Published on February 3rd, 2020 by Nate Parsh

The Dividend Aristocrats are a unique group of companies. This group represents some of the largest companies within the S&P 500. These companies must also have at least 25 consecutive years of dividend growth to qualify as a Dividend Aristocrat. Membership is difficult to attain, which is why there are just 64 Dividend Aristocrats.

We believe long-term investors can generate superior returns by investing in high-quality dividend growth stocks, such as the Dividend Aristocrats. To maximize potential returns, investors should focus on buying Dividend Aristocrats when they are undervalued.

You can download an Excel spreadsheet of all 64 Dividend Aristocrats, including important financial metrics such as P/E ratios and dividend yields, by clicking the link below:

Each year we review all of the Dividend Aristocrats individually. Next up is Ross Stores (ROST), one of 7 new additions to the Dividend Aristocrats for 2020. While we find the company’s business model, recession performance and potential growth rate appealing, shares are trading at a significant premium to the historical valuation.

That doesn’t mean investors should completely ignore Ross Stores. The company’s business model and growth prospect make Ross Stores a quality business to buy on a pullback.

Business Overview

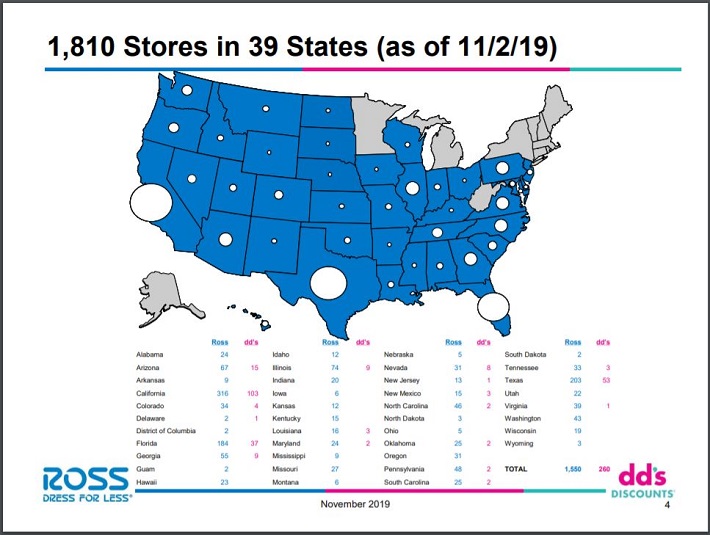

Ross Stores operates 1,550 Ross Dress For Less stores in 39 states and 260 dd’s DISCOUNTS stores in 19 states. The company has a market capitalization of approximately $40 billion.

As the following image shows, the company operates more than 1,800 stores in the United States.

Source: Investor Presentation, slide 4.

Ross Stores specializes in off-price and home fashion apparel. The company offers name brand department and specialty store merchandise at a discount of 20% to 70% off of regular store prices.

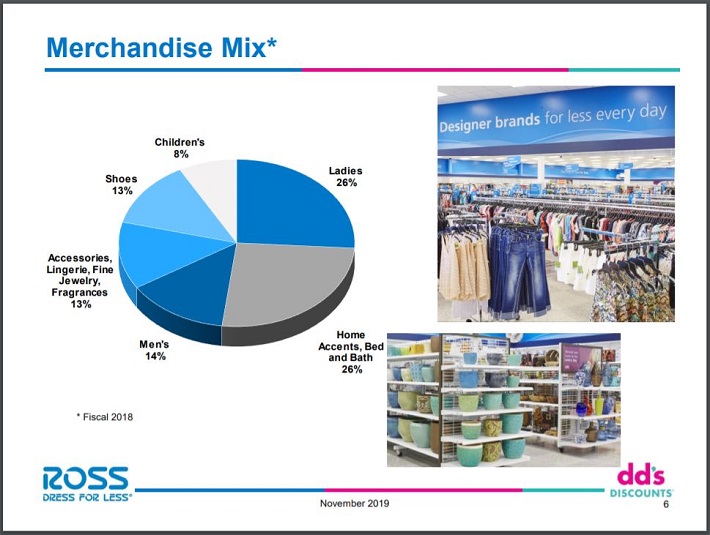

The company’s merchandise mix isn’t overly reliant on any one category either.

Source: Investor Presentation, slide 6.

Ladies and Home Accents, Bed and Bath merchandise each account for slightly more than a quarter of total revenue in the most recent year. Every other category contributed 14% or less of total revenue. Maintaining a diverse merchandise mix allows Ross Stores to appeal to a wide variety of potential customers.

This business model has been so successful that Ross Stores has more than 10 years of revenue and earnings-per-share growth.

Ross Stores reported earnings results for the third quarter of 2019 on 11/21/2019. Revenue improved 8.4% to $3.85 billion, topping estimates by $76 million. Earnings-per-share for the quarter increased 12% to $1.03. This was $0.05 higher than analysts had expected.

Growth Prospects

Retail is in the midst of seismic industry change. The rise of online giant Amazon (AMZN) and other e-commerce retailers has become a significant headwind to how traditional brick and mortar big box retailers do business. For a very long time, many retailers opened large standalone locations in hopes of offering consumers everything they could possibly need to shop for.

The need for these large stores has diminished as more consumers stay home to shop and instead choose to hunt for specific items. Many companies in this sector have struggled to adapt to this changing landscape and thousands of large, standalone retail locations have closed over the past few years.

On the other hand, Ross Stores believes it can operate nearly 3,000 total stores, including 2,400 Ross Dress For Less locations, in the United States. Ross Stores grew comparable sales (which measures sales at stores open at least one year) by 5% in the most recent quarter. It also continues to open new stores, including over 40 new store openings through the 2019 through quarter.

While Ross Stores has a significant presence in large states like California, Florida and Texas, the company has a limited number of locations in the Midwest. For example, there are just 44 total Ross Dress For Less Locations in Indiana, Ohio and Wisconsin combined.

This leaves almost an entire geographic area available for Ross Stores to establish its brand. And with a presence in just 39 states, there remain a sizable portion of the country that Ross Stores has not entered yet.

Another reason that the company can be so aggressive in opening so many stores is that locations tend to be much smaller than larger retailers. Most Ross Stores locations range in size from 22,000 to 30,000 square feet. Compare this to the average store size of other retailers:

- Target (TGT) – 130,000 square feet

- J.C. Penny (JCP) – 111,000 square feet

- Walmart (WMT) – 105,000 square feet

- Kohl’s (KSS) – 80,000 square feet

The average Ross Stores location is considerably smaller than other retailers, which helps it control costs and keep prices low. These locations are also usually connected to other retailers unlike many of the larger retailers. Most locations are near high traffic intersections, making stores visible to as many potential customers as possible. Ross Stores also has locations in markets of varying income levels as consumers like finding bargains regardless of pay scale.

Recent results continue to show that the focus on smaller stores pays off. Locations that have been open at least a year had same-store sales growth of 5% for the third quarter, which was much better than expected growth of 3%. This was on top of a 3% improvement in same-store sales for the third quarter of 2018.

Very few retailers have produced a stacked same-store sales growth rate of 8%. For the first nine months of the year, total sales were up 7% with 3% same-store-sales growth. Due to growing business, we expect Ross Stores to grow earnings-per-share at a rate of 10% annually through 2025.

Competitive Advantages & Recession Performance

Ross Stores has been so successful because it has been able to offer customers popular brands at a steep discount to regular prices. Consumers remain focused on name brand merchandise, but don’t necessarily want to pay name brand prices.

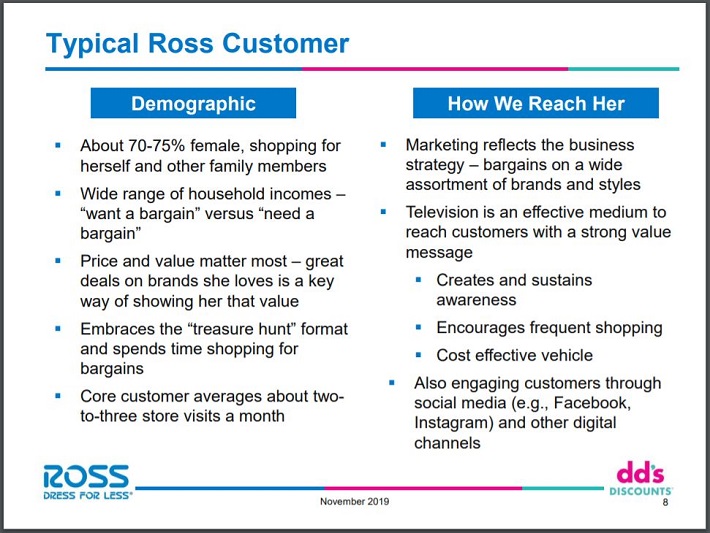

This has helped Ross Stores create a stable of loyal customers, particularly female customers, who are not just buying for themselves, but often also for their families.

Source: Investor Presentation, slide 8.

In addition, Ross Stores has invested in the company’s dd’s DISCOUNTS locations. The first dd’s DISCOUTNS opened in 2004 and has grown to 260 stores today, with almost three-quarters of all stores located in California, Florida and Texas.

This small store format is targeted at younger, more ethnically diverse audience. Customers tend to be from lower-to-moderate income households and these locations tend to have lower prices than the company’s Ross Dress For Less stores.

The company’s competitive advantages have allowed it to thrive even in the midst of a recession. Listed below are earnings-per-share results before, during and after the last recession.

- 2006 earnings-per-share of $0.43

- 2007 earnings-per-share of $0.48 (12% increase)

- 2008 earnings-per-share of $0.58 (21% increase)

- 2009 earnings-per-share of $0.89 (53% increase)

- 2010 earnings-per-share of $1.16 (30% increase)

At a time when most other companies, specifically retailers, were under severe pressure, Ross Stores had double-digit earnings growth during the Great Recession. In fact,the last time earnings-per-share for the year declined from the prior year was 2004.

While the share count has declined for more than 15 years, net income continues to grow. This means that Ross Stores’ growth in earnings has come primarily from its business improvements and not from financial engineering. This is a testament to Ross Stores able to weather any storm, either from adverse economic conditions or from a disruption like online shopping.

Valuation & Expected Returns

Shares of Ross Stores currently trade at $112. The company expects earnings-per-share of $4.56 for 2019, giving shares a price-to-earnings ratio of 24.6. The stock’s 10-year average price-to-earning ratio is 17.1. This is our fair value estimate for the stock, and seems reasonable for a retailer in our view.

If shares were to revert to this target multiple by 2025, then valuation would reduce annual returns by 7% over this period of time.

Dividends will also play a role in total returns. Ross Stores increased its dividend by 13.3% for the 3/5/2019 payment. For comparison, Ross Stores compounded its dividend by 20% annually from 2008 through 2018.

Double-digit dividend growth is strong. Despite this, shares yield just 0.9% today, which is approximately half of the average yield of the S&P 500.

Total returns for Ross Stores are expected to consist of the following:

- 10% earnings growth

- 7% multiple reversion

- 0.9% dividend yield

In total, shares of Ross Stores are expected to return 3.9% annually over the next five years. This is not a high enough expected rate of return to warrant a buy recommendation at this time. Despite the company’s strong growth, we believe this growth is more than priced in to the stock valuation right now.

Final Thoughts

Reaching a quarter-century of dividend growth is no small task. Only 64 companies out of the entire S&P 500 Index can call themselves a Dividend Aristocrat. Joining this exclusive club takes a strong business that can overcome headwinds and attract customers of a wide variety.

Ross Stores has been able to do just that for a very long time. The company’s revenue and earnings growth has been remarkable even as traditional retail faces an uncertain future.

Unfortunately for investors looking to invest in the name, shares of Ross Stores have become quite expensive in relation to its historical valuation. While we find the company’s business model, recession performance and track record for dividend growth extremely appealing, the valuation is a concern. Therefore, Ross Stores earns a hold from Sure Dividend at the current valuation level.