Published on March 24th, 2022 by Aristofanis Papadatos

Inflation has surged to a 40-year high this year due to the immense fiscal stimulus packages offered by the government in response to the pandemic and the conflict between Russia and Ukraine, which has led many commodity prices to skyrocket. As a result, income-oriented investors are struggling to protect the real value of their portfolios from eroding.

High-yield stocks are attractive in the current environment but they warrant special attention, as their dividend is not safe in most cases.

You can download your free full list of all high dividend stocks with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of Edison International, which is a utility that is currently offering a 4.2% dividend yield.

Business Overview

Edison International is a renewable energy company that is active in energy generation and distribution. It also operates an energy services and a technologies business.

Edison International is a utility stock but has a key difference from a typical utility. Apart from its regulated business, the company also has non-regulated divisions, such as the production of renewable energy via methods ranging from biomass to wind energy. The non-regulated segments of the company offer higher growth potential during some periods but they also result in a less reliable growth trajectory.

In the fourth quarter of 2021, Edison International grew its revenue 5% over the prior year’s quarter but its adjusted earnings per share dipped 3%, from $1.19 to $1.16, as the growth of earnings of the regulated business was more than offset by higher depreciation amounts as well as increased operating and maintenance expenses. Nevertheless, the company exceeded the analysts’ estimates by $0.11.

Management provided lackluster guidance for this year, as its outlook for earnings per share of $4.20-$4.70 in 2022 does not signal meaningful growth over last year, when the company achieved earnings per share of $4.59. However, Edison International reiterated its guidance for 5%-7% growth of earnings per share in the long run. The bright outlook of management, along with a promising investment plan, resulted in a 5% rally of the stock after the earnings release.

Growth Prospects

Edison International has shifted its focus on renewable energy production over the last decade. Among other moves, Edison has sold coal power plants and has shut down a nuclear power plant. Moreover, the company differs from typical utilities, as it also has non-regulated divisions. These divisions could offer higher growth potential than the typical, mid-single-digit growth rate of most utilities, but this has not proved to be the case for Edison International.

The company has exhibited a remarkably volatile performance record during the last decade and has failed to grow its earnings per share meaningfully throughout this period. In fact, its earnings per share of $4.59 in 2021 were only 1% higher than the earnings per share of $4.55 posted in 2012. This is certainly a disappointing performance record for a utility.

On the bright side, Edison International seems to have a much brighter outlook in its business right now. The company has a 5-year investment plan of $25-$30 billion, which aims to enhance the safety and reliability of its infrastructure. As this amount is roughly equal to the current market capitalization of $25 billion of the stock, it is evident that the investment program will be a major growth driver in the upcoming years.

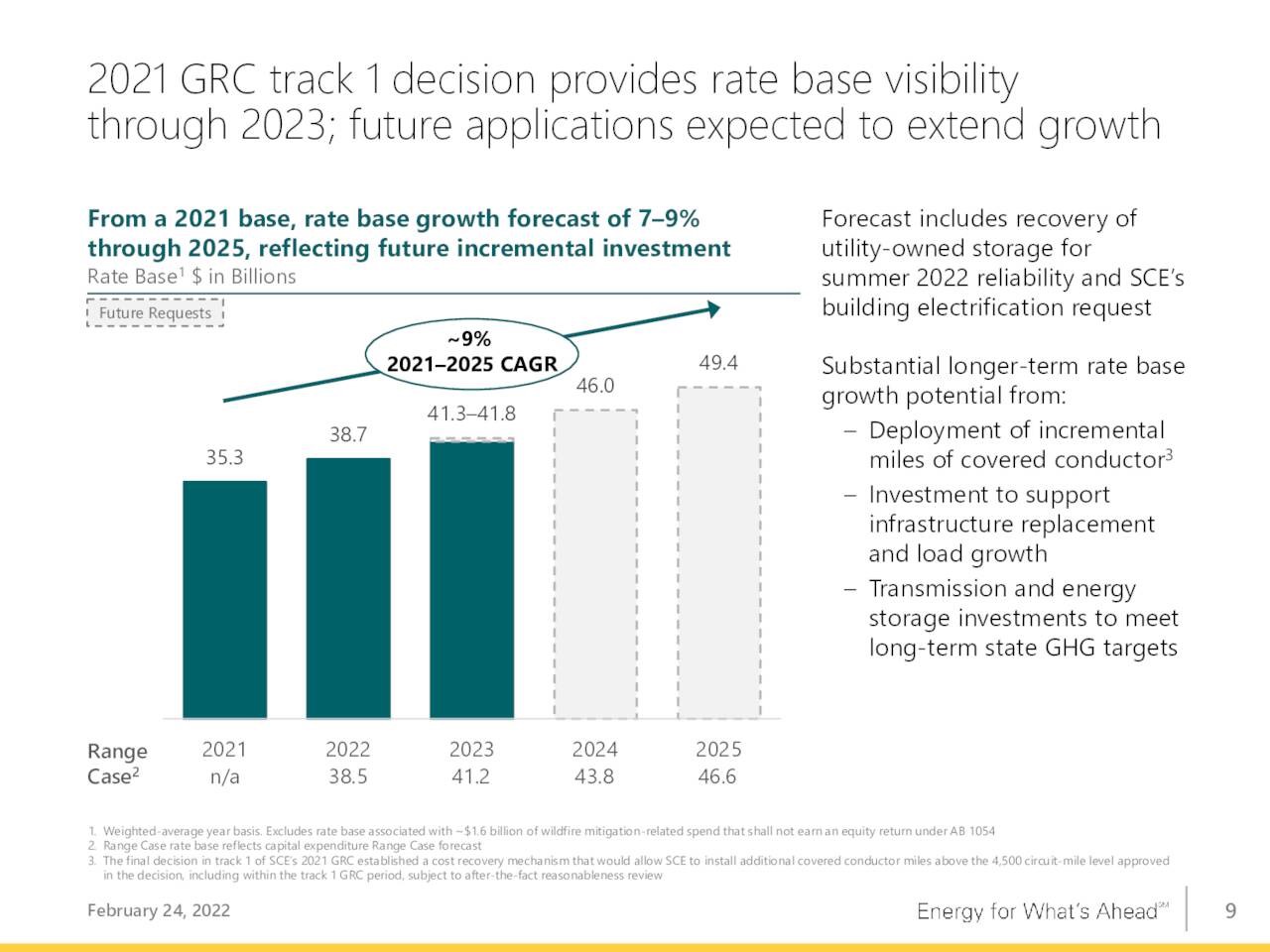

Indeed, Edison International expects to grow its rate base by 7%-9% per year on average until 2025.

Source: Investor Presentation

Thanks to the reliable growth of its rate base, the company expects to grow its earnings per share by 5%-7% per year in the long run. This is undoubtedly an attractive growth rate for a utility, particularly given its reasonable trailing price-to-earnings ratio of 14.5.

Competitive Advantages

Edison International is one of the largest electric utilities in California, as it serves approximately 15 million customers in the state. Thanks to the regulated nature of its utility business, there are extremely high barriers to entry to potential new competitors and hence Edison International enjoys a wide business moat.

Moreover, just like most utilities, Edison International has proved resilient to recessions. In the Great Recession, its earnings per share dipped just 12% and recovered swiftly during the subsequent economic recovery.

In the coronavirus crisis, the company has proved defensive once again. Its earnings per share slipped only 4% in 2020 and they are likely to recover strongly in the upcoming years thanks to the aforementioned investing program of the company.

Dividend Analysis

Edison International is currently offering a nearly 10-year high dividend yield of 4.2%. Despite its volatile performance record, the company has consistently grown its dividend for 17 consecutive years. During the last decade, it has grown its dividend at a 7.7% average annual rate, which is much higher than the median dividend growth rate of the sector (4.4%).

On the other hand, as Edison International has failed to grow its earnings per share during the last decade, its payout ratio has significantly increased during this period, from 29% in 2012 to 62% now. This may lead some investors to worry that the dividend is at risk.

However, a payout ratio of 62% is reasonable for a utility stock. In fact, this is the median payout ratio of the utility sector. Even better, Edison International is likely to grow its earnings per share by 5%-7% per year on average beyond this year thanks to its major investment program.

Therefore, its dividend should be considered safe. We expect the company to keep raising its dividend at a mid-single-digit rate in the upcoming years.

Final Thoughts

Edison International has a much more volatile performance record than most of its peers and hence it passes under the radar of most investors. With that said, the future of the company looks much brighter than its past. Thanks to a generous investment plan, the utility is likely to enter a sustainable growth trajectory from next year.

It is also important to note that the stock is trading at an attractive valuation level while it is offering a nearly 10-year high dividend yield of 4.2%.

As we expect the company to continue raising its dividend at a mid-single-digit rate, we believe that the stock is suitable for income-oriented investors who can focus on a consistently growing dividend and ignore a somewhat volatile (for a utility) stock price.