Published on April 8th, 2022, by Quinn Mohammed

Washington Trust Bancorp has raised its dividend for eleven years straight, following a 2010 dividend growth pause due to the Great Recession. Still, it did not slash its dividend as many other financial institutions at the time.

Earnings growth has led to decent dividend growth in recent years. Reliable dividend growth has caused Washington Trust to have a high dividend yield of 4.4%. And with recent share price decreases, Washington Trust may be an attractive opportunity today.

We have created a spreadsheet of high dividend stocks with dividend yields of 5% or more…

You can download your free full list of all securities with 5%+ yields (along with important financial metrics such as dividend yield and payout ratio) by clicking on the link below:

In this article, we will analyze bank holding company, Washington Trust Bancorp (WASH).

Business Overview

Washington Trust Bancorp, Inc. operates as a bank holding company, and owns The Washington Trust Company. The company was founded in 1800 and is the oldest community bank in the U.S.

Washington Trust has 24 branches in the market area of Rhode Island, eastern Massachusetts, and Connecticut. It boasts $5.9 billion assets.

The company provides banking services such as savings accounts, certificates of deposit and money market accounts. They also offers loans for residential, commercial, consumer and construction customers as well as reverse mortgages. And finally, the company also offers wealth management services, including asset management, financial planning, and advisory services.

Source: Investor Relations

Washington Trust reported fourth quarter earnings and full year 2021 results on January 26th, 2022. Revenue increased 25% year-over-year to $58.1 million for the quarter. GAAP earnings-per-share was $1.15, an $0.08 improvement over the prior year. For the full year, revenue was 1% higher to $229 million, and earnings-per-share rose 9.2% to $4.39.

Total loans, excluding PPP loans, were up 6% year-over-year to $4.2 billion. Total in-market deposits reached a record $4.5 billion, an 18% increase from a year ago.

For the third consecutive quarter, there were no provisions for credit losses. Return on average equity and average assets was 14.03% and 1.32% for the 2021 year, respectively. Wealth management revenues grew to a record high of $41.3 million and assets under administration reached an all-time high of $7.8 billion. Net interest income grew 11% year-over-year while net interest margin expanded 19 basis points to 2.59%.

In 2022, Washington Trust is expected to earn $3.79.

Growth Prospects

The company plans to expand business development by increasing its lending activity in adjacent New England states and reduce its dependence on Rhode Island for generating assets. As the bank expands, it expects to capitalize on its brand strength and its reputation for quality service.

The company’s wealth management business is comprised of primarily high net worth individuals, with an average client size of $2.8 million. Washington Trust will continue to gain in assets under administration and lead to higher revenues. The company has a strong balance sheet, and it’s fee-intensive business model will support future earnings and dividend growth.

The company will also grow its loan portfolio, which has grown by 5.7% per year on average over the last five years. Residential makes up 40% of the loan portfolio, followed by 38% in CRE, 15% in C&I and 7% in consumer. Additionally, 65% of the loans are variable.

The mortgage banking division also aims to develop banking relationships with customers. It follows a flexible origination model where the company can place the loans for sale or to be put in the portfolio. In 2021, 55% of mortgage originations were for sale, and 45% were for the portfolio. Since 2018, the majority of mortgage originations were for sale.

Since the company rarely issues equity, results on a per-share basis will be reliant on improved business performance and should remain unhampered by shareholder dilution.

Competitive Advantages & Recession Performance

Washington Trust does not appear to have any meaningful competitive advantage, and it has a relatively small footprint with only 24 branches, primarily in Rhode Island. However, the company does have a considerable wealth management business with nearly $8 billion of assets under management.

During the Great Recession, Washington Trust saw earnings-per-share decline 44% from 2007 to 2009. The company was badly affected during the Great Recession, but it fared well throughout the COVID-19 pandemic, with earnings growth since 2017 up to 2021.

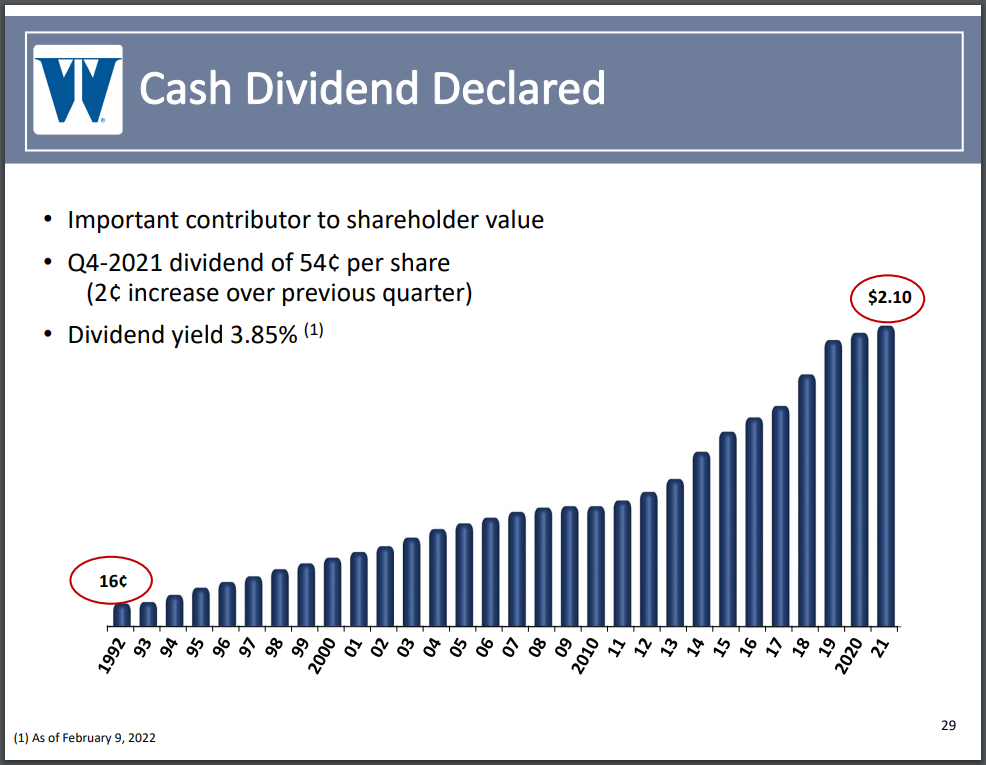

While a great deal of financial institutions slashed their dividend during the Great Recession, Washington Trust simply paused their dividend growth. Prior to 2010, Washington had a 16-year dividend growth streak. It was paused in 2010, and then grew another 11 years to-date.

Dividend Analysis

Washington Trust has increased their annual dividend for 11 consecutive years. The company paused its dividend growth in 2010, which ended a prior 16-year streak. So, the company has a demonstrated history of growing the dividend for many years.

Source: Investor Relations

The dividend has grown fairly well, with a compound annual growth rate of 8.7% in the last decade. Even in the last five years, the dividend grew at an average pace of 7% per year.

Washington’s currently quarterly dividend payout of $0.54 equates to an annual dividend of $2.16 in 2022. At the current WASH share price, the company has a high dividend yield of 4.4%. The current dividend yield is 70 basis points above the trailing decade average, which indicates some level of discount on a dividend yield basis.

With anticipated earnings per share of about $3.79 for the year, the company has a safe and manageable payout ratio of 57%. The company’s dividend growth may come more cautiously in the medium term, as the latest increase of 3.8% was a fair bit less than the average. Still, we see no immediate threat to the continuation of the dividend growth streak at this time.

Additionally, the company’s share count has remained stable over the last decade, which makes it easier for the company to grow on a per share basis. The business has performed well to generate such growth without constantly issuing equity.

Final Thoughts

Washington Trust Bancorp has performed well as a simple regional bank holding company. It has increased its dividend for 11 years straight. Even more, the company previously had a sizeable dividend growth streak which was put on pause during the Great Recession. Still, the company’s maintenance of its dividend at that time was favorable to the many financial institutions which slashed their payout.

Given recent declines in share price, the above average yield, and a mid single digit earning growth expectation, Washington Trust Bancorp appears to be an attractive total return opportunity at this time.