Updated on December 31st, 2019 by Bob Ciura

The Dividend Aristocrats prove that when it comes to investing, boring isn’t always a bad thing. The Dividend Aristocrats are a group of 57 companies in the S&P 500 Index that have at least 25 consecutive years of dividend increases.

We are big fans of the Dividend Aristocrats, which is why we have created a full spreadsheet of all Dividend Aristocrats–with important financial metrics that matter most to investors–which you can download by clicking the link below:

We review all 57 Dividend Aristocrats each year. The next stock in the series is industrial manufacturer Pentair plc (PNR).

Pentair does not have an exciting business model. It most likely will not be featured as the next hot growth stock any time soon. Instead, it is a slow-and-steady dividend stock that has created substantial shareholder wealth over the past several decades.

Pentair has increased its dividend for a very impressive 44 years in a row. It recently increased its dividend, by 6%. The company’s dividend is also very safe, which is a topic we explore in the following video:

Pentair is a high-quality business, which provides investors with international diversification and steady dividend growth. However, the stock appears to be overpriced today.

This article will discuss Pentair’s business model, and why it might be the most under-the-radar Dividend Aristocrat.

Business Overview

Pentair is based in the U.K., but has large operations across Europe and in the U.S., among other international regions. The company was formed in 1966. In 1968, Pentair acquired Peavey Paper Mills, which gave it a top position in paper products. Paper fueled the company’s growth over the next decade, until management decided to diversify into other product categories.

Pentair’s first investment outside of paper products was the acquisition of Porter-Cable, a manufacturer of portable electronic power tools. In the decades since, Pentair has continued to diversify its product line with bolt-on acquisitions.

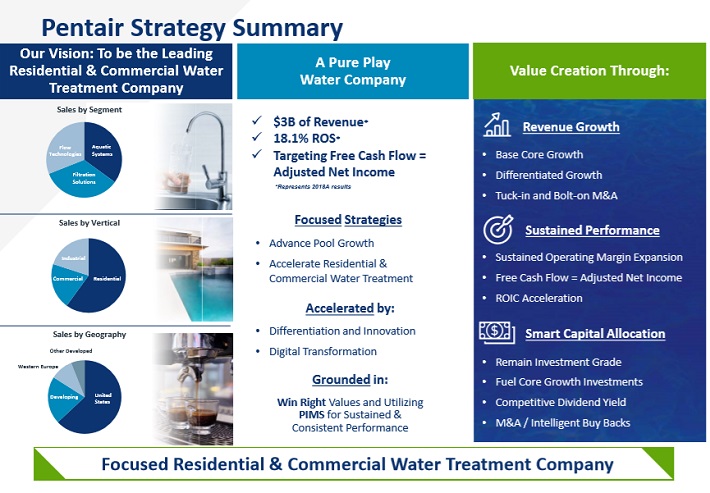

The company recently spun off its Technical Solutions business and now operates as a pure-play water solutions company. The pure-play water company now generates just over $3 billion in revenue, and focuses on improving the availability and quality of water.

Source: Investor Presentation

The spin-off was competed in the second quarter of 2018 and the new business is now called nVent Electric, trading under the ticker NVT. After the spin-off, it now operates as a pure-play water solutions company that operates in 3 segments: Aquatic Systems, Filtration Solutions, and Flow Technologies.

Pentair reported its third quarter earnings results on October 23rd. The company generated revenues of $714 million during the third quarter, up 0.3% from the same quarter a year ago. Core sales, which excludes the impact of currency rate movements, acquisitions, and dispossessions, were down 2% year over year, which was a rather weak performance compared to the revenues that Pentair has generated over the last couple of quarters.

Pentair’s gross margin expanded by 140 basis points, which was a major positive. The company managed to grow its operating income slightly. Pentair recorded earnings-per-share of $0.58 for the third quarter, up slightly from $0.54 during the previous year’s quarter. Pentair’s earnings-per-share beat the analyst consensus by $0.03, or roughly 5%.

Growth Prospects

Between 2008 and 2017 (before the nVent spin-off) Pentair grew its earnings-per-share by 5.5% annually. Adjusted for the impact of the last financial crisis – an unusually harsh recession which made Pentair’s earnings-per-share decline by slightly more than 30% between 2008 and 2009 – Pentair’s long-term earnings-per-share growth rate would have been even higher.

Pentair management believes that a long-term earnings-per-share growth rate of 10% is possible, but we are a bit more conservative. We believe it is better to expect a 6%-7% earnings-per-share growth rate from Pentair over the coming years.

The company should be able to achieve this growth through a combination of rising revenues, which will be possible thanks to organic growth and acquisitions, and through tailwinds from margin expansion and share repurchases, which will lead to further declines in Pentair’s share count.

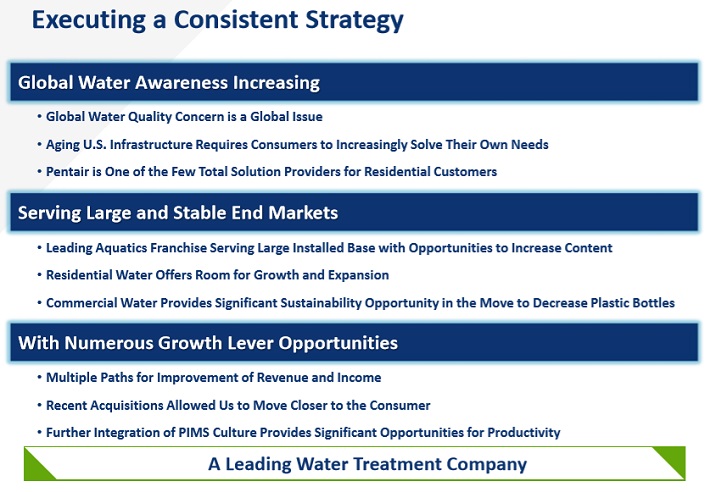

Pentair will benefit from a number of structural tailwinds, such as the aging water infrastructure in the U.S., as well as the increasing efforts to improve sustainability by reducing use of plastic bottles.

Source: Investor Presentation

Pentair continues to see very strong organic growth on a consolidated basis as Aquatic Systems performs well. Acquisitions will also help boost the company’s growth. In early January, it announced it was buying Aquion for $160 million in cash. Aquion offers a line of water treatment products for the residential and commercial water treatment industry.

Pentair also acquired Pelican Water Systems for $120 million in cash. Pelican Water Systems provides whole home residential water treatment systems. We expect Pentair will continue its long history of seeking to acquire growth, and it is certainly off to a good start in 2019.

Competitive Advantages & Recession Performance

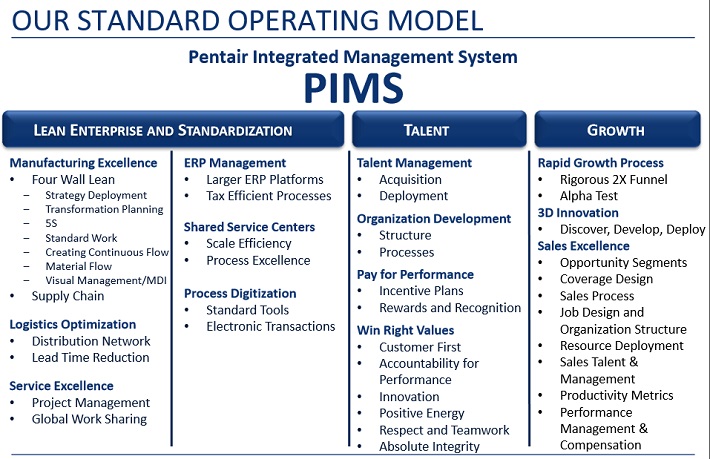

One of the competitive factors that has fueled Pentair’s impressive growth, is its lean cost structure. This is no accident; Pentair has employed a strategy called Pentair Integrated Management System, or PIMS, which has enabled its high profit margins.

PIMS enables leaner manufacturing processes and drives efficiency throughout the company’s supply chain and distribution. Even though the effort is years old at this point, it continues to permeate the company’s strategy today. The impact is a culture and mindset with a relentless focus on cutting costs from its model.

Source: Electrical Products Group Presentation

The PIMS is an organization-wide system. It effects talent management by providing employees with the proper incentives and providing all employees with individual responsibility down to the operator level.

Within the PIMS system, the ‘Lean Enterprise’ system helps to increase profit margins. It drives margin expansion by increasing productivity at manufacturing sites, and helps identify acquisition targets with the highest cost savings opportunities.

Its competitive advantages and high margins allowed the company to remain profitable during the Great Recession of during 2007-2009:

- 2007 earnings-per-share of $2.08

- 2008 earnings-per-share of $2.20 (5.8% increase)

- 2009 earnings-per-share of $1.47 (33% decline)

- 2010 earnings-per-share of $2.00 (36% increase)

As a global industrial manufacturer, Pentair is not immune from recessions. However, it quickly bounced back. Pentair’s earnings-per-share reached a new high in 2011. Given that Pentair is now a pure-play water treatment company, we expect the next recession will have a milder impact on the company’s earnings.

Pentair is now focused on services that can be considered needs and not wants, so we believe the company’s recession resistance has improved in recent years.

Valuation & Expected Returns

Based on expected earnings-per-share of $2.35 for 2019, Pentair has a price-to-earnings ratio of 19.5. In the past 10 years, Pentair stock traded for an average price-to-earnings ratio of 18.2.

Based upon the company’s historical price-to-earnings ratios as well as its projected growth, we’ve assessed fair value at 18 times earnings. That makes the stock somewhat overvalued today despite the strong performance of 2018 and the company’s bright long-term outlook.

Given this, we see the stock as somewhat overvalued, and a reduction in the price-to-earnings ratio could negatively impact shareholder returns by 1.6% annually through 2025. In total, we see annual returns of 6.6% accruing to shareholders of Pentair, consisting of the 1.7% dividend yield, 6.5% earnings-per-share growth, as well as a -1.6% negative return from a declining valuation multiple.

An expected return above 6% is a satisfactory, albeit unspectacular rate of return. This is enough for investors to continue holding the stock, due to its projected earnings growth and very strong history of dividend increases, although the low dividend yield and high valuation are unattractive for new buyers.

Final Thoughts

Pentair has a strong business model, and competitive advantages. This is particularly true in the company’s new, pure-play water model. These qualities have fueled its steady dividend growth over the past four decades and we don’t see any reason to believe that won’t continue for many years to come.

While Pentair isn’t considered tremendously cheap today, it has a decent dividend yield, and it has a promising future outlook. The company should be able to continue increasing its dividend each year. As a result, we rate shares of Pentair a hold right now, but would raise our rating to a buy if the stock valuation experiences a pullback to fair value.