Published on April 28th, 2021 by Nikolaos Sismanis

Founded by Lee Ainslie in 1993, Maverick Capital is a Texas-based long/short equity hedge fund. The fund’s humble beginnings were powered by Mr. Ainslie, raising $38 million in capital by the family of Texas tech-entrepreneur Sam Wyly. Ever since, Maverick has grown into one of the largest hedge funds in the state, holding more than $6.2 billion in total Assets Under Management (AUM).

Investors following the company’s 13F filings over the last 3 years (from mid-February 2018 through mid-February 2021) would have generated annualized total returns of 14.80%. For comparison, the S&P 500 ETF (SPY) generated annualized total returns of 15.50% over the same time period.

Note: 13F filing performance is different than fund performance. See how we calculate 13F filing performance here.

You can download an Excel spreadsheet with metrics that matter of Maverick Capital current 13F equity holdings below:

Keep reading this article to learn more about Maverick Capital.

Table Of Contents

- Introduction & 13F Spreadsheet Download

- Maverick Capital’s Investing Strategy & Philosophy

- Maverick Capital’s Portfolio and 10 Most Significant Holdings

- Final Thoughts

Maverick Capital’s Investing Strategy & Philosophy

Similar to various hedge funds that we have covered over time, Maverick Capital shares little to no information regarding its operations. However, in a 2006 interview, Mr. Ainslie shared quite a bit of insight into how the fund conducts its business. Considering that these are some fundamental principles, it’s more than likely that they remain true to this day.

As he goes on to explain, Maverick’s analysts are initially trying to understand a company’s business model and whether its growth and return on capital are sustainable over the long term. The fund’s goal is to collect and act on high-quality information that the rest of the market lacks.

Maverick’s sector-specialists have decades of experience in the industry, which has helped them develop long-term relationships with various senior management and employees, giving Maverick that extra reach from its competition.

One of the fund’s core catalysts for allocating capital in a company is trust in its management. As Mr. Ainslie explains, excellent management is what matters the most and can often justify buying equities at a seemingly high valuation.

In terms of holding period, Maverick usually intends to hold its stakes from around 1 to 3 years, though this can easily change based on a company’s ongoing performance.

Maverick Capital’s Portfolio & 10 Most Significant Holdings

Maverick’s portfolio is incredibly diverse, holding over 600 individual equities. It seems that its capital allocation focused on creating a highly risk-adjusted portfolio, with multiple sector hedges and a statistics-intensive decision-making process.

At the same time, however, the company’s 10 most significant holdings account for nearly 50% of its total portfolio, which signals strong and clear confidence when it comes to the fund’s high-conviction picks.

Source: 13F Filings, Author

During the quarter, Maverick initiated a position in the following stocks:

New Buys:

- Seer, Inc. (SEER)

- MGM Resorts International, Inc. (MGM)

- ProLogis, Inc. (PLD)

- Chart Industries Inc (GTLS)

- Wynn Resorts Ltd (WYNN)

- Installed Building Products Inc (IBP)

- SQZ Biotechnologies Co (SQZ)

- DoorDash, Inc. (DASH)

In terms of its sector exposure, Maverick holds significant Communications and Technology positions, following COVID-19’s staying-at-home-economy trend while avoiding more volatile sectors like Industrials and Energy.

Source: 13F Filings, Author

The fund’s 10 most significant holdings are as follows:

Facebook (FB)

The social media giant is Maverick’s largest holding, accounting for 7.0% of its portfolio, with the company hiking its position by 19% compared to its previous quarter. The fund’s long-term commitment to Facebook dates back to Q1 2015. Since then, Maverick has built its position gradually, showing great commitment to the company’s investment case. The company is one of the most reasonably valued in the tech/communications sector while still growing rapidly, despite nearly 2.8 billion people using its services monthly.

Facebook is currently enjoying excellent financials, with a net cash position of $62 billion (7% of the market capitalization of the stock). Facebook is one of the extremely few companies that have no debt. This is a testament to the strength of its business model and its perfect execution.

Moreover, even though half of the globe uses at least one of the apps of Facebook on a monthly basis, its user base is still growing at double-digit rates. Facebook delivered an all-time high top & bottom line of $28.07 billion and $11.2 billion, respectively.

For these reasons, it would not be a complete surprise if Facebook paid a dividend at some point in the future.

Facebook remains one of the most cheaply valued growth stocks out there, still retaining 20%+ revenue growth, but trading at a forward P/E of just 26.9.

Applied Materials, Inc. (AMAT)

Applied Materials rose the fund’s second-largest position very suddenly after the equity stake was increased by 158% during the quarter. The company has been capitalizing on the growing demand for semiconductors, seeing steady growth over the past few years. Management has been rewarding shareholders primarily through stock buybacks, having repurchased around 45% of AMAT’s total shares outstanding over the past 15 years. As a supplementary return, the company pays a miniature dividend, currently yield under 1%.

While a quality company, AMAT’s forward P/E has expanded considerably lately, in the low 20s. Considering the cyclical nature of semiconductors, the stock could is likely slightly expensive at its current levels.

The stock accounts for 5.8% of Maverick’s portfolio.

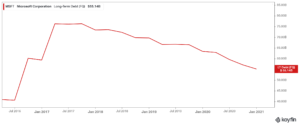

Microsoft (MSFT):

Microsoft’s diversified portfolio of tech products and services has ruled the tech sector’s digital infrastructure. The company’s CEO Satya Nadella has transformed the company into a cloud powerhouse. As a result, Microsoft has managed to accelerate its growth and post all-time high earnings in the last two years.

Microsoft is now a mega-cap stock with a market capitalization of $1.9 trillion.

Supported by the company’s strong profitability, management has been consistently raising buybacks over the past decade, to further reward its shareholders. The amount allocated to stock repurchases has reached new all-time highs over the past four quarters, at nearly $26.1B.

Revenue growth remains in the double-digits, so it’s likely to see capital returns accelerating moving forward. The company is also growing the dividend at a double-digit rate, though at the current yield which stands below 1%, investors should expect the majority of their future returns in the form of capital gains.

Despite that, Microsoft’s cash position has been growing continually, with the company currently sitting on top of a massive $153.28 billion cash pile.

Further, while many companies have chosen to utilize the current ultra-low interest rates to raise cheap debt and buy back stock, Microsoft’s approach has been prudent and thoughtful. Not only are current earnings extensively covering buybacks (59% buyback “payout ratio”), but long-term debt has been substantially reduced from $76 billion in mid-2017 to around $55 billion as of its last report.

Maverick increased its position by 19% during the quarter. It now accounts for 5.5% of its total holdings.

DuPont de Nemours, Inc. (DD)

DuPont de Nemours, Inc. provides technology-based materials, ingredients, and solutions for every industry imaginable that utilizes specialty chemicals. The company comes from the original DowDupont, which was split into 3 separate companies specializing in agriculture (Corteva), materials science (Dow Inc.), and specialty products (DuPont). The massive revenue decline recorded this past year was attributed to the business splitting. The stock currently trades at a rather rich multiple, as the market remains quite optimistic when it comes to the company’s short-term growth.

Maverick trimmed its position by 19%, likely to reduce exposure in what could be considered an arguably overvalued stock in the Industrials sector. Still, its stake accounts for 5.4% of its total holdings. With an average purchase price of around $96, the fund has likely lost money on the stock, on aggregate.

Lam Research Corporation (LRCX)

Semiconductor giant Lam Research was not materially affected by the ongoing pandemic, displaying resilient cash flows in its past quarters as demand for electronics remained sky-high.

Despite Maverick’s massive stake increase happening only recently, the fund has been holding shares since 2016. It has an average purchasing price of around $324, making Lam Research one of its most profitable picks as of lately. Shares are currently trading at all highs, with a forward P/E of around 23.6, which is a relatively pricey valuation multiple for the sector. Hence, investors should be wary about buying at the stock’s current levels. Like Applied Materials, management has been rewarding shareholders primarily through stock buybacks and a tiny dividend.

Lam Research accounts for 5.3% of Maverick’s portfolio and is its fifth-largest position.

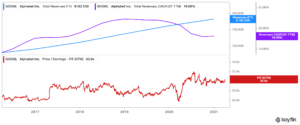

Alphabet (GOOGL)(GOOG)

Alphabet offers several well-known products, such as Ads, Android, Chrome, Google Cloud, Google Maps, Google Play, YouTube, as well as technical infrastructure. While the company’s expansion has lasted for more than a decade and a half, it is still a high-growth stock. The company’s most recent quarter was once again a blockbuster, with both their quarterly revenues and net income hitting an all-time high of $56.9 billion and $15.2 billion, respectively.

The three-year revenue CAGR (compound annual growth rate) currently stands at an impressive 18%, despite the deceleration caused during the first couple of quarters during the initial pandemic outbreak. The company is one of the most attractively priced stocks in the sector as well, trading at around 31 times its forward earnings, despite its consistent growth, massive moat, and strong balance sheet.

With its robust profitability, Alphabet has accumulated a cash and equivalents position of $136 billion. As a result, the company can comfortably afford to burn up cash for its long-term bets, such as Waymo, and in the meantime return ample dollars back to its shareholders. Alphabet has repurchased nearly $32 billion worth of stock over the past year, retiring shares at an all-time high rate.

Maverick increased its position by 7% during the quarter. The stock accounts for around 4.8% of its portfolio.

FLEETCOR Technologies, Inc. (FLT)

FLEETCOR provides digital payment solutions for businesses to manage purchases and make payments. The company provides corporate payments solutions, such as accounts payable automation, virtual cards, employee expense management solutions, etc. FLEETCOR’s revenues have yet to fully recover from the impact of the ongoing pandemic, which is likely attributable to the competition skyrocketing during the past year.

Similar to many of Maverick’s holdings whose management teams focus on stock buybacks as the primary method of capital returns, FLEETCOR uses any excess cash it generates towards repurchasing its own stock.

Due to the competition risks and lack of adequate growth, the stock’s valuation is quite inexpensive compared to its industry peers, which may explain why Maverick increased its position in FLEETCOR by 78%. It is now the fund’s seventh-largest holding, accounting for around 3.9% of its portfolio.

Alibaba Group Holdings (BABA):

Maverick has held its position in Alibaba since Q3-2017, currently occupying around 3.9% of its total holdings. The company recently reported its Q4 results, smashing estimates by delivering revenues of $33.88 billion, a 37.0% growth year-over-year.

While Alibaba remains a highly profitable company, displaying net income margins that often surpass the 30%+ levels, its shares have been recently lagging due to the ongoing concerns surrounding Chinese equities.

The recent incident of Jack Ma’s prolonged and mysterious disappearance is an unacceptable event for one of the largest publicly traded companies in the world, while the Chinese government’s involvement in steering the company’s direction has also been raising questions amongst investors. The stock is currently trading at around 20.5 times its forward net income, to reflect these risks.

With Alibaba focusing on reinvesting all its profits towards growing, investors should not expect an Alibaba dividend in the near future.

The fund increased its position in Alibaba by 15% quarter-over-quarter.

GameStop Corp. (GME)

Maverick initially purchased its GameStop position in Q1-2020. As of its latest filing, it hiked its equity stake by 164%, which now accounts for 3.6% of its portfolio. We believe the most probable reason for Maverick to add to its GameStop is to bet on the possibility of the hype surrounding the stock. The fund has little to lose since it features a phenomenal average purchasing price of $15.5.

1Life Healthcare, Inc. (ONEM)

1Life Healthcare is a membership-based basic care platform operating under the One Medical brand. The company has created a healthcare membership business model based on direct consumer enrollment, as well as employer sponsorship. As of its latest report, 1Life had nearly 550,000 members in 13 markets in the United States as well as 8,000 enterprise clients.

Maverick initiated its position back in Q1-2020, around the company’s IPO. Revenues have been growing consistently amid the recurring nature of its business model, though the company remains unprofitable.

Maverick trimmed its position by 7% during the previous quarter, likely to book some profits off of the stock rally over the past year.

Final Thoughts

Maverick’s operations and investing principles remain relatively unknown. Still, Mr. Ainslie’s 14-year old interview sheds plenty of light on how the fund’s capital allocation is executed, including assigning a high significance to a company’s management team.

The fund’s portfolio is quite enormous, containing hundreds of equities. However, the company’s 10 largest significant holdings occupy nearly half of its total AUMs, making for some compelling picks for retail investors to consider.

Additional Resources

Lone Pine Capital’s 37 Stock Portfolio: Top 10 Holdings Analyzed

Akre Capital’s 26 Stock Portfolio: Top 10 Holdings Analyzed

Slate Path Capital’s 20 Stock Portfolio: Top 10 Holdings Analyzed

Appaloosa Management’s 35 Stock Portfolio: Top 10 Holdings Analyzed

Viking Global’s 75 Stock Portfolio: Top 10 Holdings Analyzed