Natural Gas Will Boom in 2025, and Kinder Morgan Is The Play

Natural gas prices are trading near historical lows and will likely remain depressed because supply is so high and capacity is rising, which is good news for Kinder Morgan (NYSE: KMI). According to many sources, demand for liquified natural gas (LNG) is expected to boom due to low prices and the rising need for energy. In this scenario, low prices are bad news for energy producers but good news for midstream operators that make their money on the volume of gas transported, not its price.

The latest forecast is from Wells Fargo (NYSE: WFC), which forecasts LNG capacity to grow by 30% between 2026 and 2028. In their view, supply will grow by 31 million metric tons annually through the decade's end, providing ample business for mid-stream operators like Kinder Morgan. Unlike the LNG producers, it is insulated from the LNG price decline and set up to generate significant growth through volume and capacity expansion as demand for LNG increases.

The latest draw on the electric grid is AI, and demand for AI is robust and unlikely to wane, so there is no end in sight. AI means data centers, which draw lots of power because of AI's computing capacity. AI's power needs rival those of mining Bitcoin, a known power consumer, and there will be far more “hashing power” focused on AI than Bitcoin. Data centers need power but also need to be green, and LNG is the obvious choice as it has long been viewed as a bridge to sustainable power generation.

Kinder Morgan Rises Despite Weak Quarter, Yields 5%

Kinder Morgan’s stock price faltered following the Q2 earnings release but quickly regained its footing because of the robust outlook for LNG demand. The results were mixed, with revenue falling short of the analysts’ consensus, but the margin was strong and sustained the cash flow. Takeaways from the conference call include CEO Kim Dang’s comments that data centers and AI were driving a robust demand outlook. He went on to say that, based on interest in new supply, there was little expectation for demand to slow.

Kinder Morgan transports roughly 40% of the U.S. natural gas supply daily and is well-positioned to benefit from LNG demand increases. demand increases are critical to investors because they will fuel earnings growth and capital return growth over time. The balance sheet is a fortress with net debt running at 1x equity and 0.5x equity, so there are no red flags, and share buybacks are also in play. The company reduced the count by 0.8% on average for the quarter and can be expected to continue lowering it.

Kinder Morgan’s dividend is more than attractive. The stock pays more than a 5% yield after its 20% YTD gain and is a safe and reliable payment. The payout ratio to earnings is troubling—over 100%—but it is offset by free cash flow and distributable cash, which is what matters. The company is on track to hit its $2.26 DCF target, which gives a ratio of 50%.

Analysts Lead KMI Stock to New Highs

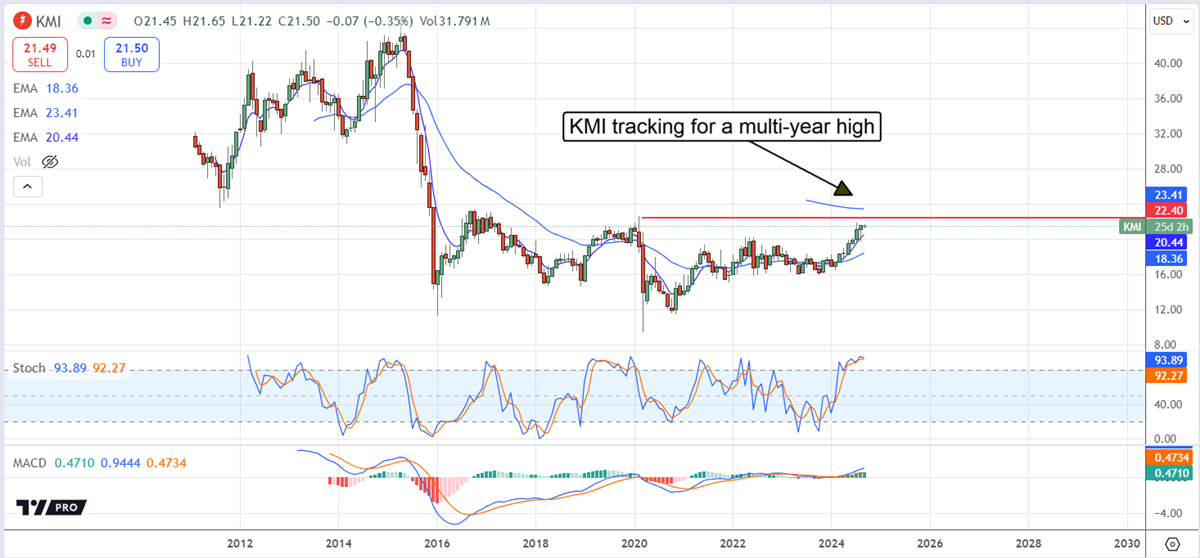

The analysts' support for KMI is solid, with 13 tracked by MarketBeat rating a consensus of Moderate Buy. The Moderate Buy is up from Hold on a YoY basis due to steady upgrades and price target increases leading to a new high. The consensus price target of $22.50 aligns with a critical resistance target and may cap gains, but the most recent targets are above it, so a move to new highs is more likely. Critical resistance is near $22.50 and may be reached before Q3 results are released. The report is due in early October and is expected to show substantial revenue and earnings power acceleration.

The price action in KMI stock is favorable. The market has been trending higher since the start of the year and heading toward a multiyear high. The move to multiyear highs will be significant, opening the door to a much larger move. Technical targets include a $10 or nearly 50% increase from the $22.50 level to align with support levels not seen since 2014.

Source MarketBeat