This is a guest contribution by Stratosphere.io

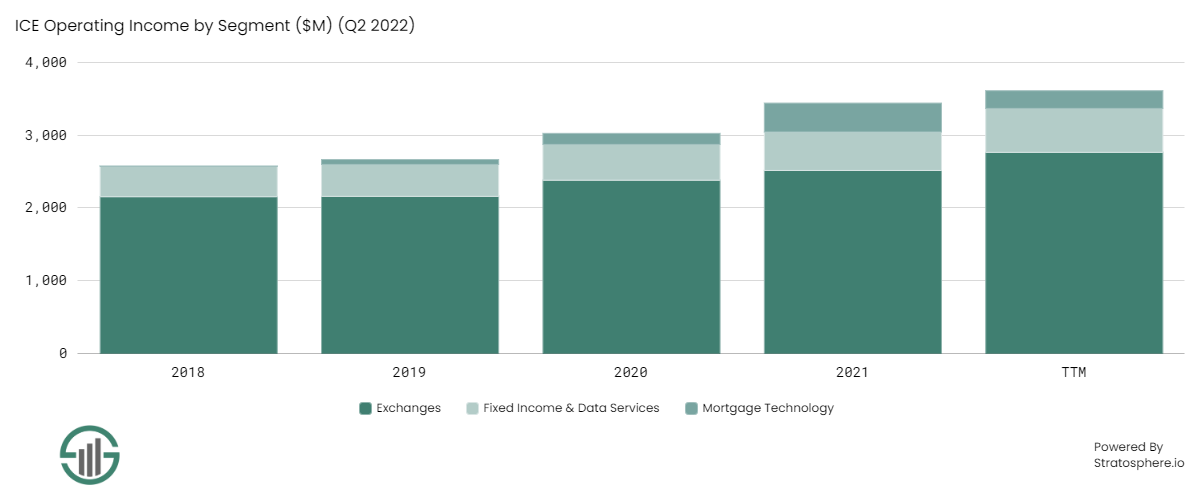

Intercontinental Exchange (ICE) serves the financial markets as a market infrastructure, data services, and technology solutions provider. The company operates three main segments or product groups:

- Exchanges

- Fixed Income & Data Services

- Mortgage Technology

Exchanges are ICE’s regulated marketplaces where listing, trading, and clearing of derivative contracts, financial securities (including commodities, interest rates, foreign exchange, and stocks), and ETFs can occur. ICE operates 13 of these regulated exchanges (including the New York Stock Exchange) and 6 clearing houses around the world.

The Fixed Income & Data Services segment includes digitized tools for fixed income asset execution and clearing, as well as data and analytics. The Mortgage Technology Segment focuses on digitizing the mostly analog mortgage origination and closing processes in the US. The segment also provides data and analytics.

Investment Thesis

- ICE possesses some of the most powerful network effects of any business in the world. Its financial products / contracts and exchanges grow stronger as more volume pours into these areas. This is so because all parties involved (buyers, sellers, and market makers) benefit from liquidity, price transparency, and execution speed.

- ICE is well-known for owning the largest stock exchange in the world — the New York Stock Exchange. However, ICE largely creates value by extracting and selling data from assets like the NYSE and its many other financial products. In many respects, ICE is a technology company with a focus on data.

- ICE also does not derive much of its growth from the well-known equities and options trading on the NYSE. However, the company has been able to exercise great pricing power in its other financial and exchange products, especially energy contracts and its fixed income, equities, and mortgage data and analytics solutions. These should remain growth drivers going forward.

- ICE’s largest risk revolves around regulation. While a recent SEC ruling regarding private vs. public data transparency was dismissed by the US appeals court, regulation will likely remain a headwind. ICE’s sale of private / proprietary exchange and fixed income data could disproportionately benefit its paying customers, affecting smaller investors. We believe regulators will be watching ICE’s actions closely, and this may discourage the company from exercising its pricing power to its full potential.

- The company takes a contrarian, “blue ocean” approach to M&A and innovation. The company is currently focused on modernizing the US residential mortgage industry from end to end. It did so by acquiring several large companies and aggressively integrating them. ICE’s future growth opportunities are thus mostly unpredictable, but potentially highly rewarding.

Key Company Metrics

A set of metrics constantly kept up-to-date on Stratosphere.io for ICE:

Competitive Advantages

The King of Network Effects

ICE spurs and benefits from powerful network effects. In our opinion, ICE’s exchanges and clearinghouses (and the data / analytics that flow from them) hold one of the strongest examples of the “network effect” in the world.

Exchanges allow buyers and sellers to “exchange” goods and services (financial assets in this case). Clearinghouses are also involved in these “buy” and “sell” transactions, albeit after the transactions have been executed.

Clearinghouses work to make sure transactions on an exchange settle and clear in the way the buyer and the seller of each transaction achieved the outcome they were looking for. In other words, a clearinghouse will ensure the seller can transfer over the purchased assets and the buyer can receive the funds implied by the sale.

The role of exchanges and the clearinghouses that essentially power them are important to stock markets, and arguably more important for derivatives markets, like futures, where leverage is commonly used. Clearinghouses work to ensure these markets are stable and all transactions are settled fully at the end of each trading day.

Exchanges and the underlying clearinghouses benefit from having more transactors on them. An exchange is only as “good” as the speed, efficiency, accuracy, and level of liquidity with which traders, investors, and institutions can operate at. Each of these affect the degree of bid-ask spreads, speed of execution, and the overall level of liquidity (gross dollar amount).

Therefore, smaller exchanges are effectively crowded out eventually. Generally speaking, investing, trading, market making, capital raising, and financial risk management all benefit from high levels of liquidity, speed of execution, and thin bid-ask spreads. Market makers make more money on high-volume exchanges while investors and traders benefit from narrow bid-ask spreads where the best prices and execution of trades can be achieved.

So, these parties will naturally gravitate to large exchanges over time, similar to how the most powerful social media networks tend to be the ones that have the most users. More users = even more users over time.

The ICE-owned NYSE is the largest stock market exchange in the world, having over $25 trillion in listings (the second largest is the NASDAQ exchange at around $17 trillion). Today, the NYSE has 70% of the S&P 500 and 77% of the Dow Jones listings on its exchange. In 2021, 3 of the 4 largest IPOs were listed on the NYSE, attesting to the attractiveness of large and liquid exchanges.

However, the NYSE is only one piece of the ICE puzzle. Before the NYSE acquisition in 2013, ICE primarily focused on eliminating the inefficiencies in energy and other derivatives markets.

The company owns and operates highly liquid contracts and derivatives, such as WTI and Brent crude oil, 60 foreign exchange contracts, several agricultural futures (i.e., coffee, cocoa, cotton, sugar, UK feed wheat, canola, and frozen concentrated orange juice), among many more for businesses and other institutions to manage financial risk and set prices.

The popularity of these ICE products has grown so high that now, for instance, 80% of global crude oil of various grades is traded with Brent crude oil contracts as the price reference for those grades.

The vast amount of various parties using the NYSE exchange and other ICE products improve the collective experience trading ICE or ICE-hosted products on its exchanges, which benefits the company through transaction and listing fees.

These powerful network effects are combined with strong economies of scale and low capital requirements on the part of ICE. On top of these barriers, exchanges and clearinghouses are highly regulated, making it highly unlikely that emerging or new exchanges could uproot such a large conglomerate of exchanges and clearinghouses like ICE.

World-Class Integrator

In one interview of Jeff Sprecher, the Founder & CEO of ICE, he had mentioned that his approach to M&A is as follows: ICE either pays up for fast-growing companies in secular trend markets that help its customers solve a problem that legacy companies did not tackle, or it acquires out-of-favour, mature businesses that could be turned around and do significantly better under the ICE umbrella.

Each of ICE’s three main segments today have been defined by ground-breaking M&A transactions completed over the past decade.

Exchanges has the NYSE, which had been purchased for $11 billion in 2013. The previous subsection includes all the benefits from this acquisition.

Fixed Income & Data Analytics was defined by the acquisitions of IDC — a leading provider at the time for fixed income pricing, data, and analytics — and BofAML’s Index business — the second largest fixed income platform in the world. These two acquisitions bolstered ICE’s fixed income offerings, expanding the number of products and the data & analytics capabilities. With these acquisitions, ICE continues to electronify the fixed income workflow and aid in the adoption of passive fixed income funds around the world. Today, the segment produces price evaluations on around 3 million fixed income securities with reference data on over 33 million securities. The scale is massive.

Lastly, ICE has been focused on improving the US residential mortgage workflow, which is still highly inefficient and prone to fostering errors at many points in the full workflow today. ICE acquired MERSCorp (leading database of US mortgages), then Simplifile to add to the digital network it has been building, then Ellie Mae to get its hands on a mortgage origination network. With these three acquisitions, ICE can now fully focus on digitizing the entire mortgage workflow.

Integrating these purchased and internally generated assets resulted in scaling & cost advantages for ICE and its consumers, however, the bulk of the value from these acts over the years has largely been the extraction of data and analytics.

For its fixed income customers, ICE is able to provide powerful reference data, pricing & valuation, and trading and portfolio analytics. These capabilities not only provide recurring revenue to ICE, but its customers benefit from being better able to understand the products in their portfolios and improving their workflows. This likely would not have been possible had ICE not digitized fixed income trading execution and CDS clearing.

On the mortgage front, ICE offers origination and closing technologies for US residential mortgages. Without these offerings, ICE would likely not have developed the data and analytics capabilities that it now offers to originators and other stakeholders in the US residential mortgage market.

For example, ICE provides real-time trends of almost 50% of the US residential mortgage market and a Data-as-a-Service (“DaaS”) offering for lenders to analyze their own data and origination information. With these offerings, customers benefit from cost and time savings on the front-end (originating and closing mortgages) while also obtaining feedback from the very network they use to help make better decisions.

ICE is a world-class integrator of various niche financial services providers. Perhaps ICE’s greatest advantage is using the swaths of data that flow through its exchanges and networks to help consumers make better financial decisions and manage risk. This improves ICE’s customers’ feedback loop. By doing this, ICE keeps its customers close both in terms of transactions and its data & analytics offerings.

ICE’s efforts on this front have paid off tremendously well. While the recurring revenue base of the company was merely 9% in 2011, recurring revenues now make up about 50% of ICE’s revenues as of 2021.

Pricing Power

ICE holds strong pricing power in some domains, while in others it is at the mercy of strong competition and regulatory pressure. The trading of cash equities and equity options on the NYSE — which ICE is widely known for — is the area which suffers from the latter.

The NYSE division of ICE’s Exchanges segment competes primarily against the NASDAQ exchange, as well as plenty of others in the US, Canada, and the rest of the world. Additionally, while the NYSE benefits from the immense amount of liquidity that flows through its exchange, there is nothing stopping listed companies from listing on other exchanges to gain access to more liquidity. While the exchanges industry has been largely consolidated, the competition from the remaining players remains fierce. The result is declining pricing, which ICE has experienced with its cash equities and equity options trading capabilities.

While the transaction-based revenues from NYSE trading are not a major growth driver for ICE, the data and analytics that are derived from the exchange are. To meet regulatory and compliance requirements, exchange customers must supply their clients and applicable regulators with accurate data related to assets and their pricing. There is little room for error, so the NYSE- and ICE-derived data for equities / options and fixed income securities, respectively, is typically the first place customers look to obtain the best data.

It goes without saying that these data and analytics solutions are a steady organic growth driver for ICE in the form of high retention, consistent new business, and of course, pricing power (via increases).

Opportunities Ahead

- ICE’s largest growth driver today is its efforts in the digitization of the US residential mortgage market. Management of ICE sees a $10 billion total addressable market in this space according to ICE’s 2022 Investor Overview presentation. As of 2021, ICE Mortgage Technology has captured around $1.4 billion of these yearly revenues. Over the next decade, ICE believes it can achieve 8-10% annual growth rates in this segment, carving out a significant chunk of the market. This would be a significant contributor to ICE’s growth profile, which would help offset the stale growth stemming from equities and options trading. Although the NYSE is an incredible asset, it has been a drag on the financial performance of the business, largely due to the secular decline in listed companies for the past few decades, competitive and regulatory pressure on equities / options pricing, and the variability in volumes from year to year.

- Energy trading has contributed significantly to ICE’s Exchanges revenue growth and should continue to do throughout the forthcoming decade and beyond.The three main reasons for this are the growing complexity around the world’s energy transition, globalization of natural gas, and the requirement for carbon price transparency in energy markets. Collectively, these are driving the demand for trading, hedging, and risk management in / with / of energy contracts. The products that are affected by the three factors above have grown at a 23% annual average return between 2016 and 2021.

- The financial services and data & analytics offerings within the industry are highly fragmented and ripe for consolidation.This has several advantages for a company as strong as ICE on the M&A and innovation fronts. ICE tends to improve businesses once integrated within it, often bolting them onto other offerings within the ICE umbrella to create synergized products. This generally results in cost and efficiency advantages for customers, which helps with regulatory approvals of these transactions. As such, we think ICE will continue to exercise optionality with its data & analytics offerings, continuing the diversification away from transaction-based revenues (primarily in Exchanges). With any extra cash, ICE will return cash to shareholders via dividends and share repurchases. Despite growth in Exchanges being fairly low, the segment operates at high operating margins (~40% as a percentage of revenue before rebates compared to margins between 25-30% in the other two segments). The segment will serve as a reliable cash cow for the company to exercise optionality and reinvest into fixed income and mortgage data & analytics, and whatever comes beyond that.

Valuation & Expected Returns

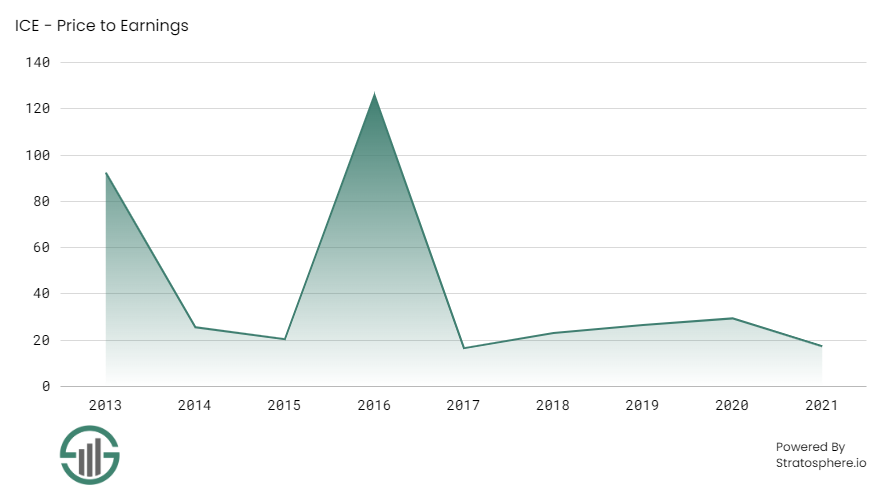

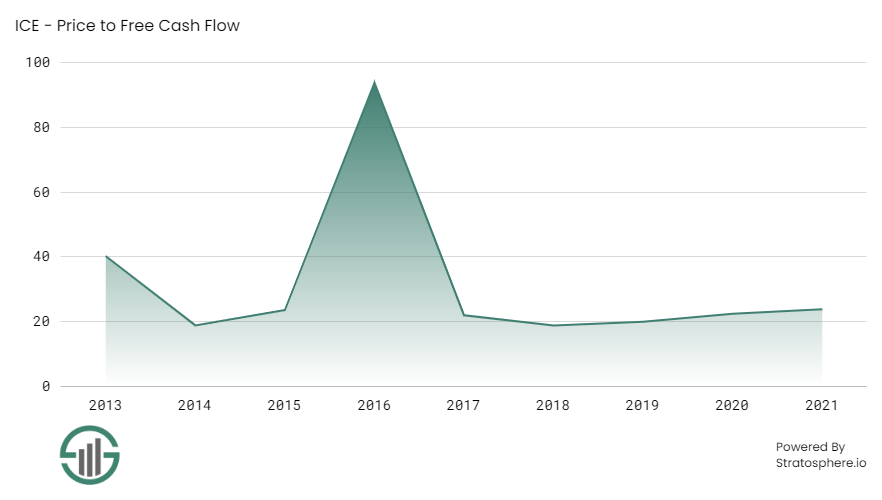

ICE’s current price-to-earnings (“P/E”) ratio based on the consensus expected 2022 EPS figure ($5.36 / share) is roughly 19.5. This P/E ratio is roughly in line with the valuation ICE traded at since 2017. The company trades similarly on a price-to-free-cash-flow basis. We believe this valuation is aligned with a high-quality company such as ICE, which not only considers the growth avenues of the business, but also the cyclicality / seasonality associated with its transaction-based businesses. These businesses still make up about half of the company’s total revenues. The valuation charts below can be found on ICE’s Financial Summary tab on Stratosphere.io:

As ICE’s revenue mix shifts towards a greater amount of recurring revenue sources stemming from its data and analytics offerings, we believe there is a case for the forward P/E multiple to increase modestly to 22.5 over the next five years. Over this five-year period, the modest multiple expansion alone could yield shareholders annual returns of 3.0%. Should the company exercise even greater optionality than is expected now with the data and analytics offerings in its three segments, the P/E ratio could expand even further. On the other hand, if ICE cannot expand its recurring revenue base as quickly or smoothly as expected, it is possible that the P/E multiple contracts modestly to 17.5.

In any case, ICE is a high-quality company that should be able to grow organically at a high single-digit rate. We believe the company can continue to grow revenues at 6% per year over the next five years; in this case we assume margins do not contract or expand as the company faces counteracting forces between scaled economies benefiting margins while continued investments in innovation and acquisitions pressure margins and offset the benefits.

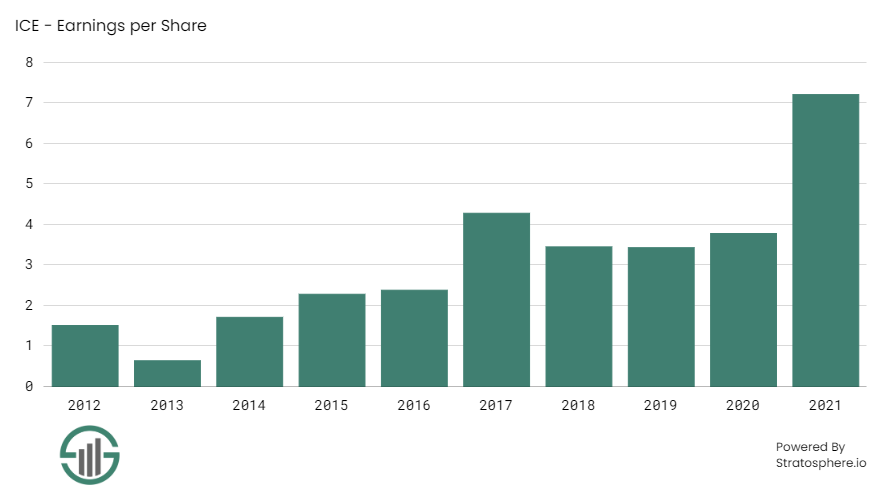

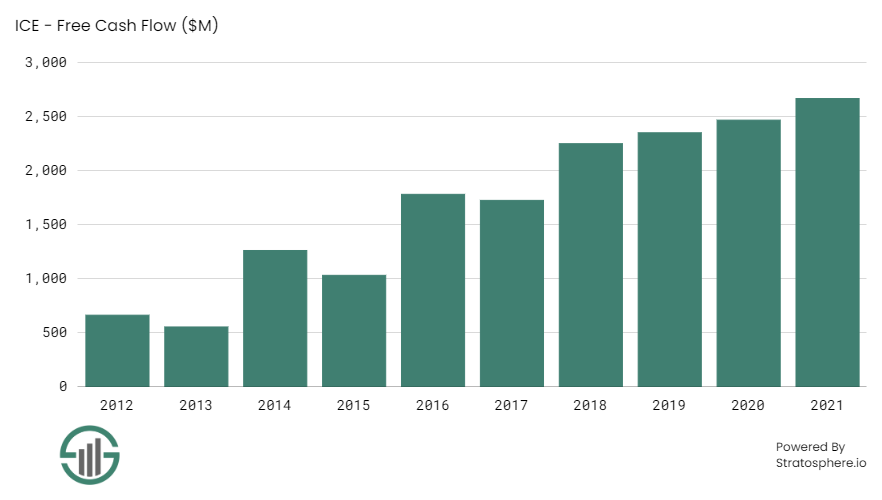

Based on the dividend coverage ratio with either free cash flow or net earnings as the denominator, ICE’s dividends are adequately covered by cash flows and earnings. The dividend payout ratio using free cash flow did not exceed 32.0% since 2013 and the dividend payout ratio using net earnings did not exceed 32.1% since 2013. The EPS and free cash flow charts below can be also found on ICE’s Financial Summary tab on Stratosphere.io:

Between 2013 and 2021, the dividend per share increased from $0.13 to $1.32 at a CAGR of 33.6%. Between 2017 and 2021, the dividend per share increased from $0.80 to $1.32, a CAGR of 13.3%. Going forward, we believe the dividend per share will increase roughly in line with the growth in EPS. Therefore, we think EPS and dividends should increase at a rate of ~6% annually through 2027.

Based on all the factors above and a current dividend yield of almost 1.5%, it appears ICE is poised to deliver compounded annual average returns of 10.5% over the next five years.

Risks

Transaction-Based Revenues

While ICE’s recurring revenue base has substantially increased over the last 10 years, today there is still a 50/50 split between recurring and transactional revenues.

The failure to continue exercising optionality with data and analytics in the financial services space or the inability to successfully integrate and / or locate meaningful targets could impede ICE’s ability to continue expanding its offerings in this space.

Additionally, regulation is likely the most severe risk to ICE’s ambitions in the data and analytics space today.

In late 2020, the SEC approved new rules that took aim at the exchanges. The exchanges sell proprietary data to exchange customers that is much faster and more reliable than the public data available. The concern from regulators is this fosters a two-tier market as important information is withheld from the public.

The US appeals court initially allowed the SEC to proceed with its ambitions to change the way exchange data is made available to customers and the public.

However, in July 2022, the appeals court dismissed the order after it deemed a clause that acted against the Securities Exchange Act.

While this order was dismissed, we believe this risk to exchanges will always remain, and may resurface. This may also put a damper on ICE’s ability to exercise pricing power in a way that would once again attract the eyes of regulators.

Aggressive M&A Approach

ICE relies on aggressive M&A practices to fuel its growth. In the past, ICE has been known to cut costs aggressively with newly integrated target companies as well as pay large sums for these companies with the expectation that the eventual synergies will significantly outweigh any risk on the purchase price.

For example, after the acquisition of the NYSE, ICE saw an opportunity to slash a majority of the expenses that the NYSE had. While this acquisition has worked out well, it is possible that with future acquisitions, important human resources are cut that affect operations, too many expenses are cut that could affect growth, and / or the synergies that were first identified take longer to be or may never be realized.

The mitigating factor here is that Jeff Sprecher has used acquisitions to lay the foundation of ICE and also to expand on its offerings. This aggressive approach has worked to date through a number of acquisitions, both big and small, which have been largely accretive to the overall strategic and financial direction of the company.

The track record of the company bodes well, which outweighs some execution risk given that the company has been conducting these sorts of acquisitions for a long time. However, we must caution that every new deal is different, and there may be longer term risks associated with the eventual successor of Jeff Sprecher.

Other Dividend Lists

The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 45 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- The Complete List of Russell 2000 Stocks: arguably the world’s best-known benchmark for small-cap U.S. stocks.

- The Best DRIP Stocks: The top 15 Dividend Aristocrats with no-fee dividend reinvestment plans.

- The 2022 High ROIC Stocks List: The top 10 stocks with high returns on invested capital.

- The 2022 High Beta Stocks List: The 100 stocks in the S&P 500 Index with the highest beta.

- The 2022 Low Beta Stocks List: The 100 stocks in the S&P 500 Index with the lowest beta.