Infotech Capital Offerings Raise $2.94B In May – S&P Analysis

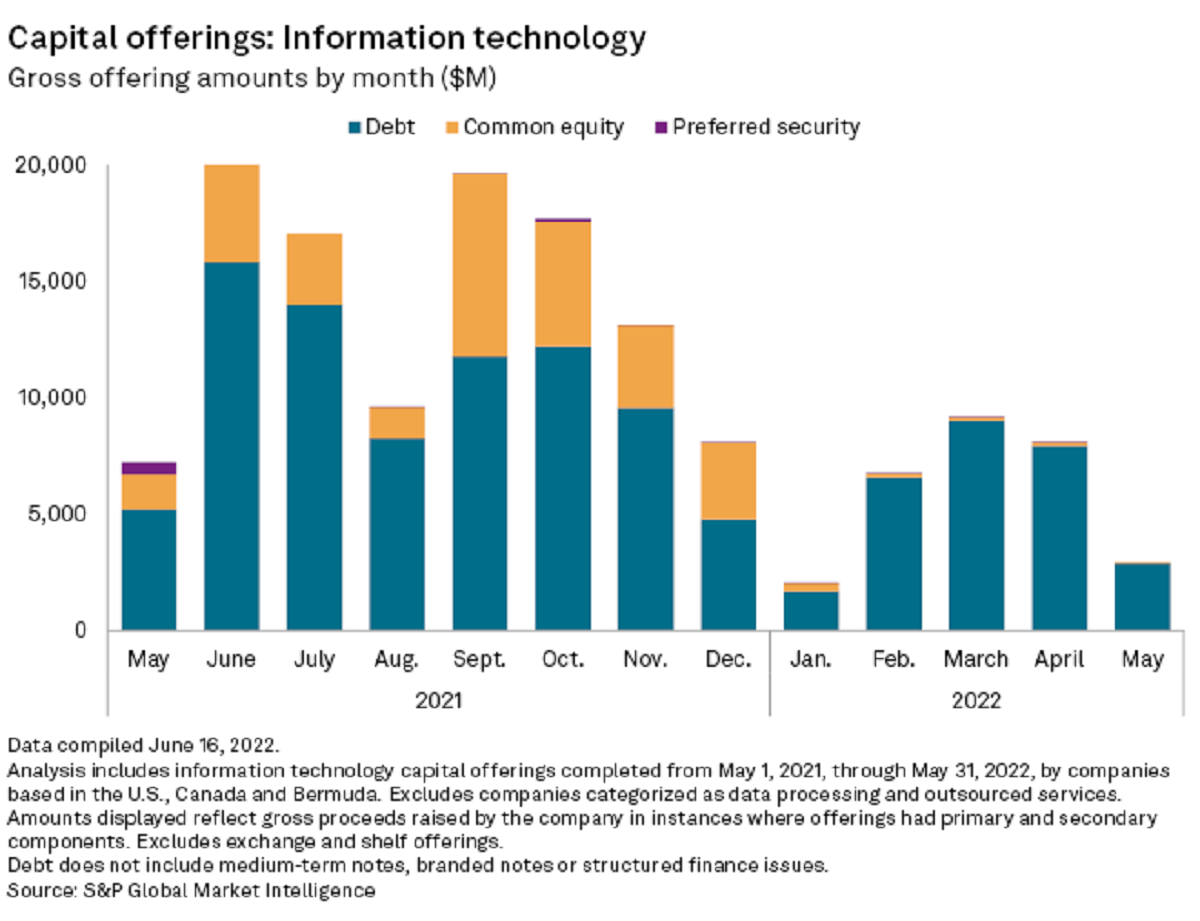

Capital markets activity among publicly traded infotech companies in the U.S., Canada and Bermuda brought in $2.94 billion in May, according to S&P Global Market Intelligence data. The figure is a 63.73% drop from the April total of about $8.1 billion. It is also the sector’s second-lowest monthly total in 2022, after the $2.04 billion raised in January.

Capital Raised By Infotech Companies

Key highlights from the report include:

- The biggest portion of the total capital raised in May came from senior debt offerings at nearly $2.9 billion, while common equity offerings brought in the remaining $39.1 million.

Q1 2022 hedge fund letters, conferences and more

- Qualcomm , Inc. (NASDAQ:QCOM)'s $1.00 billion offering of its 4.500% notes was the month's largest offering.

- Broadcom Inc (NASDAQ:AVGO)'s $2.5 billion debt offering in March is the largest debt offerings year to date, outranking Snap Inc.'s private placement in February of $1.5 billion of its 0.125% convertible senior notes.

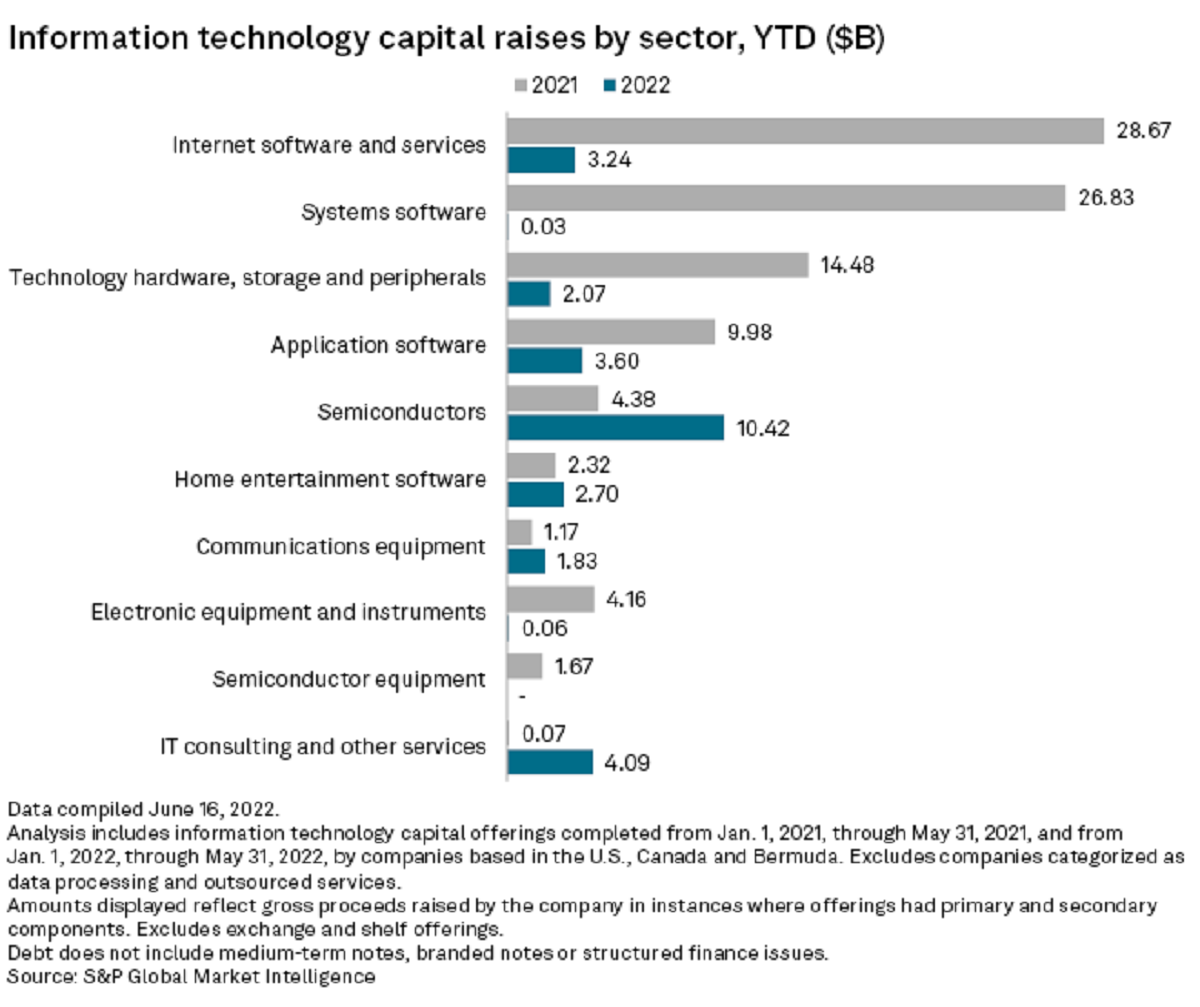

- For the second month in a row, semiconductor companies achieved the biggest total raise year to date across the broader infotech sector with $10.42 billion. IT consulting and other services companies came in next, holding on to the April total of $4.09 billion, while application software companies ranked third with $3.60 billion.

Please find the full analysis here: Infotech capital offerings raise $2.94B in May | S&P Global Market Intelligence

Updated on

Source valuewalk