Published January 12th, 2017 by The Financial Canadian

Geographic diversification is something generally accepted as beneficial to investors. By purchasing shares with exposure to various countries, one can diversify away from the risk of localized economic downturns.

What most investors don’t know is that this sort of international exposure can be achieved by purchasing shares of selected U.S. corporations.

There is no need to venture out to international stock exchanges – many companies, such as Coca-Cola (KO), Apple (AAPL), and Johnson & Johnson (JNJ) derive a significant portion of their earnings from their international operations.

Many investors (including myself) would be surprised to find out that there is a Dividend Achiever that generates more than 50% of its earnings from the United Kingdom…

The Dividend Achievers are a select group of stocks with 10+ consecutive years of dividend increases. You can see the full list of all 272 Dividend Achievers here.

This company is the PPL Corporation (PPL), a large cap utilities company based in Allentown, Pennsylvania.

This article discusses the investment prospects of the PPL Corporation in detail.

Business Overview

The PPL Corporation is a holding company that owns PPL Electric Utilities, which stands for Pennsylvania Power & Light Company (the former legal name of this entity).

The company can trace its roots back to the 1920s, when PPL was created from the merger of 8 much smaller utility companies. After decades of continuous expansion, PPL now has annual net income of $1.4 billion and a market capitalization of ~$23 billion.

PPL is diversified into three geographic segments for reporting purposes:

- Pennsylvania (23% of EPS)

- Kentucky (28% of EPS)

- United Kingdom (54% of EPS)

Source: PPL Mid-Atlantic Investor Presentation, slide 3

Growth Prospects

PPL was one of the worst performing utility stocks of 2016. While much of the sector was up significantly, often ~10%+, PPL remained flat.

Determined to drive growth, PPL is aggressively investing into their business. Their planned capital expenditures over the next few years are significant, and outlined in the following diagram.

Source: PPL Mid-Atlantic Investor Presentation, slide 7

These capital expenditures are significant – this is a company with a market cap of $23 billion that is planning to execute $3 billion of capex per year. PPL expects this to translate into earnings growth, and even has expectations related to how quickly this capex will be recovered as earnings.

Source: PPL Mid-Atlantic Investor Presentation, slide 8

The above slide can be viewed almost as a mathematical equation: rate base growth + recovery of capex = annual EPS growth. It is encouraging to see that the company has so precisely identified what they expect to be the two drivers of growth.

Further, I am impressed with the company’s ability to recover capex – receiving almost ¾ of capex within the first six months is excellent.

PPL’s growth prospects are completely tied to their ability to grow their rate base. As the left section of the above slide indicates, the company expects to compound their rate base at a 5% CAGR between 2017 and 2020. This growth appears to be evenly distributed across their operating segments.

Competitive Advantage & Recession Performance

One of the major competitive advantages of PPL is their exposure to the United Kingdom. They are the first U.S. utility that I’ve seen that generates more of half their earnings from overseas.

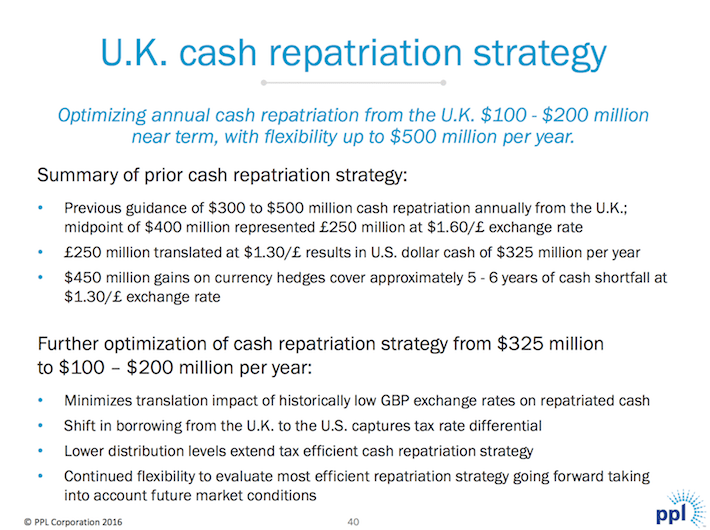

In fact, PPL’s U.K. operations have done well enough that the company is bringing back their overseas earnings (a process called repatriation) to fuel their domestic growth. When companies repatriate foreign cash, this domestic transfer of funds is subjected to the U.S. corporate tax rate minus taxes already paid in overseas countries. Companies avoid repatriating all their tax at once because it would trigger a hefty tax bill.

PPL’s U.K. Cash repatriation strategy is outlined in the following diagram.

Source: PPL Mid-Atlantic Investor Presentation, slide 40

One potential catalyst for this company comes in the form of President-Elect Donald Trump. As a strategy to fuel domestic economic growth, Mr. Trump has suggested implementing a “cash repatriation holiday” which would reduce the one-time corporate tax rate on international earnings from 35% to as low as 10%.

While it’s difficult to say precisely what will occur in the event of a tax repatriation holiday, there is some historical basis for this type of tax policy.

According to Bloomberg, the last time a tax holiday occurred (which was in 2004), more than 90% of repatriated cash was used for share buybacks, special dividend payments, and increases to executive compensation.

If Trump’s cash repatriation plan is successful, it is likely that this will be a positive for PPL shareholders.

Next I will consider the company’s recession performance. Consider PPL’s earnings per share during the 2008-2009 financial crisis:

- 2007: $2.63

- 2008: $2.45 (6.8% decrease)

- 2009: $1.19 (51.4% decrease)

- 2010: $2.29 (92.4% increase)

- 2011: $2.61 (14.0% increase)

PPL’s earnings were more than cut in half during the financial crisis. In fact, PPL’s earnings have never beaten the $2.63 high water mark that the company set in 2007. This historical performance does not give me confidence in the safety of an investment in PPL.

That being said, PPL is making efforts to solidify their balance sheet. This begins with the company’s debt profile. As the following diagram illustrates, PPL’s current liquidity profile is more than enough to pay off short-term debts (those that are due in 2019 and earlier).

Source: PPL Mid-Atlantic Investor Presentation, slide 8

This strong financial position has led to investment grade (BBB or higher) credit ratings for PPL and all of its operating subsidiaries, which should reassure investors that are worried about PPL’s creditworthiness.

Source: PPL Mid-Atlantic Investor Presentation, slide 43

Financial considerations aside, the other significant risk that PPL is exposed to is foreign exchange fluctuations.

Earlier I mentioned that PPL’s international exposure gives the company a distinct competitive advantage. Unfortunately, this exposure could also be a double-edged sword for PPL investors. Foreign currency fluctuations can affect the company’s earning.

Investors who held the company’s stock through the Brexit earlier this year watched as the stock decline from $38.57 to $36.36 overnight (a decrease of 5.7%) as geopolitical concerns surrounding the event were realized.

Source: Yahoo! Finance

Luckily, the company has a hedging program in place to minimize these currency effects. PPL’s exposure to the British Pound was 91% hedged in 2016 and the company has raised that number to 94% in 2017.

Source: PPL Mid-Atlantic Investor Presentation, slide 33

The following slide outlines a bit more about their hedging strategy, including what is (in my eyes) the most important outcome of the hedges: a more predictable USD earnings stream for investors.

Source: PPL Mid-Atlantic Investor Presentation, slide 33

To conclude, PPL has not performed exceedingly well during previous recessions, but the company’s strong financial profile and substantial hedging strategy should leave the company strengthened going forward.

Valuation & Expected Returns

Over the past five years, PPL has traded in a valuation multiple range between 10.5x and 14.1x TTM earnings. The company is currently trading at 12.6 times TTM earnings, which is roughly in the middle of this range. Compared to PPL’s historical valuations, the company appears to be reasonably valued.

Source: Value Line

The company’s current valuation is particular attractive when compared to valuation multiples in the most recent years (14.1 in 2014 and 13.9 in 2015).

PPL’s management is very candid. They clearly communicate their targeted total shareholder returns in investor presentations. The following slide outlines how the company is targeting 8%-10% total returns by combining earnings growth with the company’s dividend payments.

Source: PPL Mid-Atlantic Investor Presentation, slide 12

Total returns for PPL investors will be composed of:

- 4.4% dividend yield

- 5%-6% EPS growth

Over the long run, total expected returns will be in the range of 9.4%-10.4%. While I do not expect valuation changes to significantly affect these returns since the company appears fairly valued, currency fluctuations could move the needle in either direction due to the company’s significant exposure to the United Kingdom.

Final Thoughts

PPL is a rather unique investment prospect – a Dividend Achiever in the utility sector with significant exposure to the United Kingdom. The company also appears fairly valued compared to historical levels.

For an investors looking for a solid total return play with exposure to the UK economy but limited currency risk, initiating a position in PPL will help achieve this goal.