Published on March 13th, 2019 by Josh Arnold

Real Estate Investment Trusts are popular investments among income investors, and for obvious reasons.

They are required to pass along the vast majority of their earnings in order to retain a favorable tax structure, which results in some eye-popping yields across the REIT asset class.

You can see our full list of publicly-traded REITs here.

For example, Whitestone REIT (WSR) has a nearly-10% dividend yield, which is about five times the average dividend yield in the S&P 500 Index. It is one of nearly 400 stocks with a 5%+ dividend yield.

Not only does it have a very high dividend yield, but it also makes its payments each month. This helps Whitestone stand out, as there are currently just 39 monthly dividend stocks. You can download the full list of monthly dividend stocks from our database below:

Stocks with such extremely high yields can also carry significant risk. As a result, it is critical for investors to make sure the high dividend payouts are sustainable over the long term.

In Whitestone’s case, its tantalizingly high dividend yield may not be sustainable, due to high company debt and weak coverage of the dividend.

Business Overview

Whitestone is a commercial REIT. Its properties are located primarily in the South.

The trust’s properties are mostly in Phoenix and Houston, with smaller allocations to other major cities in Texas. These areas were chosen for very specific reasons.

The company’s acquisition criteria includes community-centered properties that are visibly located in developing and diverse areas.

These properties are typically in densely populated areas with growth potential, focusing on Houston, Dallas, Chicago, and Phoenix.

Source: February 2019 Investor Presentation, page 8

In terms of size, properties are typically in the 50,000-200,000 square foot range, from $5 million to $180 million in cost.

The trust focuses on very specific criteria when it looks to add properties to its portfolio, not the least of which is choosing localities with very high rates of population growth.

The major markets Whitestone serves today all fit these criteria and that is why it continues to invest and expand in those areas.

Whitestone believes its investment properties are “e-commerce resistant” because they are go-to destinations that provide necessary goods.

Moreover, the company believes these are products and services that are not readily available online. In fact, Whitestone sees itself as the least susceptible to online replacement among its peer group.

These properties are located in densely-populated, high-income areas, which are experiencing strong growth. Not only does Whitestone expect its properties to benefit from population growth, but from household income growth as well.

Source: February 2019 Investor Presentation, page 13

Whitestone is well in excess of both peer and national averages when it comes to the household income in the communities it chooses to invest in.

This is very intentional and is a core tenet of the trust’s focused strategy to go after areas that have both high household income, as well as high rates of population growth.

Going forward, the company will continue its acquisition strategy to fuel future growth.

Growth Prospects

Acquisitions are a key piece of Whitestone’s growth strategy. The company abides by several acquisition criteria before purchasing a property, as mentioned above.

Whitestone doesn’t make a great deal of acquisitions, but rather has shown patience in waiting for the right time to step in and buy.

Source: February 2019 Investor Presentation, page 7

The trust has only acquired properties in Arizona and Texas since its IPO in 2010, seeing those areas as the best combination of income and population growth.

It has spent an average of $126 million annually on acquisitions in that time frame, with 2016 being very light, and 2017 making up the difference. On a market capitalization of under $500 million, these acquisitions are fairly significant.

Source: February 2019 Investor Presentation, page 18

The trust’s acquisitions have helped it produce some very meaningful growth, as shown here. Whitestone’s occupancy rate at IPO was just 80%, but today it is closer to 91%.

Its average base rent has also nearly doubled in that time frame and it continues to produce above-average growth rates in comparable net operating income as a result.

The trust’s 2018 earnings showed comparable net operating income growth of 3.3% as its average base rent expanded 2.8% year-over-year. Occupancy came in at 90.5%, up 30bps from 2017.

Whitestone divested five properties in 2018, which helped drive core funds-from-operations, or FFO, down from $1.25 per share to $1.16.

However, those dispositions generated $29 million of proceeds that can be used for paying the dividend, existing property improvements, or acquisitions.

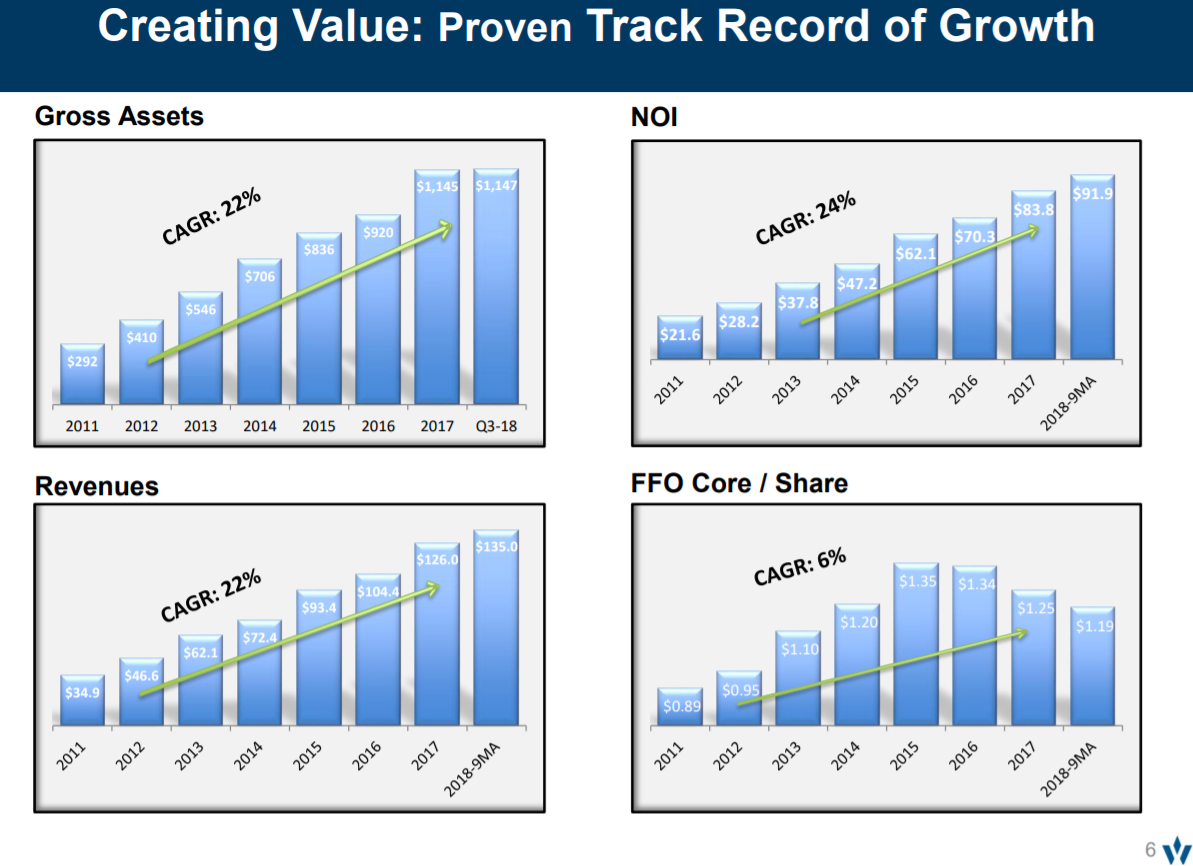

Source: February 2019 Investor Presentation, page 6

All of this has translated into meaningful growth rates over time, although core FFO per share has suffered in recent years. The trust’s asset base and revenue continue to grow at very high rates, as does its net operating income, however.

Guidance for this year is for $1.06 to $1.10 in core FFO as the trust expects to see a higher share count, higher SG&A costs, and lower revenue thanks to 2018 dispositions.

Whitestone’s growth appears to be somewhat in question given these developments as its history of growing asset base hasn’t necessarily translated into FFO growth.

With 2019 shaping up to be another year of disappointing growth, we have less confidence in forecasting high rates of FFO expansion in the years to come.

Dividend Analysis

Whitestone has obvious appeal for income investors because of its very high dividend yield. Indeed, shares yield nearly 10% today.

That said, it is also important to assess a REIT’s ability to pay its dividend, especially with such high-yielding stocks like Whitestone.

The dividend costs $1.14 per share annually, and in recent years, Whitestone’s core FFO per share has covered the payout. Guidance for 2019 would suggest that won’t be the case as the midpoint is below the cost of the dividend. That works out to about $3 million in terms of the deficit.

Any time a dividend isn’t covered by earnings, investors should take notice. This is particularly true for Whitestone given that its FFO is moving in the wrong direction.

Source: February 2019 Investor Presentation, page 22

The trust’s long-term strategy should help with dividend coverage in the coming years. Its G&A costs are still very high, growing again in 2018.

Management has a plan to reduce those costs considerably by simultaneously growing revenue and reducing costs. That will help improve FFO and coverage of the dividend.

In addition, Whitestone wants to reduce leverage given that its debt to EBITDA ratio is 8.5x, which is tremendously high. The trust sees 6x to 7x as a target long-term rate, and getting there will reduce the trust’s debt service expense. This will also help improve dividend coverage over time.

Even given all of this, Whitestone’s dividend is certainly a higher-risk proposition than many other REITs that have their payouts well covered. Even if Whitestone is successful, it may take a couple of years before its FFO covers the dividend again.

We see Whitestone’s yield as very attractive, but also one that carries risk of a cut given the factors discussed here. That, in turn, reduces the attractiveness of the stock.

Final Thoughts

The old saying ‘high risk, high reward’ seems to apply to Whitestone. While the stock has a tantalizingly high dividend yield, it is not without risk.

The current dividend payout looks sustainable for now given that the deficit between the payout and FFO is quite small. Whether the dividend can be maintained over the long-term remains to be seen and has much to do with the success of the company’s long-term plan.

If everything goes according to plan, Whitestone could be an attractive stock for investors looking for income right now, such as retirees.

Whitestone has not raised its dividend since its IPO in 2010, meaning it is not as attractive for dividend growth investors. However, the nearly-10% yield and monthly dividend payments are attractive attributes.

As a result, the decision whether to buy Whitestone stock may come down to the investor’s time horizon and level of risk aversion. We do not foresee a dividend cut at this point, but deterioration in the trust’s portfolio’s performance may result in a cut at some point in the future.