DA Davidson Initiates Coverage Of Custom Truck One Source (CTOS) with Buy Recommendation

On February 16, 2023, DA Davidson initiated coverage of Custom Truck One Source Inc (NYSE:CTOS) with a Buy recommendation.

Analyst Price Forecast Suggests 37.68% Upside

As of February 16, 2023, the average one-year price target for Custom Truck One Source is $9.77. The forecasts range from a low of $8.58 to a high of $12.60. The average price target represents an increase of 37.68% from its latest reported closing price of $7.10.

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

The projected annual revenue for Custom Truck One Source is $1,682MM, an increase of 16.58%. The projected annual EPS is $0.26, an increase of 1,705.33%.

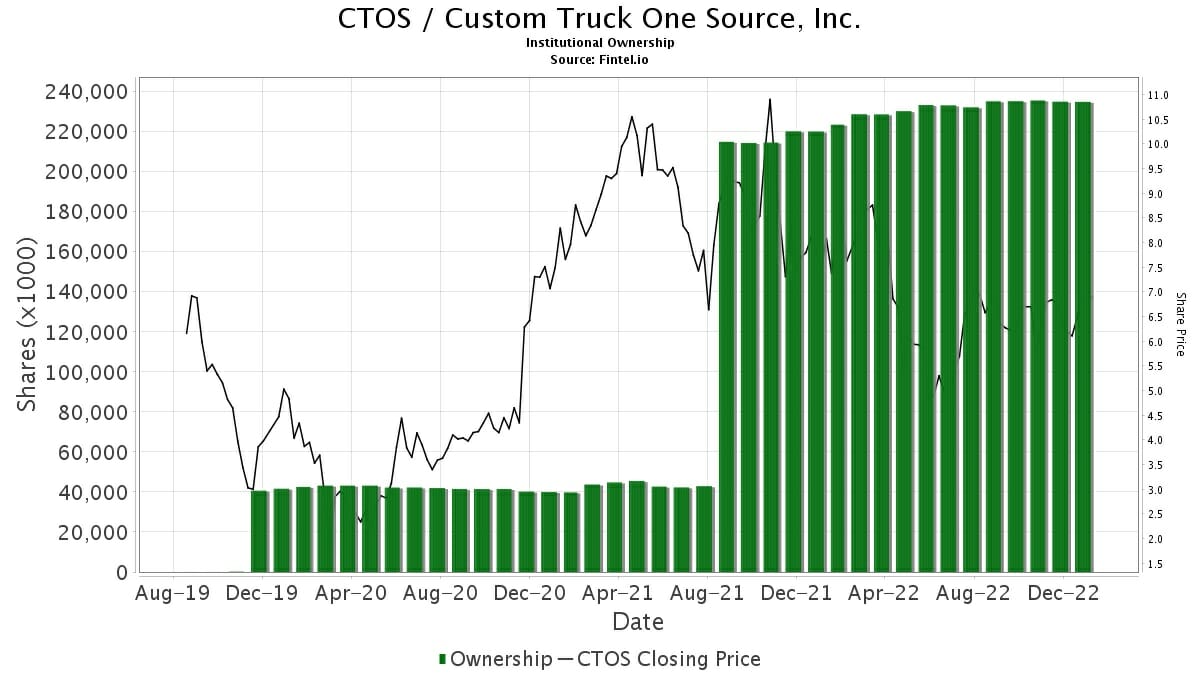

What Are Large Shareholders Doing?

Platinum Equity Advisors holds 148,600K shares representing 60.26% ownership of the company. No change in the last quarter.

ECP ControlCo holds 25,739K shares representing 10.44% ownership of the company. No change in the last quarter.

Federated Hermes holds 4,735K shares representing 1.92% ownership of the company. No change in the last quarter.

FDVLX - Fidelity Value Fund holds 3,803K shares representing 1.54% ownership of the company. In it's prior filing, the firm reported owning 3,945K shares, representing a decrease of 3.72%. The firm increased its portfolio allocation in CTOS by 16.39% over the last quarter.

Alyeska Investment Group holds 3,128K shares representing 1.27% ownership of the company. In it's prior filing, the firm reported owning 3,247K shares, representing a decrease of 3.80%. The firm decreased its portfolio allocation in CTOS by 7.31% over the last quarter.

What Is The Fund Sentiment?

There are 218 funds or institutions reporting positions in Custom Truck One Source. This is a decrease of 6 owner(s) or 2.68% in the last quarter. Average portfolio weight of all funds dedicated to CTOS is 0.62%, an increase of 3.78%. Total shares owned by institutions decreased in the last three months by 0.53% to 233,614K shares. The put/call ratio of CTOS is 0.04, indicating a bullish outlook.

Custom Truck One Source Background Information

(This description is provided by the company.)

The Company is a leading provider of specialized truck and heavy equipment solutions to the utility, telecommunications, rail and infrastructure markets in North America. The Company's solutions include rentals, sales, aftermarket parts, tools, accessories and service, equipment production, manufacturing, financing solutions, and asset disposal.

With vast equipment breadth, the Company's team of experts service its customers across an integrated network of locations across North America.

Article by Fintel

Source valuewalk