Updated on November 25th, 2019 by Nate Parsh

Investors looking for high-quality dividend growth stocks, should look first and foremost at the Dividend Aristocrats. The Dividend Aristocrats are an exclusive list of 57 stocks in the S&P 500 Index, with 25+ years of consecutive dividend increases.

In addition to the full downloadable spreadsheet, you can see a preview of the Dividend Aristocrats list in the table below:

| 3M Co. | 167.60 | 3.4 | 96,378 | 19.6 | 66.4 | 1.08 |

| A. O. Smith Corp. | 48.20 | 1.8 | 6,606 | 19.9 | 36.3 | 0.91 |

| Abbott Laboratories | 83.74 | 1.5 | 148,002 | 45.1 | 68.9 | 1.06 |

| AbbVie, Inc. | 86.05 | 5.0 | 127,252 | 39.5 | 196.3 | 0.88 |

| Aflac, Inc. | 53.99 | 2.0 | 39,629 | 13.3 | 26.3 | 0.71 |

| Air Products & Chemicals, Inc. | 237.60 | 1.9 | 52,356 | 29.8 | 57.4 | 0.81 |

| Archer-Daniels-Midland Co. | 42.72 | 3.2 | 23,781 | 20.2 | 65.5 | 0.81 |

| AT&T, Inc. | 37.75 | 5.4 | 275,763 | 16.9 | 91.0 | 0.61 |

| Automatic Data Processing, Inc. | 169.65 | 1.9 | 73,407 | 31.0 | 57.8 | 1.02 |

| Becton, Dickinson & Co. | 249.89 | 1.2 | 67,458 | 63.0 | 77.7 | 0.99 |

| Brown-Forman Corp. | 67.04 | 1.0 | 32,014 | 39.1 | 38.2 | 0.71 |

| Cardinal Health, Inc. | 55.69 | 3.4 | 16,288 | -4.0 | -13.6 | 0.92 |

| Caterpillar, Inc. | 143.88 | 2.5 | 79,516 | 13.5 | 34.0 | 1.38 |

| Chubb Ltd. | 151.13 | 2.0 | 68,492 | 19.0 | 37.2 | 0.63 |

| Chevron Corp. | 118.63 | 4.0 | 224,313 | 16.9 | 66.8 | 0.85 |

| Cincinnati Financial Corp. | 105.75 | 2.1 | 17,276 | 18.8 | 39.3 | 0.72 |

| Cintas Corp. | 254.09 | 1.0 | 26,298 | 29.2 | 29.3 | 1.01 |

| The Clorox Co. | 146.26 | 2.8 | 18,356 | 22.9 | 63.2 | 0.45 |

| The Coca-Cola Co. | 53.03 | 3.0 | 227,206 | 29.3 | 87.9 | 0.43 |

| Colgate-Palmolive Co. | 66.71 | 2.5 | 57,173 | 24.7 | 62.9 | 0.54 |

| Consolidated Edison, Inc. | 86.19 | 3.4 | 28,652 | 20.3 | 69.0 | 0.24 |

| Dover Corp. | 109.48 | 1.8 | 15,903 | 24.5 | 43.1 | 1.07 |

| Ecolab, Inc. | 182.51 | 1.0 | 52,607 | 34.5 | 34.8 | 0.80 |

| Emerson Electric Co. | 73.66 | 2.7 | 44,870 | 19.7 | 52.3 | 1.17 |

| Exxon Mobil Corp. | 69.37 | 4.9 | 293,512 | 20.2 | 98.5 | 0.92 |

| Federal Realty Investment Trust | 130.34 | 3.2 | 9,925 | 38.7 | 122.1 | 0.52 |

| Franklin Resources, Inc. | 27.32 | 3.8 | 13,607 | 11.6 | 44.1 | 1.11 |

| General Dynamics Corp. | 182.88 | 2.2 | 52,908 | 15.7 | 34.2 | 0.91 |

| Genuine Parts Co. | 103.71 | 2.9 | 15,068 | 19.0 | 55.0 | 0.78 |

| Hormel Foods Corp. | 42.31 | 1.9 | 22,592 | 23.0 | 44.3 | 0.48 |

| Illinois Tool Works, Inc. | 173.56 | 2.3 | 55,783 | 22.8 | 53.3 | 1.20 |

| Johnson & Johnson | 138.07 | 2.7 | 363,382 | 26.0 | 69.7 | 0.61 |

| Kimberly-Clark Corp. | 133.53 | 3.1 | 45,774 | 22.7 | 69.7 | 0.46 |

| Leggett & Platt, Inc. | 52.33 | 3.0 | 6,886 | 23.5 | 70.0 | 1.08 |

| Linde Plc | 204.91 | 1.7 | 110,072 | 21.0 | 35.3 | 0.78 |

| Lowe's Cos., Inc. | 118.20 | 1.7 | 90,777 | 31.2 | 54.4 | 1.04 |

| McCormick & Co., Inc. | 166.91 | 1.3 | 22,184 | 31.4 | 41.9 | 0.40 |

| McDonald's Corp. | 193.14 | 2.4 | 145,452 | 25.1 | 60.3 | 0.43 |

| Medtronic Plc | 110.82 | 1.9 | 148,540 | 31.8 | 59.7 | 0.67 |

| Nucor Corp. | 55.24 | 2.9 | 16,749 | 9.4 | 27.3 | 1.15 |

| People's United Financial, Inc. | 16.30 | 4.3 | 7,239 | 12.4 | 53.6 | 0.96 |

| Pentair Plc | 43.73 | 1.6 | 7,350 | 21.2 | 34.7 | 1.20 |

| PepsiCo, Inc. | 134.07 | 2.8 | 186,951 | 15.2 | 42.7 | 0.53 |

| PPG Industries, Inc. | 125.41 | 1.6 | 29,654 | 24.6 | 38.3 | 0.90 |

| Procter & Gamble Co. | 120.29 | 2.4 | 299,980 | 74.7 | 181.8 | 0.53 |

| Roper Technologies, Inc. | 355.75 | 0.5 | 37,018 | 32.0 | 16.6 | 1.04 |

| S&P Global, Inc. | 265.21 | 0.8 | 64,817 | 31.3 | 26.0 | 0.99 |

| The Sherwin-Williams Co. | 574.83 | 0.7 | 53,061 | 37.9 | 28.0 | 0.87 |

| Stanley Black & Decker, Inc. | 157.28 | 1.7 | 23,908 | 33.8 | 57.3 | 1.53 |

| Sysco Corp. | 79.06 | 2.0 | 40,338 | 23.9 | 47.2 | 0.51 |

| T. Rowe Price Group, Inc. | 121.02 | 2.5 | 28,279 | 15.2 | 37.3 | 1.22 |

| Target Corp. | 127.02 | 2.0 | 64,358 | 20.1 | 41.2 | 0.85 |

| United Technologies Corp. | 147.70 | 2.0 | 127,479 | 24.7 | 49.2 | 1.09 |

| VF Corp. | 86.51 | 2.3 | 34,549 | 26.6 | 60.3 | 1.14 |

| W.W. Grainger, Inc. | 319.00 | 1.8 | 17,183 | 18.5 | 32.5 | 1.07 |

| Walmart, Inc. | 119.36 | 1.8 | 339,493 | 23.7 | 41.9 | 0.61 |

| Walgreens Boots Alliance, Inc. | 60.60 | 2.9 | 54,087 | 14.1 | 41.2 | 1.03 |

| Name | Price | Dividend Yield | Market Cap ($M) | Forward P/E Ratio | Payout Ratio | Beta |

T. Rowe Price Group (TROW) is on the list, and is one of just seven Dividend Aristocrats from the financial sector. It has increased its dividend for 33 years in a row, including an 8.6% hike on February 12th, 2019. T. Rowe Price has a strong brand, a highly profitable business, and future growth potential.

The stock has a 2.5% dividend yield, which is above the 1.8% average dividend yield of the S&P 500 Index. And, though shares are slightly above our price-to-earnings ratio target, the stock does have a lower valuation than the S&P 500, meaning it could perform well if the rest of the market continues to move higher.

Add it all up, and T. Rowe Price has many of the qualities dividend growth investors typically look for.

Business Overview

T. Rowe Price was founded in 1937 by Thomas Rowe Price, Jr. In the eight decades since, T. Rowe Price has grown into one of the largest financial services providers in the United States. Today, the company has a market cap of more than $28 billion and manages over $1 trillion in assets.

The company provides mutual funds, advisory services, and separately managed accounts for individuals, institutional investors, retirement plans, and financial intermediaries.

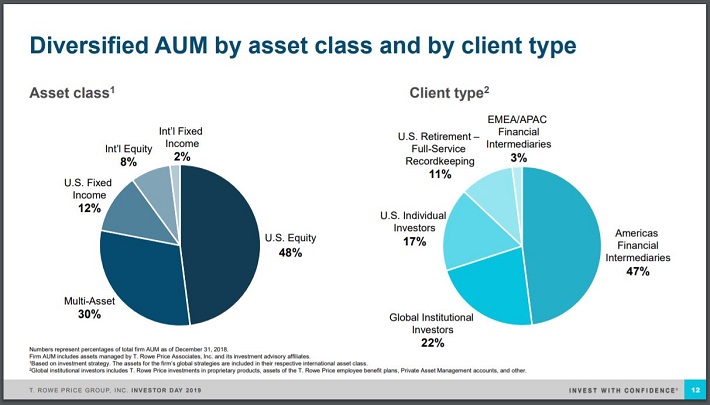

T. Rowe Price has a diverse client base, in terms of assets and client type. The following image provides a breakdown of T. Rowe Price’s assets under management.

Source: 2019 Investor Presentation, slide 12.

This is a difficult climate for asset managers. Certain investors have grown weary of higher trading costs. The onset of low-cost exchange traded funds, or ETFs, have successfully lured client assets away from traditional mutual funds that have higher fees. In addition, the S&P 500 Index can be a negative catalyst for assets under management, AUM, when the market performs poorly.

Another issue facing T. Rowe Price is that many competitors have decided to do away with trading fees for stocks and ETFs. So far, T. Rowe Price has not changed what it charges for trades. Depending on the amount of assets being held in a T. Rowe Price account, investors pay between $9.95 and $19.95 per trade. There is a possibility that clients will leave the company over trading fees if T. Rowe Price maintains these fees.

However, shares of T. Rowe Price continue to perform well, returning nearly 32% year-to-date, and the company has strong growth potential in the years ahead.

Growth Prospects

T. Rowe Price has a number of catalysts for future growth. The first catalyst is higher assets under management. The company has done very well this year, in attracting investor capital. T. Rowe Price reported third quarter results on October 24th, 2019. Revenue increased 2.3% to $1.4 billion, narrowly missing estimates by $15 million. Earnings-per-share increased 7% to $2.13, topping estimates by $0.16.

T. Rowe Price ended the third quarter with $1.13 trillion in assets under management. AUM increased 3.9% from the previous year. AUM improved 0.1% from the second quarter of 2019. The company saw $2.5 billion in net client inflows during the quarter, with international investors accounting for 6.5% of AUM.

This is decent growth, and will help drive higher revenue through investment fees. For example, third quarter advisory fees improved more than 3% to $1.3 billion.

T. Rowe Price saw sharp improvements in net revenues in both 2017 and 2018, growing 13.6% and 16%, respectively, over this period of time. Growth, however, has decelerated so far this year, with just 2% growth in net revenues for the first three quarters of 2019. Still, improvement in AUM and net revenues is a positive for the company.

Share repurchases are also a part of the company’s earnings growth plan. T. Rowe Price repurchased 1.6 million of its own shares in the third quarter for a total price of $173.1 million. The company saw its share count decline 3.8% year-over-year. A lower share count added more than half of the third quarter’s growth in earnings-per-share.

For the first three quarters of 2019, T. Rowe Price has repurchased 5.7 million shares worth $566.7 million. This has reduced the number of outstanding shares by 3.7% from the prior year. T. Rowe Price has reduced its share count by more than 8% over the last decade. Overall, adjusted earnings-per-share have increased 8.4% through the first three quarters of the year.

One item investors should note is that the company’s operating expenses are up 4.2% year-to-date, more than double the increase in net revenues.

Competitive Advantages & Recession Performance

T. Rowe Price’s competitive advantage comes from its brand recognition and expertise. The company enjoys a good reputation in the financial services industry. This helps generate fees, a major driver of revenue. It has built this reputation through strong mutual fund performance. Over the past 10 years, over half the company’s mutual funds placed in the top quartile of performance among their peer group.

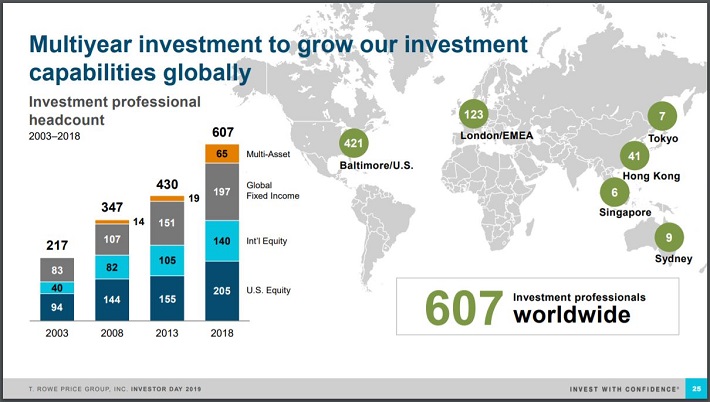

T. Rowe Price considers its employees to be its most valuable assets. There is good reason for this, since it is critical for an asset management company to have qualified experts and retain top talent.

Source: 2019 Investor Presentation, slide 25

This focus on building a strong brand gives the company competitive advantages, primarily the ability to keep existing clients, and bring in new ones.

T. Rowe Price did not perform well during the Great Recession:

- 2007 earnings-per-share of $2.40

- 2008 earnings-per-share of $1.82 (24% decline)

- 2009 earnings-per-share of $1.65 (9% decline)

- 2010 earnings-per-share of $2.53 (53% increase)

As could be expected, T. Rowe Price experienced a sharp decline in earnings-per-share in 2008 and 2009. When stock markets decline, equity investors typically withdraw funds to raise cash.

Fortunately, the company remained profitable throughout the recession, which allowed it to continue raising its dividend each year. And, T. Rowe Price quickly recovered in the aftermath of the Great Recession. Earnings increased significantly in 2010, and by 2011 had reached a new high.

Valuation & Expected Returns

We expect T. Rowe Price to produce adjusted earnings-per-share of $7.60 for 2019. Using the recent closing price of $121, the stock has a price-to-earnings ratio of 15.9. We have a 2024 target price-to-earnings ratio of 15, due to the slowing of revenue growth this year. If the stock valuation returns to the fair value estimate, annual returns would be reduced by 1.2% annually over the next five years.

For a company with a strong brand, consistent profitability, and earnings growth, T. Rowe Price stock seems to be just slightly overvalued. On the other hand, this valuation appears reasonable when compared to the average price-to-earnings ratio of 23 for the S&P 500 Index.

We see earnings-per-share increasing 8.4% for 2019, but growing at a rate of 5% annually through 2024 due to lower management fees.

Over the long-term, earnings growth in the mid-single digits seems realistic and attainable for T. Rowe Price. If that proves accurate, a potential breakdown of future returns is as follows:

- 5% earnings growth

- 2.5% dividend yield

- 1.2% multiple reversion

T. Rowe Price is expected to return 6.3% annually through 2024. T. Rowe Price is a particularly attractive stock for dividends. The company has raised its dividend for over 30 years in a row, including a high single-digit earlier this year. And, the dividend has a solid yield of 2.5%. Plus, the dividend is highly secure, with an expected payout ratio of just 40% this year. This is slightly below the company’s 10-year average payout ratio of 43%.

Final Thoughts

Investors scanning the financial sector for dividend stocks may naturally land on the big banks. But there is only one bank stock on the list of Dividend Aristocrats, People’s United Financial (PBCT).

In fact, most Dividend Aristocrats hailing from the financial sector, come from the insurance and investment management industry. This speaks volumes about the stability of their business models.

T. Rowe Price is an industry leader, and should continue to increase its dividend each year. However, with just a mid-digit expected rate of return over the next five years, T. Rowe Price receives a hold recommendation from Sure Dividend at this time. Investors are encouraged to wait for a pullback before purchasing this Dividend Aristocrat.