This is a guest contribution from Shailesh Kumar, founder of Value Stock Guide

Cyclical stocks tend to be shunned by investors when the sector is weak, but this can be precisely the time to invest. Automotive is one such sector currently under duress. Edmunds anticipates that U.S. vehicle sales for 2019 will drop to 16.9 million, from 17.3 million last year.

Furthermore, AlixPartners forecasts the decline to stretch to 2021 to as low as 15.1 million vehicles. U.S. auto sales peaked at 17.5 million vehicles in 2015 and since then we have seen a declining trend in the sales. As a result, automakers are currently being stretched in multiple directions.

Not only do they need to defend their market share in the face of declining demand, but at the same time they are being forced to invest in newer technologies such as self-driving cars and electric vehicles.

In such conditions, it is not surprising that an automotive dealership such as Penske Automotive Group (PAG) has seen its sales growth slow and profitability decline. However, Penske appears to be an undervalued stock with a 3% dividend yield and the ability to grow its dividend regularly.

Penske Automotive Group Business Profile

Penske owns and operates 149 US automotive franchises and 185 franchises overseas. It is the second largest dealership in the US in terms of revenue after AutoNation. 92% of its retail automotive revenue comes from luxury and import names. Penske also holds a 28.9% ownership in Penske Truck Leasing, and as we know, trucking companies are in their own recession.

The Current Economic Trends and Drivers

The latest quarterly report for PAG shows that the revenues declined by 0.33% in the first nine months of 2019, compared to the same period in 2018. Retail automotive dealership segment showed a decline of 2.87% while the relatively smaller Retail commercial truck dealership segment reported a 42.78% increase in revenues in the corresponding periods. Net income attributable to PAG common stockholders declined 10.38% to $334.3 million in the first 9 months of 2019.

Within the retail automotive segment, the company observes that the changing customer tastes are driving several changes in the revenue mix. For example, in the first nine months, U.S. light vehicle sales decreased 1.6% compared to the same period last year. The sales of trucks, crossovers and sport utility vehicles increased 2.7% while the sales of passenger cars decreased by 11.0%.

Consumer preferences are changing and so are the vehicle offerings by the manufacturers. For example, Ford’s (F) decision to exit passenger car manufacturing and focus primarily on its truck and SUV offerings reflect the change in consumer preference. The company expects these trends to continue for the foreseeable future. While the new vehicle sales remain strong, they have plateaued.

Additionally, 70% of the company revenues come from the import and luxury segment with premium brands such as Mercedes-Benz, BMW, Audi, Porsche and Land Rover. The ongoing threat of tariffs and trade wars cast a temporary shadow on this segment in the near future.

Valuation Reflects Current Weakness–PAG Stock Appears Cheap

One of the adages we value investors live by is that every stock is a buy at some price (that is, except the companies that are obviously mismanaged).

The stock currently trades at the following ratios

- P/E = 10.1

- P/B = 1.6, and,

- P/S = 0.2

A quick glance at these ratios show a stock that is inexpensively priced. There is no froth. Additionally, 15.2% of the float is currently shorted and this shows that the market is decidedly pessimistic about the stock.

That Altman Z-Score stands at 2.3. This is higher than 1.8 so the company does not appear to be headed to bankruptcy. In a cyclical trough, this is an important measure as many formerly profitable companies run out their luck and exit the market. This does not appear to be the case here. However, we do note that the working capital has weakened in the recent times and the company has increased its borrowings (higher net debt). The debt/equity ratio has crept up to 2.3, which is higher than what we like to see (< 1.5) due to several new operating lease liabilities on the balance sheet added this year.

So far so good, with a caveat to keep an eye on the debt levels.

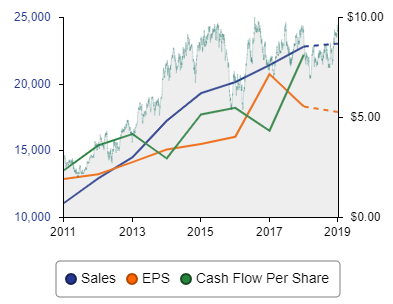

Looking at the past 10 years of trends, it seems that the company has worked hard to maintain a stable EPS. Part of this has been possible via an aggressive stock repurchase program. You can easily see that the average number of outstanding diluted shares has steadily declined from 92 million shares in 2009 to about 82 million shares today. During the first 9 months of 2019 itself, the company repurchased 3.87 million shares of common stock for $169.2 million, and the board increased the share repurchase authorization to another $200 million.

The company has shown an impressive 9.3% CAGR on ROE, but the ROE has recently declined in the past 3 years. Regardless, it remains at 16.4% which is particularly strong. This is a reflection of their focus on the premium automotive market. This shows that the company does have some defensible competitive advantage that can help it survive the recessionary pressures in the automotive sector.

Impressive Dividend Yield and Growth

Last quarter the company paid a dividend of $0.41/share. The quarter before that the dividend was $0.40/share. In the 2nd quarter of 2011, the company paid a dividend of $0.07/share and since then has increased its dividend by a penny every single quarter. If this trend continues, the company will increase its dividend to $0.42/share next quarter, and $0.43/share the quarter after, ad infinitum.

The cynical among us will note that the dividend growth rate is declining over time.

It is therefore important to note that while the EPS has grown at a CAGR of 23.5% over the last 10 years, the dividend per share has grown at a CAGR of 28.9% during this period. The dividend growth has outpaced the EPS growth. Alternatively, you can say that even as the EPS growth has slowed and recently reversed, the company has committed itself to keep its dividend growing every quarter.

This is a commitment to paying a solid dividend to the shareholders that we can get behind.

The stock currently yields 3.0% in dividends payable quarterly. The dividend payout ratio is just 29.7%, which means there is enough room to keep the dividend growing.

Combining Valuation and Dividend

If you are primarily a value investor with dividends being a secondary concern, a down cycle can present a good opportunity to get into a stock of a well-run company at a cheap price. This may be one of those opportunities. However, as is often the case in cyclical sectors, the balance sheet could be deteriorating. This appears to be the case with Penske Automotive Group. Your call to make is whether the company has seen the best prices on its stock.

On the other hand, if you are a dividend investor with value being of a secondary concern, this is a great opportunity to acquire a company with a history of growing dividends and a commitment to keep it going. The company is profitable today even as the sector reels. You are likely to continue and hold the stock even if it declines further in the near term. You may not be paying the best price, but you are acquiring a nice income stream that will rise.

Please do your due diligence.

About the Author

Shailesh Kumar is the founder of Value Stock Guide, a website focused on unearthing the most profitable undervalued opportunities in the market today.