Updated on January 2nd, 2020 by Bob Ciura

Over time, the Dividend Aristocrats have proven to be among the best-performing dividend growth stocks in the entire market. Broadly speaking, the Dividend Aristocrats have leadership positions in their respective industries, with durable competitive advantages that allow them to generate long-term growth.

The Dividend Aristocrats are a group of 57 companies in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can see a full downloadable spreadsheet of all 57 Dividend Aristocrats, along with several important financial metrics such as price-to-earnings ratios, by clicking on the link below:

A select number of Dividend Aristocrats also qualify as Dividend Kings, an even more exclusive group of stocks that have raised their dividends for 50+ consecutive years.

Colgate-Palmolive (CL) is a Dividend Aristocrat, and is also a Dividend King.

Colgate-Palmolive’s long history of dividend increases is due to its strong brands and dominant position across multiple product categories. These time-tested brands have fueled the company’s growth for over 100 years.

Colgate-Palmolive has paid uninterrupted dividends since 1895, and has increased its dividend payments for the past 57 consecutive years.

The one negative aspect of Colgate-Palmolive as a potential investment is its lack of meaningful revenue and earnings growth, as well as its high stock valuation. Colgate-Palmolive stock appears to be significantly overvalued today, which could limit its shareholder returns over the next five years.

Business Overview

Colgate-Palmolive traces its roots all the way back to 1806, making it one of the oldest companies in the US stock market. It was founded by William Colgate, who started a starch, soap, and candle business in New York City.

Today, the company manufactures oral care products like toothpaste, personal care products such as soap, home cleaning products, and pet food.

Source: Investor Presentation

Major brands include Colgate, Palmolive, Hill’s Science Diet, and many more. The core segment is Oral Care, which constitutes nearly half of revenue. Colgate-Palmolive is a global giant. It sells its products in over 200 countries and territories around the world, and the company generates almost $16 billion in annual sales.

Colgate-Palmolive has a highly diversified business model, in terms of products as well as geographic markets. Approximately half of the company’s revenue comes from emerging markets, although its reliance upon these markets for growth has waned a bit recently.

This is due to the success of the company’s pet nutrition business, as it continues to take revenue share from other segments. Emerging markets will be a critical growth catalyst for the company moving forward. Colgate-Palmolive has the #1 position in China, with market share above 30%.

However, the company also faces several challenges, including a strong U.S. dollar, rising costs, and the ongoing trade war between the U.S. and China, which could keep a lid on growth going forward.

Growth Prospects

Colgate-Palmolive enjoys a world class brand portfolio and high profit margins. But as conditions have tightened as of late, Colgate-Palmolive has struggled to generate meaningful growth in recent years.

The company’s recent quarterly earnings have highlighted some of the recent struggles the company has experienced. In the 2019 third quarter, net sales came in at $3.9 billion, an increase of 2% versus the year-ago period.

Global unit volume increased 3% as pricing increased 1.5%, but foreign exchange translation reduced the top line by -2.5%. Organic sales increased 4.5%, which was above consensus, and was attributable to positive volume and higher pricing.

Gross profit margin was 59% of revenue in Q3, which was flat year-over-year. On an adjusted basis, gross margins declined 20 basis points due to higher raw material and packaging costs, which were partially offset from cost savings.

Operating profit declined from $874 million to $856 million as operating margin declined 50 basis points, to 22.9% of revenue. The decline was due to the increase in advertising spending. On an adjusted basis, earnings-per-share came to $0.71, a slight decline against the same quarter last year.

Despite the difficulties posed by volatile exchange rates, Colgate-Palmolive continues to generate positive organic growth, which indicates the core business is performing well.

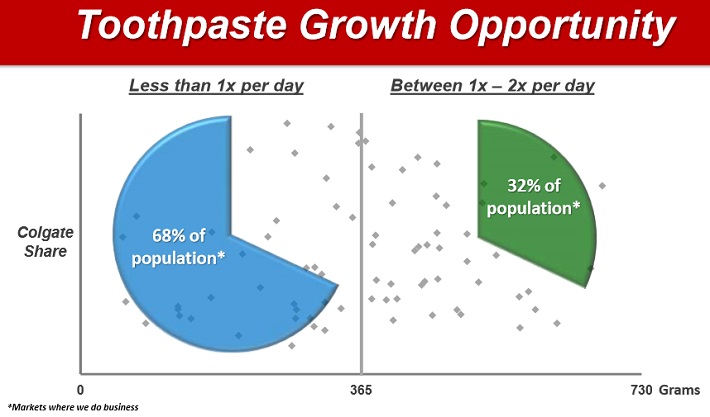

The emerging markets are a long-term growth catalyst for Colgate-Palmolive, as global toothpaste use remains relatively low.

Source: Investor Presentation

Colgate-Palmolive has a high market share in regions of the world where toothbrush use is low. This leaves lots of growth potential for Colgate-Palmolive in the years ahead.

However, profitability has been an issue of late, as adjusted earnings-per-share continues to decline due to higher expenses. Higher pricing as well as productivity savings helped to offset some of this headwind over the past year, as has growth in the international markets.

In the most recent quarter, organic sales increased 6% in the Africa/Eurasia segment, 3% in Asia-Pacific, and 8% in Latin America. These growth rates are indicative of Colgate-Palmolive’s long-term growth potential in the emerging markets, where consumers are using oral hygiene products with greater frequency.

Lastly, the company’s pet food products are a compelling growth catalyst. Pet food is a growth industry in the U.S., and Colgate-Palmolive’s pet segment generated 10% organic sales growth last quarter.

We see Colgate-Palmolive as producing 4% annual earnings-per-share growth on average in the coming years with 2019 coming in weaker than forecast. The company continues to produce low single digit organic revenue gains, but its significant global presence means forex translation continues to be a problem.

Product extensions into premium lines of soap and toothpaste, for instance, should help drive incremental revenue gains in the years to come, and higher pricing should help offset rising costs.

Competitive Advantages & Recession Performance

Colgate-Palmolive has many competitive advantages which have fueled its growth over the past 200 years.

First, it has built a dominant position in its core product categories, most notably in toothpaste.

In toothpaste, Colgate-Palmolive’s market share has risen steadily for many years. Today, it commands a higher market share than the next-three biggest competitors combined.

Source: Investor Presentation

Such high market share allows Colgate-Palmolive to charge higher prices for its premium products, and raise prices over time. Pricing power is a critical competitive advantage for consumer goods stocks.

Another major advantage for Colgate-Palmolive is that products the company sells are necessities of modern life. Consumers need oral, personal, and pet care products irrespective of economic conditions. Colgate-Palmolive enjoys steady demand, which gives the company consistent profitability, even during recessions.

Colgate-Palmolive’s earnings-per-share through the Great Recession are shown below:

- 2007 earnings-per-share of $1.69

- 2008 earnings-per-share of $1.83 (8.3% increase)

- 2009 earnings-per-share of $2.19 (20% increase)

- 2010 earnings-per-share of $2.16 (1.4% decline)

Colgate-Palmolive generated positive earnings growth in 2008 and 2009, during the worst years of the recession. Earnings dipped slightly in 2010, but resumed growing in 2011 and thereafter.

The company’s strong performance from 2007-2010 is a credit to its strong business model and powerful brands. When the next recession strikes, we expect Colgate-Palmolive’s earnings to hold up very well.

Colgate-Palmolive’s dividend is also very safe, which is a topic that we explore in the following video:

Valuation & Expected Returns

With expectations of $2.70 in earnings-per-share for 2019, Colgate-Palmolive stock has a price-to-earnings ratio of 25.3. While the stock has certainly had higher valuations than this in the past, it is still elevated.

Given Colgate-Palmolive’s struggles to generate earnings growth in recent years, it does not seem to justify a premium valuation multiple. Our estimate of fair value is 19 times earnings, and shares are well in excess of that today, meaning they are overvalued.

As a result, there is risk of multiple contraction. Should this contraction come to fruition, it would negatively impact shareholder returns. We see a ~5.6% headwind to total annual returns from the valuation reverting back to fair value over time. This is a significant challenge for the stock moving forward, as it makes it very difficult to generate a compelling total return in such a scenario.

Even with 4% projected earnings growth and the 2.5% current dividend yield, total returns are expected to reach just 0.9% per year through 2025. This makes the company’s prospects unattractive and therefore, we rate the stock a sell.

Colgate-Palmolive’s impressive dividend increase streak certainly counts for something, but the yield isn’t high enough to warrant purchasing the stock since it is trading at a significant premium to fair value today.

Final Thoughts

Colgate-Palmolive is a high-quality business, with several category-leading brands. The company has growth potential, through product innovation, its Hill’s pet food brand, and expected growth in the emerging markets.

Now might not be the best time to buy shares of Colgate-Palmolive, however, as the stock appears to be meaningfully overvalued. The company needs to prove it can generate higher levels of growth in order to justify its premium valuation.

Colgate-Palmolive does not offer a high yield, or high dividend growth. That said, investors can still count on steady dividend increases each year. The overvaluation of the stock, however, warrants a sell rating. We believe there are a number of Dividend Aristocrats that are likely to generate higher returns for shareholders over the next several years.