Updated on April 4th, 2019 by Josh Arnold

In general, income investors are primarily looking for a high dividend yield, a safe and predictable dividend, and the possibility of dividend growth down the road.

It is hard to find stocks that possess all three characteristics. Some asset classes have a much higher probability of delivering on these goals than others.

Real estate investment trusts – or REITs, for short – can be a fantastic source of yield, safety, and growth for dividend investors.

Dream Global REIT (DUNDF), (DRG-UN.TO) offers investors two of the the three. The company’s 5.6% dividend yield certainly allows it to satisfy the ‘high yield’ requirement.

You can see the full list of ~400 stocks with 5%+ dividend yields here.

Dream Global REIT also pays its dividends on a monthly basis, which is rare in a world where the vast majority of companies pay quarterly dividends.

There are currently only 41 companies with monthly dividend payments, a trait which helps to satisfy the requirement of ‘dividend predictability’. In addition, the payout appears to be quite safe today.

You can see the full list of monthly dividend stocks below:

Dream Global REIT’s exceptionally high dividend yield and monthly dividend payments make it an intriguing stock for dividend investors, even though it has never raised its distribution in its relatively short operating history.

This article will analyze the investment prospects of this REIT in detail.

Business Overview

Dream Global REIT is a Canadian real estate investment trust with globalized operations in Western Europe, primarily focused in Germany.

The trust trades on the Toronto Stock Exchange under the symbol DRG-UN.TO and on the Frankfurt Stock Exchange under the symbol DRG. Dream Global REIT trades in the U.S. under the ticker DUNDF.

Dream Global REIT benefits from considerable size and scale as an owner and operator of European real estate.

The trust owns 228 properties, and has an extensive presence in Europe with 13 offices and ~140 employees in the region.

Source: February 2019 investor presentation, page 4

From an investment perspective, Dream Global REIT offers investors a very interesting value proposition.

The company has strong asset quality and tenant diversification and occasionally operates within strategic joint venture opportunities with other property operators, allowing Dream to leverage its operating platform and global access to capital.

It has boosted its concentration of exposure to Germany in recent years, and as seen above, Germany now comprises about three-quarters of the trust’s gross asset value.

Source: February 2019 investor presentation, page 8

The trust organizes its assets into the four categories seen above, with the vast majority of its gross asset value in the Core and Core+ categories.

These properties are what one might consider a typical target for an industrial or office REIT to target with strong fundamentals and high occupancy rates.

Dream Global also targets redevelopment and build-out opportunities as a form of value investing, wherein it buys a substandard or undeveloped property and remodels it for future use.

Source: February 2019 investor presentation, page 16

Dream Global’s tenant base is also tremendously diversified as it counts more than 1,800 different entities among its customers. The largest is Deutsche Post at 6.5% but no other tenant makes up more than 2.5% of the trust’s portfolio.

This diversification is quite desirable as it means that Dream Global isn’t exposed to any particular group of customers should an economic downturn strike.

Next, we’ll take a look at Dream Global’s growth prospects.

Growth Prospects

Dream Global REIT’s performance in recent times has been quite strong.

For instance, in 2018, the trust boosted its funds-from-operations per share by 9%, and equity per share by 24% over 2017.

Source: February 2019 investor presentation, page 42

The trust also boosted its interest coverage ratio to a very robust 5X from 4.5X in 2017. Dream Global has been on a multi-year journey to improve its balance sheet and it has certainly worked.

Dream Global has managed to boost its growth numbers in recent reporting periods as well.

Source: February 2019 investor presentation, page 9

Total portfolio occupancy is a 91.1% as of the end of 2018, up from 89% at the end of 2017. When looking at only core properties, occupancy is much higher at 95.7%.

Earnings continue to grow over time as comparable property net operating income is steadily moving higher as well.

Looking ahead, Dream Global REIT’s future growth will be driven by the strong real estate fundamentals in Germany (the country where it has the largest exposure).

Simply put, Germany is a very attractive country to do business. The country has an unemployment rate of 3.3% (amongst the lowest in the E.U.), GDP growth of 1.8% and an attractive combination of low vacancy and moderate new property supply.

Source: February 2019 investor presentation, page 17

Dream Global has exposure to some of the strongest economies in Western Europe, which should support future growth.

Dream Global REIT’s international exposure is a key component of this stock’s investment thesis and will be the largest contributor to the trust’s growth moving forward.

Dividend Analysis

Dream Global’s monthly distribution has been $0.06667 per share (in Canadian dollars) since its inception in 2011. While Dream Global hasn’t raised its payout in the past 7+ years, it also hasn’t been cut.

In U.S. dollars, the annualized dividend payout of $0.60 per share represents an attractive yield of 5.6%.

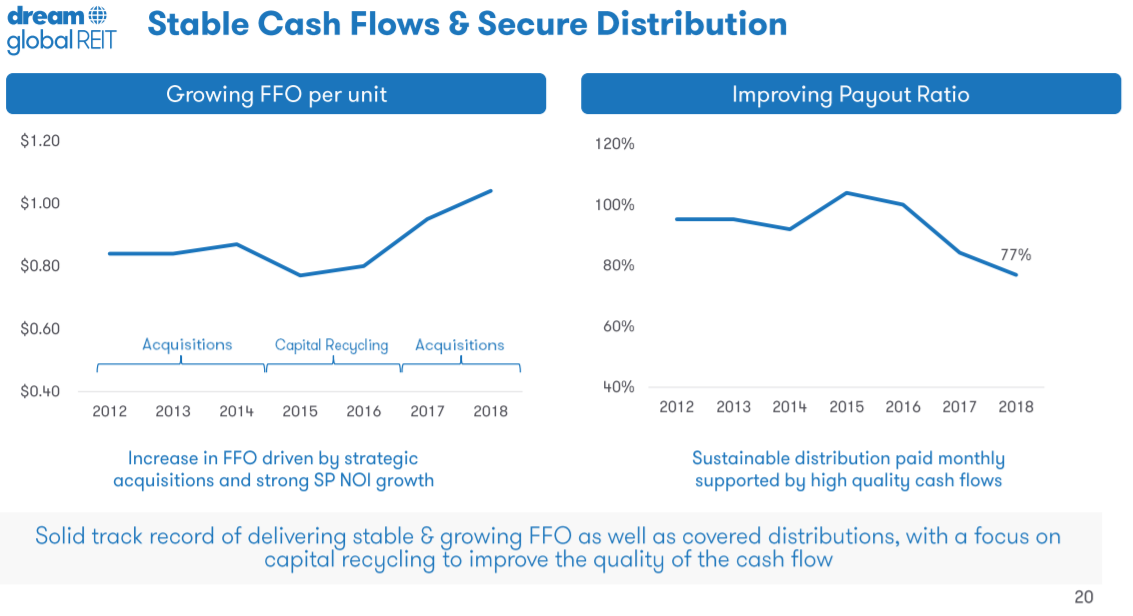

Source: February 2019 investor presentation, page 20

The trust’s FFO-per-share has moved higher in recent years as the trust has focused on building out its portfolio.

That has sent earnings higher and since the payout has been stagnant, the payout ratio is down to 77% as of 2018. For a REIT, that is a very low payout ratio and thus, we believe the payout to be safe.

Dream Global’s low payout ratio and 5.6% yield, in our view, make it quite attractive for income investors.

Final Thoughts

Dream Global REIT’s high dividend yield and monthly dividend payments make it stand out to high yield dividend investors.

Existing Dream Global REIT investors should continue to hold this stock to benefit from its attractive geographic exposure.

However, the shares have rallied considerably off their 52-week low price. As a result, value investors looking to initiate or add to a stake in this REIT should wait for a more compelling buying opportunity.