Published on July 16th, 2020 by Nate Parsh

Monthly dividend stocks are favored for their more frequent dividend payments than the traditional quarterly dividend payers. Eagle Point Income Company (EIC) is a relatively new company that offers shareholders a monthly dividend payment.

There less than 60 stocks that offer a monthly dividend. You can download our full list of monthly dividend paying stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

The stock also offers a dividend yield of more than 11% based on the current share price. Considering the S&P 500 yields approximately 1.9% right now, shares of Eagle Income provide nearly six times the income of the broader market index.

However, there are red flags to consider as well. Investors looking for income should be wary of stocks yielding over 10% in particular. While the high yields can be attractive, they can also be a warning to perspective investors as there is often higher risk associated with such a high yield.

This article will explore Eagle Point business model, potential for growth and the company’s dividend.

Business Overview

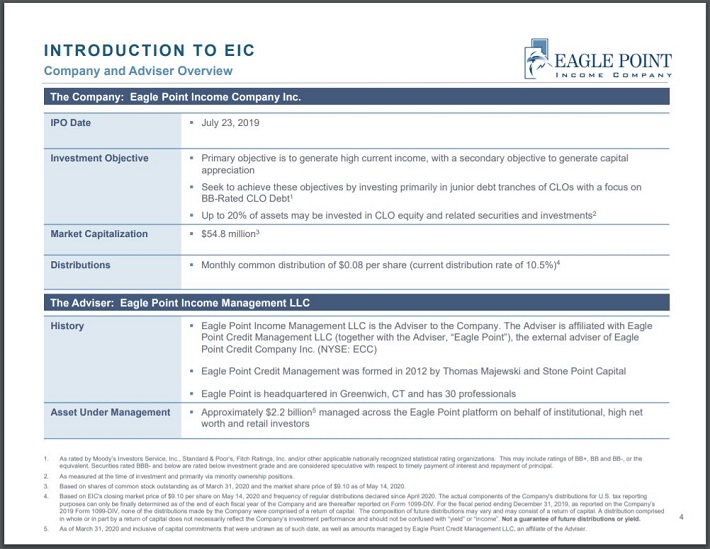

Founded in 2012, Eagle Point had its initial public offering on July 23, 2019. Eagle Point is a closed-end investment company. This means that shares of Eagle Point trade like any typical equity, with rising and falling share prices throughout the trading day, but the company will not issue additional shares.

The company will also not repurchase shares. Unlike exchange traded funds, Eagle Point will not see an influx of new capital, which allows the stock to trade more like an individual stock.

Source: Eagle Point Income’s May Investor Presentation, slide 4.

Eagle Point lists its primary investment objective as generating high current income. This should appeal to income investors as the company’s main focus is producing dividends for shareholders. Capital appreciation is the secondary objective.

The company primarily invests in junior-debt tranches of collateralized loan obligations, or CLOs. Tranches are pooled collection of securities, often debt instruments, that are organized by risk or other characteristics and marketed to investors.

Unlike a traditional fixed income product, such as debt of a corporation or municipality, Eagle Point owns collateralized loan obligations. This means that the company owns the securities issued by a CLO. Eagle Point may also invest up to 20% of total assets in CLO equity securities and related securities.

Due to the junk credit rating on most CLO issues, which are those rated BBB and below by Standard & Poor’s, funds like Eagle Point are incredibly risky. The lower the credit rating, the higher likelihood of default. To help offset this risk, CLO funds often distribute the risk by owning a wide variety of differing CLOs.

Eagle Point has exposure to nearly 1,300 different corporate obligations, so there is diversity among its holdings. The top 10 largest holdings represented just 6.1% of the company’s total CLO debt and equity portfolio in the most recent quarter. The top holding accounted for just 1.3% of the total portfolio.

Growth Prospects

While there are inherent risks when dealing with debt obligations that are below investment-grade, Eagle Point does have several positives in its favor.

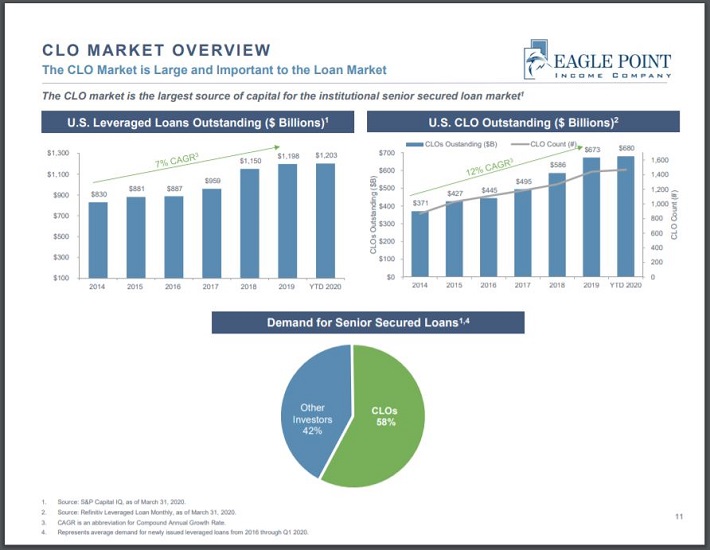

Demand for leveraged loans and CLOs has been considerably higher over the past few years, but CLOs have grown at a much faster rate.

Source: Eagle Point Income’s May Investor Presentation, slide 11.

Loans outstanding in the U.S. increased with a compound annual growth rate, or CAGR, of 7% since 2014. Over that same period of time, CLO outstanding has grown from $371 billion in 2014 to $673 billion last year, which computes to a CAGR of 12%.

CLO demand is far outpacing loan demand. This is where a company like Eagle Point can find success. With higher demand for its CLOs, Eagle Income could see its business excel and afford to pay higher dividends to investors.

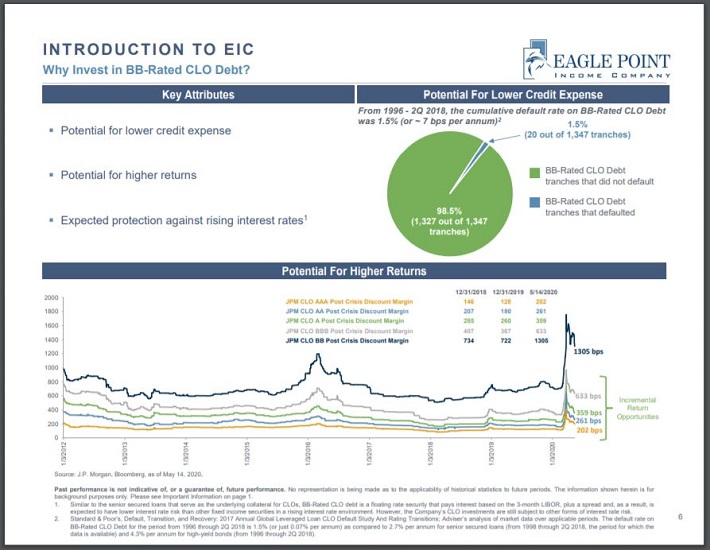

And while the rate of default can be higher in lower-rated debt, Eagle Point focuses on CLO debt that is just under investment-grade. The company invest primarily in the BB-rated debt tranche, which is one spot below an investment-grade credit rating.

Source: Eagle Point Income’s May Investor Presentation, slide 6.

From 1996 through 2018, just 20 out of 1,347 tranches of BB-rated CLO debt defaulted. This equates to a default rate of 1.5% overall or just 0.07% annually.

This default rate shows that the rate of default for BB-rated debt is pretty low over the long-term. It is a riskier business model, but not as much as investors might think.

Dividend Analysis

Eagle Point has paid a dividend every month since inception, but it has fluctuated from month to month and been reduced several times. The first cut was for the second distribution following the IPO which resulted in a 14% decline.

The company maintained the same dividend amount until reducing it by 40% for the payment made this past April. Eagle Point will keep the dividend steady through at least September.

Shareholders received $0.6851 in dividends per share last year following the company’s IPO. Annualizing this dividend and using the year-end closing price of $18.76, shares ended 2019 with a yield of 8.8%.

Through September of this year, shareholders are scheduled to receive $0.8778 per share in monthly dividends. Assuming the current payment remains the same, monthly dividends for the year should total $1.1178 per share.

Eagle Point has also declared two special dividends. At the end of both July and October, shareholders will receive a special dividend in the amount of $0.19 per share. In total, Eagle point should distribute $1.4978 of dividends per share in 2020. This gives the stock a dividend yield of 11.1% based on the current share price of ~$13.50.

Future payments should not be assumed until the company declares the dividend, due to the inherently risk nature of its business model. Investors who require dividends to cover expenses should be concerned that future payments may be reduced.

Final Thoughts

High yielding stocks often come with high risks and that is true for Eagle Point. The company specializes in CLOs, which is risky on its own, but even more so when the debt is rated below investment grade.

It is true that BB-rated debt, which Eagle Point prioritizes in its business, hasn’t experienced as many defaults over the last two decades, but this is still an area that only the most experienced and risk tolerant investor should consider investing.

Eagle Point also doesn’t have a very long track record, having gone public just last July, making it extremely difficult to answer how the company may perform in a recession.

The double-digit monthly yield is attractive as income orientated investors could reap the rewards, but there is no guarantee that the company won’t drastically reduce its dividend once again if its fundamentals deteriorate.

Therefore, Sure Dividend believes that Eagle Point Income Company is best avoided by the majority of investors.