Updated on December 30th, 2019 by Bob Ciura

The Dividend Aristocrats are some of the best dividend stocks an investor will find. These are companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

We believe the Dividend Aristocrats are among the highest-quality dividend growth stocks around, which is why we created a downloadable spreadsheet of all Dividend Aristocrats. You can download the Excel sheet of all Dividend Aristocrats by clicking the link below:

Each year, we review all of the Dividend Aristocrats. The next stock in the series is industrial giant Dover Corp. (DOV). Dover might not be a familiar stock for most investors, but it has certainly earned its place on the list.

Dover is not only a Dividend Aristocrat. It is also a Dividend King, an even smaller group of companies with 50+ consecutive years of dividend increases. There are fewer than 25 Dividend Kings.

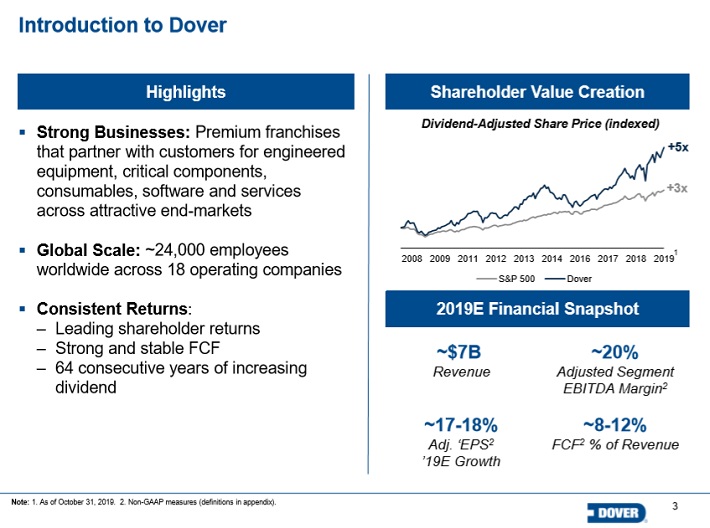

Dover has now increased its dividend for an amazing 64 consecutive years. The company’s dividend is also very safe at current levels, which is explored in more detail in the following video:

At the same time, Dover stock has experienced a multi-year rally. As an industrial stock, it has benefited from the steady economic growth since the Great Recession ended. The end result is that the stock appears to be overvalued, which is why right now might not be the best time to buy Dover stock.

Business Overview

Dover Corporation is a diversified global industrial manufacturer with annual revenues of ~$7 billion and a market capitalization of $15 billion. Dover is composed of three segments: Engineered Systems, Fluids and Refrigeration, & Food Equipment.

Slightly more than half of revenues come from the U.S., with the remainder coming from international markets. Dover spun off its energy business, Apergy, at the beginning of May 2018.

Source: Investor Presentation

Dover reported earnings results for the third quarter on 10/17/2019. The company’s adjusted earnings-per-share totaled $1.60 per share, $0.09 above consensus estimates and improved 17.6% from the previous year. Revenue increased 4.6% to $1.86 billion, $20 million higher than expected. Currency exchange reduced revenues by 1.6%.

Organic revenue came to 5.6% for the quarter, with acquisitions adding 1%. Engineered Systems grew 4.5% to $702 million mostly due to gains in industrial sales, which were up 8%. Waste handling and vehicle service were standouts during the quarter. Print & ID was higher by 4%. Net sales for Fluids was up 9.1% to $753 million due to strength in demand for pumps and process solutions. Fluids also had a 30% growth in sales in China.

Refrigeration & Food Equipment continues to struggle, with sales declining 4.1% to $370 million due to lower volumes. Slower demand for products led to a mid-teens decrease for Refrigeration & Food Equipment in Asia, though sales in Europe improved year-over-year. Dover did see double-digit growth for its door case product line.

Gross margins dipped 10 bps to 36.9%, while operating margins were lower by 70 bps to 15.5%. On the other hand, Adjusted EBITDA improved 17% and adjusted EBITDA margin expanded 160 bps to 21.1%. Dover’s backlog grew 3.5% to $1.4 billion and cash flows increased 44%.

Growth Prospects

Dover’s future growth will come from continued expansion of the global economy. As a diversified industrial manufacturer, Dover will naturally benefit from GDP growth. Besides organic growth in existing businesses, Dover’s earnings growth will also come from margin improvements thanks to its recent portfolio actions.

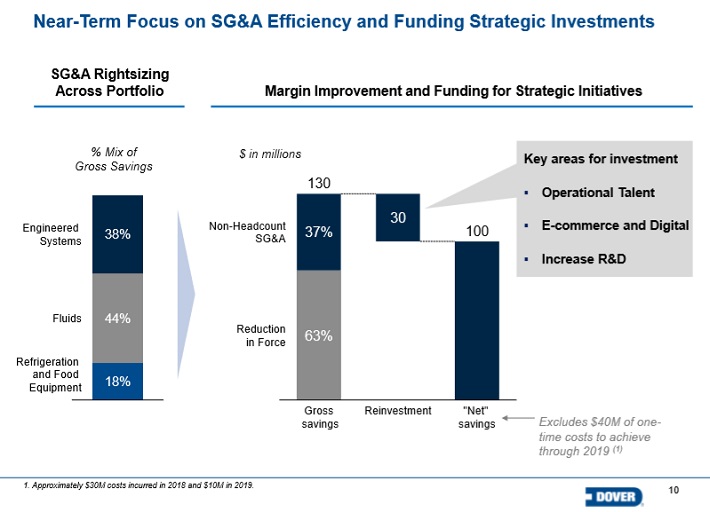

First, Dover launched an aggressive cost-cutting program to boost margins across its operating segments.

Source: Investor Presentation

The ambitious cost-reduction effort will also free up additional resources for investment in growth. Dover is active on the mergers and acquisitions front. Since 2014, Dover has spent billions on a number of bolt-on acquisitions.

Dover’s future growth prospects are accelerated by its portfolio reshuffling. The company launched a re-segmentation of its businesses. The goal of this re-segmentation is to increase efficiency and transparency across the organization.

Lastly, emerging markets are a long-term growth catalyst for Dover. Under-developed regions are reporting higher economic grown than more developed parts of the world. This was apparent from the company’s recent earnings report.

By region, the U.S. grew 7% organically due to high demand for products from Engineered Systems and Fluids. Europe was up 8% due to contributions from all segments. Asia sales increased 6%, with 20% growth in China.

Dover now expects to earn $5.84 per share in 2019, up from $5.80 previously. We expect approximately 5% annual earnings-per-share growth for Dover through 2025.

Competitive Advantages & Recession Performance

No company can increase its dividend for 60+ years in a row, without durable competitive advantages. In Dover’s case, its competitive advantages include a large intellectual property portfolio, economies of scale, and a strong balance sheet.

Dover is in good financial condition. It has a long-term credit rating of BBB+ from Standard & Poor’s and A3 from Moody’s. High credit ratings helps Dover keep its cost of capital low.

Dover is in a fortunate position, in that it generates high levels of cash flow. It can invest ~60% of cash flow in acquisitions and capital expenditures, and also return cash to shareholders through dividends and buybacks.

Dover’s competitive advantages allow it to maintain consistent profitability each year, even during recessions. Dover’s earnings-per-share during the Great Recession are below:

- 2007 earnings-per-share of $3.22

- 2008 earnings-per-share of $3.67 (14% increase)

- 2009 earnings-per-share of $2.00 (45% decline)

- 2010 earnings-per-share of $3.48 (74% increase)

As a major industrial manufacturer, Dover is a bellwether for the global economy. As should be expected, it is not a highly recession-resistant company.

The deep economic downturn caused Dover’s earnings to nose-dive in 2009. However, the company only had one year of declining earnings during the recession. It returned to growth in 2010 and beyond. And its dividends continued to grow during this period of uncertainty.

Valuation & Expected Returns

Dover stock trades for a price-to-earnings ratio of 19.7, using the company’s earnings guidance for 2019. Dover held an average price-to-earnings ratio of 16.7 over the past 10 years. Dover stock appears to be undervalued, based on its average valuation multiples.

If Dover stock experiences an expansion of the valuation multiple to our estimate of fair value, it would reduce annual shareholder returns by 3.3% annually over the next five years.

Earnings growth and dividends will positively impact future returns. First, we expect the company to grow earnings-per-share by 5% per year through 2025. This is a reasonable forecast, as Dover forecasts 3%-5% annual revenue growth, along with additional earnings growth from share repurchases and margin improvements each year.

Lastly, Dover stock has a dividend yield of 1.7%. Putting it all together, a breakdown of our expected future returns is as follows:

- 5% expected earnings-per-share growth

- 1.7% dividend yield

- 3.3% negative return from valuation contraction

In this projection, total shareholder returns could reach 3.4% annualized through 2024. This is a positive–albeit unspectacular–expected rate of return for this Dividend King.

Final Thoughts

Dover has endured a number of challenges over the past decade, including the Great Recession and the oil and gas downturn of 2014-2016. And yet, it continued to raise its dividend each year, no matter what. Very few companies have this ability, which makes Dover a rare dividend growth stock.

Dover’s two largest segments showed solid growth during the last quarter. And, we feel that removing energy from its core business was a prudent move by the company. These factors have the company positioned for growth in future years, making it highly likely that Dover will continue to increase its dividend.

Dover is a high-quality business and a dividend growth company, but the stock is simply too overvalued to earn a buy rating from Sure Dividend at this time. That said, on a pullback, we would be buyers of this quality industrial name.