Updated on June 7th, 2021 by Nikolaos Sismanis

Founded by Rey Dalio in 1975, Bridgewater Associates is currently the world’s largest hedge fund, boasting $140 billion of assets under management (AUM) as of March 2021. The fund has 105 clients, including pension funds, endowments, foundations, foreign governments, and central banks.

To satisfy the needs of its diverse client base, Bridgewater applies a global macro-investing style that takes into account international metrics such as inflation, currency exchange rates, and gross domestic product. Bridgewater is based in Westport, Connecticut.

Investors following the company’s 13F filings over the last 3 years (from mid-May 2018 through mid-May 2021) would have generated annualized total returns of 6.45%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 18.60% over the same time period.

You can download an Excel spreadsheet with metrics that matter of Bridgewater Associates’ current 13F equity holdings below:

Keep reading this article to learn more about Bridgewater Associates.

Table Of Contents

Bridgewater Associates’ Principles And Culture

Bridgewater utilizes a principle-based approach designed by its founder, Ray Dalio. Mr. Dalio bought his first shares in the then-Northeast Airlines at the age of 12, tripling his money upon the airline’s following merger. Since then, he has carved a prosperous career, including working as a trader on the NYSE floor, before eventually leading Bridgewater to become the world’s largest hedge fund.

In 2011, he self-published “Principles”, a 123-page volume that sketches his investment philosophy and corporate management based on a lifetime of observation. With a net worth of $18.7 billion and the world’s largest institutions in his clientele, it’s safe to say that Mr. Dalio’s principles have been proven to be quite triumphant.

While Mr. Dalio’s principles are better read as a whole to fully grasp, we have summed up what we believe are five key takeaways that should be quite relevant to any investor.

Diversify by placing many smaller bets vs. fewer larger bets

Diversification is a common theme that most investors are aware of, but one that few know how to truly practice. In Bridgewater Associates, Mr. Dalio has pioneered the “Holy Grail” portfolio. It is invested in multiple uncorrelated equities that provide numerous income streams, aiming to provide similar returns to other investment strategies while lowering the overall risk (i.e., standard deviation).

In this way, Bridgewater has been able to achieve superior risk-adjusted returns. Keep in mind that Bridgewater does not necessarily strive to “beat the market.” The fund has clients like Government entities, which are more interested in keeping with inflation and the economy. Risk-adjusted returns are more important in this case.

Avoid false dichotomies in risk-reward tradeoffs

Ray Dalio emphasizes that decisions don’t always have an either-or outcome, and there is usually a solution just out of view that allows both goals to be achieved.

Systematize and codify your decision-making

Each investor has different criteria that they use to make investment decisions. In his investment strategy (and that of Bridgewater Associates), Dalio explains how he is a huge advocate of documenting all your decision-making criteria so that successful actions can be replicated in the future.

Keep an investment decision log

This is quite similar to our third point, but instead of replicating past successful strategies, it aims to birth new ones. By writing down your present rationale for decisions you make, it will allow you to get a less distorted view of your perspectives and views later. This will improve your process of reflecting on past choices and can assist you in sharpening your future decision-making.

Realize that nothing is a sure bet. The pain will be your teacher

Investing in equities always bears a certain amount of risks. Many companies that appear like “sure wins” may fail, and businesses that seem laughable and desperate may go on to be huge successes. Realizing that nothing is a sure bet is a great asset. Additionally, using the pain of past failures to grow as an investor should also be highly valued.

Bridgewater Associates’ Portfolio & 10 Largest Public-Equity Investments

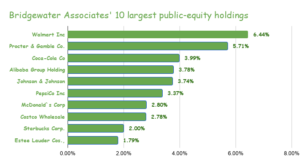

Bridgewater Associates’ portfolio seems to be following closely Mr. Dalio’s diversification principle, numbering 411 individual equities. Its top 10 holdings account for 36.4% of the total capital invested, including Mr. Dalio’s highest conviction picks.

Source: 13F filing, Author

Walmart Inc. (WMT):

Walmart is the largest company in the world by revenues, generating over $500 billion in annual sales. Its stock is Bridgewater’s largest holding, accounting for just over 6% of its total portfolio. Despite having such a high exposure to the company, Bridgewater initially bought into Walmart very recently, in Q3 of 2020. Bridgewater is likely betting on Walmart’s e-commerce skyrocketing in the short term, as the company leverages its huge logistics network to compete with Amazon.

The fund’s conviction seems to be remaining strong, as Bridgewater increased its position by a further 16% during the previous quarter. The stock is trading at 24.3 times its forward net income, presenting a relatively attractively priced investment case considering the company’s wide moat and e-commerce growth prospects. Walmart is also a Dividend Aristocrat, counting 46 years of consecutive annual dividend increases.

The Procter & Gamble Company (PG):

While the consumer staples sector has lagged the overall market over the past few quarters, its components have been delivering impressive underlying results. This is the case with Procter & Gamble, which currently features an all-time high LTM (Last Twelve Month) net income of $14.2 billion.

The stock is trading at 23.5 times its forward net income, which, combined with management aggressive capital returns and the company’s robust balance sheet, could provide an optimal entry point for those looking to hold over the long term.

The company is also a Dividend King, featuring 64 years of consecutive annual dividend increases. Dividends have grown at a 5-year CAGR of 3.59%, beating inflation during this period.

Bridgewater increased its position by 119% in its Q4 filing and by another 19% as of the latest filing. The stock currently accounts for 5.7% of its total holdings.

Coca-Cola Co. (KO) & PepsiCo, Inc. (PEP):

Coca-Cola and PepsiCo collectively account for around 7.4% of Bridgewater’s total holdings. The consumer staples giants are both Dividend Aristocrats, boasting 58 and 49 years of consecutive annual dividend increases, respectively. Both companies possess a massive moat in their respective categories. Consequently, their predictable business model and operations make them excellent sources for income generation.

In terms of dividend growth, PepsiCo features a substantially higher increase pace over the past few years, displaying a 5-year DPS CAGR of 7.8% against Coca-Cola’s 4.25% during the same period.

PepsiCo’s and Coca-Cola’s cash flow stability are a great advantage to achieving strong returns over the long term, which is a valuable quality for funds catering to such a diverse client base like Bridgewater.

Both stocks yield around 3%, which in today’s ultra-low yield environment should make for a respectable tangible return. Their valuation multiples move almost identically, featuring a forward P/E of approximately 24.

Bridgewater’s positions in Coca-Cola and PepsiCo were increased by 25% and 21%, respectively.

Alibaba Group (BABA):

Mr. Dalio has been an enthusiast in regard to China’s investing potential for years. Alibaba, the Chinese tech behemoth, has been in Bridgewater’s portfolio since 2018 and has since grown to its largest position. The company recently reported its Q1 results, smashing estimates by delivering revenues of $28.60 billion, a 64.0% growth year-over-year.

While Alibaba remains a highly profitable company, displaying net income margins that often surpass the 30%+ levels, its shares have been recently lagging due to the ongoing concerns surrounding Chinese equities. Jack Ma’s prolonged and mysterious disappearance was an unacceptable event for one of the largest publicly traded companies in the world, while the Chinese government’s involvement in steering the company’s direction has also been raising questions among investors.

Hence, while those who are interested in investing in China’s tech world are likely to find Alibaba one of the most attractive investments out there, they should also consider the underlying risks involved. Bridgewater trimmed its Alibaba position by 12% during the quarter.

Johnson & Johnson (JNJ):

Following the theme of holding credible Dividend Aristocrats, Bridgewater has allocated around 3.7% of its assets in the healthcare behemoth, Johnson & Johnson. The company recently posted quarterly revenues of $22.32 billion, 7.90% higher YoY, and first-quarter EPS of $2.32, implying an increase of 6.9% YoY. The Dividend King’s results were once again solid, resulting in raising its quarterly dividend once again by ~5% to $1.06 per share.

Having already delivered 59 years of consecutive annual increases, investors are buying into a high-quality company with a highly competent management team. The stock is trading at a relatively fair valuation at 18 times its forward net income, presenting a decent entry point for current investors.

The most recent Johnson & Johnson position hike was by 16%.

McDonald’s Corporation (MCD):

With McDonald’s, we can see once again how much Mr. Dalio and his investment team value companies that have proven their ability to deliver sustainable long-term returns to their shareholders.

McDonald’s business model and brand value have remained resilient for decades, with the company raising its dividend annually for 45 consecutive years. The stock should be relatively recession-proof as well, as fast food holds up very well even during economic downturns. At around 26.4 times its forward earnings, the stock may not be cheap but should make for a solid long-term holding.

Bridgewater raised its stake in McDonald’s Corporation by 22% during the quarter.

Costco Wholesale Corporation (COST):

Costco’s unique consumer culture has been a strong driver in the company’s long-term revenue growth. While the business itself is a low-margin one, Costco’s economies of scale are massive, resulting in a robust bottom line.

Unlike its competitors, the stock has always attracted a premium valuation. At a forward P/E of 34.5, the stock is definitely not cheap. Still, with its resilient cash flows and resilient organic growth, Costco’s premium valuation multiple may be justified.

In its latest quarterly report, net sales increased by 21.7%, to $44.38 billion, while EPS grew to $2.75, 44.7% higher YoY, comprising another report of excellent performance. We can see the stock retaining its pricey valuation, and consequently, its yield to stay at tiny levels below 1%.

The most recent Costco position hike was 15%.

Starbucks Corp. (SBUX):

Starbucks Corp. is Bridgewater’s ninth-largest holding, accounting for 2% of its total portfolio. The Seattle-based iconic coffee company reported revenue growth of 11% YoY to $6.7 billion, continuing its post-pandemic recovery. In Q1, global comparable store sales increased by 15%, driven by a 19% increase in average ticket and a 4% decline in comparable transactions.

As a result of better than expected results, management hiked its FY2021 guidance, expecting sales of $28.5 billion to $29.3 billion (prior $28B to $29B) vs. a consensus of 28.62 billion. Non-GAAP operating margin is expected at 16.5% to 17.5%, while non-GAAP EPS should be in the range of $2.90 to $3.00 (prior $2.70 to $2.90).

Starbucks’ dividend continues to grow rapidly, featuring a 5-year DPS CAGR of 18.29%. The dividend has been growing annually since the company initiated it, numbering 11 consecutive increases.

Bridgewater raised its stake in Starbucks by 17% during the quarter.

The Estée Lauder Companies Inc. (EL)

Last but not least, Bridgewater’s tenth-largest position is Estée Lauder Companies, which occupies around 1.8% of its total portfolio. The stock has been growing shareholders’ wealth for years very consistently, as the company has dominated the skincare and makeup markets in the U.S.

In Q1, revenues grew by 16% to $3.86 billion, with expanding sales in every region and in most product divisions. Its growth exhibited the recovery in several areas compared to last year, where brick-and-mortar began to shut down as COVID-19 spread. While the company’s performance has been very solid, its valuation has been expanding over the past decade, resulting in a lower yield over time. Therefore, current investors are subject to a lower margin of safety.

The position was increased by 24% during the quarter.

Final Thoughts

Bridgewater has grown into the largest hedge fund in the world under the leadership of Ray Dalio and his simple, yet mastered, principles. The company’s holdings structure is not extraordinarily complex, with the fund holding mostly traditional equities.

Source: 13F filing, Author

However, considering its diverse client base, such a greatly diversified portfolio makes a lot of sense. Even though it may not outperform the market, it should provide great returns on a risk-adjusted basis over the long term. Mr. Dalio’s picks provide some compelling investment ideas for retail investors, so make sure you download the spreadsheet to browse them all.