Updated on March 20th, 2019 by Josh Arnold

Gladstone Land Corporation (LAND) is a Real Estate Investment Trust. REITs are popular investments because they typically pay high dividend yields. Gladstone Land is one of 167 publicly-traded REITs in the Sure Dividend database. You can see all 167 REITs here.

Gladstone Land has an attractive dividend yield of 4.4%, which is more than double the average yield of the S&P 500 Index. In addition, the trust pays its dividends each month, rather than each quarter.

Sure Dividend has compiled a list of all ~40 monthly dividend stocks, which you can access below:

Gladstone Land is a unique REIT. Many REITs own physical buildings across various industries like retail or healthcare.

Gladstone Land, however, owns farmland, as well as vineyards.

This article will discuss the trust’s prospects and why it could be a valuable stock for diversification and dividend income.

Business Overview

Gladstone Land invests in farmland and farm-related properties in the U.S. Its property portfolio currently includes 85 farms, encompassing over 73,000 acres in 9 different U.S. states.

The reported value of the portfolio is approximately $618 million. This compares to the trust’s current market capitalization, which is $224 million at just over $12 per share.

Gladstone Land typically purchases properties and leases them back to farmers, known as sale-leaseback transactions.

Many of its leases are triple-net, meaning the trust receives a steady stream of rental income, while the tenants are also responsible for real estate taxes, insurance, and maintenance expenses.

Some of the trust’s leases also include a revenue-sharing component, based on the crops harvested on the farms.

Source: Investor Presentation, page 6

Gladstone Land’s investment focus is primarily on fresh produce, which it believes is the group with superior long-term fundamentals.

Commodities tend to yield less for farmers, so lessors of the farmland also tend to earn less. Focusing on the best plots of land that are used for the most profitable crops is an advantage for Gladstone Land.

U.S. farmland has proven to be a very strong investment over many years, characterized by stronger returns and lower volatility than other real estate investments, and the S&P 500 Index.

Source: Investor Presentation, page 5

As a result, Gladstone Land generates lots of cash flow, which allows it to pay dividends to shareholders.

Adjusted Funds From Operation, a non-GAAP measure of cash flow, declined 8% in 2018. Adjusted FFO was actually higher on a dollar basis, but the share count rose 29% year-over-year.

Net asset value at the end of 2018 was listed as $12.88 per share, which is moderately in excess of the current share price. Cash distributions rose fractionally year-over-year, coming at 53.2 cents per share in 2018.

Growth Prospects

Gladstone Land has positive growth prospects, because it stands to capitalize on two major long-term trends. First is growth of the global population.

The world population is around 7.5 billion, and strong growth rates are expected to continue. This is a long-term tailwind for those that own farmland as a constantly-increasing population will need ever-increasing rates of food.

At the same time, there is only so much land for farming. In fact, the supply of available farmland is actually decreasing in the U.S., as large amounts of farmland are converted to suburban use each year, for things like housing, schools, and offices.

Source: Investor Presentation, page 4

The combination of falling supply and increasing demand has caused farmland prices to rise steadily for many years.

As the supply and demand trends are not expected to reverse any time soon, Gladstone Land continues to have a strong future growth outlook.

Future growth will be achieved through growth at existing properties, and by investing in new properties. There is plenty of room for future M&A activity.

Source: Investor Presentation, page 15

The U.S. farmland industry is highly fragmented, with significant family ownership. This means the environment for continued acquisitions remains fertile for Gladstone Land.

Gladstone Land continues to make meaningful acquisitions, as seen above, and we believe this is a steady source of growth for the trust moving forward.

This strategy has led to a higher share count over time, with the above-mentioned significant dilution of 2018 as an example, but over time, acquisitions are key to the trust’s growth.

Source: Investor Presentation, page 16

The trust’s assets have grown roughly 8X their starting point at the IPO in 2013 as measured by fair value.

We see smaller rates of portfolio growth moving forward since the period of heavy investment between 2013 and 2017 would be difficult to replicate.

However, Gladstone Land continues to go after strong M&A opportunities, and there is no reason to think its growth will cease.

Source: Investor Presentation, page 17

These fundamentals have led to long-term earnings growth as measured by adjusted FFO, although that growth has leveled off recently.

Revenue has grown by 6.6X since the IPO – in a period of just 5+ years – and adjusted FFO has nearly tripled.

However, adjusted FFO was higher in 2017 than 2018. With the trust’s higher share count, we’d expect adjusted FFO growth to be very low or possibly slightly negative in 2019, despite the long-term fundamental outlook that we believe is positive.

Dividend Analysis

Not surprisingly, Gladstone Land’s dividends will make up a significant portion of total future returns. This, of course, is typical for a REIT.

Gladstone Land currently pays a monthly dividend of $0.04445 per share. The annualized payout of $0.533 per share, represents a current dividend yield of 4.4%.

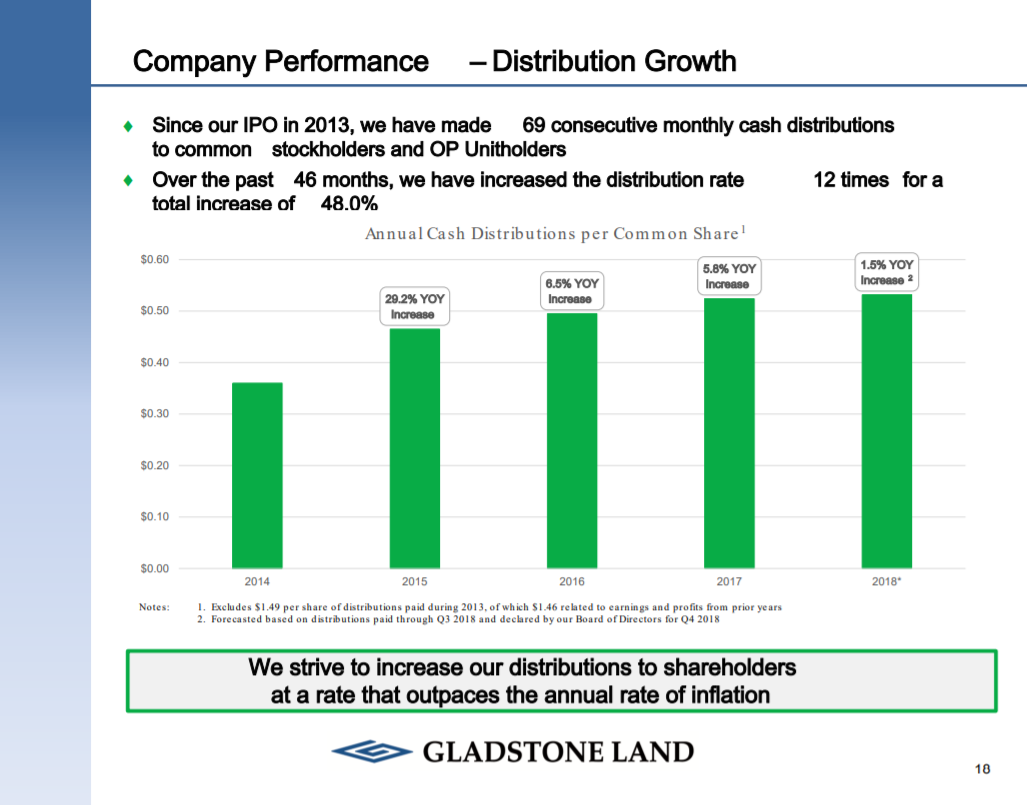

Gladstone Land has a good dividend track record. Since it went public in January 2013, it has paid more than 70 consecutive monthly dividends to shareholders. It has also increased its dividend several times.

Source: Investor Presentation, page 18

The dividend’s safety has been somewhat called into question given the recent lower adjusted FFO and the small increase in the payout.

Indeed, the distribution is currently equal with adjusted FFO from 2018, meaning there is essentially no room for error.

Should Gladstone experience further weakness in adjusted FFO in 2019, the payout ratio will likely be in excess of 100%. For this reason, we are cautious on Gladstone Land given the relative danger the distribution could be in.

We do not believe the payout is going to be cut in the near term, but long-term impairment of adjusted FFO growth could certainly produce that outcome.

Final Thoughts

The rising global population and falling supply of available farmland in the U.S., sets up a very profitable future for Gladstone Land. Supply and demand factors support continued farmland investment.

The trust pays an attractive dividend yield of 4.4%, with the potential for dividend increases at a rate above inflation over time.

While we like Gladstone Land’s long-term fundamentals, we also recognize the rather precarious position the dividend is in at the moment.

As a result, we believe investors should look elsewhere until the dividend’s safety is in a better position.