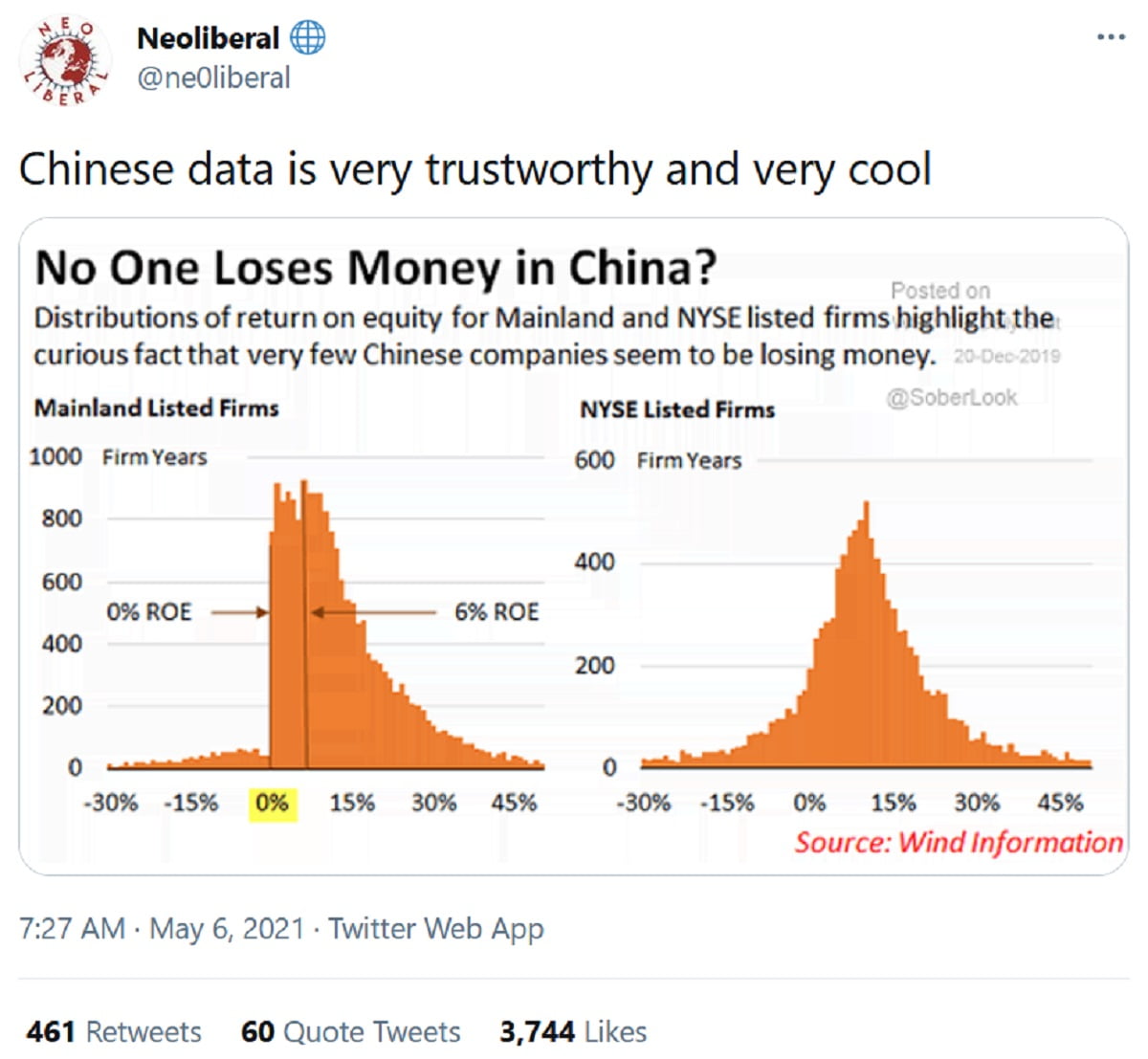

Evidence Of Massive Fraud Among Chinese Companies?

Whitney Tilson’s email to investors discussing the evidence of massive fraud among chinese companies.

Q1 2021 hedge fund letters, conferences and more

A hat tip to Edwin Dorsey of The Bear Cave for flagging this tweet:

I’d welcome feedback on two questions:

1) Is this correct?

2) If so, is there any possible explanation for this, other than massive fraud?

Massive Fraud Among Chinese Companies?

Two of my wise readers came up with the right answer I think:

One wrote:

Listing requirements are very different between the two markets. For China’s A-share market, companies can’t list without several years of profitability. I’d be curious for the Chinese companies with negative ROE - they are likely almost all recent listings on the “Star board” (market created in 2019 to be the Chinese NASDAQ).

Curious what the distribution would look like for other major markets… (i.e. Europe, Japan, etc.)

The other added:

Have any PE friends that play in China? Ask them. CSRC (China’s SEC) are very strict. But Trump activism forcing major change in China’s exchanges.

And with the anti-corruption campaign in China, lying to regulators is close to capital punishment.

Hence activism works in China.

The post Evidence Of Massive Fraud Among Chinese Companies? appeared first on ValueWalk.

Source valuewalk