Updated on March 30th, 2021 by Nikolaos Sismanis

Founded by Ravenel and Beth Curry, Eagle Capital Management, LLC is an asset management firm aiming to apply thoughtful research and rigorous valuation disciplines to achieve superior returns over the long-term. Eagle Capital has retained a consistent strategy and philosophy since its inception in 1988. The fund has around $31 billion of discretionary assets under management (AUM).

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 12.20%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 12.50% over the same time period.

You can download an Excel spreadsheet with metrics that matter of Eagle Capital Management’s current 13F equity holdings below:

Keep reading this article to learn more about Eagle Capital Management.

Table Of Contents

Eagle Capital’s Investment Strategy and Philosophy

Eagle Capital’s investment team intends to build a portfolio of businesses that are reasonably valued based on their current growth. Eagle Capital’s management will purchase stocks that the market is not fully appreciating in terms of their long-term potential for market expansion.

The company believes that by applying this philosophy of buying great businesses at a reasonable price, it will eventually achieve market-beating returns in the long term while being subject to lower risk. Eagle Capital tends to dodge high expectation stocks where the future opportunity has been already priced-in, providing little to no margin of safety.

The fund’s strategy revolves around a long-only, concentrated portfolio, which holds around 50-60 individual equity stakes. The investment focus primarily includes large-cap stocks, which have proven they can drive higher revenues over the long-term. Eagle Capital’s investment team assembles the portfolio by applying fundamental, bottom-up research.

Eagle Capital’s Portfolio & 10 Largest Public-Equity Investments

Eagle Capital’s portfolio currently consists of 54 individual holdings, which indicate a quite over-diversified portfolio against its original strategy. Its funds are mostly allocated in the Communications, Financials, and Consumer Discretionary sectors, which collectively occupy more than 3/4 of the total portfolio.

During the quarter, Eagle Capital initiated or sold its position in the following stocks:

New Buys:

- Constellation Pharmaceuticals Inc (CNST)

- ConocoPhillips (COP)

New Sells:

- Raytheon Technologies Corp. (RTX)

- GCI Liberty Inc. (GLIBA)

Eagle Capital’s 10 most significant holdings account for around 59% of the total portfolio and are comprised of the following equities:

Source: 13F filings, Author

Alphabet Inc. (GOOGL) (GOOG):

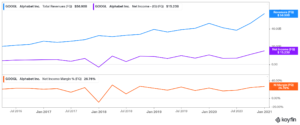

Alphabet is Eagle Capital’s most significant holding, occupying around 9.2 of its portfolio. The tech giant greatly matches the fund’s philosophy of buying reasonably-priced growth equities. Alphabet has been growing its top and bottom line consistently, yet only trades at around 30 times its next year’s net income.

While Alphabet’s financials lagged temporarily during COVID-19’s initial outbreak, both revenues and net income hit new all-time highs of $56.9 billion and $15.26 billion, respectively. The company enjoys margins north of 20% consistently.

With its robust profitability, Alphabet has accumulated a cash and equivalents position of $136 billion. As a result, the company can comfortably afford to burn up cash for its long-term bets, such as Waymo, and in the meantime return ample dollars back to its shareholders. Alphabet has repurchased nearly $32 billion worth of stock over the past year, retiring shares at an all-time high rate.

Eagle Capital has been holding shares since 2014, adding to its position occasionally. It trimmed its stake by 5% last quarter, likely for diversification reasons.

Microsoft Corporation (MSFT):

Microsoft can be found amongst the top holdings of multiple funds we have covered. It is Eagle Capital’s second-largest position, accounting for 8.6% of its portfolio. The company has taken the tech world by storm, leading internet infrastructure through Azure and its various office applications and various other SaaS.

Its latest quarter marked another profitability record, achieving a net income of $15.46 billion. The ongoing pandemic continues to be a positive catalyst for Microsoft’s growth, which, along with its relatively fair P/E of 31, fit Eagle’s investment criteria.

The fund has been holding shares from as early as 2004, which means that it has enjoyed the entirety of the stock’s prolonged rally.

Comcast Corporation (CMCSA):

Comcast is Eagle Capital’s third-largest position. While the company is being criticized consistently by its customers, it continues to be a cash cow generating between $2-3 billion of net income per quarter, on average. Its operations are largely recession-proof as well, which helps increase investors’ margins of safety.

The company is also trading at a reasonable valuation, around 19.8 times its net income, currently yielding a modest yield of 1.78%. The stock could be an ideal pick for dividend growth investors. Management’s latest dividend increase was by a confident 9%, while the low payout ratio of 34% should allow for significant dividend-per-share increases in the future.

Eagle Capital has been holdings Comcast since late 2015, featuring an average purchasing price of $52. The position was slightly trimmed during the quarter.

Amazon.com, Inc. (AMZN):

Amazon’s rapid delivery services have played an integral role during the ongoing pandemic in ensuring households get their essential goods. Simultaneously, the company’s internet infrastructure services run by its Amazon Web Services have helped keep the world’s most complex websites running smoothly in a period of peak internet traffic.

While Amazon has continued its “indefinite reinvestment of all profits strategy,” the company has also started posting substantial net income levels, while its latest quarter counting $7.22 billion. Despite its relatively high P/E of 65 the company has proven that it’s worthy of a hefty premium, surprising investors and analysts alike positively more often than not.

Eagle Capital has been holdings Comcast since late 2014. The position was trimmed by 5% during the quarter.

Berkshire Hathaway Inc. (BRK-B):

Led by legendary investor Warren Buffet, Berkshire was known for market-beating returns for several decades. The company’s portfolio has lagged in the overall market over the past few years. However, Berkshire remains an attractive pick for conservative investors who prioritize wealth preservation and low volatility returns.

The company holds more than $138 billion in cash, which provides a large margin of safety for investors and a large war chest for Mr. Buffet and his team to execute any type of elephant deal as well. While Berkshire’s portfolio is not positioned to deliver extraordinary returns in the medium term, it should offer a compelling investment case for value-oriented investors who don’t seek any dividend payments.

Since Berkshire is a holding company, a smart way to exploit additional gains off of the stock is to buy it whenever it trades under its book value, similar to last year’s March Madness. Mr. Buffet has reputedly mentioned that he executes buybacks when the stock is trading at a P/B below 1, which should provide investors some extra gains on the way up.

Eagle Capital has been holding Berkshire since late 2006, indicating confidence in Mr. Buffet’s ability to deliver superior returns over the long term.

The Goldman Sachs Group, Inc. (GS):

The Goldman Sachs Group is Eagle Capital’s largest pure-financials play, accounting for around 5% of its total holdings. The global wealth manager’s net income has remained relatively stagnant over the past decade. However, management has been returning large portions of its bottom line in the form of buybacks, boosting EPS, and hence the stock as of recently. Goldman has also been a decent dividend payer, having never cut its payouts since initiating it in 1999.

The stock is currently trading at around 9.3 times its forward earnings, and yields 1.5%. Eagle Capital first bought into the stock in mid-2011, and since added to its position at an average price of $157. The position was trimmed by 3% quarter-over-quarter.

Aon Plc (AON):

Aon provides advice and solutions to clients focused on risk, retirement, and health worldwide. The U.K.-based company is growing slowly, but gradually, generating around $11 billion in annual revenues. The company has a long history of consistent dividend payments.

However, management prefers to maintain a comfortable payout ratio, so despite the constant dividend increases, the payout is quite low, currently assigning a yield under 1%. The stock is also trading at a P/E ratio of around 20, which is a reasonable metric for its industry.

Aon is one of Eagle Capital’s oldest holdings, initially buying shares in 2010. The fund trimmed its position by 6% in its last quarter. It now owns 3.12% of the whole company.

Marriott International, Inc. (MAR):

Marriott International is Eagle Capital’s eighth-largest holding and its largest in the consumer discretionary sector. The hospitality industry has suffered hugely due to the ongoing pandemic, but Marriott’s franchise-focused business model is capital-light. Hence, the company doesn’t have to suffer any of the actual costs hotel operators do, sustaining manageable losses.

As a result, its shares have recovered relatively fast since their earlier lows, which also indicates confidence amongst investors for a rapid recovery in the tourism and travel industries as well. Still, it’s important to note that the company’s dividend remains suspended.

Eagle initially purchased shares in Marriott in 2016. The fact that the stock remains amongst its top holdings despite the ongoing industry challenges indicates a strong conviction towards its investment case. The fund owns nearly 4% of Marriott’s total shares outstanding.

UnitedHealth Group Incorporated (UNH):

UnitedHealth Group is America’s second-largest company in the healthcare sector in terms of market capitalization, generating nearly $250 billion in annual revenues. The company’s healthcare plans are low-margin by nature. However, the company’s massive economies of scale have been pushing profitability higher consistently. The company is a solid play in the healthcare sector, with a growing dividend and a resilient business model.

It’s noteworthy that Eagle Capital’s position in UNH goes back to 2001, during which time the stock has delivered market-beating returns.

Wells Fargo & Company (WFC):

Banking giant Wells Fargo accounts for just under 5% of Eagle Capital’s holdings and its ninth-largest holding. The company saw its financials taking heavy damage during the past year, significantly under-performing its competitors.

Wells Fargo also finds itself in numerous scandals, which hasn’t helped with either consumer or investor relations either. Due to the recent pressure, Wells Fargo slashed its quarterly dividend by 80% in 2020. The stock trades at a relatively reasonable valuation, nevertheless, at around 15 times its forward income.

Eagle initiated a position in Wells Fargo in 2017 and has accumulated its position at an average price of $40, which means that the fund is still sitting on unrealized gains despite the stock’s decline. The position was trimmed by 3% during the quarter.

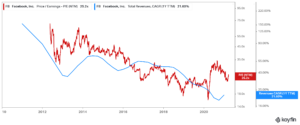

Facebook, Inc. (FB):

Facebook is Eagle Capital’s tenth-largest holding, with its $1.5 billion-worth position accounting for 4.6% of the total portfolio. Despite the company’s unique ability to attract a negative reputation, its financials are world-class, with juicy margins and positive catalysts ahead. The company has no long-term debt on its balance sheet and $62 billion of cash to fuel its future ventures.

The ongoing pandemic has boosted social media and users’ engagement metrics, which has attracted more advertisers, expanding Facebook’s turnover. The company delivered an all-time high top & bottom line of $28.07 billion and $11.2 billion, respectively. Facebook remains one of the most cheaply valued growth stocks out there, still retaining 20%+ revenue growth, but trading at a forward P/E of just 25.

Facebook has been a part of Eagle Capital’s portfolio since 2018. The position was trimmed by 4% quarter-over-quarter, similar to most of Eagle’s position during this period.

Final Thoughts

Eagle Capital’s philosophy and investment strategy are not revolutionary, but they provide the blueprint for long-term sustainable returns. With robust securities amongst its top holdings, the fund is likely to keep performing nicely over time. You can take advantage of its 13F filings, having access to the fund’s well-researched positions, and potentially consider some of those for yourself after some additional due diligence.

Additional Resources:

Appaloosa Management’s 35 Stock Portfolio: Top 10 Holdings Analyzed

Viking Global’s 75 Stock Portfolio: Top 10 Holdings Analyzed

Lone Pine Capital’s 37 Stock Portfolio: Top 10 Holdings Analyzed

Slate Path Capital’s 20 Stock Portfolio: Top 10 Holdings Analyzed