Updated on June 24th, 2020 by Nate Parsh

Real Estate Investment Trusts, or REITs, are divided into different sub-sectors depending on the operations of the underlying businesses.

Industrial REITs stand out because of their focus on single-tenant properties. While this poses higher vacancy risk than multi-tenant properties, it can also lead to mispriced assets and attractive buying opportunities.

Dream Industrial REIT (DREUF), (DIR.UN.TO) is an industrial REIT which may not be well-known to investors because it operates primarily in Canada and unfortunately has struggled in recent years. Dream Industrial’s share price has declined 23% year-to-date in 2020.

However, Dream Industrial REIT has a high dividend yield of 6.5%, which is more than three times the average dividend yield in the S&P 500. And, the stock pays its dividends on a monthly basis.

You can download our full list of monthly dividend stocks (along with relevant financial metrics like dividend yields and payout ratios) which you can access below:

For retirees and other investors who rely on dividend payments, monthly dividends are far superior to the traditional quarterly payment schedule.

Dream Industrial REIT’s high dividend yield and monthly dividend payments are characteristics that appeal to income investors.

This article will analyze the investment prospects of Dream Industrial in detail.

Business Overview

Dream Industrial is a Canadian-based, industrial-focused Real Estate Investment Trust that operates in two broad divisions:

- Multi-Tenant Properties (63% of net operating income)

- Single-Tenant Properties (37% of net operating income)

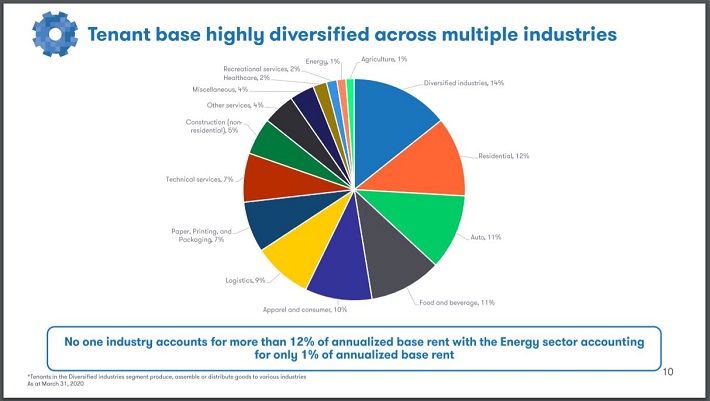

Dream Industrial’s asset base stands out for being highly diversified, with 1,161 total tenants.

Source: May 2020 Investor Presentation, page 20

In addition, its largest tenant is just 3.5% of its total rental revenue, with the top 10 tenants comprising just 16.3% of total rental revenue. This diversification is outstanding among other industrial REITs and also among many other types of REITs with single-tenant properties.

Dream Industrial’s weighted average lease term is also 4.8 years for its top 10 tenants, and 4.1 years for the entire portfolio. This offers the trust a mix of stability and expiring leases that it can charge higher rates on for renewals.

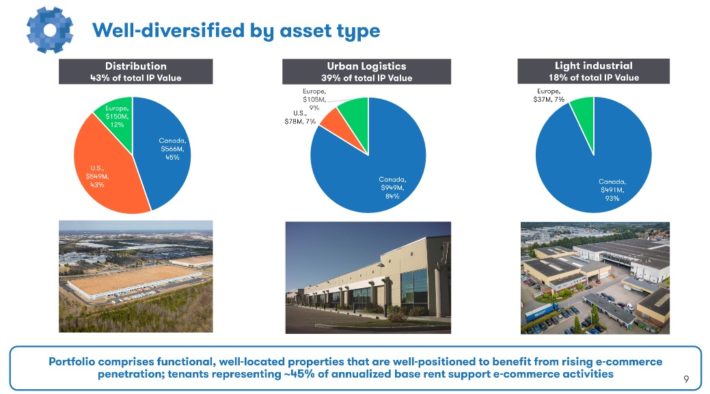

The company’s portfolio is diversified by asset type as well.

Source: May 2020 Investor Presentation, page 28

Dream Industrial’s portfolio is a mix of light industrial (18%), distribution (43%), and urban logistics (39%). The trust’s concentration in Canada is still very high at 69% of total investment property value, with 21% coming from the U.S and 10% from Europe.

Dream Industrial is in the process of diversifying its asset mix, but it will likely remain focused on Canada and on industrial properties.

Growth Prospects

Dream Industrial REIT’s growth depends on the ability to issue new units or issue debt, and invest the proceeds of these capital markets transactions into high-quality industrial real estate assets. The trust is also highly dependent on its ability to source new tenants and renew existing leases in its property portfolio.

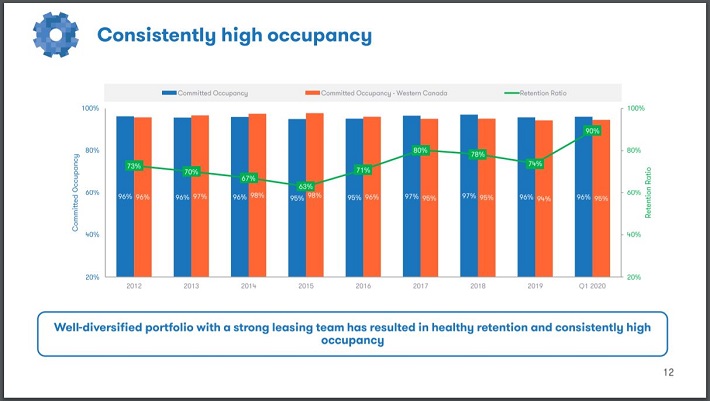

With that in mind, investors should note that the trust has had a very strong level of occupancy since its initial public offering, with an average occupancy of 96% since that time.

Source: May 2020 Investor Presentation, page 12

Its occupancy rate has improved in recent quarters as the trust continues to take advantage of strong fundamentals in industrial properties. Dream Industrial is focusing on the above four long-term growth drivers, in addition to future acquisitions that will build and improve its total portfolio.

The trust is heavily concentrated in Ontario and Quebec, areas in which it has experienced great success in terms of renewal spreads in recent years. It also has contractual rent increases of 1.5% annually, a natural tailwind to rental growth.

Occupancy remains high and is still increasing, and it is constantly managing its renewals to capture higher rents as quickly as possible. Dream Industrial is building its focus on e-commerce properties because the trust sees powerful, long-term tailwinds in that space.

The trust is positioning itself to be a premier provider of space its tenants need to do business in the coming years. Approximately 45% of rental revenues come from businesses that support e-commerce activities.

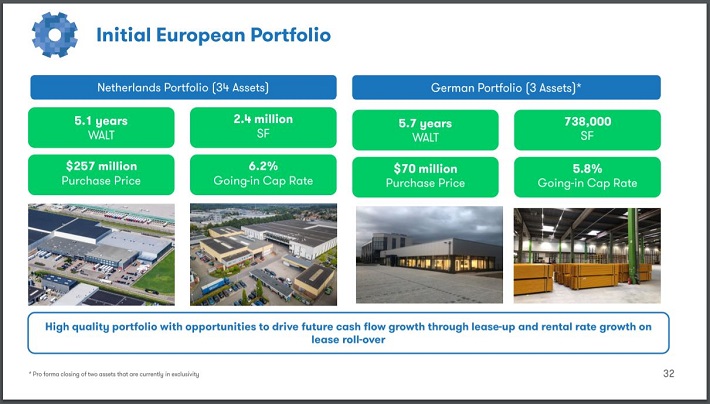

In total, we see Dream Industrial’s growth outlook as quite favorable and supportive of long-term funds-from-operations growth. Finally, Dream Industrial has begun to expand in Europe, with an initial portfolio concentrated primarily in the Netherlands, and also in Germany.

Source: May 2020 Investor Presentation, page 32

Europe is an attractive investment opportunity, as this region has lower levels of e-commerce penetration in comparison to the U.S. and Canada. The population density is also higher in the Netherlands (511 people per square kilometer) and Germany (237) than in North America.

Lastly, Europe is responsible for 22% of world GDP, and holds more than 500 million people. With Dream Industrial just beginning to scratch the surface of possibilities in Europe, the trust has the potential to see a long runway for growth in this region.

Dividend Analysis

Dream pays a current monthly distribution of 5.833 Canadian cents per share on the company’s Canadian listing, DIR.TO. That works out to 70 cents annually in Canadian currency. In U.S. dollars, Dream has an annualized dividend payout of $0.52 per share, which represents a current yield of 6.5%.

Note: As a Canadian stock, a 15% dividend tax will be imposed on US investors investing in the company outside of a retirement account. See our guide on Canadian taxes for US investors here.

In fact, the distribution has never been cut in the trust’s relatively short operating history, but also hasn’t increased it for seven years. The stagnant payout is undoubtedly part of the reason why the share price didn’t move for five years.

The dividend payout is covered, as 2019 saw FFO-per-share of $0.58. That was down from the prior year, but from a dividend coverage perspective, Dream Industrial is in pretty good shape.

Payout ratios for REITs are always very high because they are required to distribute nearly all of their earnings. At 90% in 2019, Dream Industrial’s payout ratio appears healthy and we view it as safe. Distribution growth may prove to be elusive, but we do not see a cut anytime soon.

Final Thoughts

Dream Industrial REIT’s high dividend yield and monthly dividend payments are two reasons why the company will stand out to income investors.

With the yield being slightly higher than it has been in recent years – thanks to a significant decline this year following a surge in share price last year– investors may find the high yield an attractive income possibility.

The REIT has strong fundamentals and a very high occupancy rate. The trust also has the potential for future growth, especially in Europe. Dream Industrial could interest those investors looking for high income and growth potential.