Published on October 6th, 2020 by Aristofanis Papadatos

The Dividend Kings consist of companies that have raised their dividends for at least 50 years in a row. Many of the companies have turned into huge multinational corporations over the decades, but not all of them. You can see the full list of all 30 Dividend Kings here.

We created a full list of all Dividend Kings, along with important financial metrics like price-to-earnings ratios and dividend yields. You can download your copy of the Dividend Kings list by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Emerson Electric (EMR) has raised its dividend for 63 consecutive years and thus it has one of the longest dividend growth streaks in the investing universe. There are only four companies that have longer dividend growth streaks than Emerson.

The company has achieved such an exceptional dividend growth record thanks to its strong business model, its decent resilience to downturns and its somewhat conservative payout ratio. These factors provide a margin of safety during recessions. In addition, its 3.0% dividend yield is nearly twice as much as the broad market’s yield (1.6%), and there is a lot of room for more dividend raises down the road.

Business Overview

Emerson Electric was founded in Missouri in 1890. Since then, it has evolved from a regional manufacturer of electric motors and fans into a technology and engineering company, which provides solutions to industrial, commercial and individual customers.

It is a global leader, with presence in more than 150 countries, and operates in two segments: Automation Solutions and Commercial & Residential Solutions. The Automation Solutions segment, which generates 67% of the total revenue, offers industrial equipment and software to the oil and gas industry, refining, power generation as well as other industries. The Commercial & Residential Solutions segment, which generates the remaining 33% of the total revenue, offers residential and commercial heating and air conditioning products.

Emerson generates the majority of its revenue from the oil and gas industry. As this industry is infamous for the dramatic swings of commodity prices, Emerson is highly sensitive to the cycles of the oil and gas industry. This helps explain the 34% decrease in Emerson’s earnings per share from 2014-2016, which coincided with the fierce downturn in the energy sector caused by the collapse of the oil and gas prices during that period.

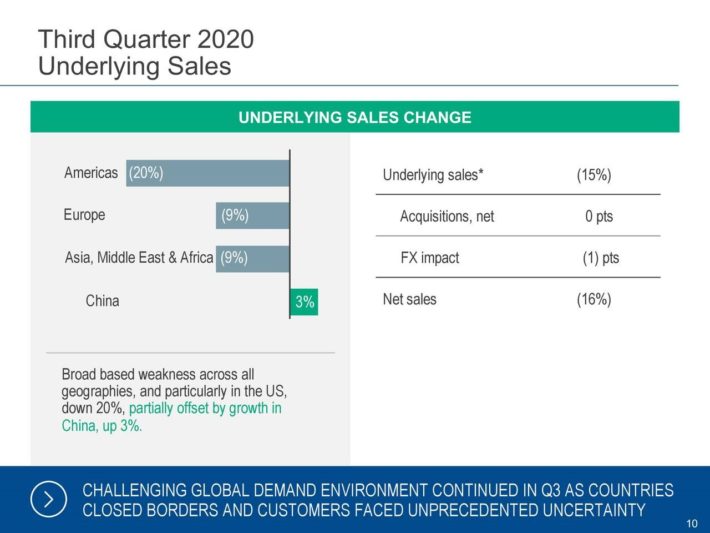

Emerson is currently facing another downturn, due to the coronavirus crisis. The pandemic caused a collapse in global demand for oil products this year, which in turn caused a major downturn in the energy sector. Emerson has been significantly affected by this downturn. In its fiscal third quarter, the company posted a 15% decrease in its underlying sales due to a 13% decrease in sales in Automation Solutions and a 19% decline in sales in Commercial & Residential Solutions.

Emerson incurred the steepest decrease in its revenue in the Americas, where it posted a 20% decline. The only bright spot was China, which is ahead of the other regions in the recovery from the pandemic, and thus helped Emerson post 3% sales growth in the region.

Source: Investor Presentation

Adjusted earnings per share fell 18%, from $0.97 to $0.80, but exceeded the analysts’ consensus of $0.59 by a wide margin thanks to the aggressive cost-cutting measures implemented by management in response to the pandemic.

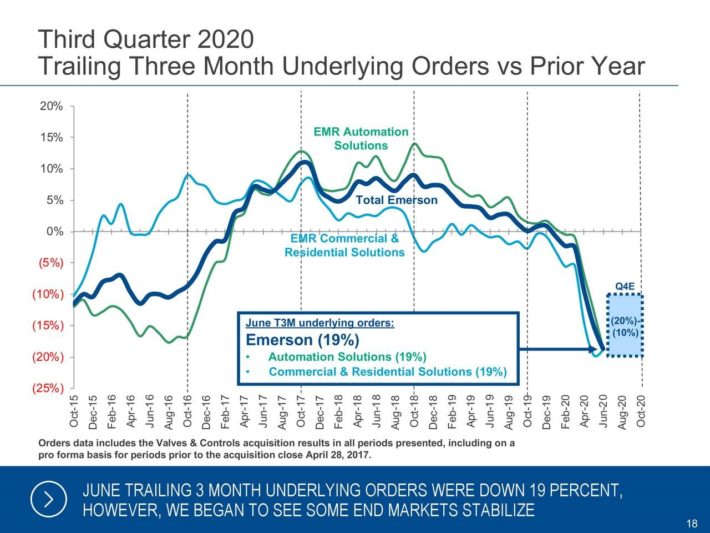

Moreover, management has observed improving trends in the business lately and thus it is confident that the bottom is already behind the company.

Source: Investor Presentation

As shown above, Emerson expects a 10%-20% decrease in sales in the fourth fiscal quarter and raised its guidance for its adjusted earnings per share for the full year from $3.00-$3.20 to $3.20-$3.35. If the company meets its guidance, it will incur just an 11% decrease in its earnings per share this year.

Such a performance would be outstanding, given the unprecedented recession caused by the pandemic and the company’s dependence on industrial customers, who have greatly suffered from the pandemic.

Growth Prospects

Emerson has pursued growth by expanding its customer base but also by acquiring many companies. It recently completed the acquisition of Progea Group, a provider of industrial Internet of Things, plant analytics and other applications, which will help Emerson offer its industrial customers an integrated package of plant control.

Emerson also recently acquired Open Systems International for $1.6 billion. This acquisition will enable Emerson to offer technology software to customers in the global power industry and thus it will essentially double the total accessible global power market of the company, to $5.4 billion.

Source: Investor Presentation

Going forward, acquisitions are likely to remain a major growth driver for Emerson, as the company aims to incorporate new products in its portfolio and thus offer improved, integrated solutions to its customers.

On the other hand, it is critical to note that Emerson has essentially failed to grow its earnings per share since 2011. This is a stern reminder of the strong dependence of Emerson on the oil and gas industry, which is highly cyclical. This exposure can bring extraordinary returns during booming years but it can also erase many years of growth during a severe downturn.

Nevertheless, thanks to its recent acquisitions and the low comparison base formed this year due to the pandemic, we expect Emerson to grow its earnings per share at a 5.0% average annual rate over the next five years. This growth will be comprised partly of revenue growth but also share repurchases after the pandemic ends.

Competitive Advantages & Recession Performance

As Emerson has served its customers for several decades, it has built great expertise in the markets it serves. In addition, thanks to its large scale and its dominant global presence, it has great reputation. This provides the company with a significant competitive advantage.

On the other hand, due to its reliance on industrial and commercial customers, Emerson is vulnerable to recessions and downturns in the energy sector. In the Great Recession, its earnings per share were as follows:

- 2007 earnings-per-share of $2.66

- 2008 earnings-per-share of $3.11 (17% increase)

- 2009 earnings-per-share of $2.27 (27% decline)

- 2010 earnings-per-share of $2.60 (15% increase)

- 2011 earnings-per-share of $3.24 (25% increase)

Emerson got through the Great Recession with just one year of decline in its earnings per share. That performance was certainly impressive.

Emerson was more heavily affected in the downturn of the energy sector, which was caused by the collapse of the price of oil from $100 in mid-2014 to $26 in early 2016. Its earnings per share decreased 34%, from $3.75 in 2014 to $2.46 in 2016, and have not recovered to the level of 2014 yet.

Given its sensitivity to the economic cycles, it is impressive that Emerson has grown its dividend for 63 consecutive years. The exceptional dividend record can be attributed to the aforementioned decent resilience of the company during downturns. Another reason is the conservative target payout ratio of about 60%, which provides a material margin of safety to the dividend during downturns.

Moreover, management has become remarkably conservative in its dividend hikes in recent years. Emerson has raised its dividend by only 1.2% per year on average over the last five years. Overall, the stock may be suitable for some income-oriented investors thanks to its 3.0% dividend yield and its exceptional dividend growth record but investors should not expect high dividend growth going forward.

Valuation & Expected Returns

Emerson is currently trading at 20.5 times its expected earnings of $3.30 per share this year. This earnings multiple is higher than the average price-to-earnings ratio of 18.6 of the stock over the last decade. Due to the cyclical nature of Emerson’s businesses, we believe that a fair earnings multiple for the stock is around 18.0.

If the stock reverts to our assumed fair valuation level over the next five years, it will incur a 2.6% annualized drag in its returns. Given 5% expected annual earnings-per-share growth, the 3.0% dividend and a 2.6% annualized contraction of the price-to-earnings ratio, we expect Emerson to offer a 5.0% average annual return over the next five years.

Final Thoughts

Emerson has an impressive dividend growth record, particularly given its heavy reliance on industrial and commercial customers, who struggle during recessions or downturn in the energy sector. The decent dividend yield of the stock and its reliable dividend growth render the stock suitable for some income-oriented investors.

However, it is critical to note that the stock has retrieved all its pandemic-driven losses and thus it is standing at a rich valuation level right now. Moreover, its high cyclicality can result in dismal long-term returns if the stock is purchased at a rich valuation level.

For instance, the stock has remained flat over the last seven years, whereas the S&P 500 has essentially doubled over the same period. Therefore, investors should pay special attention on the valuation of the stock before purchasing it. Otherwise, they could experience poor long-term returns.

To conclude, Emerson seems richly valued right now and as a result, investors should wait for a meaningful correction of the stock before purchasing.