

The coffee and the pet food market are growing at above-average rates compared to other segments of the food industry, which is one reason why JM Smucker has a solid sales growth outlook.

Source: JM Smucker CAGNY presentation

JM Smucker targets earnings-per-share growth through a multitude of measures, including cost savings, tuck-in acquisitions, organic sales growth through rising market shares, and share repurchases.

JM Smucker also makes investments into e-commerce, improves acquisition synergies, and tries to drive growth in key brands such as Dunkin’.

Margin pressures have been a headwind in the recent past, but due to the positives we still forecast earnings-per-share growth at a mid-single digits pace over the coming five years.

JM Smucker will also, in all likelihood, continue to raise its dividend, which currently yields 3.3%. Despite a relatively low payout ratio of ~50% JM Smucker thus offers a lot of income generation potential, at the same time the dividend looks very safe.

Shares of JM Smucker trade at roughly 16 times this year’s forecasted earnings, which is slightly below the valuation shares have traded at in the past. We forecast a multiple expansion tailwind of roughly half a percentage point annually going forward.

Combined with ~5% earnings-per-share growth and a 3.3% dividend yield JM Smucker therefore has a solid total return outlook, as the company could produce total annual returns of slightly below 9% a year from the current level. We give JM Smucker a Dividend Risk Score of C and a Retirement Suitability Score of B.

3. General Mills (GIS)

General Mills is a well-diversified packaged foods company that sells more than 100 brands in more than 100 countries around the globe. The company is famous for paying dividends for 118 years in a row, an exceptional dividend record that is unmatched by most companies, and that has made General Mills a favorite holding among income investors.

After a major run-up in its share price over the last couple of years investors have been disappointed with General Mills’ performance over the last couple of years. Shares peaked at more than $70 in 2016, and have since fallen to $47.

Rising interest rates made dividend stocks such as General Mills less attractive on a relative basis, and General Mills’ operating performance during that time frame has not been overly strong, either.

General Mills has taken steps towards reinvigorating growth, such as with its acquisition of Blue Buffalo, which gave it an entry into the higher-growth pet food industry:

Source: General Mills CAGNY presentation

A pet food company, is not the first thing that came to mind as an acquisition target for General Mills, but it nevertheless has the potential to drive growth at the company, even though the segment only provides 8% of General Mills’ overall revenues.

The pet food industry is growing substantially faster than the packaged food industry as a whole, which should positively impact General Mills’ sales growth going forward.

Solid growth rates in the category will also allow for rising margins, which General Mills is eager to achieve, as price wars in its traditional business have hurt margins in the past.

Blue Buffalo along with organic brands such as Annie’s, will be the growth catalysts for General Mills going forward.

We forecast that General Mills will be able to grow its earnings-per-share by 3% annually going forward. The company also offers a dividend yield of 4.2% right here, which provides a sizeable amount of the total returns that we forecast from the current level.

Investors should also benefit from multiple expansion over the coming years, as General Mills’ current valuation is below the historic norm. This will, we believe, add about 2.2% to General Mills’ annual total returns, which is why we believe that investors have a good chance of generating total returns in the 9%-10% range over the coming five years.

We give General Mills a Dividend Risk Score of C and a Retirement Suitability Score of B.

2. Conagra Brands (CAG)

Conagra Brands is a food company that operates through the Grocery & Snacks, the Refrigerated & Frozen, the International, and the Foodservice segments.

Conagra Brands sells both shelf stable products as well as temperature controlled foods in the US as well as internationally. Conagra’s Foodservice segment offers food products such as meals, entrees, and sauces to restaurants and other establishments.

Conagra Brands has made a major acquisition when it bought Pinnacle Foods in 2018 for $8.1 billion. This is relatively close to Conagra’s current market capitalization of $11.2 billion, which shows that the market is a bit skeptical about the positive impact of the acquisition.

The combined market value of the two companies is not much higher than the price Conagra paid for Pinnacle Foods alone.

Source: Conagra Brands earnings presentation

Conagra Brands’ performance has not been bad, though, the company achieved sales growth during each of the last five quarters, with stacked sales (2 years) rising steadily throughout that time frame.

We believe that Conagra should be able to grow its profits during the coming years, due to a solid underlying sales growth rate and benefits once Pinnacle Foods is fully integrated. Our forecast sees Conagra growing its earnings-per-share by 3.6% annually.

The company offers an above-average dividend yield of 3.7% on top of that, which means that total returns would be 7%+ at constant multiples.

Since Conagra Brands’ shares trade below the historic median valuation right now, shareholders should benefit from some multiple normalization tailwinds going forward, which we believe will fall into the 2%-3% range.

All in all, Conagra Brands has thus potential to generate total returns of ~10% annually over the coming five years, despite the fact that the company is not growing at an overly high pace. We give Conagra Brands a Dividend Risk Score of C and a Retirement Suitability Score of B.

1. Kellogg Co. (K)

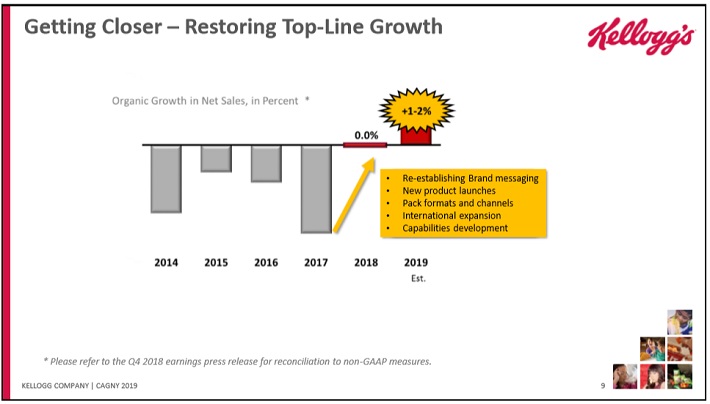

Kellogg is a breakfast producer that has, over the years, expanded into other packaged food segments. The company, which is valued at $18 billion, has battled with declining sales throughout the last couple of years, but Kellogg has made some progress in 2018 and forecasts that 2019 will be an even better year:

Source: Kellogg earnings presentation

According to management’s guidance, Kellogg should be able to achieve 1%-2% organic top line growth this year, which would make 2019 the best year in quite a while. Thanks to the impact of acquisitions Kellogg’s reported revenues could grow even faster.

A strong performance of Kellogg’s snack brands (that offset weaknesses in the cereal business) helps bolstering the growth outlook over the foreseeable future.

Kellogg hasn’t been a high-growth business for a long time, but recently growth rates improved thanks to the company’s focus on the better-performing snack foods business (e.g. Pringles) and on acquisitions, such as RXBAR.

Continuing efforts in improving margins (e.g. cutting overhead costs) and share repurchases will be positives for Kellogg’s earnings-per-share growth as well, which is why we forecast annual growth of ~5%.

Kellogg’s share price has gotten under pressure over the last couple of months, along with that of many of its peers, which is why Kellogg’s dividend yield has risen to a quite high level of 4.2% — more than twice the broad market’s yield.

At the same time Kellogg’s valuation has declined to just 13 times this year’s earnings, which represents a significant discount relative to how Kellogg’s shares were valued in the past (median earnings multiple of 16).

We believe that multiple expansion will add considerably to Kellogg’s total returns going forward, to the extent of a 4% annual tailwind.

Through a combination of mid-single digit earnings-per-share growth (~5% a year), valuation expansion tailwinds (~4% a year) and its dividend, which yields 4.2% right now, Kellogg should be able to deliver total returns of more than 13% a year going forward.

With expected total returns of 13% per year, Kellogg is rated the packaged food stock with the best total return outlook in our database. Kellogg has a Dividend Risk Score of C and a Retirement Suitability Score of B.