Published on March 18th, 2021 by Nikolaos Sismanis

Founded by Rey Dalio in 1975, Bridgewater Associates is currently the world’s largest hedge fund, boasting $101.9 billion of assets under management (AUM) as of January 2021. The fund has 103 clients, including pension funds, endowments, foundations, foreign governments, and central banks.

To satisfy the needs of its diverse client base, Bridgewater applies a global macro-investing style that takes into account international metrics such as inflation, currency exchange rates, and gross domestic product. Bridgewater is based in Westport, Connecticut.

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 8.12%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

You can download an Excel spreadsheet with metrics that matter of Bridgewater Associates’ current 13F equity holdings below:

Keep reading this article to learn more about Bridgewater Associates.

Table Of Contents

Bridgewater Associates’ Principles And Culture

Bridgewater utilizes a principle-based approach designed by its founder, Ray Dalio. Mr. Dalio bought his first shares in the then-Northeast Airlines at the age of 12, tripling his money upon the airline’s following merger. Since then he has carved a prosperous career, including working as a trader on the NYSE floor, before eventually leading Bridgewater to become the world’s largest hedge fund.

In 2011, he self-published “Principles”, a 123-page volume, that sketches his investment philosophy and corporate management based on a lifetime of observation. With a net worth of $18.7 billion and the world’s largest institutions in his clientele, it’s safe to say that Mr. Dalio’s principles have been proven to be quite triumphant.

While Mr. Dalio’s principles are better read as a whole to fully grasp, we have summed up what we believe are five key takeaways that should be quite relevant to any investor.

Diversify by placing many smaller bets vs. fewer larger bets

Diversification is a common theme that most investors are aware of, but one that few know how to truly practice. In Bridgewater Associates, Mr. Dalio has pioneered the “Holy Grail” portfolio. It is invested in multiple uncorrelated equities that provide numerous income streams, aiming to provide similar returns to other investment strategies while lowering the overall risk (i.e. standard deviation).

In this way, Bridgewater has been able to achieve superior risk-adjusted returns. Keep in mind that Bridgewater does not necessarily strive to “beat the market.” The fund has clients like Government entities, which are more interested in keeping with inflation and the economy. Risk-adjusted returns are more important in this case.

Avoid false dichotomies in risk-reward tradeoffs

Ray Dalio emphasizes that decisions don’t always have an either-or outcome, and there is usually a solution just out of view that allows both goals to be achieved.

Systematize and codify your decision-making

Each investor has different criteria that they use to make investment decisions. In his investment strategy (and that of Bridgewater Associates), Dalio explains how he is a huge advocate of documenting all your decision-making criteria so that successful actions can be replicated in the future.

Keep an investment decision log

This quite similar to our #3 points, but instead of replicating past successful strategies, it aims to birth new ones. By writing down your present rationale for decisions you make, it will allow you to get a less distorted view of your perspectives and views later. This will improve your process of reflecting on past choices and can assist you in sharpening your future decision-making.

Realize that nothing is a sure bet. The pain will be your teacher.

Investing in equities always bears a certain amount of risks. Many companies that appear like “sure wins” may fail, and businesses that seem laughable and desperate may go on to be huge successes. Realizing that nothing is a sure bet is a great asset. Additionally, using the pain of past failures to grow as an investor should also be highly valued.

Bridgewater Associates’ Portfolio & 10 Largest Public-Equity Investments

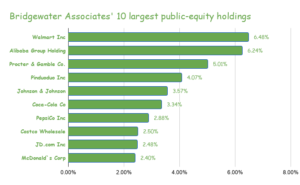

Bridgewater Associates’ portfolio seems to be following closely Mr. Dalio’s diversification principle, numbering 484 individuals equities. Its top 10 holdings account for 38.9% of the total capital invested, including Mr. Dalio’s highest conviction picks.

Source: 13F filing, Author

Walmart Inc. (WMT):

Walmart is the largest company in the world by revenues, generating over $500 billion in sales annually. Its stock is Bridgewater’s largest holding, accounting for just over 6% of its holdings. Despite having such a high exposure to the stock, Bridgewater initially bought into the company very recently, in Q3 of 2020. In our view, considering the timing of Mr. Dalio’s investment, Bridgwater is likely betting on Walmart’s e-commerce skyrocketing in the short term as the company leverages its huge logistics network to compete with Amazon.

The stock is trading at 24.2 times its forwards net income, presenting a relatively attractively priced investment case considering the company’s wide moat and e-commerce growth prospects. Walmart is also a Dividend Aristocrat, counting 46 years of consecutive annual dividend increases. Mr. Dalio increased the fund’s exposure in Walmart by 120% according to the latest 13F filings.

Alibaba Group (BABA):

Mr. Dalio has been an enthusiast in regards to China’s investing potential for years. Alibaba, the Chinese tech behemoth, has been in Bridgewater’s portfolio since 2018 and has since grown to its largest position. The company recently reported its Q4 results, smashing estimates by delivering revenues of $33.88 billion, a 37.0% growth year-over-year.

While Alibaba remains a highly profitable company, displaying net income margins that often surpass the 30%+ levels, its shares have been recently lagging due to the ongoing concerns surrounding Chinese equities. Jack Ma’s prolonged and mysterious disappearance is an unacceptable event for one of the largest publicly-traded companies in the world, while the Chinese government’s involvement in steering the company’s direction has also been raising questions amongst investors.

Hence, while those who are interested in investing in China’s tech world are likely to find Alibaba one of the most attractive investments out there, they should also consider the underlying risks involved. Bridgewater grew its Alibaba position by 19% during the quarter.

The Procter & Gamble Company (PG):

While the consumer staples sector has lagged the overall market over the past few months, its components have been delivering impressive results. This is the case with Procter & Gamble, which produced all-time high Q4 revenues of $19.75 billion, a massive $3.85 billion of which made it to the bottom line. The stock is trading at 22 times its forward net income, which combined with management aggressive capital returns and the company’s robust balance sheet could provide an optimal entry point for those looking to hold over the long term.

Bridgewater is definitely keen on the stock in any case, as it increased its position by 119% during the quarter, which currently accounts for 5% of its total holdings. The company is also a Dividend King, featuring 64 years of consecutive annual dividend increases.

Pinduoduo Inc. (PDD) & JD.com, Inc. (JD):

Pinduduo and JD.com are Chinese e-commerce mobile platforms selling a variety of products. The two stocks present another example of Mr. Dalio’s long-term conviction in China’s economic future. Both companies have been growing revenues rapidly. However, they still present a much riskier investment case compared to their larger peers, such as Alibaba and Tencent (not e-commerce here, tech in general). Bridgewater has been holding both stocks since Q2-2018, while at its latest filing, it showed 46% and 20% position increases, respectively, indicating strong confidence in their long-term prosperity.

The two companies account for around 6.6% of Bridgewater’s holdings. The two positions were increased by 29% and 2%, respectively, during the quarter.

Coca-Cola Co. (KO) & PepsiCo, Inc. (PEP):

Coca-Cola and PepsiCo collectively account for nearly 6% of Bridgewater’s total holdings. The consumer staples giants are both Dividend Aristocrats boasting 58 and 48 years of consecutive annual dividend increases, respectively. While both companies are not the most exciting investments in the world, they possess a massive moat in their respective categories.

Their cash flow stability is a great advantage to achieving strong returns over the long-term, which is a great quality for funds catering to such a diverse client base like Bridgewater. Both stocks yield above 3%, which in today’s ultra-low yield environment should make for a respectable source of income.

Bridgewater’s positions in Coca-Cola and PepsiCo were increased by 123% and 113% respectively.

Johnson & Johnson (JNJ):

Following the theme of holding credible Dividend Aristocrats, Bridgewater has allocated around 3.6% of its assets in the healthcare behemoth, Johnson & Johnson. The company recently posted its Q1-2021 results, reaching a new all-time high revenue of $22.48B.

Having already delivered 58 years of consecutive annual increases, investors are buying into a high-quality company with a highly competent management team. The stock is trading at a relatively fair valuation at 18 times its forward net income, presenting a decent entry point for current investors.

The most recent Johnson & Johnson position hike was by 120%.

Costco Wholesale Corporation (COST):

Costco’s unique consumer culture has been a strong driver in the company’s long-term revenue growth. While the business itself is a low margin one, Costco’s economies of scale are massive, resulting in a robust bottom line.

Unlike its competitors, the stock has always attracted a premium valuation. At a forward P/E of 31.7, the stock is definitely not cheap. Still, with its resilient cash flows and resilient organic growth, Costco’s premium valuation multiple may be justified.

The most recent Costco position hike was by 122%.

McDonald’s Corporation (MCD):

Closing the company’s top 10 most significant holdings, we can see once again how much Mr. Dalio and his investment team value companies that have proven their ability to deliver sustainable long-term returns to their shareholders.

McDonald’s business model and brand value have remained resilient for decades, with the company raising its dividend annually for 45 consecutive years. The stock should be relatively recession-proof as well, as fast food holds up very well even during economic downturns. At around 27 times its forward earnings, the stock may not be cheap but should make for a solid long-term holding.

Bridgewater raised its stake in McDonald’s Corporation by 119% during the quarter.

Final Thoughts

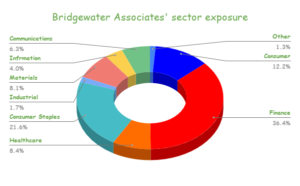

Bridgewater has grown into the largest hedge fund in the world under the leadership of Ray Dalio and his simple, yet mastered, principles. The company’s holdings structure is not extraordinarily complex, with the fund holding mostly traditional equities.

Source: 13F filing, Author

However, considering its diverse client base, such a greatly diversified portfolio makes a lot of sense. Even though it may not outperform the market, it should provide great returns on a risk-adjusted basis over the long term. Mr. Dalio’s picks provide some compelling investment ideas for retail investors, so make sure you download the spreadsheet to browse them all.