FICO UK Credit Card Market Report: September 2022

FICO’s latest report of UK card trends — for September 2022 — provides clear signs of consumer indebtedness as the cost of living crisis impacts finances.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221121005194/en/

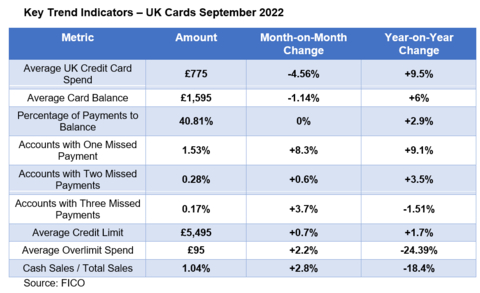

(Graphic: FICO)

Highlights

- Average total sales were £775 – 4.56 per cent lower than August

- The average active balance also dropped in September to £1,595 – 1.14 per cent lower than August and reversing the upward trend seen over the previous 18 months

- Customers missing one payment increased by 8.3 percent compared to August and 9.1 percent year on year

- Accounts with two missed payments increased marginally month on month — by 0.6 per cent — but those missing three payments increased by 3.7 per cent compared to August

FICO comment

Analysis of the largest consortium of UK cards data shows clear signs of the impact of the cost-of-living crisis.

In particular, the FICO data reveals that veteran credit card accounts — those that have been open for five years or more and which are normally considered low-risk by lenders — have shown an increase in the average balance where they have missed two or more payments. This will be a concern for credit card providers.

The percentage of cardholders missing one payment is also rising, although, overall, the average balance for customers missing two payments is trending downwards. This suggests that lenders have already taken targeted activity earlier in the year to help customers who have missed one payment to avoid the debt escalating. This targeted activity will be critical now as the numbers of cardholders missing one payment increases.

Another indicator of consumers reining in spending is in the total average sales on credit cards. This has dropped in September, in contrast to the summer months.

There is, however, another worrying trend in the percentage of payments to balance. Cardholders are starting to pay less than earlier in the year, perhaps suggesting they are no longer able to rely on pandemic savings. The percentage of accounts paying the full balance has also decreased for the last three months, which may be a reflection that customers are now not able to make the full balance.

Lenders can use segmentation analysis on their portfolios to ensure that their web and mobile applications encourage consumers in distress to make contact at the first indications of difficulty, and to consider establishing special payment plans for those struggling to stay on top.

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service produced by FICO® Advisors, the business consulting arm of FICO. The data sample comes from client reports generated by the FICO® TRIAD® Customer Manager solution in use by some 80 percent of UK card issuers.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 200 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 120 countries do everything from protecting 2.6 billion payment cards from fraud, to helping people get credit, to ensuring that millions of airplanes and rental cars are in the right place at the right time.

Learn more at https://www.fico.com

FICO and TRIAD are registered trademarks of Fair Isaac Corporation in the U.S. and other countries.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221121005194/en/

Fair Isaac Corp. Stock

With 22 Buy predictions and not a single Sell prediction Fair Isaac Corp. is an absolute favorite of our community.

However, we have a potential of -0.61% for Fair Isaac Corp. as the target price of 1714 € is below the current price of 1724.5 €.