Published on March 17th, 2022, by Quinn Mohammed

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only 1.4%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

Next on our list of high-yield stocks to review is New York Community Bancorp (NYCB).

NYCB last cut its dividend by 32% in 2016, and it has maintained its $0.68 annual dividend since. While the company’s dividend history is less than stellar, the payout ratio is moderating as earnings have grown.

The long-term decline of the share price has caused NYCB to sport a high dividend yield of 6.2% at this time, which may interest income investors.

Business Overview

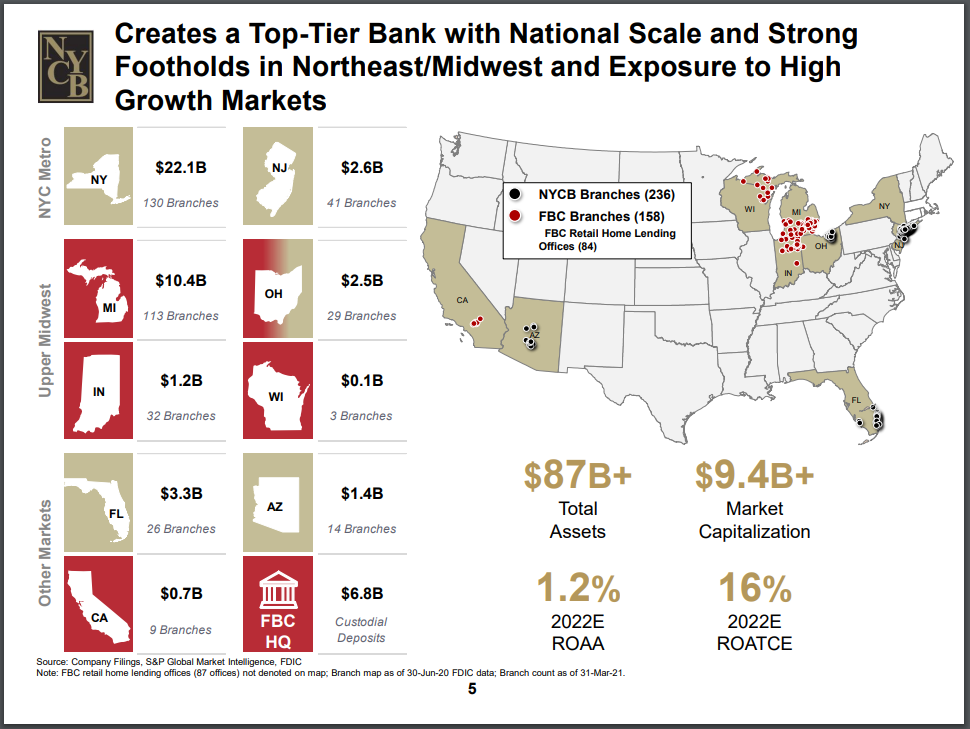

NYCB is a bank holding company. The wholly owned subsidiary operates 236 branches in New York, New Jersey, Ohio, Florida, and Arizona. It operates two major entities, the New York Community Bank; a savings bank established in 1859, and the New York Commercial Bank, established in 2005.

NYCB operates a savings and loans business model. It has more than $59 billion of total assets, $35.1 billion in deposits, and a $45.7 billion multi-family loan portfolio.

Source: Investor Presentation

New York Community Bancorp reported Q4 and FY 2021 results on January 26th, 2022. The bank achieved record quarterly loan growth in the final quarter of the year, as well as deposit growth. Asset quality also improved.

The company reported earnings-per-share of $0.31, up from $0.27 in the same period a year ago. Pre-provision net revenue was $203 million, up 7% year-over-year. After adjusting for merger-related expenses, that number was up 11% year-over-year.

The bank originated $4.6 billion in new loans and leases, up 18% year-over-year, and 55% higher than the third quarter. Multifamily originations were up 62% quarter-over-quarter, while specialty finance originations were up 52% from Q3.

Net interest margin was 2.44%, down three basis points year-over-year. Loans held for investment were up $2.1 billion to $45.7 billion, up 19% from one year ago. Total deposits were up 5% to $35.1 billion.

Following excellent 2021 results, we estimate NYCB will generate $1.40 in earnings-per-share in 2022.

Growth Prospects

New York Community Bancorp has stumbled on growth from 2016 through 2020, after the corporation cut its dividend. However, results in 2021 were great, and we expect growth to continue into 2022.

New York Community Bancorp will benefit from increasing rates, with multiple increases currently anticipated in 2022. Rising rates generally widen the profit margins of banks. And earnings from loans tend to rise at a faster pace than interest paid on deposits.

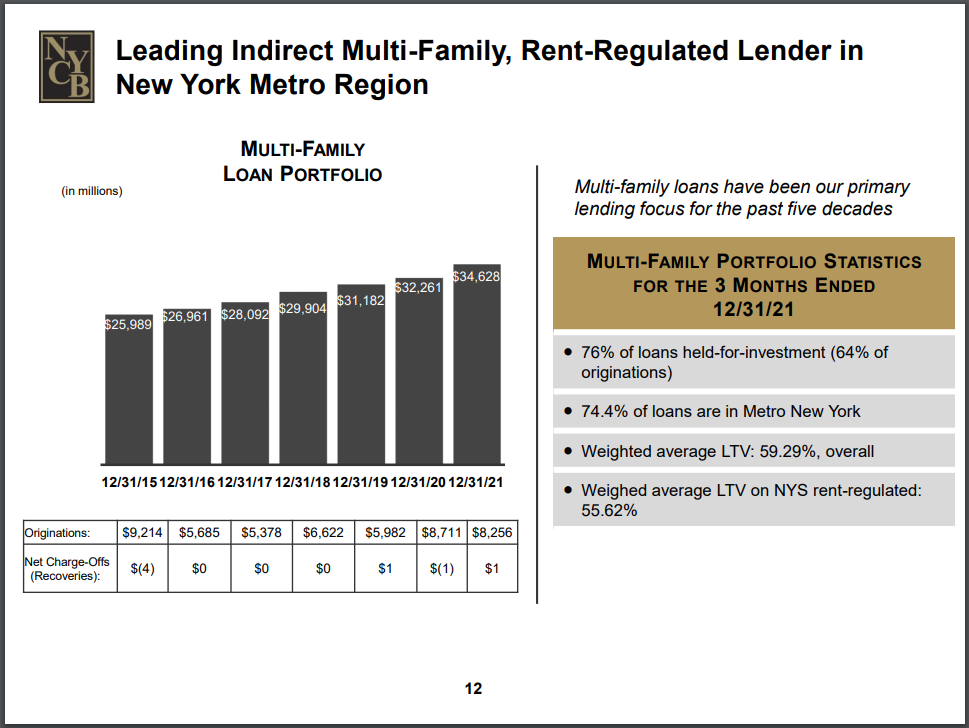

Also, the company will grow as its loans and deposits increase. It has a prudent loan strategy, which is to focus on multi-family loans. Multi-family loans are particularly attractive, and the company is aiming for growth specifically in this area.

Multi-family loans represent 76% of NYCB’s total loan portfolio. However, New York City passed stricter regulations, making it more challenging for landlords to raise rents on rent-controlled units, which could negatively affect the bank’s customers, and by extension, their ability to service their loans.

Source: Investor Presentation

The majority of multi-family units in New York have rent control features. Of NYCB’s multi-family loans in New York City, more than 50% are collateralized by buildings with rent-regulated units.

Rent-regulated units typically have below-market rents. According to NYCB, these buildings are more likely to retain their tenants in downward credit cycles. Thus, they can be a reliable source of income during mild recessions.

This helps explain NYCB’s extremely low losses on multi-family loans.

Additionally, multi-family loans are cheaper to produce and service than other types of loans, which allows for NYCB to generate high levels of efficiency.

NYCB’s efficiency ratio improved to 38.4% for 2021, compared to 44.0% in 2020. Additionally, the company’s efficiency ratio is far superior to that of its peer group, at over 50.0%.

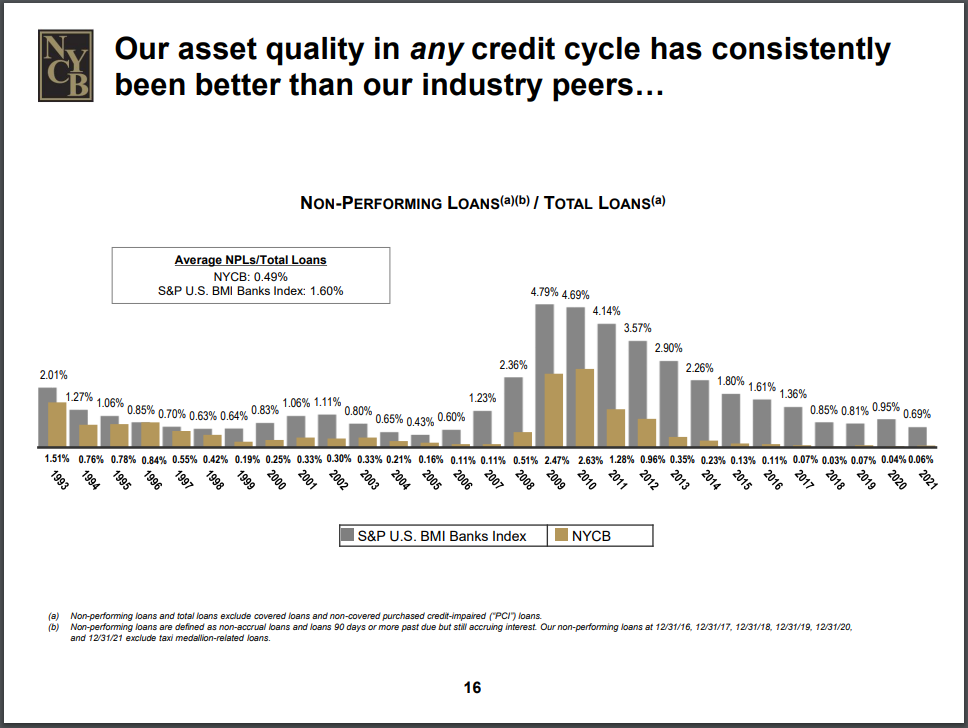

Competitive Advantages & Recession Performance

NYCB’s high-quality assets consistently outperformed its banking peers during various industry downturns, including the Great Recession and the COVID-19 pandemic. In 2021, non-performing assets were only 0.07% of total assets.

Source: Investor Presentation

New York Community Bancorp’s earnings-per-share throughout the Great Recession of 2007-2010 are listed below:

- 2007 earnings-per-share: $0.90

- 2008 earnings-per-share: $0.83

- 2009 earnings-per-share: $1.13

- 2010 earnings-per-share: $1.24

The company remained profitable through the entire stretch. Earnings dropped in 2008, but NYCB recovered and surpassed their 2007 results immediately after. Its earnings reached a new high by 2010.

This strong and efficient performance allowed NYCB to maintain its dividend during the recession, at $1.00 per share. At the same time, many U.S. banks were cutting their dividends and posting big losses.

Even though the dividend held up during the great recession, it was still slashed later in 2016.

Dividend Analysis

The corporation’s current annual dividend remains $0.68 per share. Shares of NYCB currently trade at $10.97, thus yielding 6.2%. This is a high yield for NYCB, even when accounting for its trailing ten-year average of 6.0%.

With 2022 earnings-per-share expectations of $1.40, and the annual dividend of $0.68, the company is anticipated to pay out 49% of EPS in dividends. This payout ratio is quite safe and sustainable for NYCB. In fact, the payout ratio today is healthier than it has been in the last decade.

With further earnings growth, the payout ratio should moderate even further. We are not expecting the company to increase the dividend in the near-term, as they appear to be investing in growth.

However, investors may not view NYCB’s dividend favorably, given it does not have an excellent history. The company went through a dividend cut in 2016. At the time, NYCB attempted to acquire Astoria Financial, a similar New York-based company.

NY Community Bancorp cut the dividend in anticipation of this acquisition, which was going to increase compliance and regulation costs. In the end, however, the merger agreement was terminated due to a low expectation for regulatory approval.

Final Thoughts

New York Community Bancorp has a high dividend yield of 6.2%, even in comparison to its historical average. The company does not have a history of dividend increases, and last cut its dividend by 32% in 2016.

Today its dividend is well covered by earnings. Additionally, the corporation should benefit from rising interest rates in 2022. This earnings growth will further moderate the payout ratio in the next few years.

It’s possible, though not expected, that NYCB will raise the dividend in the future. Currently, they appear to be more focused on earnings growth and acquisitions.

NYCB’s 6.2% yield seems to be secure, and the stock could be a solid bank pick for income investors.