Updated on June 17th, 2020 by Josh Arnold

Investors can buy stock in companies of all shapes and sizes thanks to the diverse offerings available in the stock market. Companies with market capitalizations of $10 billion or more are considered large-caps. Small-caps have market capitalizations below $2 billion.

However, there are even smaller companies that trade in the United States. For example, micro-caps are generally companies with market capitalizations of $300 million or less.

Cross Timbers Royalty Trust (CRT) is a micro-cap, and a tiny one at that—it has a market capitalization of just ~$45 million. Its market capitalization is minuscule, but its dividend is quite large. Cross Timbers stock has a high dividend yield above 12%.

Plus, Cross Timbers pays a monthly dividend. Sure Dividend has compiled a database of the 56 monthly dividend stocks (along with important financial metrics such as dividend yields and payout ratios) which you can access below:

Despite its high yield and monthly dividend payouts, Cross Timbers has a highly uncertain outlook. The company has a very risky business model, and recently cut its dividend. Therefore, only the most risk-tolerant investors should consider buying This article will discuss Cross Timbers’ business model and whether it has appeal for income investors in these tumultuous times.

Business Overview

Cross Timbers Royalty Trust was created on February 12, 1991, and it makes money from two sources. First, income is derived from a 75% net profits interest from seven oil-producing properties in Texas and Oklahoma, operated by established oil companies.

In addition, income is generated from a 90% net profits interests from gas-producing properties in Texas, Oklahoma, and New Mexico. The primary-gas producing field is the San Juan Basin in northwestern New Mexico.

The trust was created to collect net income, then make distribution payments to unitholders based upon that income. Net income received by the trust on the last business day of each month is paid by XTO Energy, a subsidiary of ExxonMobil (XOM).

CRT’s 75% net profits interest is reduced by production and development costs, while the 90% net profits interest is not subject to these costs. Without production and development costs, the 75% net profits interest income is usually only affected by changes in sales volumes or commodity prices.

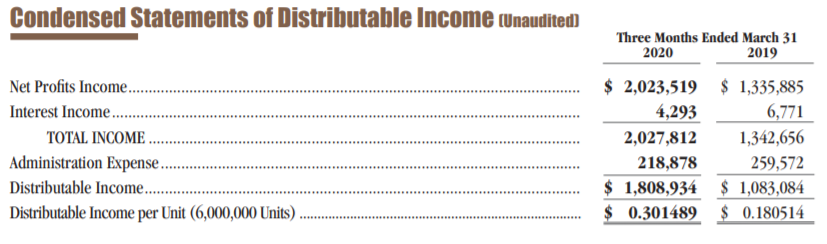

For the first quarter of this year, Cross Timbers was able to significantly increase its distributable income. Net profits income rose by half year-over-year, increasing from $1.336 million to $2.024 million.

The trust saw gains from increased oil and gas production, increased oil prices, decreased taxes, lower transportation costs, and lower development costs. This was slightly offset by lower gas prices and increased overhead, but those small headwinds weren’t enough to overcome a variety of tailwinds in Q1.

Source: First quarter earnings release

The trust used this strong net profits income to boost its distributable income per unit by two-thirds year-over-year, to $0.30 per share from $0.18 per share in the year-ago period.

The first quarter was outstanding for Cross Timbers, but we caution that the decline in oil and other commodity prices in March and April largely did not impact these results. We’re more cautious on second quarter results and beyond, but Cross Timbers had a terrific start to the year.

Growth Prospects

One of the major catalysts for Cross Timbers moving forward would be higher oil and gas prices. Falling commodity prices weighed on the income derived by the trust in recent years. We believe the recent decline in commodity prices will again weigh on the company in the second quarter. Weak commodity pricing will continue to limit distributable income, and therefore, the share price.

Oil is currently below $40 per barrel in the US after a huge swing down and then a modest recovery as a result of COVID-19-related economic weakness. With oil prices strong in the first quarter, Cross Timbers was able to produce a strong distribution. Should oil prices continue to rebound, we see a nice runway of growth ahead.

In 2019, oil prices averaged $53 per barrel, down 11% from 2018’s average price of $59 per barrel. The trust will almost certainly see an averaged realized price much lower than that for 2020. But if the global economic recovery that is already underway continues to gain momentum, 2020 may prove to be the current cycle bottom, and Cross Timbers would benefit in the coming years.

As a result, rising oil prices should be a boost for Cross Timbers, helping to offset some of the damage done earlier this year. There is some reason for optimism in this area—oil prices are rising fairly sharply after a steep collapse earlier in 2020. That would indicate that perhaps the worst has been seen for Cross Timbers at this point.

Cross Timbers has very minimal operating expenses since it is a royalty trust. This means that its operating leverage is huge when revenue rises, such as it did in 2018. Unfortunately, operating leverage works in both directions, so we expect much lower commodity prices in Q2 to drive relatively weak results. However, as stated above, if oil prices continue to rebound, Cross Timbers will accrue significant benefits.

Because of this, oil and gas prices are absolutely critical for the trust’s distributable income, and therefore, its growth is almost entirely dependent upon commodity prices. There isn’t much the trust can do to impact growth, so shareholders should certainly be aware of this. Cross Timbers is a passive play on collecting royalty income and by extension, oil and gas prices.

Dividend Analysis

Since Cross Timbers is a trust, its dividends are classified as royalty income. And since the distributions are considered ordinary income, they are taxed at the individual’s marginal tax rate.

Cross Timbers’ dividends are declared 10 calendar days prior to the record date, which is the last business day of each month.

In 2018, Cross Timber paid cumulative dividends of approximately $1.43 per share, good for a 19% dividend yield on the current share price. However, 2019 saw distributions fall to $0.88 per share, which would be an 11.7% yield on today’s share price.

Distributions have continued to fall in 2020, along with the broader drop in commodity prices. The first quarter saw total distributions of $0.301 cents per share, but the first two monthly distributions of the second quarter have totaled just $0.142 per share combined.

These payments highlight the variable nature of Cross Timber’s distribution – since it is based upon current income for the trust – as well as the impact of declining oil and gas prices. With the rebound in oil and gas prices, we’d expect Cross Timbers to be able to pay at least $0.08 per share monthly for the foreseeable future, so its yield will still be sizable.

However, we note that the trust is entirely dependent upon commodity prices it has no control over. The trust continues to distribute essentially all of its income, as it has since its inception. Dividend coverage is never going to be strong given that Cross Timbers is required to distribute basically all of its income.

Future distribution growth is reliant upon higher distributable income. As a result, the trust’s dividend growth potential is essentially a bet on oil and gas prices. If commodity prices continue to rise, there is a good chance for distribution growth later in 2020 and into 2021. However, weakness noted above in declared distributions for the second quarter will weigh on the full-year amount.

Cross Timbers’ dividend has moved around wildly throughout its operating history, so this isn’t unusual, but it does put some additional pressure on the distributions for the rest of 2020.

The bottom line for Cross Timbers’ distribution is that it is very unpredictable and while the headline yield is enticing, keep in mind there is significant variability in any particular month’s payout, depending on commodity prices and production levels. Investors should keep in mind the risk and volatility associated with oil and gas royalty trusts before buying Cross Timbers.

Final Thoughts

Cross Timbers gives investors a unique way to play potentially higher oil and gas prices in the future, all while realizing monthly income along the way. At the same time, there are risks and unique characteristics that investors should take into account before buying shares of a royalty trust.

Cross Timbers is a micro-cap, meaning it is more volatile and thinly-traded than larger companies. It is also a royalty trust, which carries its own risks.

Finally, Cross Timbers is not a long-term ‘sleep well at night’ dividend growth stock. Future results are dependent upon oil and gas prices and the true amount of reserves in the properties it has interests in.

As a result, Cross Timbers is only a recommended stock for investors who accept the risks of royalty trusts and micro-caps.