Updated on April 27th, 2021 by Nikolaos Sismanis

Altimeter Capital Management is a Boston-based multi-billion dollar technology-focused investment firm managing a long/short public equity fund and private growth equity funds. The firm was initially founded by Brad Gerstner in 2008, in Menlo Park, California, and currently has around $6.4 billion worth of Assets Under Management (AUM).

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 30.9%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

You can download an Excel spreadsheet with metrics that matter of Altimeter Capital Management’s current 13F equity holdings below:

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

Keep reading this article to learn more about Altimeter Capital Management.

Table Of Contents

Altimeter Capital Management’s Holdings

Altimeter has achieved spectacular annualized returns over the past few years, significantly outperforming the S&P 500. The fund’s success has been attributed to management’s superior skills in identifying and investing in companies in the ever-growing tech sector. Its holdings are allocated in major public equities and highly promising private companies before they eventually IPO.

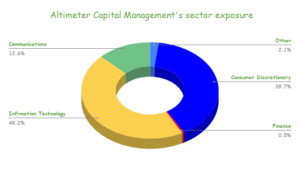

Overall, while Altimeter is one of the largest hedge funds we have covered so far, in terms of assets, its public-equities portfolio is highly concentrated with a total of 21 holdings, almost exclusively focused on technology and consumer discretionary. We have previously discussed other funds whose similar philosophy of holding a few, high conviction ideas, has been accomplishing market-beating returns, such as our recent Valley Forge Capital Management article.

Source: 13F filings, author

During the quarter, Altimeter initiated or sold its position in the following stocks:

New Buys:

- Square (SQ)

- Coupa Software Incorporated (COUP)

New Sells:

- ANGI Homeservices Inc. (ANGI)

- Stitch Fix, Inc. (SFIX)

- Trivago N.V. (TRVG)

- Ranpak Holdings Corp. (PACK)

- Vroom, Inc. (VRM)

Altimeter’s top 10 holdings weigh around 88.9% of its total portfolio and consist of the following equities:

Source: 13F filings, author

Pinduoduo (PDD):

Occupying around 21.4% of the total holdings, Pinduoduo is the second China-based firm in Altimeter’s portfolio, along with a smaller stake in Alibaba (BABA). The company operates a mobile platform that offers a range of products, including apparel, food, beverage, electronic appliances, and any consumer-related product in general. The company is still growing its revenues at nearly 100% (97.4% YoY) despite its prolonged growth, which makes Pinduoduo one of the most rapidly expanding long-term winners in the space.

Still, potential investors need to be aware of the scrutiny surrounding Chinese equities, with talks of them being delisted from the Nasdaq, including the recent delisting of Luckin Coffee due to fraud. The company didn’t make any changes in its position as of its latest filing, despite enjoying massive gains in its current equity stake. Altimeter boasts an average purchasing price point of around $25, while shares are currently trading beyond $140. This is not only one of the funds’ most successful positions, but also one that management believes will continue to outperform going forward.

The position was held steady during the quarter.

Uber (UBER):

Uber is Altimeter’s second-largest holding, occupying around 20.9% of the fund’s portfolio. The fund has been invested in the transportation disruptor before the company went public in May of 2019. While shares continue trading near their all-time high levels, Uber’s financials deteriorate by the day. The ongoing pandemic has reduced demand for constant transportation, scrapping Uber’s plans for becoming profitable. Revenues took a significant hit, while, Uber lost nearly $1 billion in the last quarter alone. Despite that, the forward P/S multiple has even grown over the past year, with investors valuing the company at 6.7 times its forward sales.

Altimeter trimmed its Uber position by around 1%, based on its latest f13 filing, pausing its continuous buying.

Altimeter’s faith in Uber through such a large stake is remarkable, considering that the company is frequently facing regulatory setbacks. At the same time, management has failed to convince the market of a clear profitability roadmap. It’s also striking that Altimeter does not hold a single share in Uber’s rival Lyft (LYFT), in efforts to hedge its large bet.

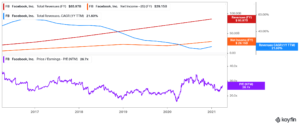

Facebook (FB):

Altimeter Capital CEO Brad Gerstner has been long on Facebook for years, with his fund doubling down on the stock on occasional dips, including the stock’s plunge during 2018’s scandal involving Cambridge Analytica. The company has not sold a single of its 3,753,400 shares since, which has greatly paid off. It is currently the fund’s third-largest position.

Facebook is currently enjoying excellent financials, with a net cash position of $62 billion (7% of the market capitalization of the stock). Facebook is one of the extremely few companies that have no debt. This is a testament to the strength of its business model and its perfect execution. Moreover, even though half of the globe uses at least one of its apps on a monthly basis, its user base is still growing at double-digit rates. Facebook delivered an all-time high top & bottom line of $28.07 billion and $11.2 billion, respectively. Facebook remains one of the most cheaply valued growth stocks out there, still retaining 20%+ revenue growth, but trading at a forward P/E of just 26.7.

Salesforce (CRM):

Salesforce’s shares have been snowballing, having doubled since March’s COVID-19 selloff. The company has been posting record revenues, with its most recent quarter tuning over a record $5.82 billion. At around 9% of total holdings, Salesforce has treated Altimeter well, as the company is taking the enterprise cloud-computing solutions market by storm.

For context, the company has incrementally grown its quarterly revenues for 72 consecutive quarters. While the stock’s forward P/E of around 63.6 may be seemingly hefty, the company has proven its ability to grow into its valuations. At the current rate of rapid profitability growth, the multiple is well-deserved.

The company recently announced its acquisition of Slack (WORK) for $27.7 billion, which should help the company’s profitability to accelerate amid cost-cuttings and synergy efficiencies. Salesforce should be able to integrate Slack in all of its consumers’ endpoints, which increases the chances of client conversion.

Altimeter held its Salesforce position steady during the quarter. It’s Altimeter’s fourth-largest holding.

Expedia Group (EXPE) & Booking Holdings (BKNG):

The online travel, restaurant, and related booking services duo collectively occupy around 10.8% of Altimeter’s portfolio. While both stocks experienced a nosedive amid COVID-19’s travel restrictions, shares have mostly recovered, as investors hope that the sector will return to normality over time. Altimeter took the chance to strengthen its position in Expedia, in the first half of 2020, benefiting greatly from the ongoing rebound.

Still, we can’t ignore that the financials of both companies took a significant hit and that investors’ confidence seen by the strong rebound is merely based on speculation around a quick recovery in the tourism industry.

During Q4, Altimeter held its Booking position constant but trimmed its Expedia stake by around 24.5%.

Microsoft (MSFT):

Found in almost every single non-specialized fund that we have covered, investors cannot get enough of Microsoft, as the company’s diversified portfolio of tech products and services has been ruling the sector’s digital infrastructure. The company’s CEO Satya Nadella has been transforming the company into a cloud powerhouse, posing recording top and bottom lines quarter after quarter.

Its latest quarter marked another profitability record, achieving a net income of $15.46 billion. The ongoing pandemic continues to be a positive catalyst for Microsoft’s growth, which, along with its relatively fair P/E of 32.2, makes it still an attractive pick despite the stock’s prolonged rally.

Altimeter has been adding shares non-stop, as the latest f13 filing revealed another 16.9% stake increase, after a previously 19% stake expansion. Shares make up around 4.2% of the fund’s total holdings, making Microsoft the fund’s sixth-largest holding.

Alibaba Group Holdings (BABA):

Occupying around 3.6% of the fund’s total holdings, Alibaba is the only other Chinese-based firm in Altimeter’s portfolio along with its largest equity stake, Pinduoduo (PDD). The company recently reported its Q4 results, smashing estimates by delivering revenues of $33.88 billion, a 37.0% growth year-over-year. While Alibaba remains a highly profitable company, displaying net income margins that often surpass the 30%+ levels, its shares have been recently lagging due to the ongoing concerns surrounding Chinese equities.

The recent incident of Jack Ma’s prolonged and mysterious disappearance is an unacceptable event for one of the largest publicly traded companies in the world, while the Chinese government’s involvement in steering the company’s direction has also been raising questions amongst investors. The stock is currently trading at around 20.5 times its forward net income, to reflect these risks.

Altimeter more than tripled its stake during the quarter, now holding 1.1 million shares, vs. 294,000 shares during its previous filing.

Farfetch (FTCH):

The U.K.-based online marketplace for luxury goods is a company Altimeter has been holding since its early IPO. Over the past year, the fund has tripled its position, but shares have yet to occupy more than 3.2% of the total holdings.

While the company is technology-focused, considering its innovative online marketplace, its investment into Virgil Abloh’s Off-White has given it direct exposure to the fashion world, operating actual retail locations. Farfetch has yet to turn a profit, but its sales are strengthening, as Off-White is becoming a cultural phenomenon, exploding in popularity.

Despite the rapid revenue growth (nearly 64% YoY), and the stock’s prolonged rally, the stock’s valuation is not entirely crazy at 8.5 times its forward sales. That is, assuming the current growth rate does not take a nosedive moving forward.

Altimeter held its position steady quarter-over-quarter.

CrowdStrike Holdings, Inc. (CRWD)

CrowdStrike is currently one of the hottest cybersecurity stocks in the market. The company provides cloud-delivered solutions for endpoint and cloud workload protection, growing its revenues at a 3-year CAGR of around 94.55%. The majority of CrowdStrike’s revenues are of a recurring nature, which adds to the predictability of its cash flows. COVID-19 pushed the digital revolution even further, which should boost the demand for CrowdStrike’s tools and services.

However, investors need to keep in mind that the industry is brutally competitive, with many players fighting for some market share. Hence, any deceleration in CrowdStrike revenue growth could materially damage current investors, considering that the stock is trading at 31.7 times its forward sales, or 51 times its expected FY2026 net income.

Altimeter held its position steady quarter-over-quarter.

Final Thoughts

Altimeter has been delivering some of the most impressive returns we have seen in hedge funds, outperforming the overall market indices by a vast margin. Its concentrated portfolio of high conviction equities has been greatly paying off and proven to be a viable strategy. That said, investors looking to tap into Altimeter’s holdings should be wary of the fund’s lack of diversification and the tech sector’s sky-high valuations.

Additional Resources:

Slate Path Capital’s 20 Stock Portfolio: Top 10 Holdings Analyzed

Appaloosa Management’s 35 Stock Portfolio: Top 10 Holdings Analyzed

Viking Global’s 75 Stock Portfolio: Top 10 Holdings Analyzed

Lone Pine Capital’s 37 Stock Portfolio: Top 10 Holdings Analyzed