Updated on March 28th, 2019 by Josh Arnold

Midstream energy companies are widely-known to be a source of high-yield dividend stocks.

Midstream operators benefit from favorable economics, specifically the continued need for oil around the world. In addition, midstream companies are less exposed to commodity price risk than their peers in the exploration industry.

Pembina Pipeline Corporation (PBA) is a midstream energy stock that rewards its shareholders with high dividend income.

This Canadian company – cross-listed on the Toronto Stock Exchange and the New York Stock Exchange – currently has a 4.6% dividend yield, more than twice the average yield of the S&P 500.

Pembina Pipeline is unique among midstream oil companies because it pays its dividend monthly. For retirees or other investors that rely on their dividend income to cover expenses, this is highly attractive compared to quarterly dividend payments.

Despite their appeal, monthly dividend stocks are quite rare. You can see the full list of all 41 monthly dividend stocks below:

Pembina Pipeline’s high dividend yield and monthly dividend payments make it an intriguing investment from an income perspective.

This article will analyze the investment prospects of Pembina Pipeline in detail.

Business Overview

Pembina Pipeline Corporation is a Canadian pure-play energy infrastructure company based in Calgary, Alberta, Canada.

With a market capitalization of $19 billion, Pembina has significant size and scale. Pembina has a phenomenal track record of delivering outsized total returns.

Pembina’s ten-year total return performance is compared to its benchmark – the S&P/TSX Energy Infrastructure Index – in the diagram below.

Source: March 2019 investor presentation, page 40

The company’s total returns in the past decade are roughly double that of its benchmark, reflecting 19% annual compound growth, including 5% average dividend growth.

Pembina’s track record is outstanding in terms of returning cash to shareholders and growing profitably.

The company also has an integrated and growing geographic footprint in Western Canada.

Source: March 2019 investor presentation, page 6

The company’s value chain is also highly attractive, as seen below.

Source: March 2019 investor presentation, page 7

Pembina has a fully integrated value chain for natural gas, natural gas liquids, crude oil, and condensate. It also has growth opportunities, including its Canada Kuwait and Jordan Cove projects, among others.

Another attractive trait about Pembina is that the vast majority of its profits come from fee-based revenue, which is much more stable and predictable than non-fee revenue.

Source: March 2019 investor presentation, page 19

Pembina’s adjusted EBITDA used to be 77% fee-based, but is slated to be 87% this year. This creates a highly stable platform from which Pembina can invest in growth and, importantly, support the dividend.

Growth Prospects

The historical growth of the Pembina Pipeline Corporation has been nothing short of amazing.

Source: March 2019 investor presentation, page 11

Pipeline capacity is up about six-fold since 1997. Pembina has been on a years-long transformative journey to expand capacity and the results have been outstanding.

In addition, there is more capacity coming through some sizable projects in the works.

The company has a strong growth runway. There are many areas of the energy infrastructure business that Pembina has not penetrated.

Source: March 2019 investor presentation, page 25

This chart shows the billions of dollars the company has in new projects the coming years, including some that are well in progress.

These projects should continue to fuel growth in the next few years, driving Pembina’s earnings as they have in the past.

Pembina is working on building out its capacity in a diversified way, expanding currently in crude, NGL, and condensate. Pembina’s recent growth has been focused on natural gas, but now that this is complete, it is focusing on its other sources of revenue.

This includes possible international expansion in the coming years, as the company feels it is reaching some sort of ceiling in Western Canada, and is on the lookout for the next opportunity to grow.

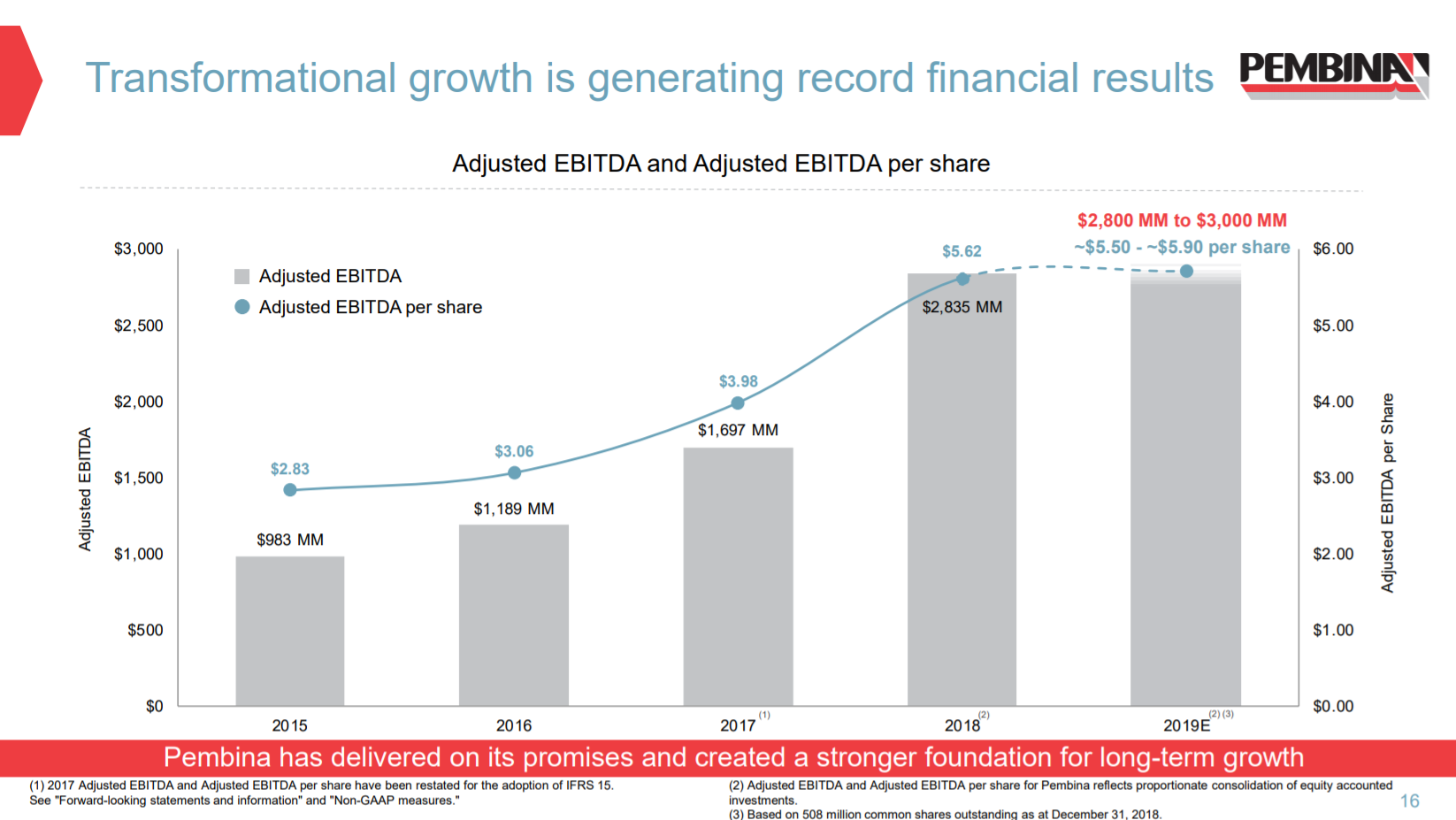

Source: March 2019 investor presentation, page 16

Pembina’s recent growth has been outstanding as the company’s adjusted EBITDA has nearly doubled since 2015.

It expects to see roughly flat profits in 2019 against 2018, but the projects in the pipeline should see growth return in the coming years.

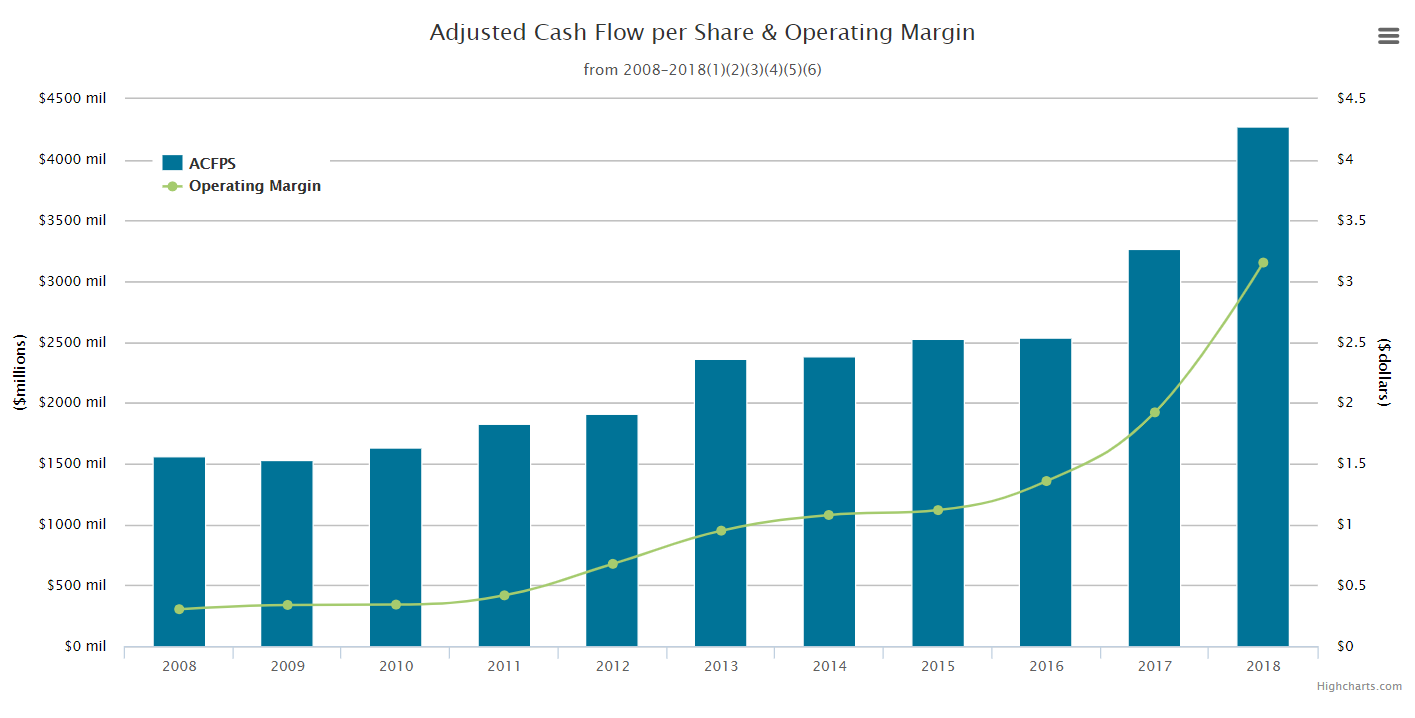

Source: Investor relations

Seen another way, Pembina’s adjusted cash flow per share, which is of particular interest as it relates to the dividend, has moved steadily higher over time.

In addition, operating margins continue to improve, something we believe will continue to occur, although not on the scale it has in the recent past.

We think Pembina can grow its earnings in the mid-single digits annually in the coming years, although this growth won’t be linear.

Pembina’s current business is well-run and highly-profitable but it is also investing for the future. In all, we see Pembina’s growth outlook as strong.

Dividend Analysis

Pembina declared its most recent dividend of $0.1424 per share monthly, good for an annualized payout of $1.71 per share, or a 4.6% yield. Its coverage is also terrific, meaning the dividend is quite safe.

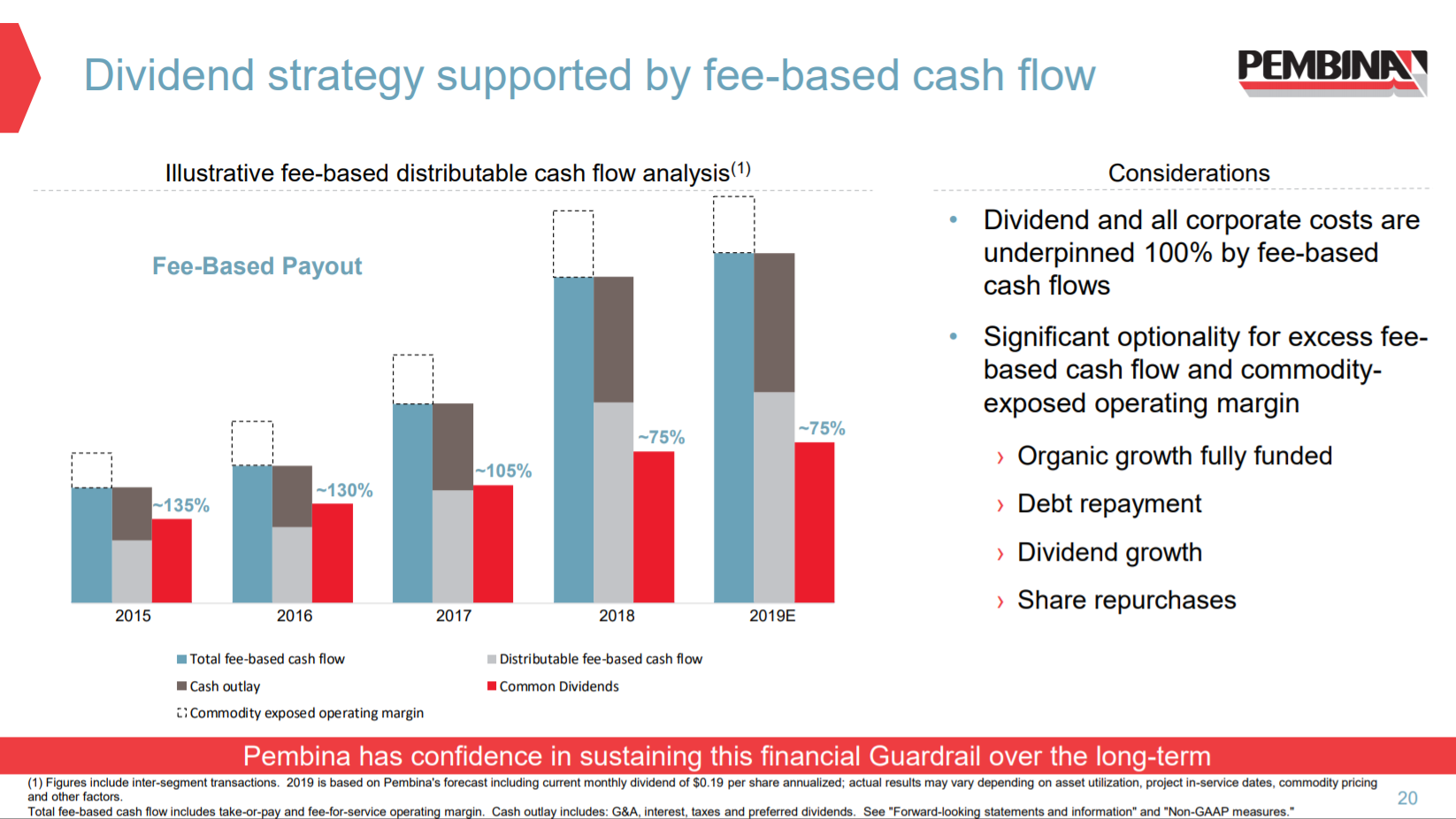

Source: March 2019 investor presentation, page 20

Pembina points out that its dividend and its corporate costs are 100% covered by fee-based cash flows. That is quite the achievement as it means the company’s dividend is covered not only by cash flows, but just cash flows from stable fee-based revenue, not commodity-exposed revenue.

It has also been able to grow in recent years without diluting shareholders, which would have made paying the dividend over a larger number of shares more costly.

Further, it allows Pembina to use its commodity-exposed earnings for debt repayment, growing the dividend, and buying back stock.

We see a long runway for dividend growth ahead as well.

Source: March 2019 investor presentation, page 38

Pembina used to pay out essentially all of its free cash flow, but in recent years, growth in cash flow has greatly outpaced growth in the dividend.

This has not only made the payout much safer, but has increased the runway the payout has to move higher over time. Pembina’s dividend is therefore very highly-rated in terms of not only safety, but growth potential among pipeline operators.

This is a hugely attractive proposition for dividend investors and when one considers the payout is also monthly instead of quarterly, Pembina is in a class of its own.

Final Thoughts

Pembina Pipeline Corporation’s high dividend yield and monthly dividend payments are among the biggest reasons why investors might take an initial interest in the company’s publicly-traded securities.

Looking more closely, Pembina appears to be well-positioned to grow over the mid-to-long term given its robust pipeline of projects on the horizon.

Pembina’s current dividend yield and growth guidance together give a high probability of strong total returns for today’s shareholders.

We see the safe and growing dividend as the principal reason to own Pembina today, and believe it is an attractive stock for income investors.