Does it Really Matter?

As of this writing, the US government has run out of funding and has shut down. To which we say, “so what? It doesn’t matter much to the markets, anyway”. Barclays shows (chart below) that there have been only three significant government shutdowns since 1976.

And these significant shutdowns had little impact, either on the GDP, or on the S&P 500 (charts below from Bloomberg).

Of course, the market might take this as an opportunity to engage in a much-needed self-correction. It could be the excuse the markets have been waiting for. So perhaps, it does matter.

Equities

Sentiment

The AAII investor bullish sentiment climbed back above the 50% mark to finish at 54.1%, and the bearish sentiment dropped -3.7% to finish at 21.41%. Bullish sentiment readings above 50%, and bearish readings less than 30% have historically increased the probability of at least local tops (chart below).

{This section is for paid subscribers only}

The NAAIM index 50 MA continues to roll-over while the SPX charges higher. Like the AAII counter-trend pattern, this negative correlation is also similar to what preceded the 2015 double-dip correction (red arrows below). The fact that the market has refused to correct a healthy 3–5%, could mean that in the near future the correlation will revert to the mean with a more substantial 10–15% correction in the S&P 500, like it did in 2015 (chart below).

{This section is for paid subscribers only}

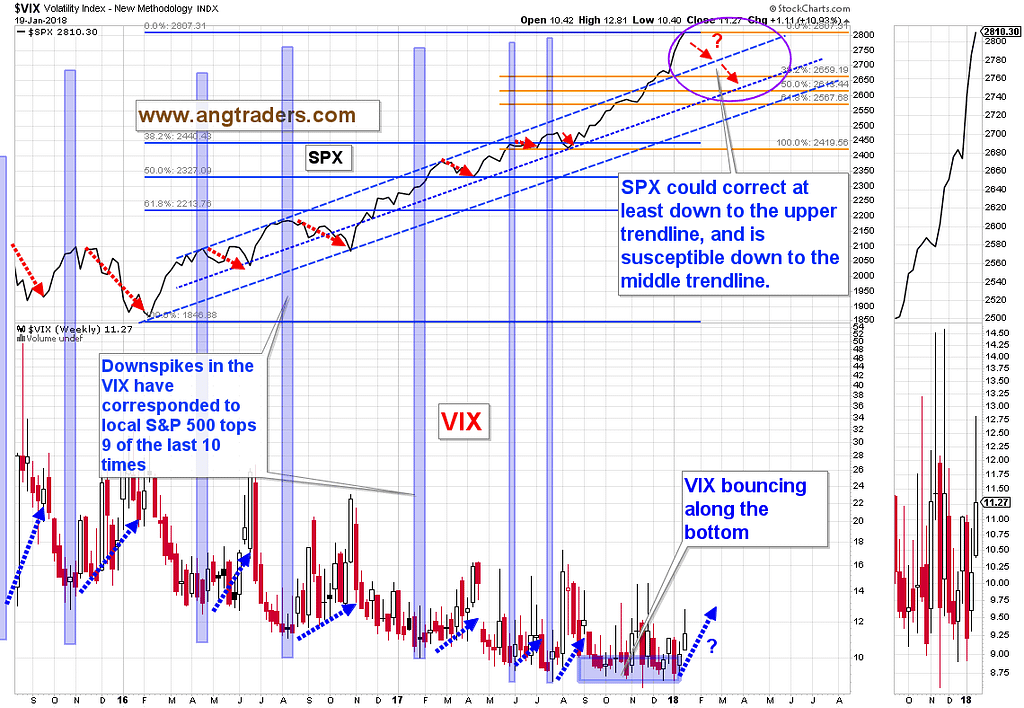

The VIX volatility index has been bouncing along at historic lows for six months now, but it may be starting to show pressure to move higher from here. The SPX is overextended and is likely to move lower to at least meet the upper trendline, in which case, the VIX would pull away from its lows (chart below). This is why we have taken another hedged position on the UVXY this week.

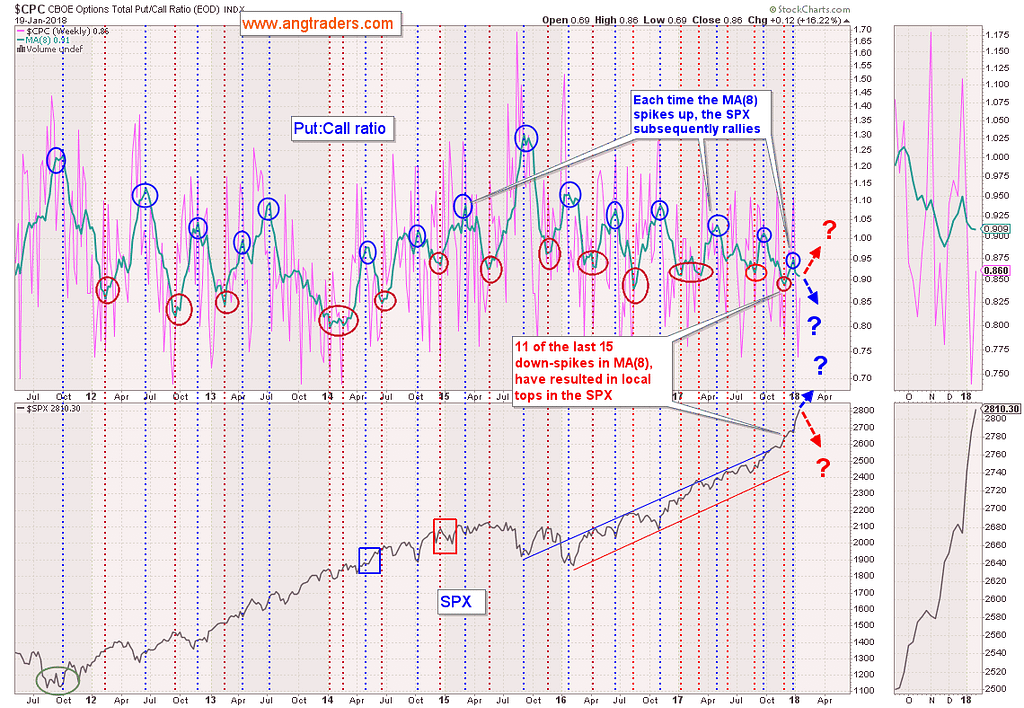

The put-to-call ratio moving average has made a bullish spike up, and the SPX has rallied in response, as usual. A turn upward in the ratio’s average would indicate an 80% chance of a correction (chart below).

Technical

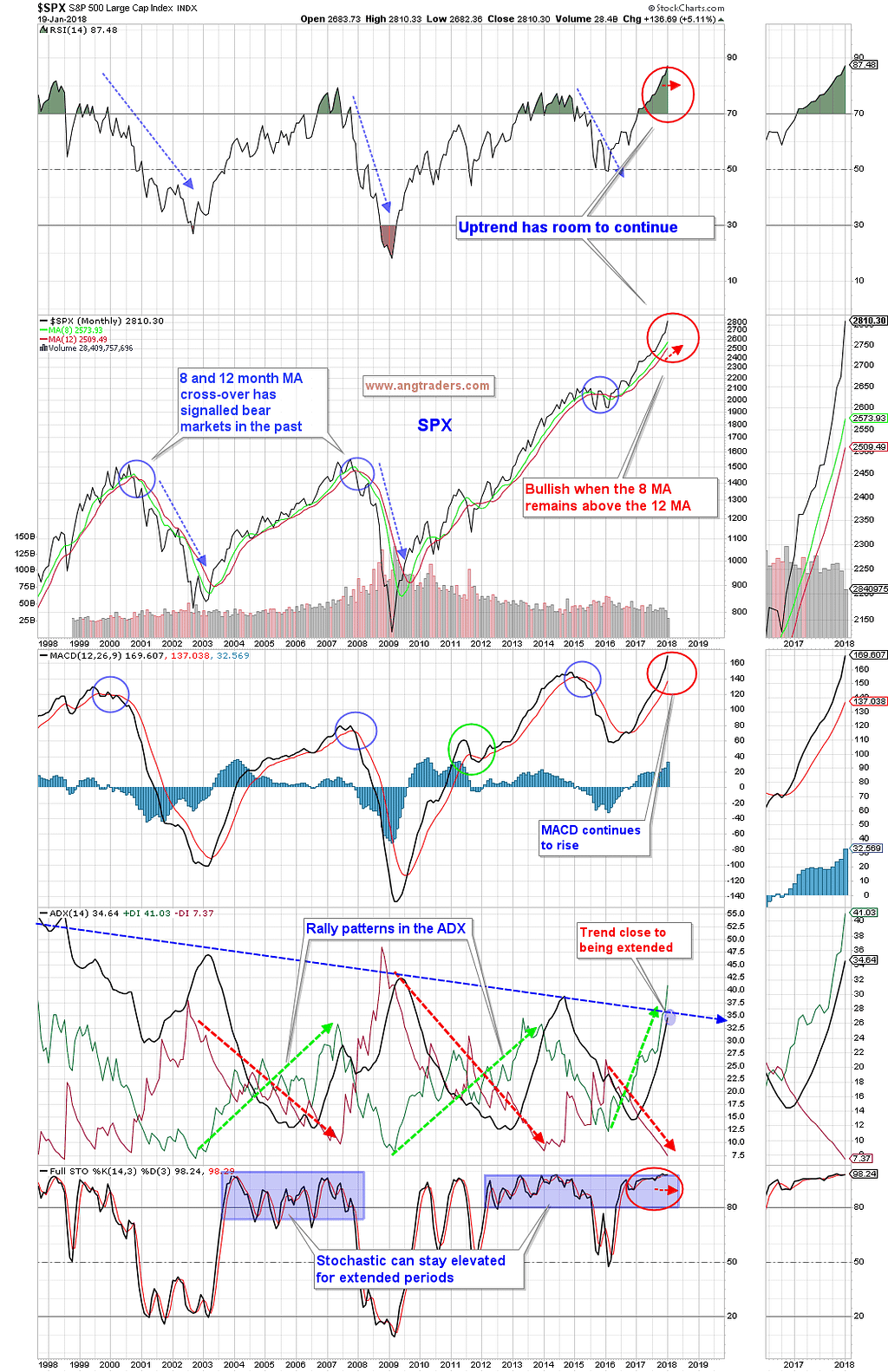

The long-term technical averages continue to demonstrate a late-stage bull market and no warning signs are evident. The 8-month moving average falling below the 12-month moving average would be a long-term bear signal. The ADX trend (black line) continues to move closer to the down-sloping major trend (blue dashed line on chart below), and the bullish and bearish momentum (green and red lines, respectively) are both at extreme levels which could facilitate a correction (chart below).

{This section is for paid subscribers only}

Fundamentals

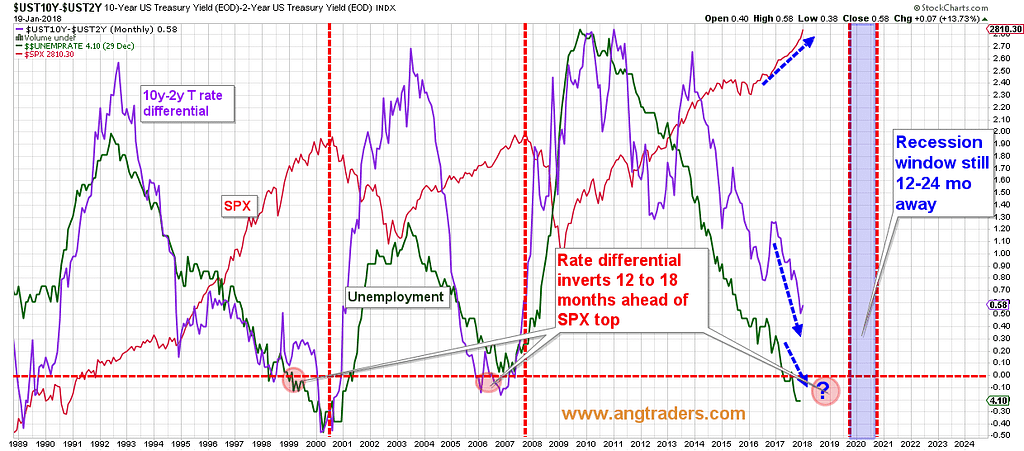

The 10-y minus 2-y differential increased slightly again this past week to 0.58, but continues to maintain a slope that would see an inversion in the second half of 2018. That would imply a recession could start sometime in 2019. However, there are no red flags at this time.

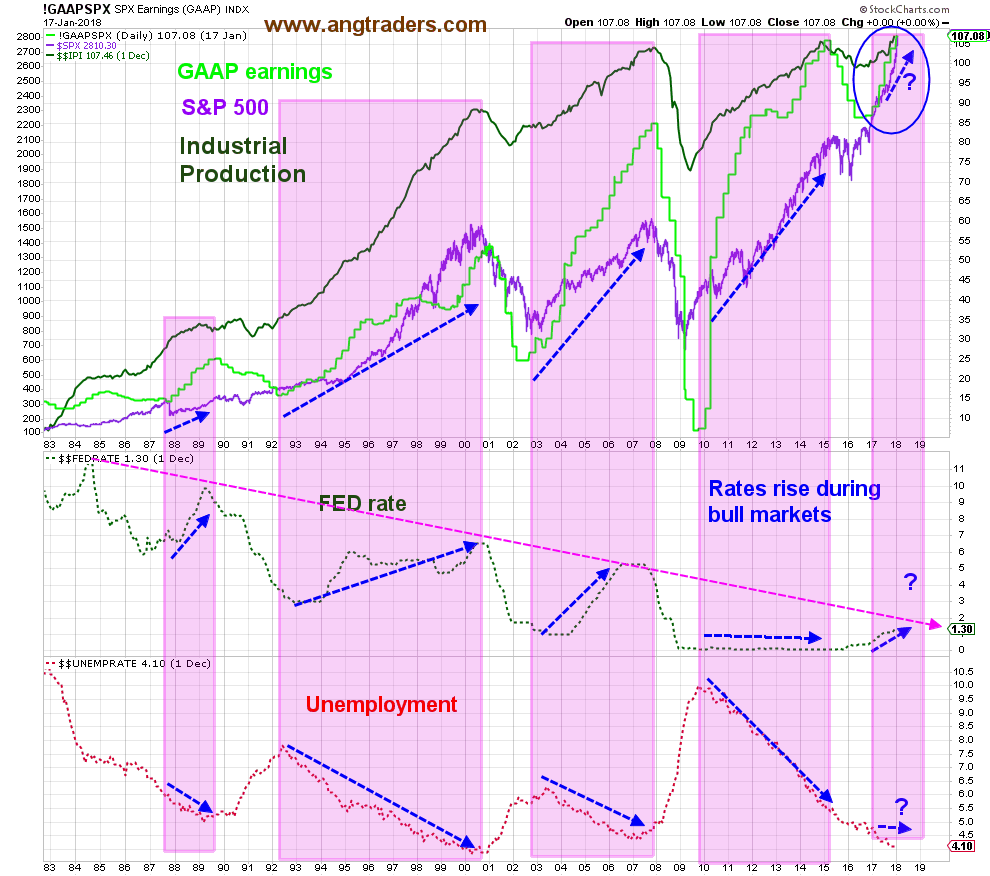

Fundamentally, we continue in a secular bull market where interest rates, GAAP earnings (a new high) and industrial production are rising, while the unemployment rate is falling. It is notable that the Fed funds rate has displayed a declining topping pattern over the last 35-years (pink trend line on chart below). Accordingly, it looks like this hiking cycle could max-out around the 2.0% level for the Fed funds rate late in 2018, which would align with the timing of the next recession derived from the 10-y minus 2-y chart. (chart below).

Oil

{This section is for paid subscribers only}

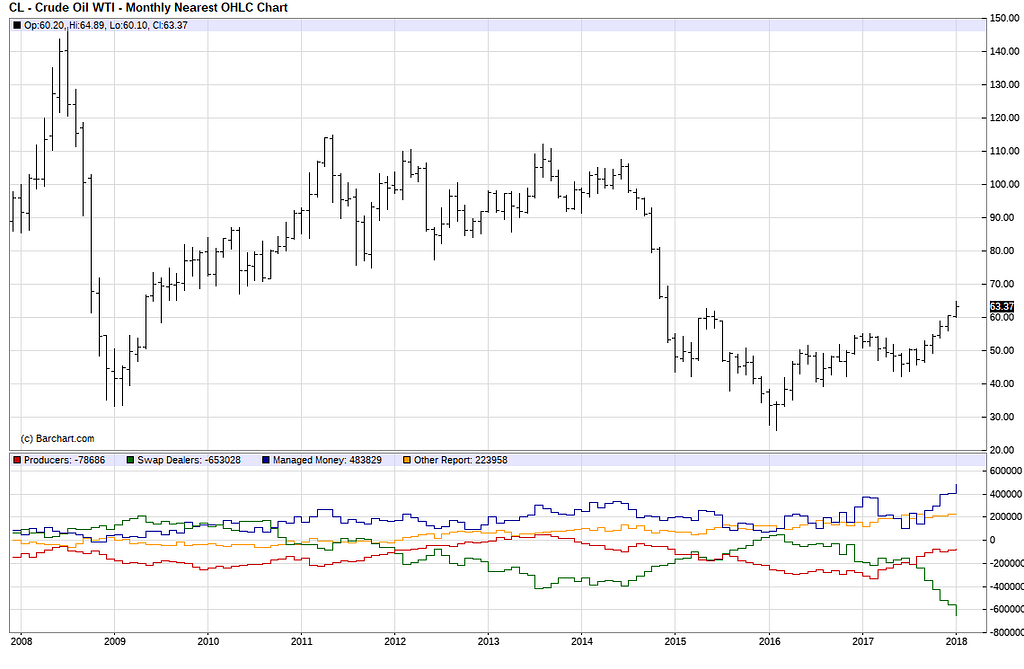

Oil futures positioning continues to be a big red flag for the oil price. The commitments of oil futures traders increased further their all-time extreme levels; The swap dealers (the true experts in this market) added another 50k contracts to their net short position for an outrageous 653k contracts, while the speculators (you know, the guys with suspenders that play with other people’s money) increased their bullish bet by another 50k contracts for a net long 483k contracts. The managed money (other people’s money) are usually wrong at the pivot points, while the swap dealers are usually correct. The swap dealers are obviously expecting to buy back the oil at lower prices in the future (February). We are looking to short USO and hedge the position by going long call options.

Gold

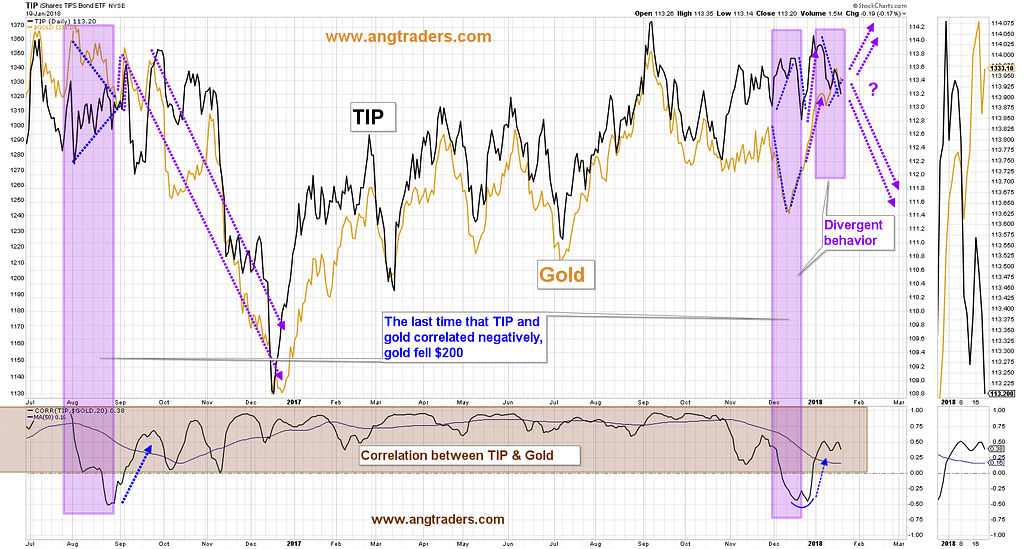

Gold continues exhibiting fairly-odd behavior. Normally, gold has a strong positive correlation with TIP (the Treasury Inflation Protected Securities etf), but lately gold has diverged from TIP. The last time it did this was in mid-2016, shortly before it dropped $200 (chart below).

{This section is for paid subscribers only}

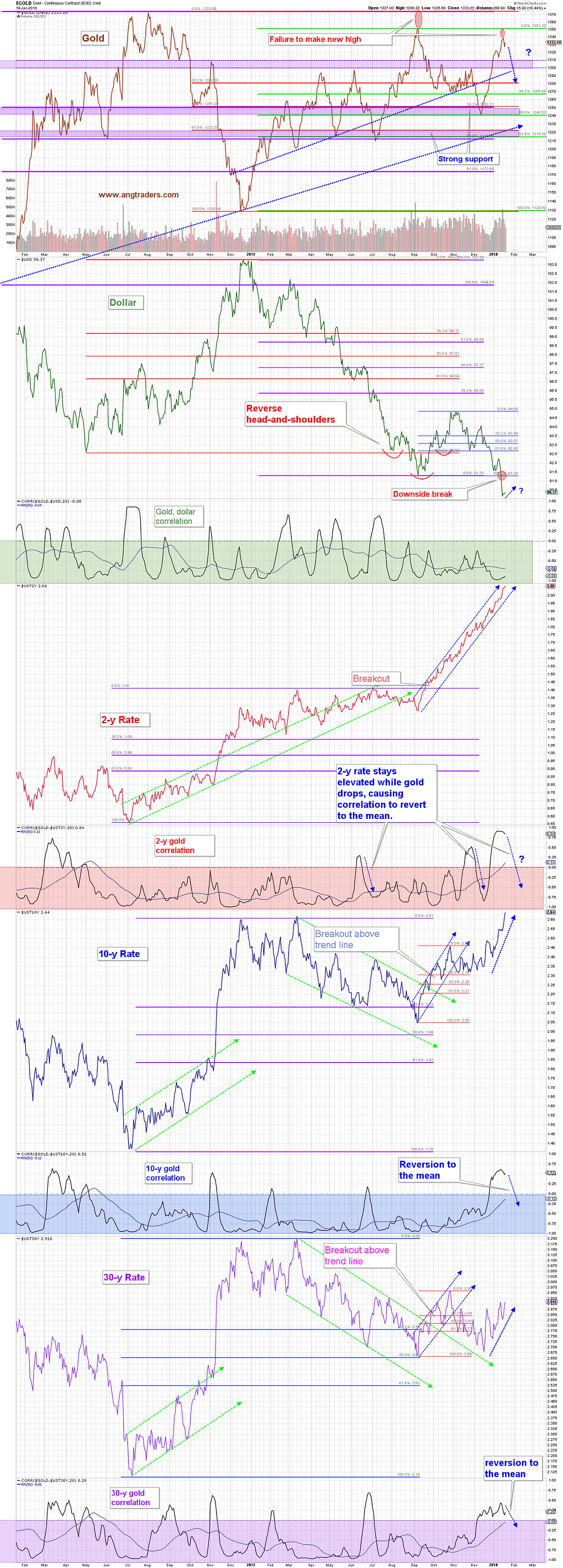

Gold and Treasury interest rates normally trade with a negative correlation, but since the beginning of December, rates and gold have traded up together. This positive correlation has started to revert to the mean, as all three rates rise, while gold has halted its rise. Since the Fed is unlikely to lower rates anytime soon (3 hikes this coming year), it is more probable that gold will continue dropping in price (chart below).

In addition, the dollar has collapsed below the recent lows, and gold is trading as usual with a strong negative correlation to the dollar. The dollar may have stabilized at these levels which, along with rising rates, may put further pressure on gold (chart below).

{This section is for paid subscribers only}

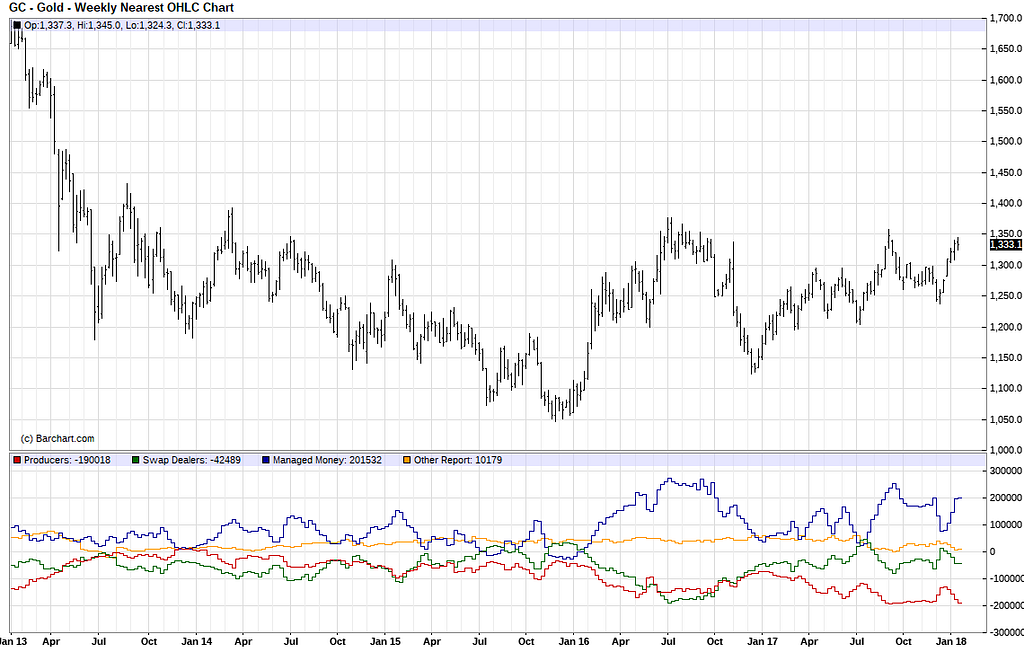

The commitments of futures traders in gold continue to move in a bullish direction; producers increased their net short position by 23k contracts to 190k contracts, while swap dealers remained essentially unchanged at net short 42k contracts. Speculators increased their net long position by 5k contracts to 201k contracts. These levels, while not record highs, are still substantial and well above average, especially for the producers (chart below).

{This section is for paid subscribers only}

We wish our subscribers a profitable week ahead and ask that email be monitored for Trade Alerts.

Regards,

ANG Traders

Source: Nicholas Gomez