Market Buzz and the Fed

Market Buzz and The Fed

It is well known that the Fed is anxious to both normalize rates, and reduce the balance sheet. The recovery from the great recession has been unusually gentle which has forced historically low rates for the better part of the last decade. The Fed understands that the economy is closer to the next recession than it is to the last one, and that it will need more rate-hike ammunition in order to deal with the inevitable downturn. That it only has one or two years, in which to accumulate that ammunition, is the source of its anxiety.

Rates are unlikely to rise at the November 1 meeting, but they are very likely to be higher after the December meeting:

November 1, 2017

December 13, 2017

The Fed has two mandates: to get unemployment below 5%, and keep inflation around 2%. Success in the former mandate came early with unemployment staying close to 4%, however, CPE inflation remains below the Fed’s 2% target. Along with dual mandates, the Fed has dual tools with which to fulfill those mandates: control over short-term interest rates, and quantitative easing (QE). The latter, involves the purchase of mortgage-backed securities in order to prop-up prices and provide liquidity.

QE has been successful, unfortunately, the increased prices and liquidity have been limited to the financial sector while failing to spread through-out the wider economy. The “trickle down” effect has not materialized, inflation has been limited to financial assets only. Stocks and real estate have inflated, but wages have been unable to grow in proportion thereby keeping PCE inflation below the Fed’s desired 2%.

Only fiscal policy is capable of moving money into the real economy, and it is only the government that can effect loose fiscal policy. So far, the government has been unable to act. That inaction — along with other factors, such as technology and demography — has limited the ability of labor, which is responsible for the lion’s share of consumption expenditures, to make inflation-inducing gains in wages. The Fed will raise rates again in December because it simply cannot wait around for the dysfunctional government to get its act together. The Fed needs to get ahead of the curve in preparation for the next recession. And it needs to do that in small steps over an extended time-frame rather than delivering a huge (market destroying) rate increase at the last minute.

There is another decision that will be made shortly concerning the Federal Reserve which is likely to set the markets buzzing. Before president Donald departs for an 11-day trip to Asia on November 3, he is expected to announce his choice for Fed Chairman (Yellen’s term ends on February 3, 2018). This announcement could certainly be a “market-moving moment”, but in turns out that we may not have to wait for the actual announcement for the market reaction to materialize.

In a two-part series scheduled to air on the FOX network this Sunday and Monday, interviewer Maria Bartiromo has the following exchange with Trump regarding the next Fed Chairman:

BARTIROMO: Mr. President who do you want to see running the Fed?

TRUMP: Well as you know I — I’ve been seeing a number of people and most people are saying it’s down to two, Mr. Taylor, Mr. Powell. I also met with Janet Yellen, who I like a lot. I really like her a lot. So I have three people that I’m looking at. And there are a couple of others.

I said I will make my decision very shortly, pretty shortly.

BARTIROMO: Isn’t there a way that you can get Taylor and Powell in there? Because you’ve got a vice chairman opening as well, you can actually put them both in there. Is that in your thinking?

TRUMP: It is in my thinking. And I have a couple of other things in my thinking. But I like talent. And they are both very talented people. And it’s a hard decision. It’s actually a very important decision. People have no — most people have no idea how important that position is. That position is actually — more — a lot of people get rid of the Fed.

Take the Fed out. That’s a very important position. It’s also important psychotically. If the right person is there a lot of good things can happen. I think I’m doing a good job for businesses in that way. People are coming into the country; you saw what happened with Foxconn going to Wisconsin.

There you have it. Do you see why we think the market might start buzzing even before any announcement is actually made?

Equities

As we hypothesized last week, while the Chinese Congress is in progress, most of the stock markets around the world have continued to rise.

Sentiment

The AAII investor sentiment survey was essentially unchanged this week, remaining at 40% bullish:60%bearish/neutral. The wall-of-worry remains in place and the market continues to climb it

{This section is for paid subscribers only}

The Rydex Bear:Bull fund asset allocation ratio continues to move in a bullish direction (lower). Despite being at historic lows, this index can remain at low levels for many more months before a recession arrives. What it indicates, is that we are in the later stage of the bull market, but not yet at the end of the bull market. Any near-term correction that occurs (like the one we expect after the end of the Chinese Congress), will be considered temporary, as opposed to signaling the end of the current bull (chart below).

Technical

{This section is for paid subscribers only}

The long-term moving averages continue to paint a strong bullish picture (chart below).

There is a fractal similarity in the way the dollar and the SPX traded during the tech rally of 1995–2000 and with today’s market. If this pattern continues to form (i.e. the dollar rally), we can expect the longer-term bull market to have significant life left in it (chart below). (We expect to be taking a closer look at these fractals in an Update later this coming week).

Fundamental

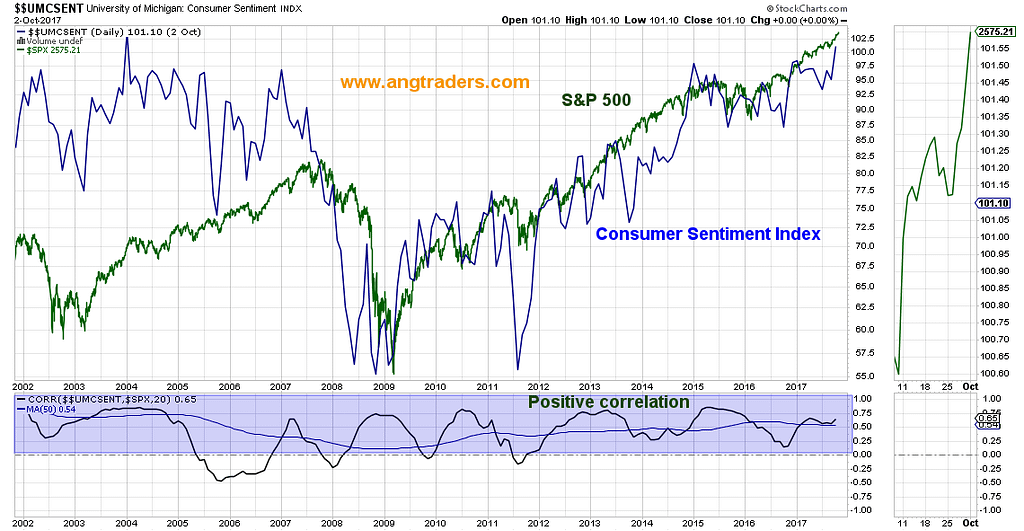

Even though consumer confidence measures are a form of sentiment, the fact that the sentiment refers to fundamental quantities (income and expenditures), we prefer to use it as a fundamental indicator, albeit, a “soft” measure. In any case, there is a strong positive correlation between consumer sentiment and the SPX. The strong showing in the latest numbers from the University of Michigan, demonstrates that the bull market remains healthy (chart below).

{This section is for paid subscribers only}

Gold

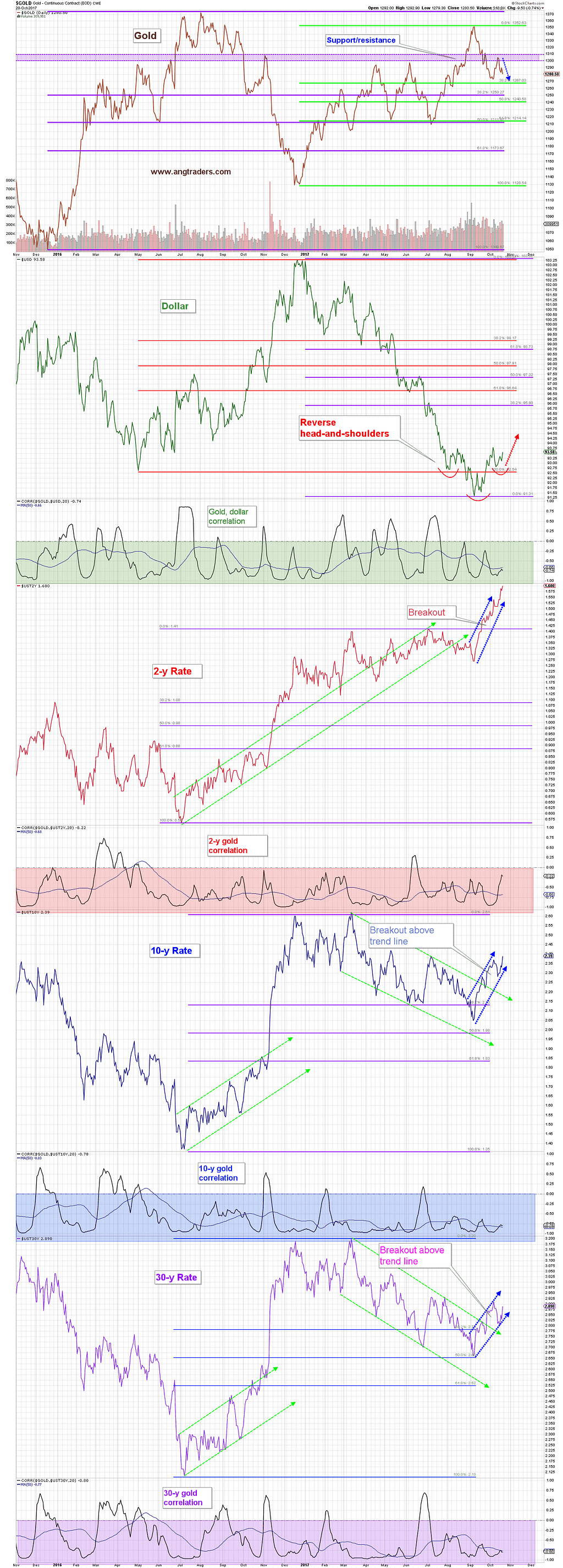

During the week, gold dropped back down from the $1300-$1310 resistance zone as the dollar and rates both rallied. The dollar has strengthened its bullish reverse head-and-shoulders pattern, and rates have bounced off the lower boundary of the rising trend-channel (chart below).

{This section is for paid subscribers only}

{This section is for paid subscribers only}

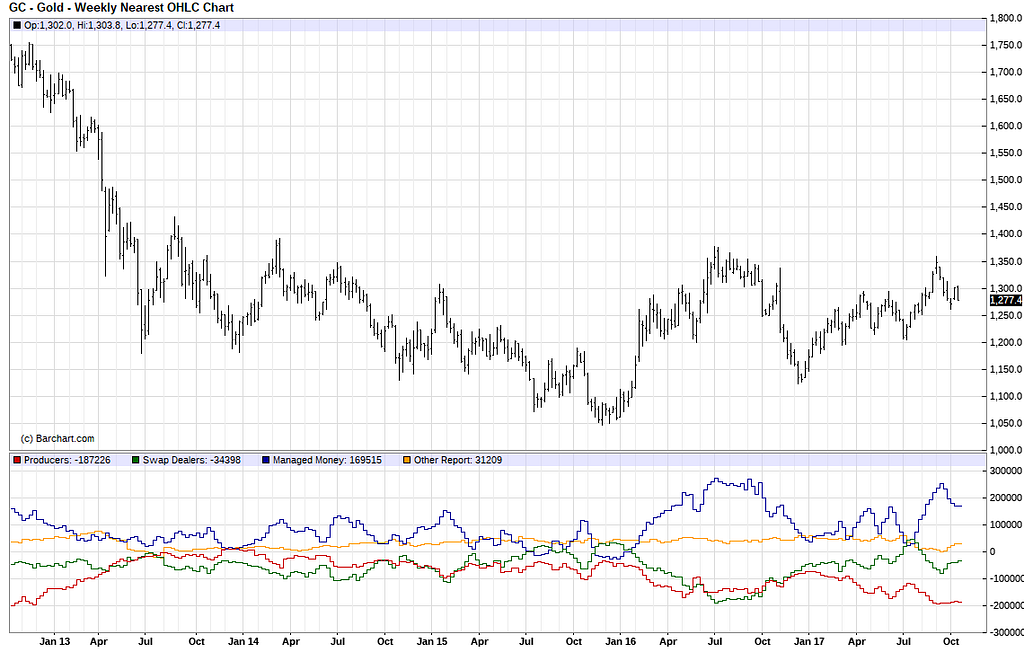

The commitment of futures traders shows that there was essentially no change to the net positioning. The swap dealers and the commercials, maintained their elevated net short positions, and the managed money held their historically high long position. Rallies do not normally start from these elevated levels (chart below).

{This section is for paid subscribers only}

Regards,

ANG Traders

Email queries to [email protected]

Join us at www.angtraders.com and replicate our trades and profits.

Disclaimer:

ANG Traders makes no guarantees concerning the profitability of our trades. Our trade notification service is not intended as investment advice in any way. It is simply providing information about the trades we ourselves are executing. Always consult a registered advisor for assistance with your investments. ANG Traders assumes no liability for any losses that may arise from replicating our trades.

.

Source: Nicholas Gomez