Published on March 17th, 2022 by Aristofanis Papadatos

After having remained low for more than a decade, inflation has surged to a 40-year high this year due to the unprecedented fiscal stimulus packages offered by most governments in response to the pandemic.

It is natural that income investors are looking for high dividend stocks, in order to offset the impact of inflation on the value of their portfolios.

With this in mind, we have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more.

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze the prospects of International Business Machines (IBM).

The tech giant exhibited mediocre business performance for several years but it has begun to turnaround. And, it is also offering an attractive 5.3% dividend yield.

Business Overview

IBM is a global information technology (IT) company that provides integrated enterprise solutions for software, hardware, and services. It runs mission critical systems for large, multi-national customers and governments and typically provides end-to-end solutions.

In late 2021, the company spun off Kyndryl, its managed infrastructure business, due to declining revenues and lack of profits, but it remains the largest IT services provider in the world, with a market share of 5.5%.

IBM exhibited poor business performance for several years due to the transition of the IT industry to cloud and SaaS. It took several years to IBM to realize the importance of this shift in its industry. At the same time, some of its competitors claimed a dominant position in the new business landscape.

Fortunately for shareholders, IBM has finally decided to focus on cloud and SaaS and intends to be a major player in hybrid cloud, as evidenced by the acquisition of Red Hat and some smaller companies. As a result, the business outlook of IBM has greatly improved lately.

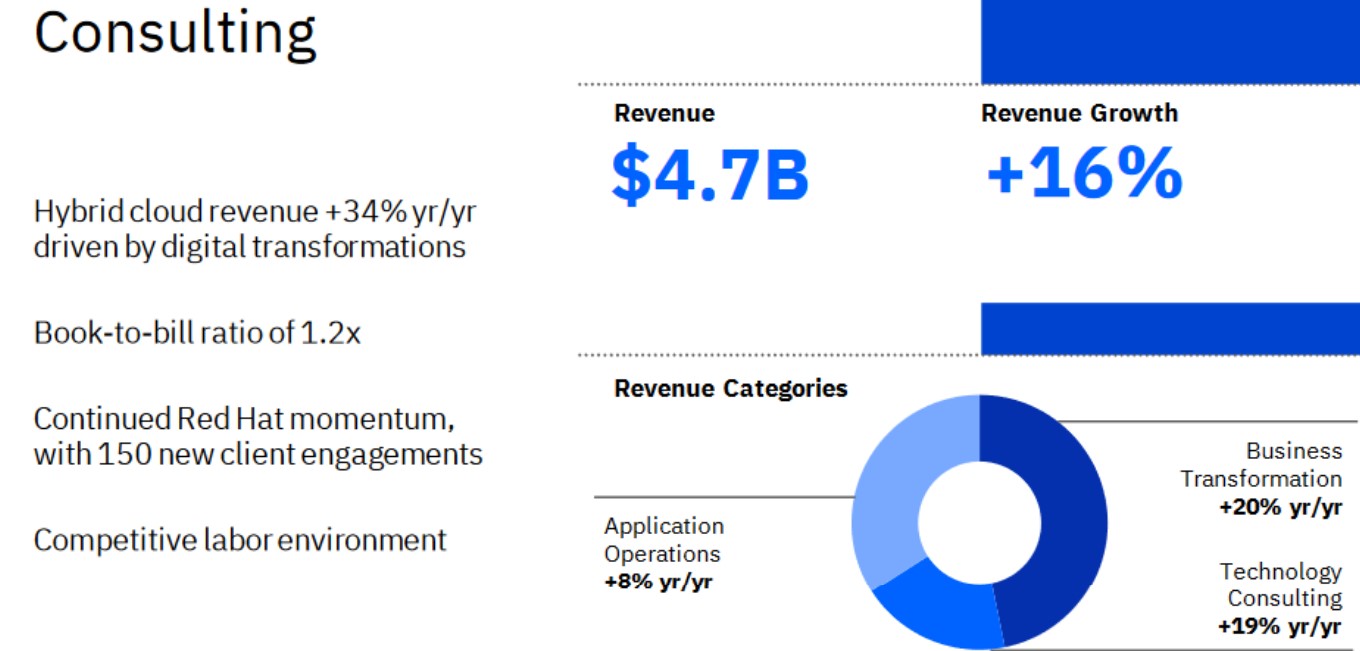

In the fourth quarter of 2021, IBM grew its revenue 6.5% over the prior year’s quarter, primarily thanks to 13% growth in consulting revenue and 8% growth in software revenue.

Source: Investor Presentation

The company posted a healthy book-to-bill ratio of 1.2 and more than doubled its adjusted earnings per share, from $1.32 to $2.72.

Thanks to its strong business momentum, IBM is expected to grow its earnings per share by approximately 27% in 2022.

Growth Prospects

As mentioned above, IBM has exhibited a poor performance record during the last decade due to the secular shift of its business. Its earnings per share decreased 1.6% in total between 2012 and 2019, from $14.37 to $12.81.

Even worse, the company was severely hurt by the pandemic. Its earnings per share plunged 38%, from $12.81 in 2019 to $7.93 in 2021.

However, IBM has eventually begun to recover strongly from the pandemic and is expected to grow its earnings per share by about 27% this year. Moreover, the company has set a goal to become a leader in artificial intelligence and hybrid cloud solutions.

IBM has invested heavily in these areas, as evidenced by its acquisition of Red Hat for $34 billion in 2019 and many more small acquisitions in 2021. Management has stated that hybrid cloud represents a $1 trillion business and hence it is doing its best to enhance the market share of the company in this business.

These efforts have already begun to bear fruit, as Red Hat grew its revenue 17% in the third quarter and 19% in the fourth quarter over the prior year’s periods.

Nevertheless, due to the ongoing transition phase of IBM, which inevitably has some uncertainty, and the highly competitive landscape of the technology sector, we prefer to keep conservative growth expectations.

We expect IBM to grow its earnings per share by approximately 4.0% per year on average over the next five years. This growth should be enough to maintain the dividend, and raise the dividend by a small amount each year.

Competitive Advantages

IBM is one of the leaders in the IT industry, with a strong brand, entrenched customer relations and an extensive patent portfolio. These are significant competitive advantages, which helped the company grow tremendously for decades, until the 2010s.

On the other hand, investors should always keep in mind that the technology sector is characterized by cut-throat competition, as many companies are doing their best to progress faster than their peers. In addition, this sector has the fastest-changing business landscape thanks to the immense technological breakthroughs achieved on a regular pace.

The poor business performance of IBM in the last decade, which resulted from a major shift in its business, is a stern reminder that IT companies can never get complacent. Instead, they should always try to be one step before their competitors.

Dividend Analysis

Despite its lackluster business performance during the last decade, IBM has grown its dividend for 26 consecutive years and hence it is a Dividend Aristocrat. You can see all 66 Dividend Aristocrats here.

The stock is currently offering a 5.3% dividend yield, which is much greater than the median dividend yield of 1.3% of the technology sector. Most technology companies offer low yields, as they prefer to reinvest earnings in their business instead of returning them to their shareholders.

IBM is much more mature than a typical technology stock. It has lower growth prospects but offers a much more generous dividend.

In fact, IBM is currently the highest-yielding Dividend Aristocrat.

Moreover, IBM has a payout ratio of 66%. This is high for a technology company but still provides a meaningful margin of safety for the dividend. Furthermore, IBM has an interest coverage ratio of 5.2 but net debt of $97.5 billion.

As its net debt is 86% of its market capitalization and about 17 times the annual earnings of the company, it is undoubtedly high, though it is not extreme. Given the reasonable payout ratio of IBM, its ongoing recovery and its fairly defensive business model, its dividend should be considered safe for the foreseeable future.

On the other hand, IBM has grown its dividend by only 3.6% per year on average over the last five years. Given the aforementioned debt metrics and the payout ratio of 66%, investors should not expect much higher dividend growth rates going forward.

Final Thoughts

IBM has dramatically under-performed the broad stock market over the last decade due to its failure to adjust to the changing business landscape. During this period, the stock has shed 39% whereas the S&P 500 has rallied 208%.

However, the company has finally begun to turnaround and has promising growth prospects right now. As the stock also offers an attractive dividend yield of 5.3%, it is an attractive dividend stock.