Updated on April 13th, 2022 by Quinn Mohammed

Real estate investment trusts sometimes have high dividends yields in excess of 10%. Ellington Residential Real Mortgage REIT is one such example. The REIT has a massive dividend yield of 12.9% today.

Real estate stocks are a popular choice for creating passive retirement income, but high-yielding stocks can sometimes be a warning sign that significant challenges are impeding the business. For Ellington Residential, as the share price drops due to its circumstances, the dividend yield increases.

Ellington Residential Mortgage (EARN) may not be a well-known REIT. In October 2021, the corporation chose to modify its dividend payment schedule from quarterly to monthly.

That means EARN joins the list of monthly dividend stocks. We’ve compiled a list of 52 monthly dividend stocks, along with important financial metrics like dividend yields and payout ratios, which you can view by clicking on the link below:

This article will analyze the investment prospects of Ellington Residential Mortgage REIT in detail.

Business Overview

Ellington Residential Mortgage REIT acquires, invests in, and manages residential mortgage and real estate-related assets. Ellington focuses primarily on residential mortgage-backed securities, specifically those backed by a U.S. Government agency or U.S. government-sponsored enterprise.

Ellington Residential is headquartered in Old Greenwich, Connecticut. It is a small-cap company with a market capitalization of only $122 million. Ellington Residential Mortgage REIT is externally managed by Ellington Residential Mortgage Management LLC.

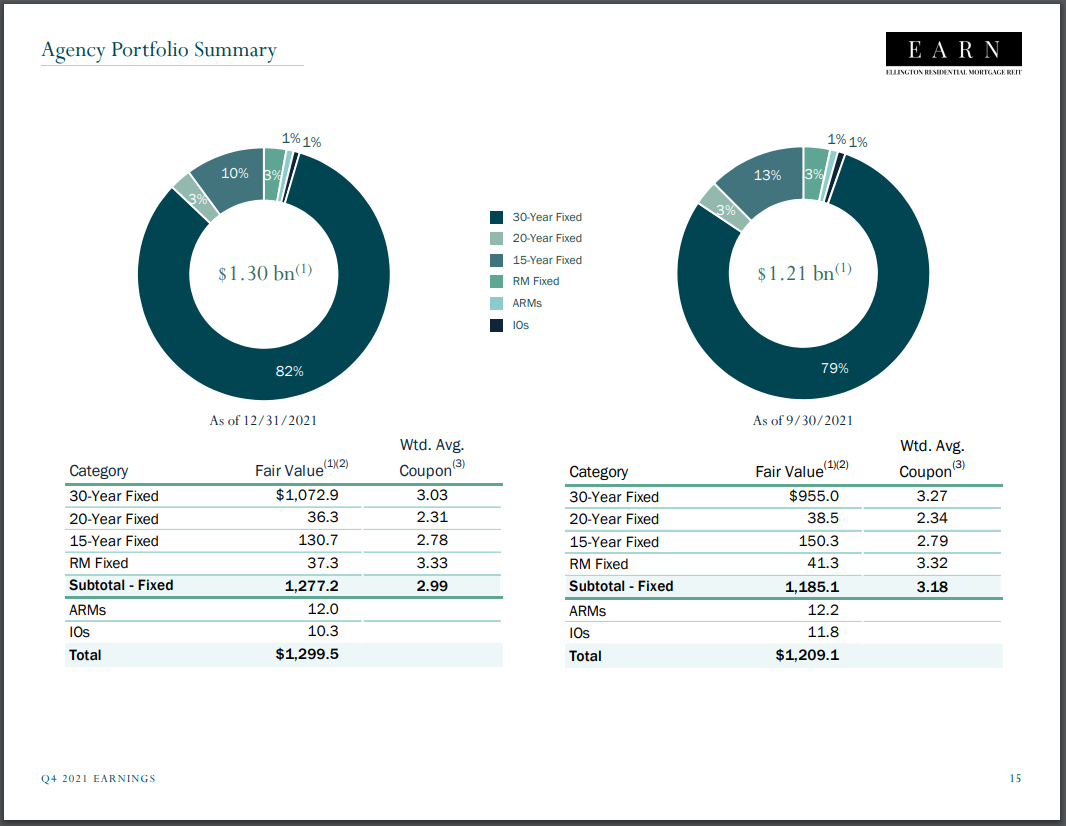

The mortgage REIT has an agency residential mortgage-backed securities (RMBS) portfolio of $1.3 billion and a non-agency RMBS portfolio of $9.1 million. Agency MBS are created and backed by government agencies or enterprises, while non-agency MBS are not guaranteed by the government.

Source: Investor Presentation

On March 7th, 2022, Ellington Residential reported its Q4 results for the period ending December 31st, 2021. The company booked a $(0.21) net loss per share for Q4. Core earnings of $3.7 million this quarter led to core EPS of $0.28 per share, which does not cover the $0.30 quarterly dividend payment.

For the full year, Ellington Residential generated core earnings per share of $1.27 and paid out $1.18 in dividends. For 2021, EARN covered its dividend with a 93% payout ratio.

EARN achieved a net interest margin of 1.81% in Q4. At quarter end, Ellington had $69 million of cash and cash equivalents, and $16.7 million of other unencumbered assets. The debt-to-equity ratio was 6.9x. The company also had a book value of $11.76 per share.

Growth Prospects

Ellington has seen its core earnings per share shrink rather than grow for most of its history. Since 2016, the compound annual growth rate has been -5.8%.

In its first few years, the company held their share count consistent, but following 2016, the number of shares outstanding has grown, which can be another barrier to growing earnings on a per share basis.

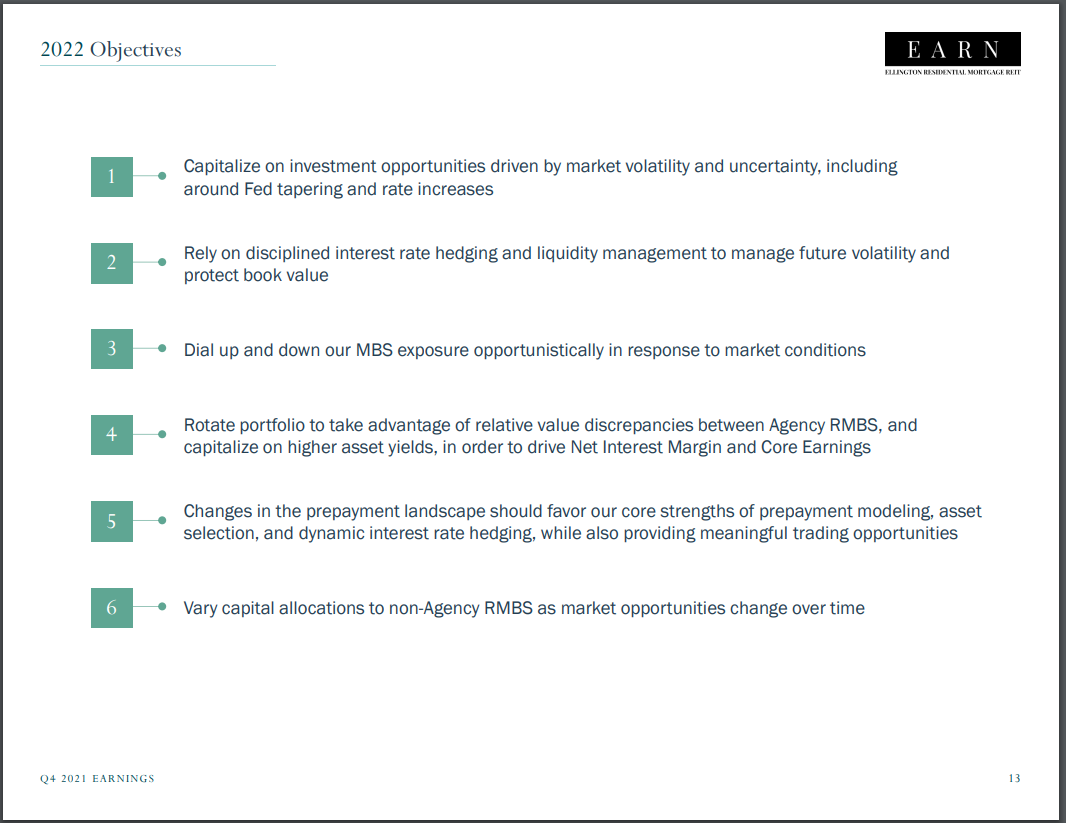

The corporation has a few avenues of growth, which all revolve around optimizing their MBS portfolio. Capitalizing on opportunities driven by market volatility, particularly around Fed tapering, could yield results. The increasing interest rates will also benefit the company in the long-term.

Source: Investor Presentation

Additionally, Ellington will protect their book value through interest rate hedges and liquidity management. Despite this, the company has a poor track record of earnings, leading us to anticipate very little growth of 1.0%. This anemic growth is unlikely to lead to any further dividend increases in the medium term.

Competitive Advantage & Recession Performance

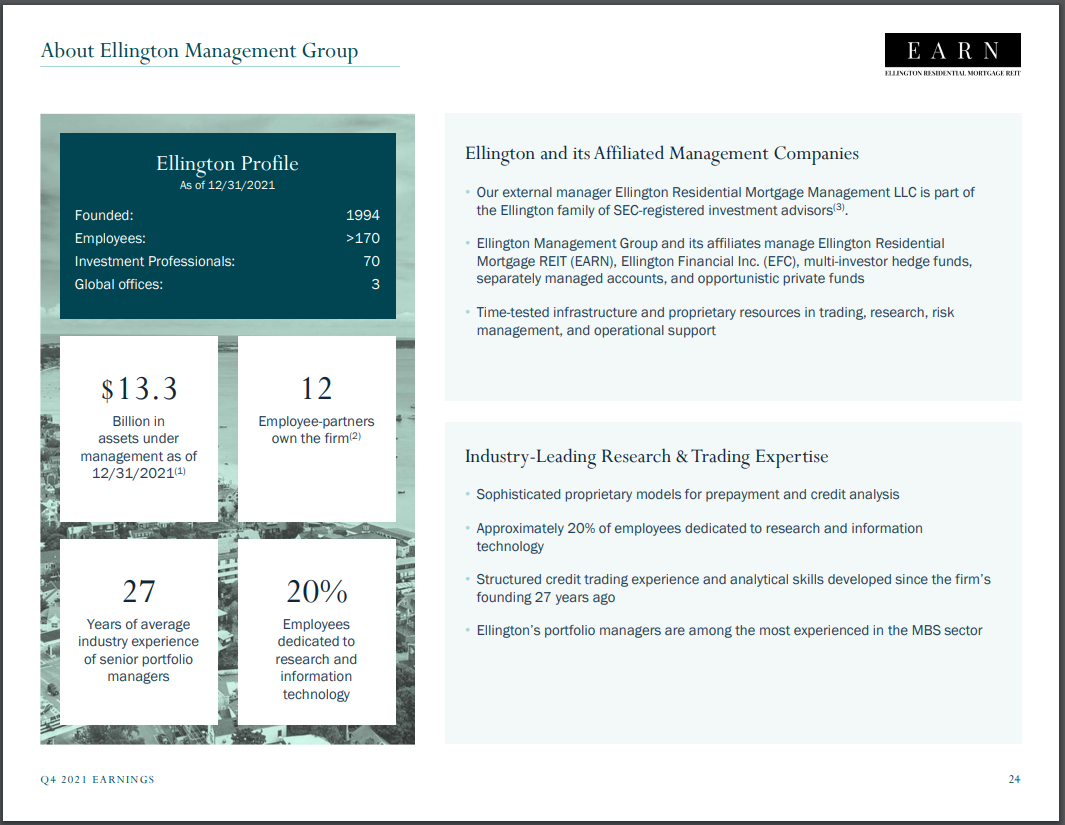

Ellington claims that their portfolio managers are among the most experienced in the MBS sector and their analytics have been developed over the company’s 27-year history. Elligton Management Group is large, with $13.3 billion in assets under management. The group has been around since 1994 and has over 170 employees and 70 investment professionals.

Source: Investor Presentation

The company possesses advanced proprietary models for prepayments and credit analysis. Also, roughly 25% of the company’s employees focus on research and information technology.

While the company’s details were not public in the 2008 real estate crash, a recession of that magnitude would almost definitely affect EARN. It’s focus on government-sponsored MBS provide some safety, but a prolonged recession in the future would likely affect EARN’s bottom line, and result in further dividend reductions.

Dividend Analysis

The dividend has been cut every single year (results from 2013 only account for half the year) in its history with an increase in 2021. Followed by the dividend schedule being modified to monthly over quarterly, which certain shareholders may prefer.

Ellington’s latest dividend increase was a 7.1% raise and is now $0.10 per month. This equals an annual dividend of $1.20.

On an annualized basis, the $1.20 per share dividend is still below the 2018 payout of $1.45 per share. The annual dividend was also higher from 2014 to 2018 than it is today.

Still, at a level of $1.20 per share, EARN stock yields 12.9%. Therefore, EARN stock is still attractive for income investors as a high dividend stock.

EARN’s dividend is far from trustworthy given the corporation has a trail of cuts in the past. In at least three years of the last eight full calendar years in operation, the company’s payout ratio was near or above 100%. Currently, the dividend appears to be stretched, and it may not be covered for the year.

Final Thoughts

Ellington Residential Mortgage REIT has a massive dividend yield of 12.9%, and the company only recently started paying out monthly dividends.

However, Ellington Residential has a long history of cutting their dividend. That, and the fact that the company is anticipating paying out 100% of core earnings for 2022, puts the dividend at risk for another cut.

Ellington Residential may be a fitting choice for high-yield investors with an appetite for risk, but it’s dividend history is far less than stellar. And the dividend today is on shaky grounds.