Updated on August 27th, 2020 by Bob Ciura

Spreadsheet data updated daily

Mega-cap stocks are companies with market capitalizations in excess of $200 billion. The total number of mega cap stocks varies depending upon market conditions, but there are generally 25 to 30 in the US, so there are plenty to choose from for investors.

These are the largest stocks in the market today and tend to have recognizable brands, in addition to fairly steady revenue, earnings, and in many cases dividends. Thus, mega cap stocks would tend to appeal to a wide variety of investors as they would typically see less volatility than smaller stocks and have more predictable forward returns.

You can download a free spreadsheet of all 20+ mega cap stocks (along with important financial metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Click here to download your Mega Cap Stocks List Excel Spreadsheet now. Keep reading this article to learn more.

This article includes a spreadsheet and table of all mega cap stocks, as well as detailed analysis on our Top 10 mega cap stocks today.

Keep reading to see the 10 best mega cap stocks analyzed in detail.

The 10 Best Mega Cap Stocks Today

Now that we’ve defined what a mega cap stock is, let’s take a look at the 10 best mega cap stocks, as defined by our Sure Analysis Research Database. The database ranks stocks’ total prospective annual returns, combining current yield, forecast earnings growth and any change in price from the valuation.

We’ve screened the mega cap stocks with the best prospective returns and have provided them below, ranked in reverse order of forecast total returns. You can instantly jump to any individual stock analysis by using the links below:

- Merck & Co. (MRK)

- UnitedHealth Group (UNH)

- Verizon Communications (VZ)

- Berkshire Hathaway (BRK.B)

- JP Morgan Chase (JPM)

- Bank of America (BAC)

- Netflix Inc. (NFLX)

- Intel Corporation (INTC)

- Pfizer Inc. (PFE)

- AT&T Inc. (T)

Mega Cap Stock #10: Merck & Co. (MRK)

Merck & Company is one of the largest healthcare companies in the world. Merck manufactures prescription medicines, vaccines, biologic therapies, and animal health products. Merck generates annual revenues of $49+billion.

On 2/5/2020, Merck announced that it was spinning off its women’s health, legacy brands and biosimilar products into a separate company. These businesses represent ~$6.5 billion of revenues. The transaction should be completed in the first half of 2021.

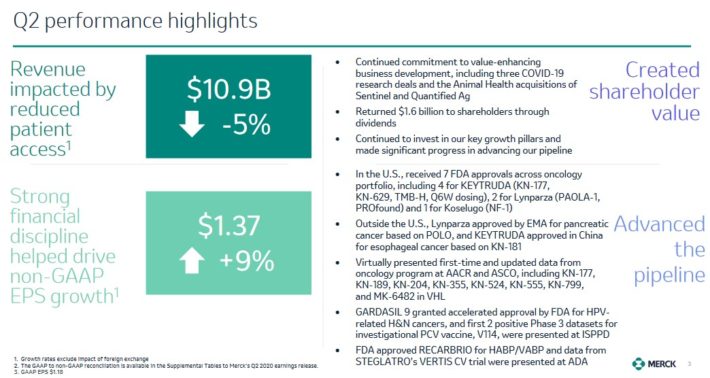

Merck released second quarter earnings results on 7/31/2020. Revenue decreased 7.6% to $10.9 billion, but topped estimates by $348 million. Adjusted earnings-per-share increased $0.07, or 5.4%, to $1.37, $0.32 ahead of expectations.

Source: Investor Presentation

Pharmaceutical revenues fell 8% during the quarter as the COVID-19 pandemic impacted vaccine and hospital acute care products. Revenues for Keytruda, which treats cancers such as melanoma that cannot be removed by surgery and non-small cell lung cancer, improved 29% to $3.4 billion. Keytruda also received four approvals from the FDA during the quarter.

Merck has two COVID-19 vaccine trials in place as well as a novel antiviral candidate. Merck raised its guidance for the year and now expects revenue of $47.2 billion to $48.7 billion, up from $46.1 billion to $48.1 billion previously. Adjusted earnings-per-share are now expected in a range of $5.63 to $5.78, up from $5.17 to $5.37 previously.

Merck’s key competitive advantage is that it is seeing strong growth rates in key product areas.While generic competition is putting pressure on certain pharmaceuticals, we find Keytruda’s growth rate and peak sales expectations very appealing. We expect 5% annual EPS growth through 2025

Merck also pays a dividend which yields 2.9%, while we find the stock to be fairly valued at the current share price. We estimate total returns to reach nearly 8% per year through 2025.

Mega Cap Stock #9: UnitedHealth Group (UNH)

UnitedHealth offers global healthcare services to tens of millions of people via a wide array of products. The company has two major reporting segments: UnitedHealth and Optum. The former provides global healthcare benefits to individuals, employers and Medicare/Medicaid beneficiaries, while Optum is a services business that seeks to lower healthcare costs and optimize outcomes for its customers. UnitedHealth produces about $255 billion in revenue annually.

UnitedHealth reported second quarter earnings on July 15th, with results coming in better than expected on the bottom line, but revenue came up short. Revenue was up 2.5% year-over-year to $62.1 billion, with Premiums revenue rising 4.7%, Products revenue down 1.3% and Services revenue off -7.6%. The UnitedHealthcare business saw its revenue deviate from its long-term trajectory and gained just 1.1% in Q2, rising to $49.1 billion.

The Optum business was up very strongly, adding 16.6% to $32.7 billion year-over-year. Adjusted earnings-per-share nearly doubled to $7.12 inQ2, and cash flow from operations was up 42% to $12.9 billion. The medical care ratio fell to 70.2% from 83.1% last year as customers temporarily deferred care due to the pandemic. We expect this to begin to unwind and normalize in Q3 and Q4.

The company reiterated its guidance of $16.25 to $16.55 in adjusted earnings-per-share for this year. We see forward earnings-per-share growth of 10% annually as UnitedHealth continues to buy back stock and generate strong revenue growth.

We expect approximately 8.4% annual returns going forward, due to 10% expected EPS growth and the 1.6% dividend yield, partially offset by a declining valuation multiple as we view the stock as slightly overvalued right now.

Mega Cap Stock #8: Verizon Communications (VZ)

Verizon is a telecommunications giant. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S. Verizon has now launched 5G Ultra-Wide band in several cities as it continues its rollout of 5G service. Verizon was the first of the major carriers to turn on 5G service.

Verizon reported earnings results for the second quarter on 7/24/2020. Revenue decreased 5.3% to $30.4 billion, but topped estimates by $420 million. Adjusted earnings-per-share declined $0.05, or 4.1%, to $1.18, but was $0.03 ahead of estimates. Wireless revenue was down 1.7% to $15.9 billion.

Source: Investor Presentation

Total retail postpaid net additions were 352,000, including 287,000 postpaid smart phone net additions. At just 0.78%, retail postpaid churn remains very low. Consumer sales were down 4%, but this segment had net additions of 72,000.

Fios, which has struggled recently, had 10,000 net additions during the quarter. Media sales, however, were down 24% to $1.4 billion. Business revenues were down 3.7%, but added a net 280,000 postpaid net additions. Verizon reiterates its belief that the company will have adjusted earnings-per-share growth in a range of -2% to 2% for 2020.

One of Verizon’s key competitive advantages is that is often considered the best wireless carrier in the U.S. This is evidenced by the company’s wireless margins and very low churn rate. Its reliable service allows Verizon to maintain its customer base as well as give the company an opportunity to move customers to higher-priced plans. Verizon is also in the early stages of rolling out 5G service, which will give it an advantage over weaker carriers.

We expect 4% annual EPS growth over the next five years. The stock also has a 4.1% dividend yield. In addition to a small bump from an expanding P/E multiple, we expect total returns of 8.6% per year for Verizon stock.

Mega Cap Stock #7: Berkshire Hathaway (BRK.B)

Berkshire Hathaway traces its roots all the way back to 1839 as a textile manufacturer. Warren Buffett began acquiring its stock in 1962, eventually taking control of the company. Since that time Buffett and Vice Chairman Charlie Munger have turned the business into one of the largest companies in the world.

Berkshire can be thought of in five parts: wholly-owned insurance subsidiaries like GEICO, General Re and Berkshire Reinsurance, wholly-owned non-insurance subsidiaries like Dairy Queen, BNSF Railway, Duracell, Fruit of the Loom, Precision Cast Parts and See’s Candies, shared control businesses like Kraft Heinz and Pilot Flying J, and marketable publicly traded securities. You can see a list of Berkshire Hathaway’s top 20 stock picks here.

The company’s cash position sat at $147 billion at the end of Q2 2020. The company trades under two classes, an ‘A’ share and a ‘B’ share, which is pegged at 1/1,500th of an A share.

On August 8th, 2020 Berkshire released Q2 2020 results for the period ending June 30th, 2020. For the quarter net earnings totaled $26.3 billion compared to $14.1 billion in Q22019.

However, beginning in 2018 mark-to-market gains and losses, even if not yet realized, must be run through the income statement whereas previously the unrealized portion was only reflected in shareholder equity –a significant change given Berkshire’s very large portfolio of publicly traded securities.

On an operating basis Berkshire posted $5.51 billion ($2.28 per share) in earnings against $6.14 billion ($2.50) in the year ago quarter. An improvement in Insurance Underwriting, helped by lower claims at GEICO, and flat income from Insurance-Investment Income were offset by declines in Railroad, Utilities, Energy and Other businesses. During the quarter approximately $5.1 billion was used to repurchase shares, bringing the six-month total to $6.7 billion.

We expect 5% annual EPS growth for Berkshire Hathaway going forward. In addition, we view the stock as slightly undervalued. Berkshire does not currently pay a dividend.

Related: Will Berkshire Hathaway Ever Pay A Dividend?

Despite the lack of a dividend, we expect solid total returns of 8.6% per year over the next five years, due to earnings growth and a rising P/E multiple.

Mega Cap Stock #6: JP Morgan Chase (JPM)

JPMorgan was founded in 1799 as one of the first commercial banks in the US. Since then it has merged or acquired more than 1,200 different institutions, creating a global banking behemoth with more than $110 billion in annual revenue. JPMorgan competes in every major segment of financial services, including consumer banking, commercial banking, home lending, credit cards, asset management and investment banking.

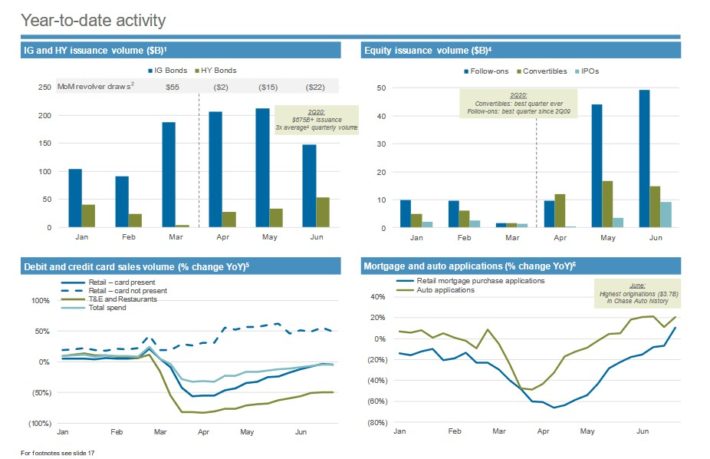

JPMorgan reported second quarter earnings on July 14th, with results coming in better than expectations for both the top and bottom lines. Revenue was up nearly 15% year-over-year to $33 billion, widely beating expectations that called for just over $30 billion. Net interest income came in at $14 billion, which was in line with expectations. However, JPMorgan’s other activities showed much better numbers in Q2.

Source: Investor Presentation

Corporate and Investment Banking revenue was up 66% year-over-year, driven by Markets & Securities revenue, which soared 77%. Fixed Income revenue doubled year-over-year thanks to strength in interest rate products, currencies, emerging markets, and credit. Equity markets revenue was up 38% year-over-year as well, with strong client activity in derivatives and cash equity trading.

Despite all of this strong activity, the bank still added nearly $9 billion to its already-enormous credit loss reserve in Q2. Reserves are taken against projected future losses, as it is clear JPMorgan expects further credit deterioration as a result of COVID-19. As a result, earnings-per-share came in at $1.38 in Q2, up from a loss of -$1.87 in Q1.

We expect 6% annual EPS growth over the next five years, although 2020 will be a challenging year due to the coronavirus pandemic. The stock also has a 3.6% dividend yield. We view the stock as slightly undervalued right now, resulting in total expected returns of 10.3% per year.

Mega Cap Stock #5: Bank of America (BAC)

Bank of America provides traditional banking services,as well as non-banking financial services to customers all over the world. Its operations include Consumer Banking, Wealth & Investment Management and Global Banking & Markets.

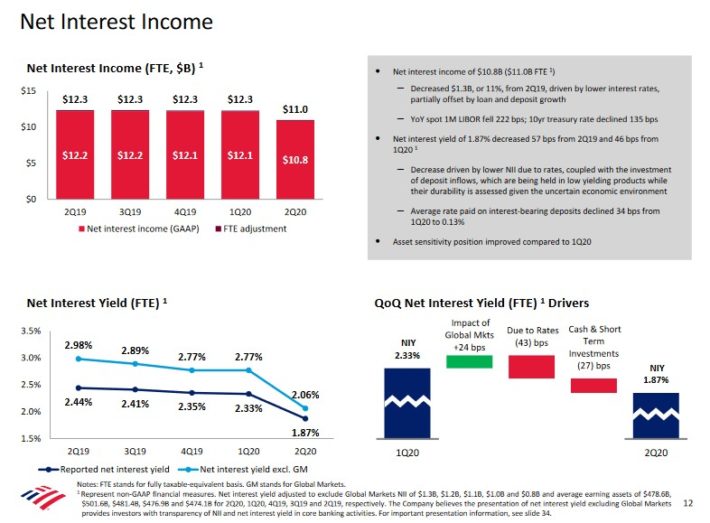

Bank of America reported second quarter earnings on July 16th, with revenue and earnings both coming in ahead of expectations. Earnings-per-share came to $0.37 in Q2, handily beating estimates calling for $0.28. However, earnings fell from $0.40 per share in Q1 and $0.74 per share in last year’s comparable period. Net interest income was $10.8 billion, down from $12.1 billion in Q1 and $12.2 billion in the year-ago period.

Source: Investor Presentation

Non-interest income picked up the slack, however, rising from $10.9 billion in last year’s Q2 to $11.5 billion. Average loans and leases rose from $990 billion to $1,030 billion from Q1 to Q2. Similarly, average deposits were up from $1.44 trillion to $1.66 trillion. Provisions for credit losses came to $5.1 billion, which is on top of $4.76 billion built in Q1, as the bank continues to worry about credit quality during the pandemic and its fallout.

Going forward, Bank of America should be able to remain on track, although the tremendous earnings-per-share growth rate seen in 2018 will not be repeatable thanks to the one-time gains accrued from tax reform.

In the coming years, a couple of factors should provide earnings growth for Bank of America. The first one is that the bank’s loan portfolio keeps growing, consistent with Q2 results. Bank of America is also focused on minimizing expenses, as evidenced by its low efficiency ratio. If this trend continues, Bank of America’s earnings growth will remain higher than the company’s revenue growth rate. We expect 6% annual EPS growth through 2025.

Bank of America also pays a dividend which currently yields 2.8%. We also view the stock as undervalued, leading to our total expected returns of 11.3% per year through 2025.

Mega Cap Stock #4: Netflix Inc. (NFLX)

Netflix Inc. is an American media company founded in 1997. Initially, Netflix’s business centered around DVD rentals through the mail, but in 2010, the company began transitioning to online streaming media. In 2012, in addition to licensing popular films and series, the company started producing its own content.

A few of Netflix’s most popular original shows include Stranger Things, Orange Is the New Black, and House of Cards. As of the beginning of 2020, Netflix had more than 167 million paid subscriptions around the globe and operations in more than 190 countries.

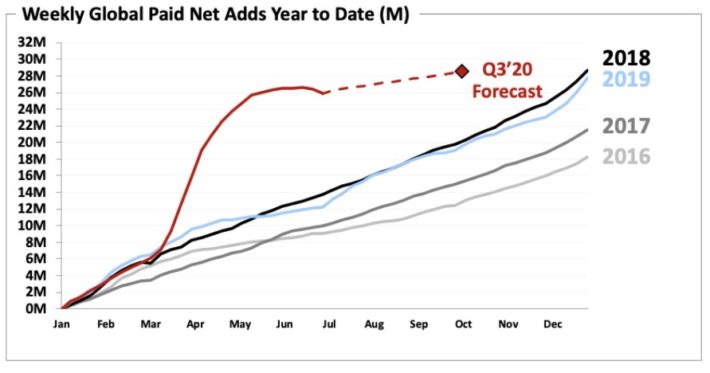

The company released second-quarter results on July 16, 2020. Revenue of $6.15 billion increased 25% year-over-year, as Netflix is one of the rare beneficiaries of the coronavirus pandemic and corresponding stay-at-home trend. Netflix saw an increase of 26 million net new users over the first half of 2020.

Customer additions continue to be the primary driver of Netflix’s revenue growth.

Source: Investor Presentation

Management is also predicting that it will increase to a total of 195.5 million for the third quarter. Net income saw tremendous year-over-year growth of 165.7%. For 3Q20, Netflix expects revenue of $6,327 million, which would be 21% growth year-over-year.

Netflix is one of the premier growth stocks. Earnings have been growing 28.9% for the last ten years and massive growth of 85.6% growth over the previous five years. It also has a long runway of growth up ahead. When Netflix unrolled its streaming services, millions of consumers “cut the cords” to their cable TVs. That trend could continue and ramp up for the foreseeable future. Thus, we expect 25% annual earnings growth over the next five years.

Earnings growth will be the primary driver of future returns for Netflix stockholders, as the company does not pay a dividend.

Related: Will Netflix Ever Pay A Dividend?

We also view the stock as overvalued, and that a declining valuation multiple could reduce shareholder returns over the next five years, perhaps by a significant margin. Overall, we see the potential for annual returns in the 11%-12% range for Netflix stock.

Mega Cap Stock #3: Intel Corporation (INTC)

Intel is the largest manufacturer of microprocessors for personal computers, shipping about 85% of the world’s microprocessors. Intel also manufactures products like servers and storage devices that are used in cloud computing. The company generates $70+ billion in annual sales.

In the 2020 second quarter, Intel reported 19.5% revenue growth. Revenue reached a second-quarter record of $19.7 billion, which was $1.2 billion above analyst estimates. Earnings-per-share increased 29% year-over-year, making for a very strong performance for Intel.

Intel saw growth across multiple areas last quarter.

Source: Investor Presentation

The company’s PC-Centric business increased revenue by 7% to $9.5 billion. This segment continued to benefit from the work and learn at home requirements related to the COVID-19 pandemic as notebook sales more than offset desktop declines.

Meanwhile, Intel’s data-centric businesses grew 34% to $10.2 billion in revenue. Data center sales rose 43% to $7.1 billion, with 47% growth in cloud service provider revenue. The company’s memory business revenue grew 76% to a record $1.7 billion as the 10nm-based Intel Atom saw an increase in demand.

Other areas were negatively impacted by the coronavirus pandemic. For example, the Internet of Things Group declined 32% due to the impact of the COVID-19 pandemic. Mobileye revenue dropped 27% on lower automotive production due to COVID-19.

Shares of Intel declined more than 16% following the release of earnings results. The primary reason for this was the company’s announcement that it was delaying its release of 7nm CPU products by another 6 months. Intel expects the product line to launch in late 2022 or early 2023.

Despite this setback, we believe Intel’s long-term future remains bright. We expect 5% annual EPS growth through 2025 for Intel, consisting of revenue growth and share repurchases. Intel continues to generate strong sales growth, particularly in data-centric areas. And, Intel recently approved a $10 billion accelerated share repurchase which will help boost EPS growth.

With a P/E of 10.2, Intel stock trades below our P/E of 13.0. An expanding P/E multiple, plus the 2.7% dividend yield and future EPS growth lead to total expected returns of 12.8% per year through 2025.

Mega Cap Stock #2: Pfizer Inc. (PFE)

Pfizer Inc. is a global pharmaceutical company that focuses on prescription drugs and vaccines. Pfizer’s new CEO completed a series of transactions in 2019 significantly altering the company structure and strategy. Pfizer formed the GSK Consumer Healthcare Joint Venture with GlaxoSmithKline plc (GSK), which will include Pfizer’s over-the-counter business. Pfizer owns 32% of the JV.

Pfizer also completed a $11 billion deal acquiring ArrayBioPharma. The spinoff of the Upjohn segment was announced as well. Pfizer’s top products include Eliquis, Ibrance, Prevnar 13, Enbrel (international), Chantix, Sutent, Xtandi, Vyndaqel, Inlyta,and Xeljanz. The company had revenue of $51.8 billion in 2019.

In the 2020 second quarter, Pfizer’s operational revenue declined 9%, but excluding the Consumer Health segment divestment, operational revenue declined a much more modest 3% year-over-year. Separately, Pfizer generated 6% operational revenue growth from its Biopharma segment, driven by Vyndaqel/Vyndamax, Eliquis, Ibrance, Inlyta and Xtandi.

Source: Investor Presentation

However, operational revenue declined 31% from Upjohn, because of the loss of exclusivity of Lyrica in 2019 in the United States, partially offset by 17% operational growth in China.

Pfizer’s current product line is expected to produce top line and bottom line growth out to 2025 as a result of acquisitions and R&D investmnets. Currently, Eliquis (cardiovascular), Ibrance (oncology) and Xlejanz (rheumatoid artacritis) are all posting robust sales growth. New launches of Vyndaqel and Inlyta are growing rapidly as well.

Growth will come from increasing U.S. and international sales for approved indications and extensions. On the other hand, growth is offset by patent expirations and also competition for Enbrel and Prevnar 13. Going forward Pfizer has a strong pipeline in oncology, inflammation & immunology, and rare diseases. We are expecting 6% EPS growth out to 2025. Pfizer also pays a solid 4% dividend. In all, we expect 12.8% annual returns through 2025.

Mega Cap Stock #1: AT&T Inc.

AT&T is the largest communications company in the world, operating in three distinct business units: AT&T Communications (providing mobile, broadband and video to 100 million U.S. consumers and 3 million businesses); WarnerMedia (including Turner, HBO, Warner Bros. and the Xandr advertising platform); and AT&T Latin America (offering pay-TV and wireless service to 11 countries).

AT&T takes the top spot on the list due to its strong business model, high dividend yield, and low valuation. It is also a proven dividend growth stock. AT&T has increased its dividend for over 30 consecutive years, placing it on the exclusive list of Dividend Aristocrats. You can see our full list of Dividend Aristocrats here.

AT&T reported second-quarter 2020 financial results on July 23rd. For the quarter, the company generated $40.95 billion in revenue, down 9% year-over-year. The coronavirus pandemic led to declines across the business, including lower content and advertising revenue for WarnerMedia, as well as lower domestic video and legacy wireless revenue. On an adjusted basis, earnings-per-share declined 6.7% to $0.83.

Still, AT&T generated $7.6 billion of free cash flow, which was used to pay down debt, return cash to shareholders, and invest in future growth. AT&T’s net debt-to-EBITDA ratio was ~2.6x at the end of the quarter.

Source: Investor Presentation

AT&T is a colossal business, easily generating profits of $20+ billion annually, but it is not a fast grower. From 2007 through 2019 AT&T grew earnings-per-share by 2.2% per year. While the company is picking up growth opportunities, notably in its recent acquisitions of DirecTV and Time Warner, we recognize the premiums paid and the fact that the company’s legacy businesses are steady or declining. AT&T is optimistic about generating reasonable growth and the payout ratio had been falling, resulting in excess funds to divert toward paying down debt.

Two individual growth catalysts for AT&T are 5G rollout and its recently-launched HBO Max service. AT&T continues to expand 5G to more cities around the country. On June 29th, AT&T announced it had turned on 5G service to 28 additional markets. AT&T now provides access to 5G to parts of 355 U.S. markets, covering more than 120 million people. The company also invested $1 billion in the second quarter to acquire 5G spectrum.

On May 27th, AT&T launched streaming platform HBO Max and generated 90,000 mobile downloads on its first day. HBO Max is priced at $15 per month and offers subscribers approximately 10,000 hours of programming. The new platform is a critical step for AT&T to keep up in the streaming wars.

Shares of AT&T trade for a 2020 price-to-earnings ratio of 9.3, below our fair value P/E of 12. The stock also has an attractive dividend yield of 6.9%. Combined with 3% expected annual earnings-per-share growth, we expect total annual returns of 13.4% per year over the next five years. With its current mix of growth catalysts, deep value and a very high yield, AT&T is the most attractive mega cap stock in our coverage universe.

Final Thoughts

Mega cap stocks offer investors access to the largest and generally most profitable companies in the world. The group tends to hold up better during downturns and offer investors steady streams of revenue and earnings.

Many of the stocks on this list offer investors generous dividend yields as well, but all of them have high prospective total returns. These 10 stocks, we believe, collectively offer investors an attractive blend of growth, value and yield.