Updated on June 23rd, by Josh Arnold

Real Estate Investment Trusts, or REITs, give investors a hands-off way to participate in the economic upside of real estate. REITs have grown in popularity over time as yield-starved investors seek alternative strategies to generate portfolio income.

One side effect of the growing popularity of REITs is the emergence of specialized REITs, focusing on only one sub-sector of the real estate industry. For example, Dream Office REIT (DRETF), (D-UN.TO) is the largest pure-play office REIT in the Canadian market, with a dominant position in office properties.

Dream makes a potentially compelling investment proposition for investors seeking high levels of regular income for two reasons. First, the stock has a high 5% current dividend yield.

The second reason why Dream is attractive is that its dividends are paid monthly, instead of the traditional quarterly payout. Monthly payments are rare – there are currently just 56 monthly dividend stocks.

You can download our full list of monthly dividend stocks (along with relevant financial metrics like dividend yields and payout ratios) which you can access below:

The combination of Dream Office REIT’s dividend yield and monthly dividend payments will surely catch the eye of high income investors.

However, the company cut its dividend in 2017, and the payout has stagnated since. This article will analyze the investment prospects of Dream Office REIT in detail.

Business Overview

Dream Office REIT is Canada’s largest pure-play office REIT. The trust has a market capitalization of ~$822 million at current market prices. It is part of the Dream Unlimited family of real estate trusts, which also includes:

- Dream Industrial REIT (DIR.UN.TO)

- Dream Global REIT (DRG.UN.TO)

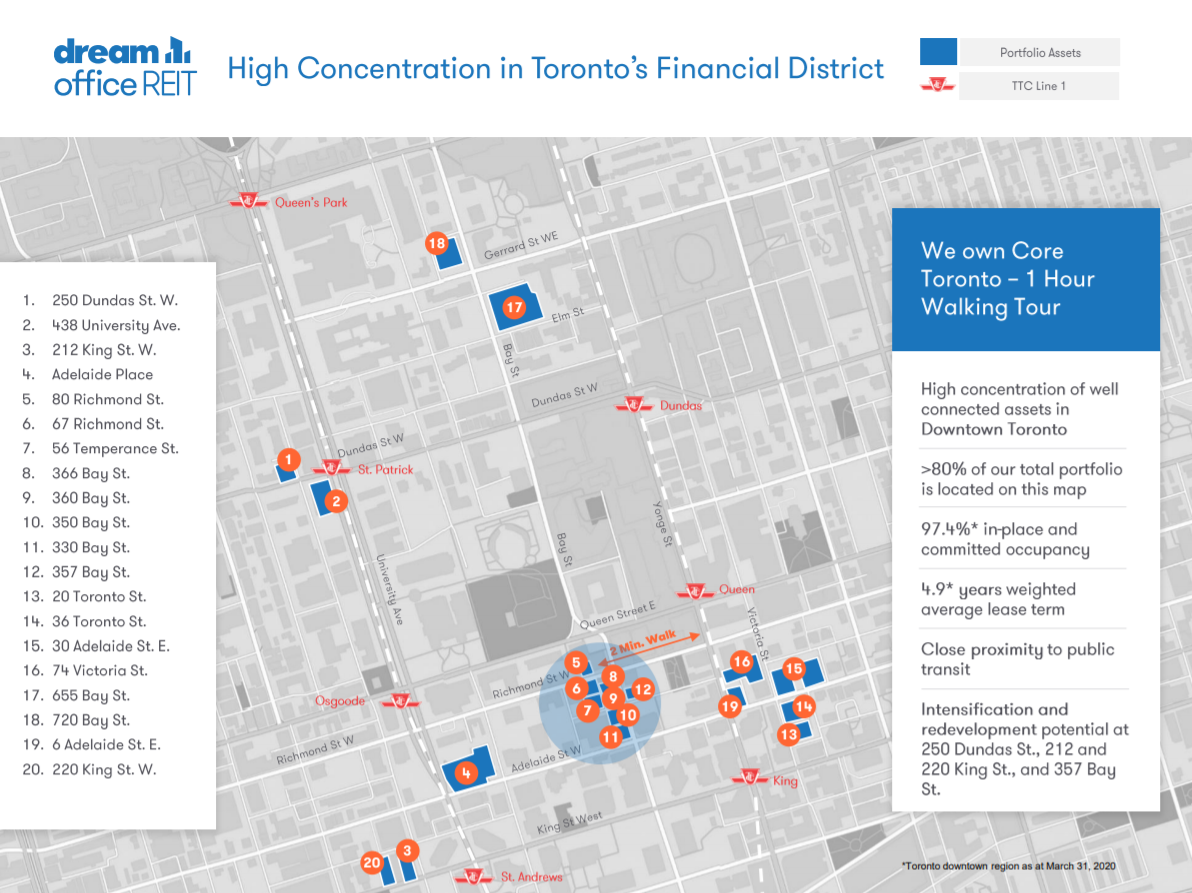

Dream has a high concentration in office space properties in Toronto specifically, owning 3.5 million square feet of downtown office space there. The trust has identified Toronto as having very favorable demographics for office space, and has invested accordingly over the years.

This concentration would generally spook investors given that REIT owners typically would seek out a geographically diversified portfolio, but Dream has made it work.

Source: Investor presentation, page 6

Over 80% of Dream’s total portfolio is shown on this fairly small map of Toronto. The trust has found a small area where it likes the fundamentals and has bet big on continued growth. Its Toronto properties boast 97.4% occupancy and a weighted average lease term of nearly 5 years.

Toronto has quite favorable fundamentals for office space, which is why Dream continues to concentrate its investments there. This is a significant change from just a few years ago, when the portfolio was more diversified. Four years ago, Dream had 166 properties and 50% exposure to Toronto.

Today, it owns fewer than 30 properties and has >80% exposure to Toronto on a portfolio that is worth just $1.4 billion against its former $5.3 billion.

Dream has taken the bold step of significantly decreasing its geographic diversification, but it has very good reasons for doing so.

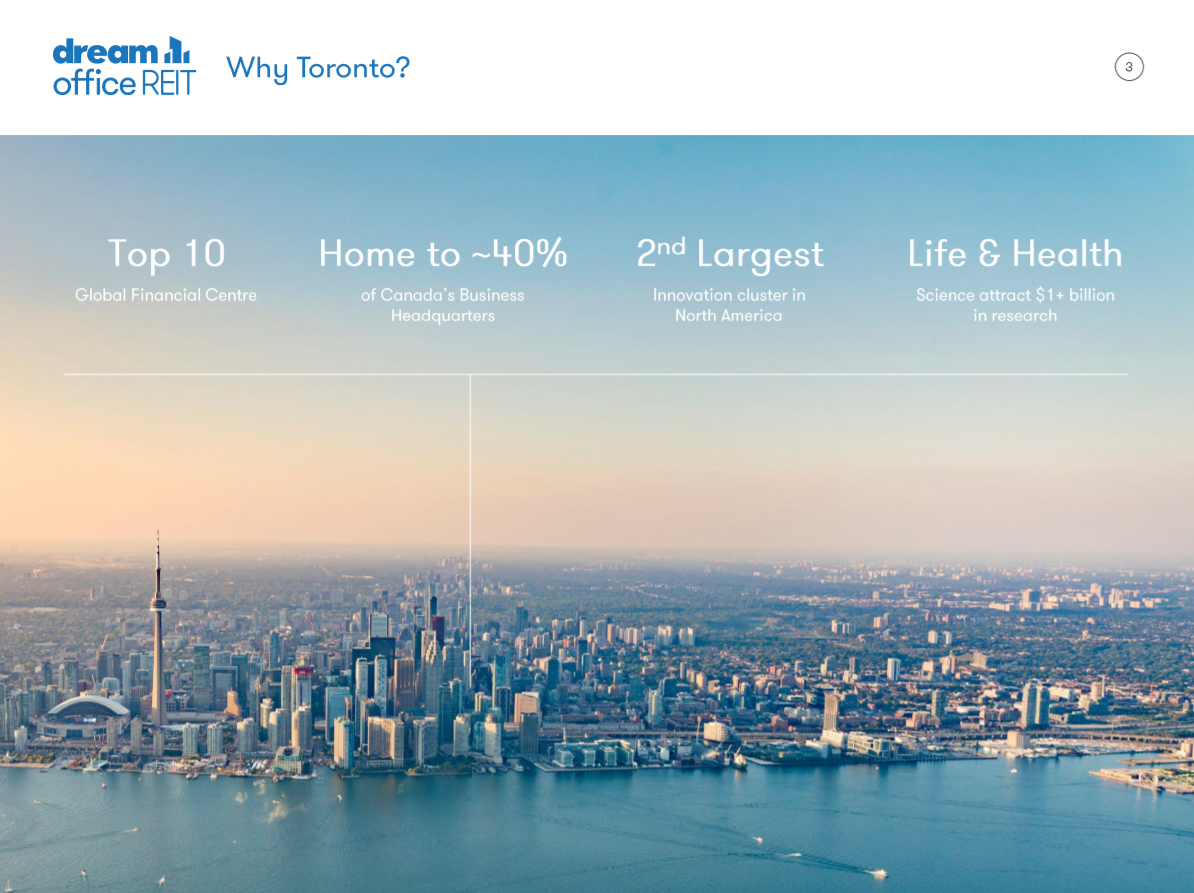

Source: Investor presentation, page 3

Toronto has tremendously strong fundamentals for office space, including low – and declining – vacancy rates. This helps drive pricing higher and this is why Dream has bet big on Toronto.

Generally, we don’t like REITs with high geographic concentrations, but Dream has built a very strong portfolio in a terrific market.

Growth Prospects

Dream’s growth prospects depend upon high occupancy rates in Toronto, as well as rising rent prices. The trust put in place a strategic plan to capitalize on its new concentration in Toronto and invest for the future. Under this plan, the trust sold billions of dollars of non-core assets, shrinking its portfolio and generating cash proceeds in the process. It used this transformation to improve unit pricing as well as enhancing its exposure to downtown Toronto.

The result has been a substantially smaller portfolio, but one that has a much higher rent base, allowed the trust to deleverage, and afforded it the ability to reduce the trust’s share count. This has not only improved the balance sheet, but its funds-from-operations per share as well as the share count has dwindled.

Looking forward, we see pricing growth as the main catalyst for better earnings for Dream. The trust’s expiring leases in the coming years are generally significantly lower than market rents today in Toronto, meaning that Dream has some built-in upside in its rent base in the coming years.

In other words, Dream is locked into prices that are well below market today, but when those rents expire on the schedule shown above, it should be able to achieve much better pricing for the same properties. That should, in turn, drive earnings higher as Dream should experience some operating leverage from higher base rents.

Source: Investor presentation, page 26

The trust’s tenant list is also quite favorable given that government entities are three of its four largest tenants. The governments of Canada and Ontario, respectively, make up almost 20% of total rent for Dream, with a variety of much smaller tenants comprising the balance.

These tenants are quite stable and should renew leases for the foreseeable future. We don’t see Dream’s very high occupancy rate as at risk at this point given its slate of tenants, as well as its class A office properties that are quite desirable.

Dream also owns a huge chunk of Dream Industrial REIT.

Source: Investor presentation, page 4

The interest the trust has in Dream Industrial is worth about $275 million and pays Dream Office a 6%+ dividend yield. Dream Industrial has performed well in recent years.

In short, while we don’t see Dream as producing huge growth numbers in the coming years, it is well-positioned to continue to grow organically from higher base rents. Toronto’s office space fundamentals are more than sufficient to support this growth.

Dividend Analysis

In 2018, Dream produced $1.66 in FFO-per-share, which was down significantly from 2017’s $2.03. Last year, FFO grew to $1.73 per share, highlighting the somewhat unpredictable nature of Dream’s FFO generation.

As mentioned, Dream cut its distribution nearly three years ago, and the payout has been stagnant since then. We don’t see the risk of a further cut today given the low payout ratio and favorable fundamentals, but the fact that the dividend was cut recently means growth may be further out.

We currently expect $1.50 in FFO-per-share for this year, reflecting a negative impact from COVID-19-related weakness. However, coverage is still strong on the current dividend, so we don’t see further cuts as necessary.

The 5% dividend yield is high enough to entice income investors. This is particularly true with the fact that Dream pays shareholders monthly instead of quarterly.

Final Thoughts

Dream Office REIT’s high dividend yield and monthly dividend payments make it appealing to income investors. Its fundamental outlook is also quite favorable, and we see moderate levels of growth in the coming years.

The 2017 dividend cut looms large for investors as the yield is much lower than it once was for Dream. But the current payout is well covered, and we view it as safe, even with COVID-19 impacts. Overall, the stock is moderately appealing for income investors.