President Without Precedent

President Without Precedent

The world has never been here before; the most powerful and influential country on the planet is being headed by a clue-less, angry, reality TV personality. It is more-or-less impossible to determine the likelihood of possible future events when we have no history to draw from. Some of the things the Donald promised, like building a wall with Mexico and have them pay for it, or bringing back the 19th century industrial jobs that no-longer exist, are simply ridiculous so we can safely say they won’t happen.

But what about repealing and replacing Obamacare, reforming the corporate tax structure, deregulating business, implementing an infrastructure improvement plan, and renegotiating bad trade deals? Those are possible, and some items on that list may produce some benefit if they were implemented with the greater good in mind. The latter qualification is key, and when one considers that Trump has NEVER done anything that wasn’t for the benefit of himself or his family — he even used the Trump charity foundation to benefit himself — it becomes unlikely that the greater-good will be realized. We simply have no way of estimating the likelihood of any of these changes, or the results that might be generated.

When it comes to foreign relations and trade (other than with Russia), the scenario is no more clear or hopeful. Even before he started his job, the Donald managed to insult China when he blamed it for the fact that American companies (his own included) have chosen to have much of their manufacturing done at the lowest cost, and when he talked to Taiwan as if it was China, thereby straying from the long-held one-China policy. He also managed to alarm the Japanese when he opined that Japan should get their own nuclear weapons — the only population to be victimized by this type of weapon of-mass-destruction and delivered by America itself — and confused the Europeans when he suggested that NATO should be defunded. The man is clue-less to the point of being dangerous.

The world is too integrated for any one country to prosper by isolating itself — we are evolving into one big tribe. North Korea is a blatant example of where isolation and a narcissistic psychopathic leader can take you.

Because of all the frightening scenarios that Trump seems capable of inflicting on the world, we have no choice, but to hope that he is a successful president. Any success, however, will be measured and compared to the following metrics:

Nominal GDP $18.68 tln

Real GDP $16.73 tln

National Debt $19.96 tln

Gross Debt-to-GDP Ratio 106.3%

Deficit as % of GDP 3.2%

Unemployment Rate 4.7%

Number of Official Unemployed 7.53 mln

Inflation Rate (CPI) 2.1%

Housing Starts (SAAR) 1226K

New Home Sales (SAAR) 592K

Existing Home Sales (SAAR) 5610K

Household Net Worth$90.2 tln

(Source: Briefing.com)

The market will be watching and casting judgement. Words are no-longer enough for the Donald. Now he must deliver.

Equities

{This section is for paid subscribers only}

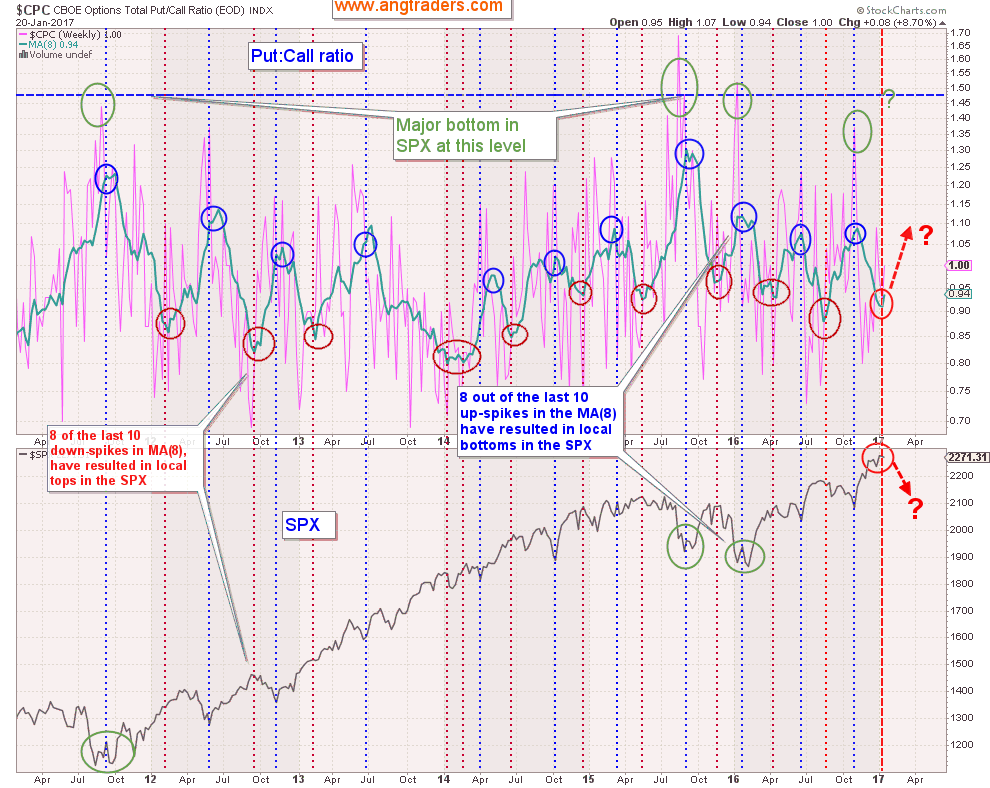

The put-to-call ratio has started to turn up this week, which has an 80% chance of indicating a local top in the SPX (chart below).

{This section is for paid subscribers only}

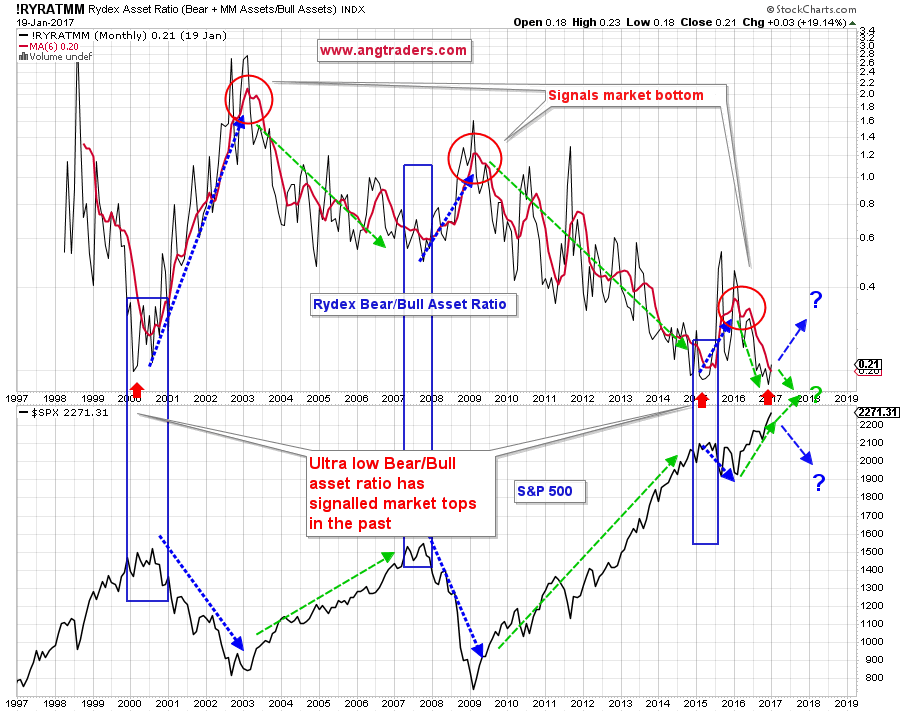

The ratio of Bear:Bull Rydex assets (chart below) is at a low (red arrow), which in 2000 and in 2015 correlated with market tops (blue rectangles). The ratio has started to move higher, but the 6-month MA has yet to respond.

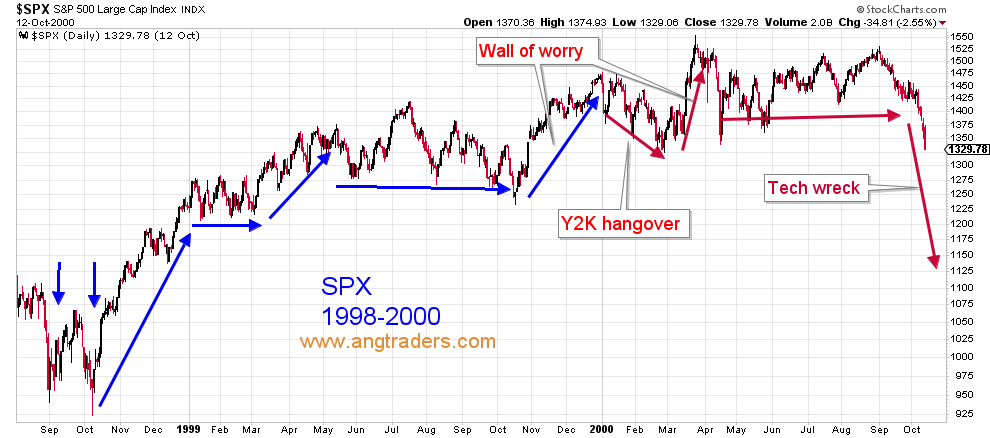

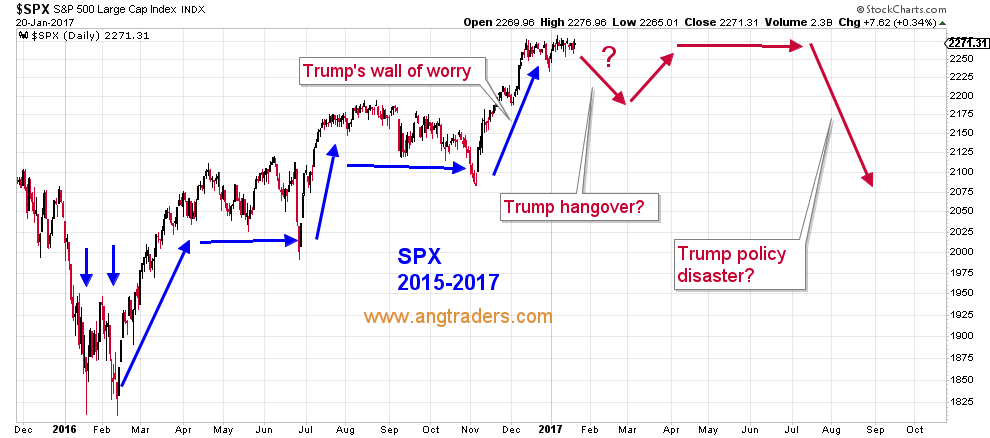

The two charts below, show the similarity between the trading in 1998–2000, and 2015–2017. The Trump hangover may still develop in the near future.

{This section is for paid subscribers only}

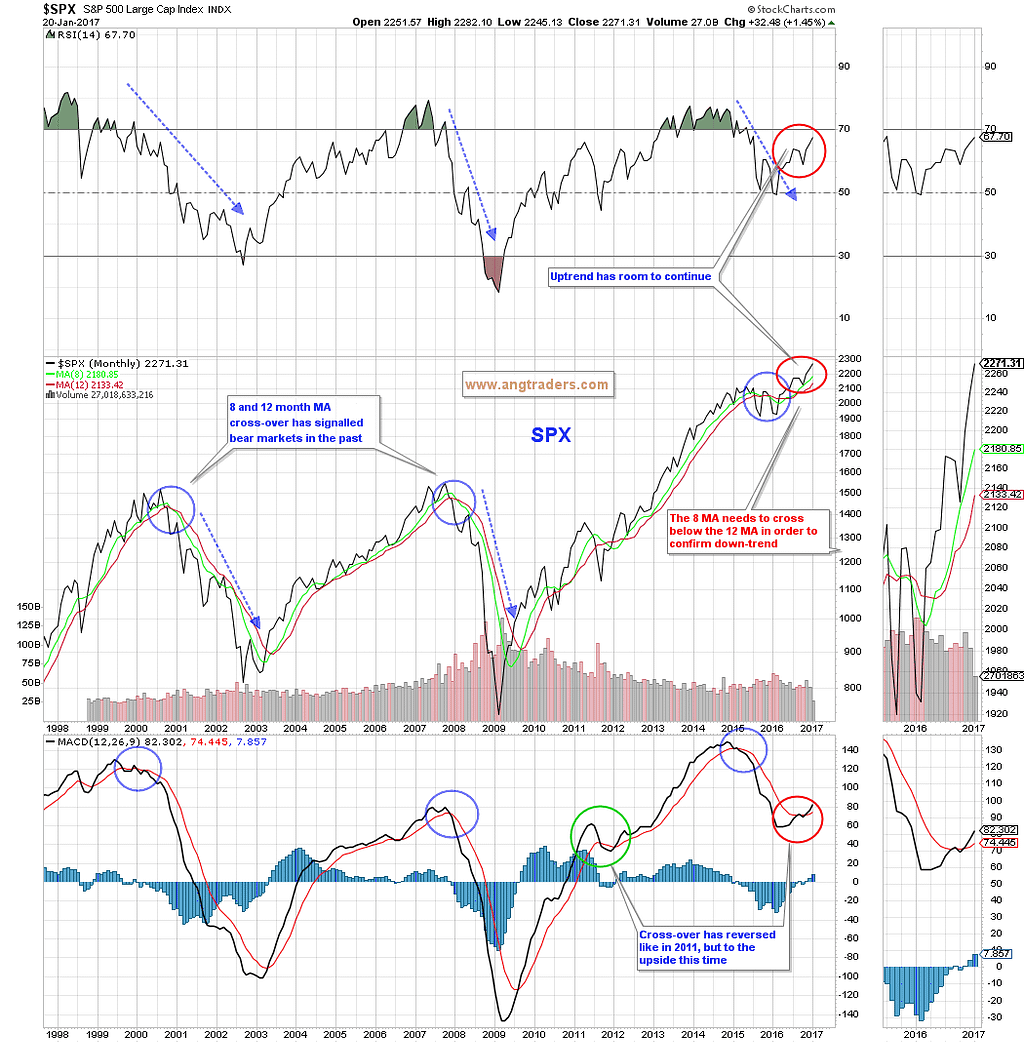

This fits in with the long-term moving averages of the S&P 500 which we have been keeping an eye on for some time now (chart below). Technically, the long-term situation still allows for significant price appreciation.

{This section is for paid subscribers only}

Gold

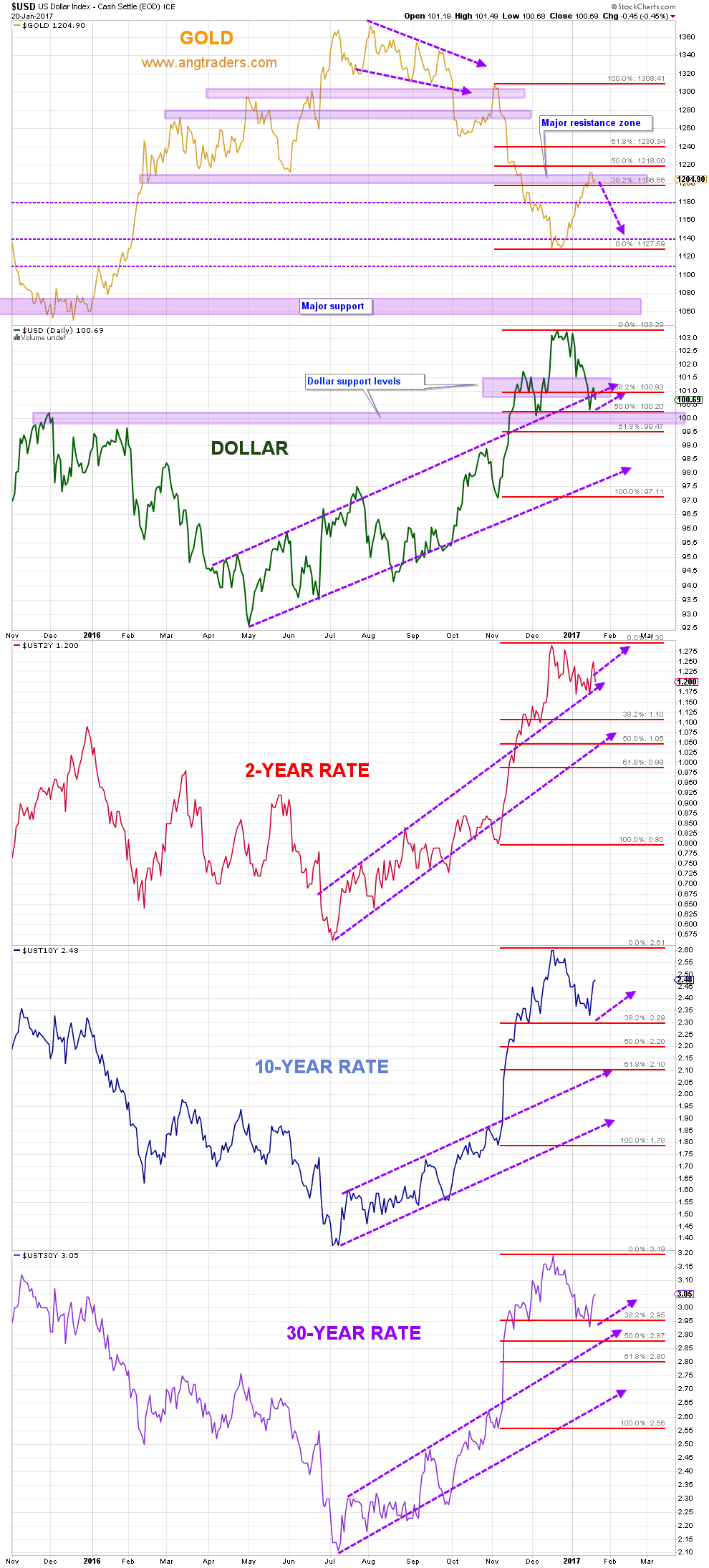

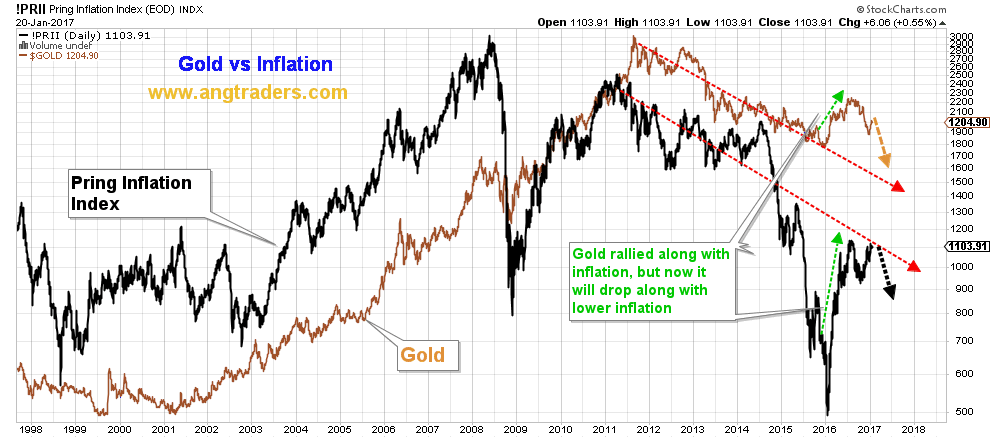

We continue with our contention that gold is the ’tail’, and that Treasury rates, the dollar, the USD/JPY FOREX ratio, and inflation are the ‘dog’. Tails don’t wag dogs, and gold does not move the four big markets. As long as the drivers don’t change their trends, gold will remain in its downward trend.

The dollar and rates have not changed their trends, although they have corrected back to technical levels (chart below).

{This section is for paid subscribers only}

Inflation, despite the Trump-induced fear of cost-push inflation, is unlikely to rage out of control as long as the FED has a stockpile of rate hikes to pour on it.

{This section is for paid subscribers only}

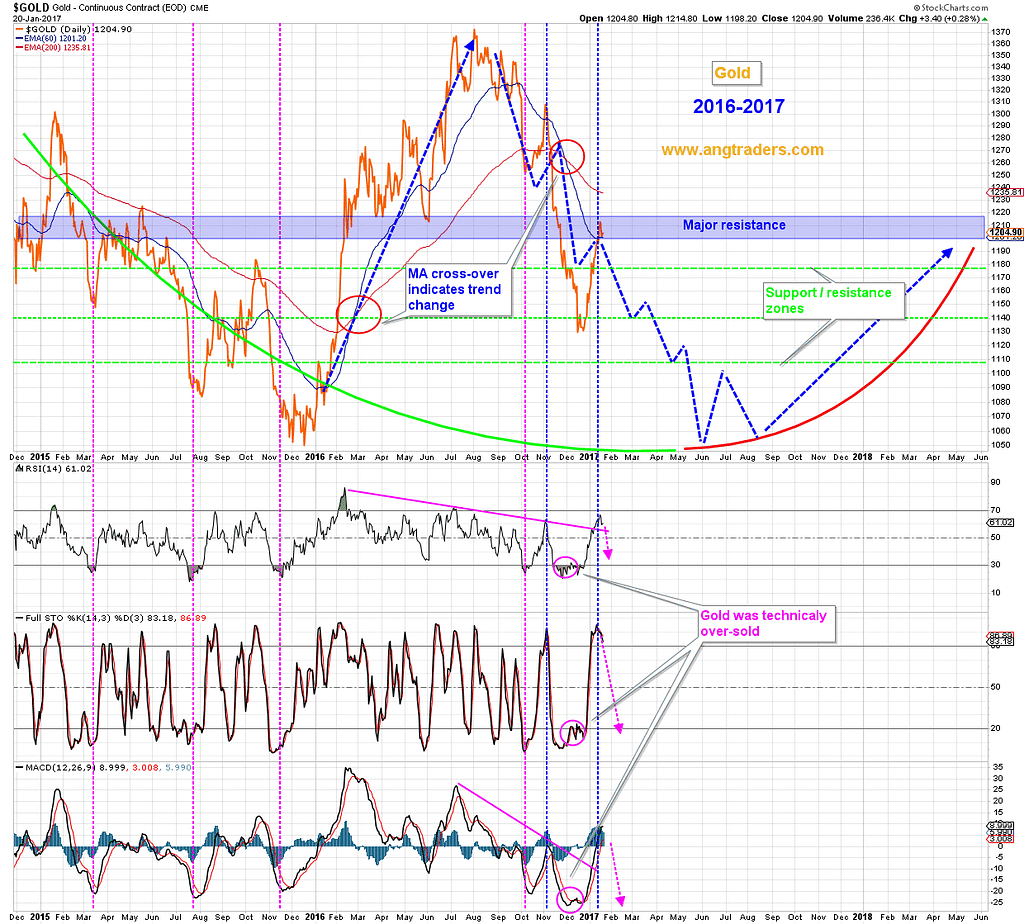

The chart below shows how, while gold was technically over-sold in December, it is now technically over-extended and struggling with major resistance.

{This section is for paid subscribers only}

We wish our subscribers a profitable week ahead, and ask that you monitor emails for Trade Alerts.

ANG Traders

Join us at www.angtraders.com and replicate our trades and profits.

Source: Nicholas Gomez