Updated on March 21st, 2019 by Josh Arnold

Real estate and dividend stocks are two of the most popular vehicles for creating passive retirement income.

The downside to owning rental properties is that it is not really passive. Any landlord who has had to call a plumber or an electrician during the middle of the night can attest to this.

For investors looking to capture the returns of the real estate sector while benefiting from the hands-off approach of dividend stocks, real estate investment trusts – or REITs – are a very attractive investment vehicle.

EPR Properties (EPR) is one of the most well-known REITs thanks to its strong total return history and large size relative to other REITs.

EPR also has an outsized dividend yield; it currently has a dividend yield of 6%, giving it a place among the select group of stocks with 5%+ dividend yields.

You can see the full list of nearly 400 stocks with 5%+ dividend yields here.

Better yet, EPR Properties pays monthly dividends. This can help retirees and other income investors to budget over small time periods, and also creates a more reliable income stream. In addition, it can help investors that reinvest dividends compound their wealth more quickly.

Unfortunately, there are very few monthly dividend stocks. We’ve compiled a complete list of each of these 41 securities, which you can view below:

This article will analyze the investment prospects of EPR Properties in detail.

Business Overview

EPR Properties is a triple net lease real estate investment trust that focuses on entertainment, recreation, and education properties.

Triple net lease means that the tenant is responsible for paying the three main costs associated with real estate: taxes, insurance, and maintenance. Operating as a triple net lease REIT reduces the operating expenses of EPR Properties.

EPR Properties is well known for its total return history. EPR’s publicly-traded common stock has outperformed all other meaningful competitors over the the long-term (which includes the financial crisis of 2007-2009).

Source: Investor presentation, page 4

Looking back further than just the past decade, EPR’s total returns have been very impressive.

Since the REIT became a publicly-traded entity in 1997, EPR Properties has delivered total returns of nearly 1,500% to its shareholders – more than four times the total returns of its competitors, as measured by the MSCI U.S. REIT Index.

Source: Investor presentation, page 6

EPR Properties has driven these total returns by focusing on the ‘white space’ between diversification and specialization.

The trust has identified entertainment, recreation, and education, respectively, as its three large buckets in which it invests. It has then identified attractive sub-segments of those larger segments including movie theaters, ski resorts, and charter schools, as examples.

This focus on the best segments – and the best sub-segments – has afforded EPR such spectacular total returns over time.

The trust’s portfolio is highly diversified within each segment, with 394 locations leased to 250+ tenants in 43 states, DC and Canada.

Source: Investor presentation, page 10

The trust is most heavily invested in entertainment, but recreation is a close second. Those two segments make up more than three-quarters of the total investment value of the portfolio today.

In addition, we can see that EPR is focused in a variety of different metropolitan areas throughout the US and parts of Canada, so it is highly diversified with not only its tenants, but geographically as well.

Source: Investor presentation, page 12

EPR’s three operating segments are all sizable in their own rights, and also boast very high occupancy rates.

The entertainment segment is the largest and has a 98.4% occupancy rate, while a full 100% of the recreation portfolio’s properties are leased, followed by a 97.8% showing from the education business.

A sizable amount of the trust’s net operating income (~39%) comes from Megaplex Theatres, but they are 100% leased and continue to perform very well.

Source: Investor presentation, page 13

EPR has worked in recent years to not only grow the portfolio, but do so in a disciplined way. The total portfolio is nearly three times the size it was in 2007, and the trust has very favorable lease characteristics.

It seeks long-term leases for tenants that have robust rent coverage and it builds in escalators to boost prices over time.

Finally, its portfolio has very low lease expirations in the coming years, so EPR isn’t exposed to a large amount of tenants leaving open spaces.

Growth Prospects

Although an established REIT with a market capitalization of $5.6 billion, EPR Properties still has many opportunities to drive its growth.

In the past, the REIT has grown by making regular property acquisitions in each of its operating segments.

In recent years, the amount of new investment allocated to its two smaller segments (Education and Recreation) has increased notably. This may be a sign that EPR Properties is attempting to diversify away from its dominant Entertainment business.

Indeed, the entertainment segment used to be nearly all of the trust’s portfolio, but is now under 50%.

The reason why the Entertainment segment is such a large component of the greater EPR Properties business is because initially, EPR Properties focused solely on this area of the real estate market. As the trust grows, it has been diversifying its real estate portfolio.

The steady real estate acquisitions made by EPR Properties has translated to fundamental growth in the REIT’s underlying business.

The trust has grown its funds from operations (FFO), revenue, and net income at very strong rates over the last several years.

Source: Investor presentation, page 38

Total revenue has compounded at an average rate of 16% since 2014 while FFO-per-share has risen by 10% annually in that same time frame.

On a dollar basis, FFO has grown at nearly double that rate, but an ever-higher share count – which is a common practice among REITs – has derailed FFO-per-share growth due to significant dilution.

As a REIT, EPR Properties is required by law to pay the majority of its income to shareholders as dividend payments. Thus, the trust has limited capital to reinvest for internal growth. EPR raises capital to fund growth by issuing debt and equity securities.

EPR’s growth prospects remain bright because of its leadership in the segments that it operates in. The trust has a flexible balance sheet, which means it has the capability to issue new securities to raise capital and acquire properties.

Source: Investor presentation, page 40

Last year’s results bear this out as FFO-per-share was up 20% on a reported basis and 22% on an adjusted basis. Revenue was also up 22% while dilution took its toll once again, trimming 6% off of dollar growth in FFO when translated to a per-share basis.

It is possible that more years of strong growth are coming for EPR as its focus on experiences – not retail – are key for long-term growth and differentiate it against competitors.

Dividend History

EPR’s dividend history is impressive, particularly considering that it pays them monthly.

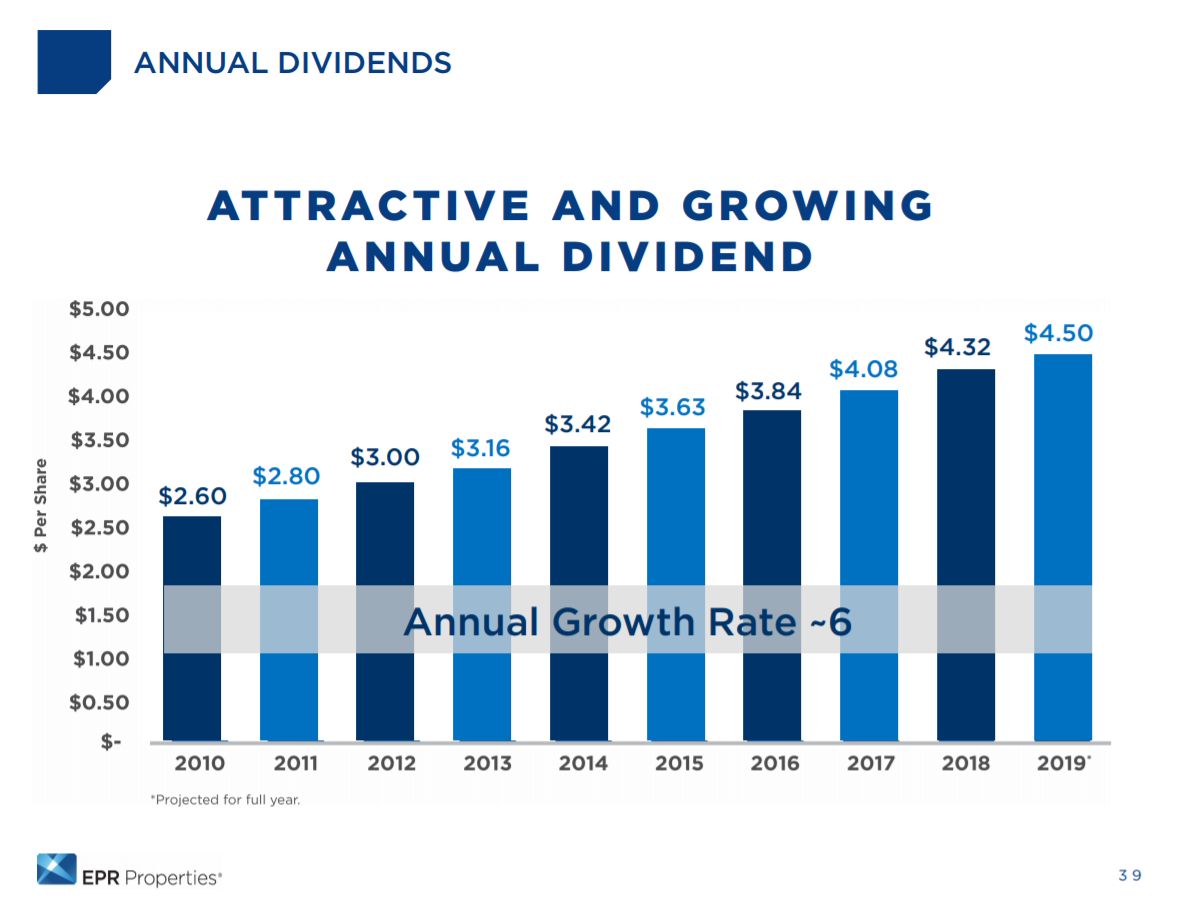

Source: Investor presentation, page 39

The trust’s dividend has grown at an average rate of 6% since 2010 and stands at an estimated $4.50 for 2019. At today’s price near $75, that gives EPR a current yield of 6%.

The trust did guide for $5.40 in FFO-per-share at the midpoint for 2019, so its payout ratio is 83% for this year. That is slightly higher than the high-70s where we usually find EPR’s payout ratio, but the dividend still appears to be safe.

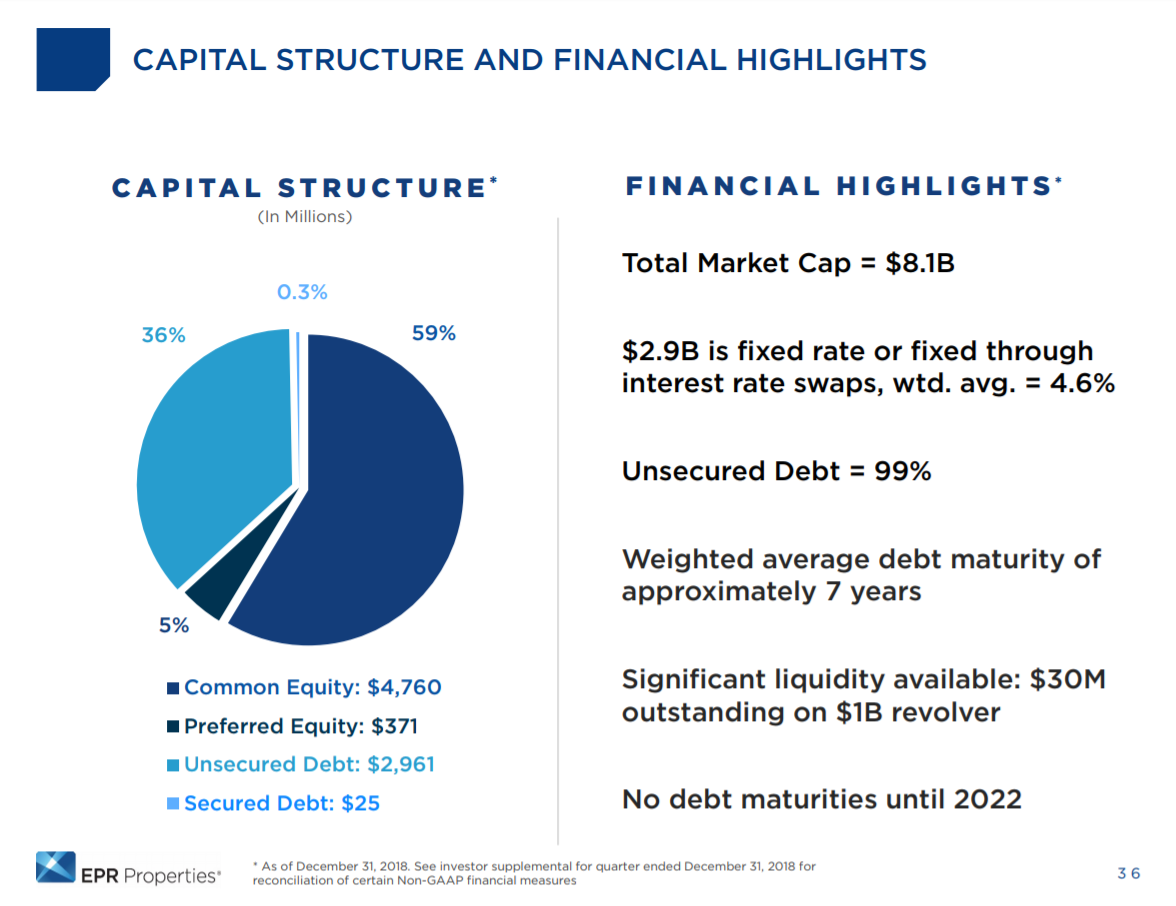

Apart from strong coverage via FFO-per-share, EPR has a reasonably leveraged capital structure that affords it significant flexibility.

Source: Investor presentation, page 36

EPR’s debt totals about $3 billion, compared to about $5 billion in total equity financing.

In addition, its revolver has nearly $1 billion available and untapped, while its debt is nearly entirely unsecured. Finally, its weighted average interest rate on its debt is just 4.6%, so financing costs are far from onerous.

Source: Investor presentation, page 37

Not only that, but EPR has no debt maturing until 2022. That will allow it to continue to invest in the coming years for future growth without undue stress on its financials.

All of this supports EPR’s growth plans and by extension, its ability to not only pay its dividend, but continue to raise it over time.

EPR’s dividend appears to be secure, and it is likely the trust will continue to raise it at meaningful rates over time. This makes the stock attractive for those seeking current income and dividend growth.

Final Thoughts

EPR Properties looks to be an attractive investment right now.

The REIT has a dominant position in the ownership of movie theaters, golf courses, ski hills, and educational institutions.

These are relatively small sub-segments of the real estate industry, and give EPR the benefit of being ‘a big fish in a small pond.’

EPR Properties is also very shareholder-friendly. The trust’s 6% dividend yield and monthly dividend payments are very attractive for investors seeking current income.

In addition, EPR’s fundamentals continue to support payout growth in the years to come.

Based on all these factors, EPR Properties appears to be a good choice for income investors, or investors that are looking for some exposure to the real estate industry.